- Despite a valiant little leap from the depths, MOVE remains bound by the weight of its bearish disposition on the 4-hour chart.

- Behold the liquidation heatmap, spotlighting the $0.55 level—an obstacle of Herculean stature for any aspiring buyer.

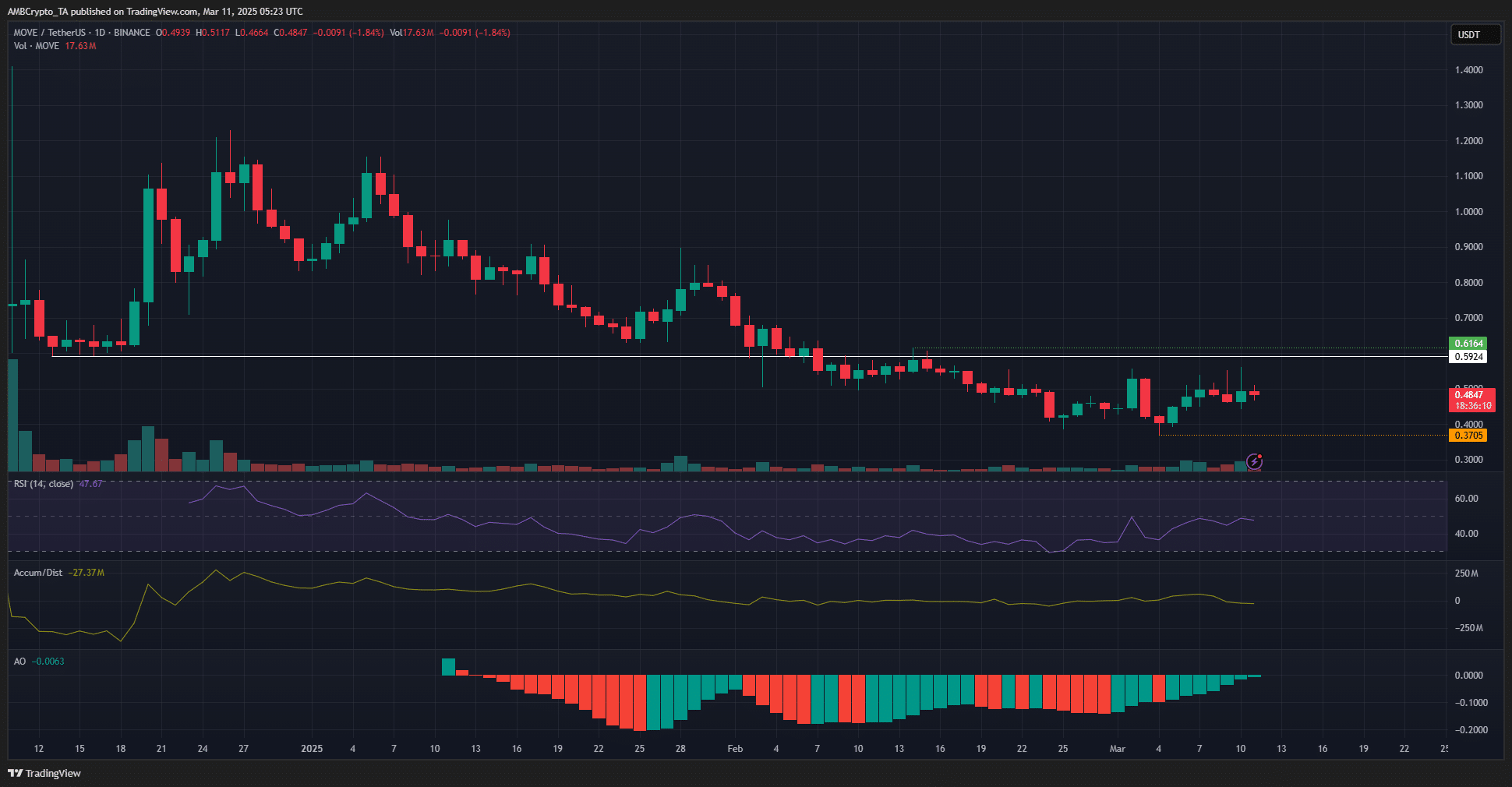

Ah, the whimsical affair of Movement [MOVE], which, in a rather theatrical twist, has executed a remarkable 33% ascent from last week’s meager low of $0.37. Yet, alas, it clings feebly to a bearish outlook! 🥲 The fervor of buyers was not nearly enough to overcome the imposing resistance at $0.55. Questing further, one might gaze upon the $0.616 level, the sacred threshold whose conquest heralds a monumental shift in the existential crisis of MOVE.

Moreover, let us turn our gaze upon Bitcoin [BTC], the ever-mysterious oracle of the markets, which is enveloped in a cloak of oppressively bearish sentiment. Destiny has yet to unveil a bottom, should the tide of selling sweep through like a melancholic breeze, it could very well drag the Movement price down the murky waters.

Thus, dear traders, a bearish outlook must remain our somber anthem for the weeks that lie ahead.

Conditions MOVE’s price must meet to shift the outlook

Our dear MOVE languishes within a bearish market structure, showcasing a recent lower high at $0.616 on the unyielding 4-hour chart. A closing session above this miraculous threshold might just hint at a burgeoning bullish renaissance.

However, let us not ignore the lurking specter of a lower low at $0.37— should this hapless price fall below such perilous depths, it will only serve to further confirm the relentless march of the ongoing downtrend. 😬

On the scantier timeframes, the $0.53 level takes center stage. Once a knightly supporter of hopes, it now stands as a formidable adversary, showcasing resistance. The zone betwixt $0.53 and $0.55 is poised to challenge those valiant bulls near term.

The Awesome Oscillator, like a fortune-teller, suggests whispers of a possible momentum swing, while the RSI, ever so politely perched at 47, edges closer to 50—a subtle nod to an anticipated buyer advantage. Yet, the A/D indicator dances in indecision, gains from the early days of March dissipating back into the nostalgia of February.

The sweeping gaze of the liquidation heatmap over the past month has marked the $0.55 level as a magnetic zone of utmost significance, with a smaller liquidity cluster at $0.52 beckoning. It is highly likely that the price will soon embark on an adventure upwards, seeking the coveted $0.55 level.

Yet, the question lingers—can the exuberance of short-term bullish sentiment endure beyond this enchanted gate? The specter of bearish reversal looms large, given the frailty of buying pressures and the overarching structural narrative of the market. 🤔

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2025-03-11 16:10