- Long-term holders may embark on a BTC feast as short-term holders scatter their coins haphazardly.🍽️

- Miners are striking gold, despite the universe conspiring to make each coin harder to unearth.⚒️

Bitcoin [BTC] has ascended to celestial levels above $100,000 for the second time this year, reaching an ethereal high of over $109,000.

This triumph suggests that $100,000 could potentially serve as a sacred psychological support level, with bullish omens driving further price ascensions.

AMBCrypto analysis has decreed that the ongoing to-and-fro of BTC between short-term and long-term holders is bolstering the divine outlook for this digital marvel.

Will history, that cunning trickster, play its game as BTC changes hands?

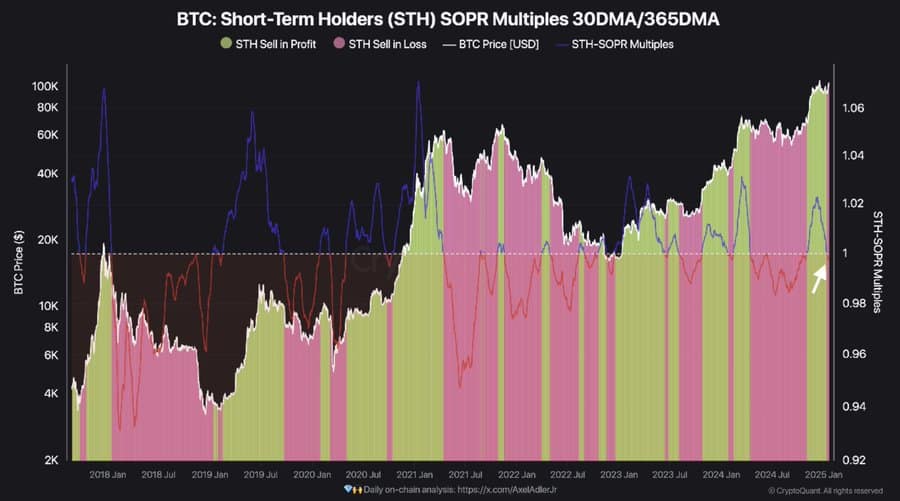

CryptoQuant whispers that short-term Bitcoin holders have started selling at a grievous loss, as shown by the Short-Term Holder (STH) SOPR multiple.

This mystical metric compares the Short-Term Holder Spent Output Profit Ratio (SOPR) over 30-day and 365-day epochs.

Usually, a number above 1 means STHs are dancing in profit, while below 1 indicates they are lamenting in losses. Current cryptic data reveals that STHs are indeed selling at a loss. 😬

Historically, when the STH SOPR frowns, it lures long-term holders (LTHs) to seize more BTC.

LTHs are the market’s steadfast disciples, holding BTC for at least 155 days. ⌛

This sacred behavior reduces circulating supply, suggesting accumulation at this stage could boost BTC’s price and send it soaring higher. 🚀

Can miners’ fortunes spark a BTC price eruption?🌋

As long-term and short-term BTC holders swap places, miner profitability is reaching legendary highs despite mounting mining challenges.

Mining difficulty, the ever-watchful guardian, ensures the Bitcoin network’s sanctity by maintaining steady block creation over time. ⛏️

As difficulty climbs, miners face Herculean tasks to process transactions and earn their fabled rewards.

According to Glassnode’s Difficulty Regression Model, miners now bask in approximately 3x profitability. The current cost to mine 1 BTC is $33,900, while BTC’s price at press time stood at $104,900.

This hefty profit margin could inspire miners to hoard their BTC treasures as the asset’s value ascends higher.

This conduct, combined with long-term holders (LTHs) accumulating, diminishes BTC’s circulating supply and could ignite a potential price surge.

Is BTC destined for a mind-blowing 500% surge? 📈

BTC’s present price journey appears to resonate with historical patterns, particularly the mighty bull market rally observed between 2015 and 2018, says Glassnode data studying BTC’s price odyssey since the cycle low.

This metric suggests that BTC has the promise to rally by approximately 562%, or 5.62 times its current price of $104,850.

Read Bitcoin’s [BTC] Price Prediction 2025–2026

Should this cosmic prediction hold, BTC could surpass $589,000 by the end of this cycle, establishing a new celestial high for the cryptocurrency.

Thus far, market sentiment remains bullish, reinforcing the hope of BTC continuing its meteoric rise.🌠

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2025-01-23 07:05