In the realm of decentralized finance, an epic skirmish of grand proportions is afoot, with the illustrious prize being none other than the highly coveted right to issue the native stablecoin, USDH, for Hyperliquid, that enchanting platform of rapid growth. Ah, the joys of modern finance! 🌍

This contest, rife with ambition to rival a Tolstoyan saga, has attracted titanic figures from the stablecoin universe, ranging from the impeccably regulated Paxos to the audacious innovators of Ethena and the institutional sages at OpenEden. Each contender aspires to be hailed as the official custodian of the hallowed USD-pegged asset on a decentralized exchange that boasts a staggering monthly trading volume, approaching the astronomical figure of $400 billion! Yes, my friends, that’s with a B. 💵

The outcome of this melodrama could redefine not only the future of Hyperliquid but also set forth convolution upon convolution in how decentralized platforms choose to embrace stablecoins and the protocols of collaboration amongst them.

The Meteoric Rise of Hyperliquid and Its Quest for a Native Stablecoin

Hyperliquid has surged forth like a youthful stallion in the DeFi pasture, establishing dominion in the bustling domain of decentralized perpetual futures. It flaunts the magnificence of a high-performance Layer 1 blockchain that marries the swiftness of centralized exchanges to the transparency of its decentralized peers. Yet, alas! It finds itself shackled to Circle’s USDC, that well-known staple, for its collateral needs, while over $5 billion gallivants through Hyperliquid, enriching Circle instead of its own noble constituency.

Realizing this travesty, the Hyperliquid Foundation has decided to break the bonds and take a bold leap, announcing their audacious initiative: the birth of a native stablecoin, USDH! Designed to craft a more harmonious and efficient ecosystem, this mighty venture seeks not only revenue capture for the community but also to reclaim what is rightfully theirs. 🍞

So, What Exactly Is This USDH? 🤔

Ah, USDH! A name that dances on the tongue, like a euphoric song sung by well-meaning cashiers in a bustling marketplace. This proposed stablecoin aims to be a fully collateralized digital asset that shall maintain a glorious 1:1 peg with the ever-mighty U.S. dollar. It aspires, once unfurled, to become the sovereign asset for trading perpetual futures and the formidable medium for settlement and fee payments within its majestic Hyperliquid territory.

In a marketplace that swells with opportunities, particularly since the GENIUS Act graced America’s legislative halls this past July, the launch of USDH stands as a pivotal achievement for the DeFi ecosystem.

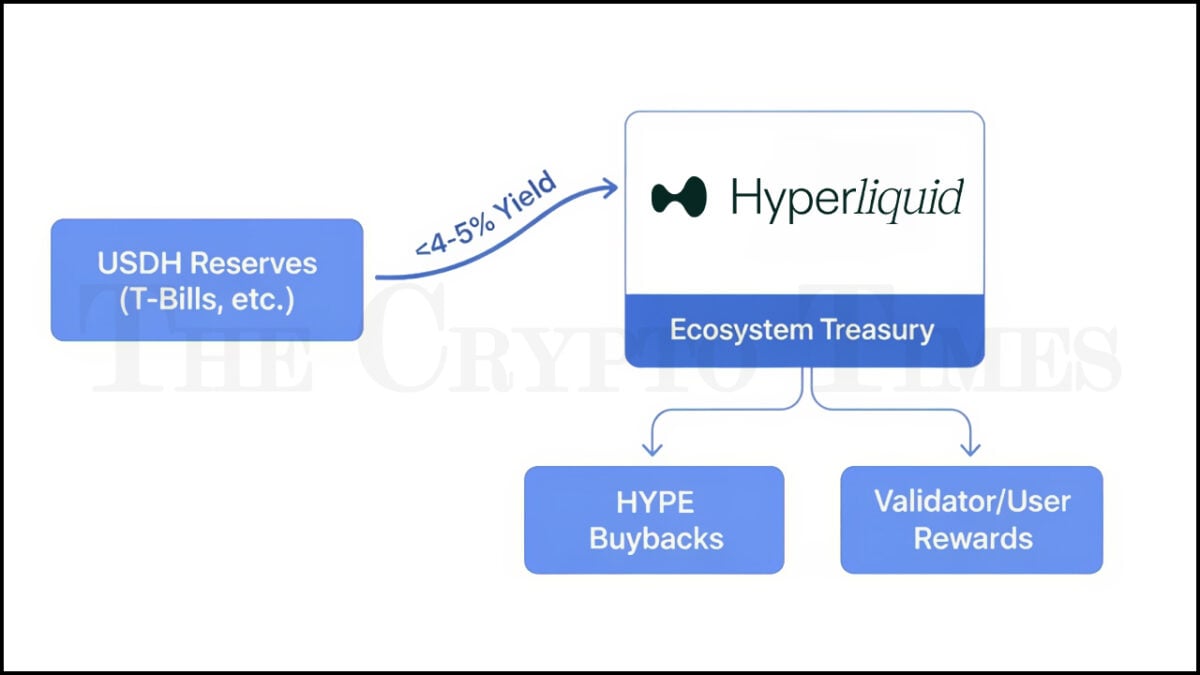

And what brilliance resides within USDH’s core! Its salient innovation lies precisely in its value-capture mechanism. As Hyperliquid endeavors to nurture its own native coin, it plans to internalize the lucrative yield that those billions in reserves might generate. Instead of these precious assets (often lounging in U.S. Treasury bills) enriching an external entity, the fruits of this labor shall flow back to the Hyperliquid protocol, creating a delightful self-sustaining ecosystem! Oh, the joys of economic symbiosis! 🎉

The issuer, chosen through this merciless bidding war, shall wield the power to issue, redeem, and manage transparently the reserves backing USDH, securing its integrity like a well-guarded treasure. Do grab your popcorn! 🍿

The Contenders: A Journey into a Thrilling Arena of Finance

Ah! The siren call for USDH proposals has summoned forth an eclectic array of contenders, each possessing a distinctive flair. Among them are:

Native Markets (The Frontrunner):

Ah, the entity sprung forth seemingly by divine intervention! Native Markets has soared to the top, buoyed by connections to the illustrious Hyperliquid advisor, Max Fiege, and aligned with the stablecoin issuer, Bridge. Their proposal, enchanting in its charm, has even garnered the favorable mention from the Nansen x HypurrCollective validator. With approximately 70% of the committed votes, they strut confidently, flaunting their apparent “home-field advantage.” Do they have your vote? 😏

Paxos:

A titan of the industry, Paxos enters with a considerable legacy, boasting partnerships with the likes of PayPal. Their proposal, steeped in regulatory assurance, attempts to woo with promises of significant strategic alliances and vast distribution. Latest revisions saw them partnering with PayPal to sprinkle more incentives into the ecosystem. Will it be enough for them to throttle their competition? They seem in dire need of a Hail Mary! 🙏

OpenEden:

Enter OpenEden, the bearer of fine institutional values and the largest distributor of on-chain U.S. Treasury bills in Asia! With regulatory compliance as their crown jewel, they vow to protect the sanctity of USDH with an intricate legal structure. Their proposal flirts mightily with transparency, promising a percentage of minting fees to the Hyperliquid ecosystem. But dear reader, is it enough to uplift their ambitions? 🏦

Ethena Labs:

With a keen eye towards innovation, Ethena Labs competed fiercely but decided to pivot towards the enchantments of product innovation instead of stablecoin governance. Their initial proposition revolved around exciting revenue share and ecosystem incentives, leaving us to ponder what might have been! 🧐

Other Notable Bidders:

As the suspense coils tightly around our narrative, a myriad of other bidders linger in the shadows, awaiting their moment in this high-stakes game!

The Voting Process and the Dance of Community Engagement 🎭

The momentous selection of the USDH issuer stands as a beacon of governance for Hyperliquid. Each validator’s vote possesses weight akin to a feather upon the scales of justice, with the final on-chain vote to be conducted on September 14. Will the validators bend the tide, or will chaos reign upon this sanctified land?

Engagement spirals through the Hyperliquid community like a swiftly flowing river, stirring vital market activity and exuberantly raising the price of the HYPE token to gloriously unprecedented heights in the lead-up to the vote. This is no ordinary market-this is a spectacle! 🍾

The Path Forward: Ushering in a New Era for Hyperliquid

The quest for Hyperliquid’s USDH stablecoin transcends mere competition; it serves as a testament to the colossal strides made by the platform and its potential to alter the DeFi landscape. The victor shall bask in the glory of a substantial user base, while Hyperliquid, at long last, will house its very own native stablecoin. No matter who claims the crown, it is the Hyperliquid ecosystem that shall ultimately flourish, blessed by the fierce competition that provides direly needed incentives and partnerships. 🍀

And thus, we stand on the precipice of transformation, as the Hyperliquid community prepares to shape its fate and herald a new era of decentralized finance into being. What a time to be alive! 🌟

Read More

- Best Controller Settings for ARC Raiders

- Ashes of Creation Rogue Guide for Beginners

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- 7 Horrific What If…? Stories To Read This Halloween

- Soulframe Opens The Door To A New Fantasy World

- Gigi Hadid, Bradley Cooper Share Their Confidence Tips in Rare Video

2025-09-12 11:37