- SAND’s bullish pennant breakout targets $1, supported by strong price action above $0.62.

- Reduced exchange reserves and bullish on-chain metrics strengthened the case for upward price momentum.

As a seasoned analyst with over two decades of market observation under my belt, I find myself optimistic about The Sandbox (SAND) following its impressive bullish pennant breakout. Having navigated through multiple bear and bull markets, I can confidently say that when the stars align as they have for SAND, it’s time to pay attention.

There’s been excitement among traders regarding The Sandbox (SAND) as it surpassed a significant barrier at $0.62, creating a bullish pattern resembling a pennant on its daily chart, suggesting potential price increases in the future.

Based on my years of experience in the cryptocurrency market, I believe that this breakout could indicate a potential rally towards the $1 mark. The increasing market momentum and improved on-chain activity suggest that there is strong investor interest and confidence in this asset. While past performance does not guarantee future results, my personal observations lead me to believe that we may be on the verge of a significant increase in value. I recommend keeping a close eye on this development as it could present an exciting opportunity for those who are invested or considering investment in this cryptocurrency.

Currently, SAND is being exchanged for approximately $0.6308, representing a 8.60% increase over the past day. Yet, potential obstacles ahead may test its resilience in maintaining this positive trend.

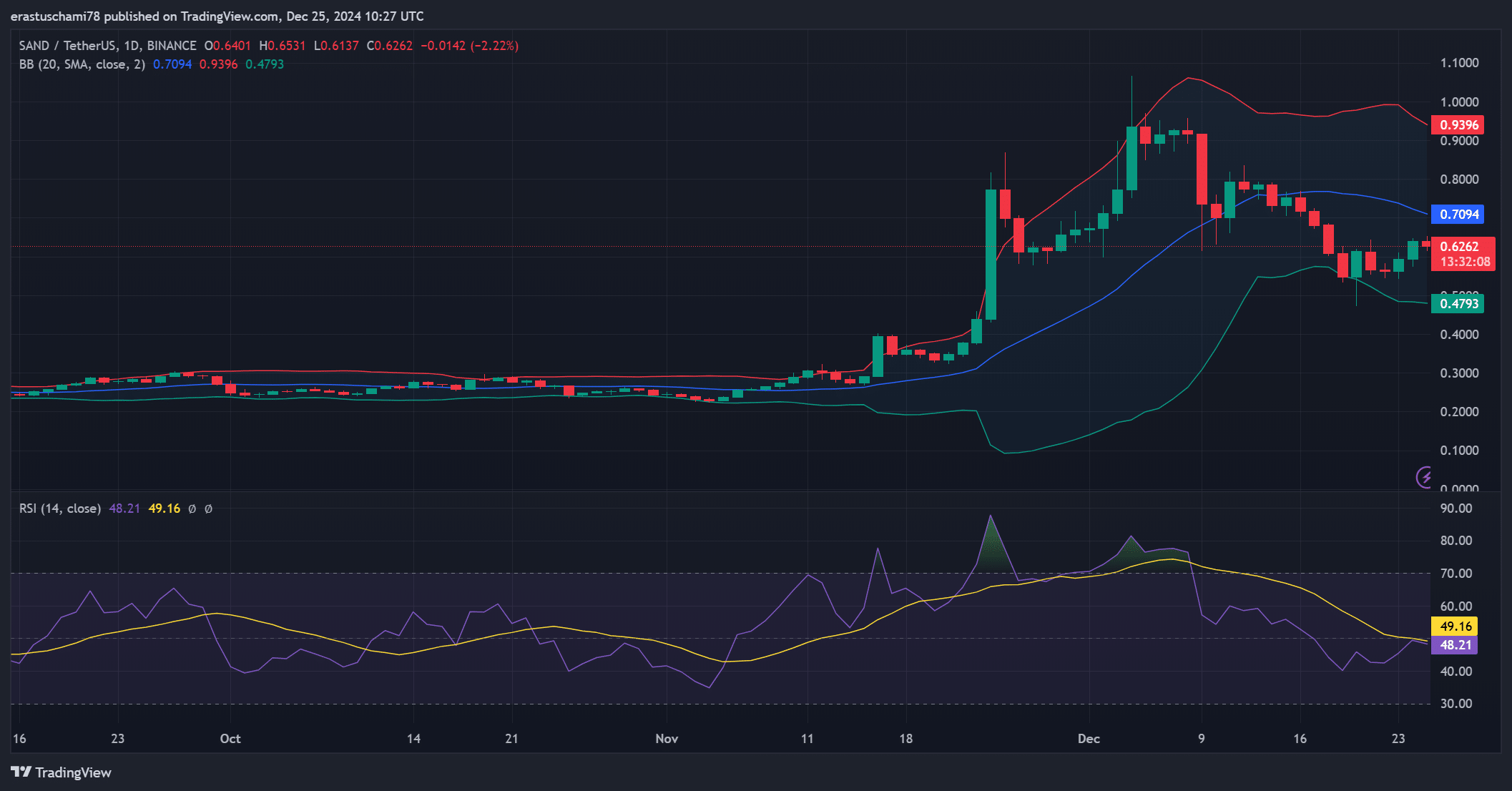

SAND price action analysis

SAND’s recent price movement has demonstrated consistent respect for the bullish pennant pattern, confirming $0.62 as a pivotal level.

Overcoming this resistance level has sparked increased demand from buyers, suggesting a possible prolongation moving upwards.

Thus, the significant goal for SAND now appears to be around $0.75, while $1.00 serves as a notable benchmark to keep an eye on.

If a correction occurs, there’s a possibility that the support at $0.43 might be re-tested. This could happen more likely if the bullish energy starts to slow down. Also, it would be wise for traders to keep an eye out for potential consolidation periods, as these may lead to another breakout.

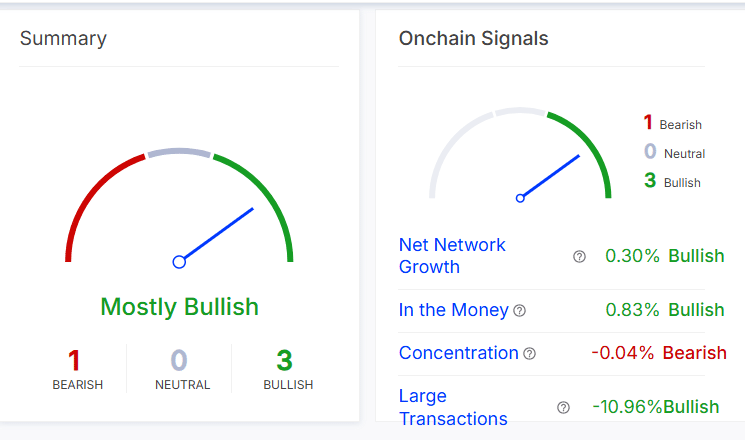

On-chain signals highlight growing interest

The data recorded on the blockchain supports a positive forecast for SAND, as it shows an increase in network growth by 0.30% and indicates ongoing user interest. Additionally, approximately 0.83% of SAND holders are now in profit-making positions.

Instead, a slight decrease of 0.04% in the concentration of large holdings suggests that some profit-taking may be occurring.

Furthermore, there’s been a notable increase of 10.96% in significant trades, suggesting increased engagement from institutional investors.

The data indicates a rising curiosity level, yet a minor decline in focus underscores the need for careful observation when tracking distribution patterns over time.

Technical indicators align with bullish outlook

The technical signs gave a thumbs-up for SAND’s rise, as they reinforced its growth prospects. At the moment, the Relative Strength Index (RSI) stood at 49, suggesting that the momentum was neither strongly bullish nor bearish but leaning slightly towards the bullish side.

Furthermore, the Bollinger Bands are becoming more compact, suggesting a possible price breakout since market volatility is decreasing.

Should SAND continue its current trajectory, there’s a possibility of a significant surge upwards. But if it fails to hold above the $0.62 mark, there might be a brief pullback before another effort to breach the resistance levels.

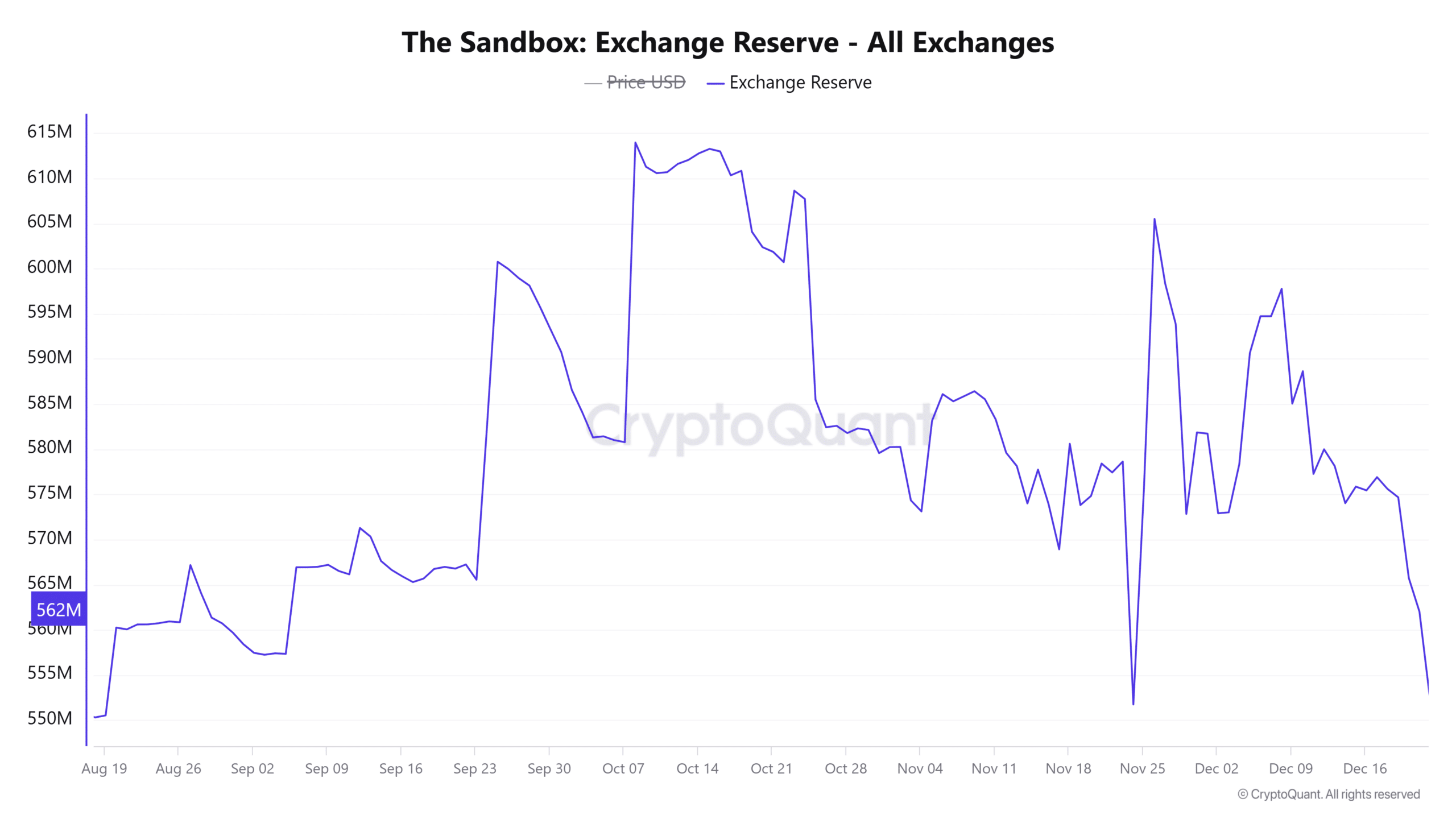

Exchange reserve analysis signals reduced selling pressure

Over the past day, the reserve data showed a positive trend, as there was a 1.51% decrease in SAND’s reserves. This reduction suggests that less of these tokens are now being traded, as holders are transferring their coins away from exchanges.

Furthermore, when the availability of an asset on exchanges decreases, it typically weakens the urge to sell, creating a setting conducive to price growth.

Therefore, continued decreases in reserves could further support the ongoing rally.

Can SAND reach $1?

SAND has strong potential to reach $1.00, supported by its bullish pennant breakout, improving on-chain metrics, and reduced selling pressure.

Maintaining the current pace will depend on breaking through crucial resistance points and keeping a positive outlook among investors. The coming days are vital for predicting the direction of SAND’s price trend.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-12-26 02:16