- Bitcoin declined by 8.42% on the weekly charts, fueling a hike in bearish market sentiment

- Accumulation trend score nearing 0 could have implications for the cryptocurrency

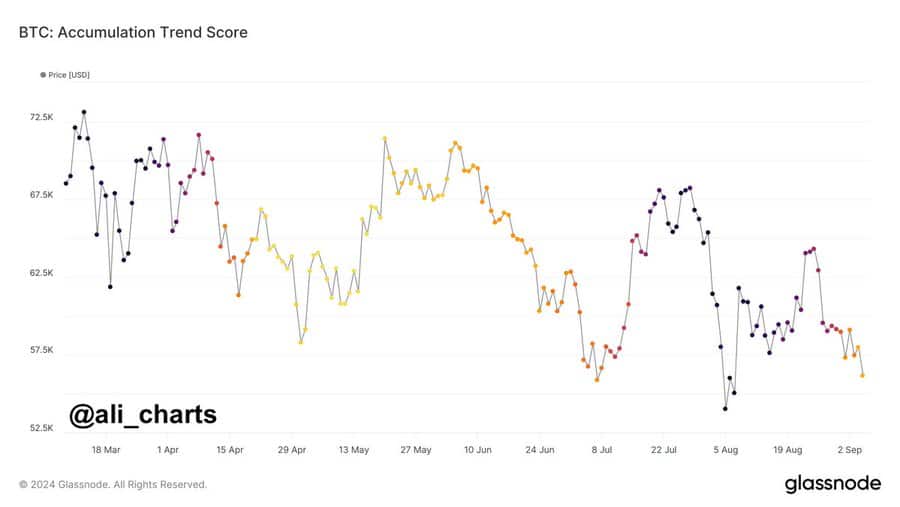

As a seasoned researcher with over two decades of experience in the financial markets, I have witnessed countless bull and bear cycles. The current Bitcoin situation seems to be leaning towards the latter, given the recent 8.42% decline on the weekly charts and the accumulation trend score nearing 0.

For several months now, Bitcoin’s price fluctuations have been quite dramatic as shown on the graphs. Although it reached an all-time peak of $73k in 2024 following the introduction of ETFs and increased market approval, it has also experienced increased volatility.

At the time of writing, BTC was trading at $54,239 after an 8.42% decline over the past week.

Despite some indications of continued activity, as evidenced by a spike in trading volume by 63.13% to $48.6 billion within the past 24 hours, it’s worth questioning what this implies for Bitcoin’s market forecast, both immediately and in the long run. Could Bitcoin fully bounce back now?

Based on the analysis of well-known cryptocurrency expert Ali Martinez, it appears that Bitcoin’s involvement might be decreasing. This is inferred from the downward trend he observed in the accumulation score.

Market sentiment analysis

As a researcher, I’m currently observing that, based on Martinez’s findings, the Accumulation Trend Score for Bitcoin is approaching zero. This suggests that market participants are either in a distribution phase, where they’re selling off their BTC, or they’re not actively accumulating it at this moment.

In this context, the Trend Score for Accumulation represents the comparative size of entities that are actively buying Bitcoin (BTC) on the blockchain with regards to their holdings. When the score is nearly 1, it implies that these participants are amassing coins, while a value close to 0 suggests they’re dispersing or distributing their BTC holdings.

When the accumulation trend score reaches 0, it means no buyers are active across all groups and indicates a distribution phase. Each time Bitcoin experiences a low point during a bear market, there’s often an increase in buying activity, referred to as “buying the dip.” However, as the bear market continues, there may be less accumulation due to reduced investor confidence in the cycle.

By this assessment, the Accumulation Score is approaching zero between late August and early September 2024. This implies a more widespread distribution and reduced accumulation among participants. This pattern hints that major investors and long-term holders may not be purchasing, which could signal a bearish outlook.

Investor uncertainty about an imminent market surge is likewise reflected in this situation. The resulting market dynamics often trigger selling actions, which can cause a drop in prices as shown on graphs.

What do the price charts say?

Currently, Martinez’s metrics offer a comprehensive perspective on the current market mood. However, it’s worth noting that the overall market has experienced some setbacks due to the recent recovery phase.

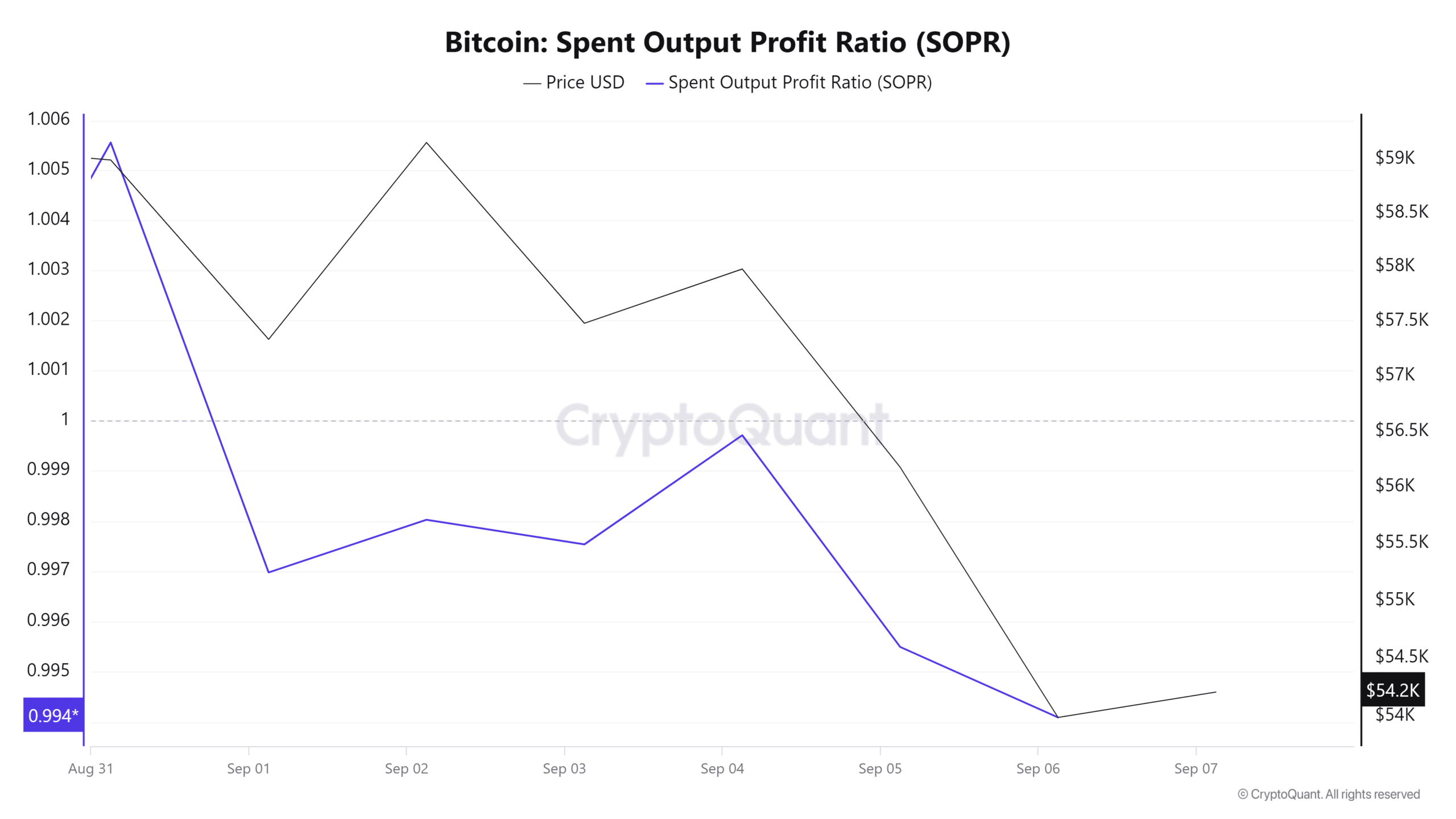

Initially, the selling rate among significant Bitcoin holders (SOPR) has dropped from 2.4 to 1.6 over the last seven days. This indicates that while long-term holders are still realizing a profit when they sell, the size of that profit is shrinking. Consequently, traders appear to be selling at a loss due to diminishing optimism about Bitcoin’s short-term and medium-term prospects.

As a crypto investor, I’ve noticed a shift in sentiment that seems to indicate a growing pessimism among us. We appear to be bracing ourselves for a potential continuation of the bearish market trend, with fewer expectations for future price surges.

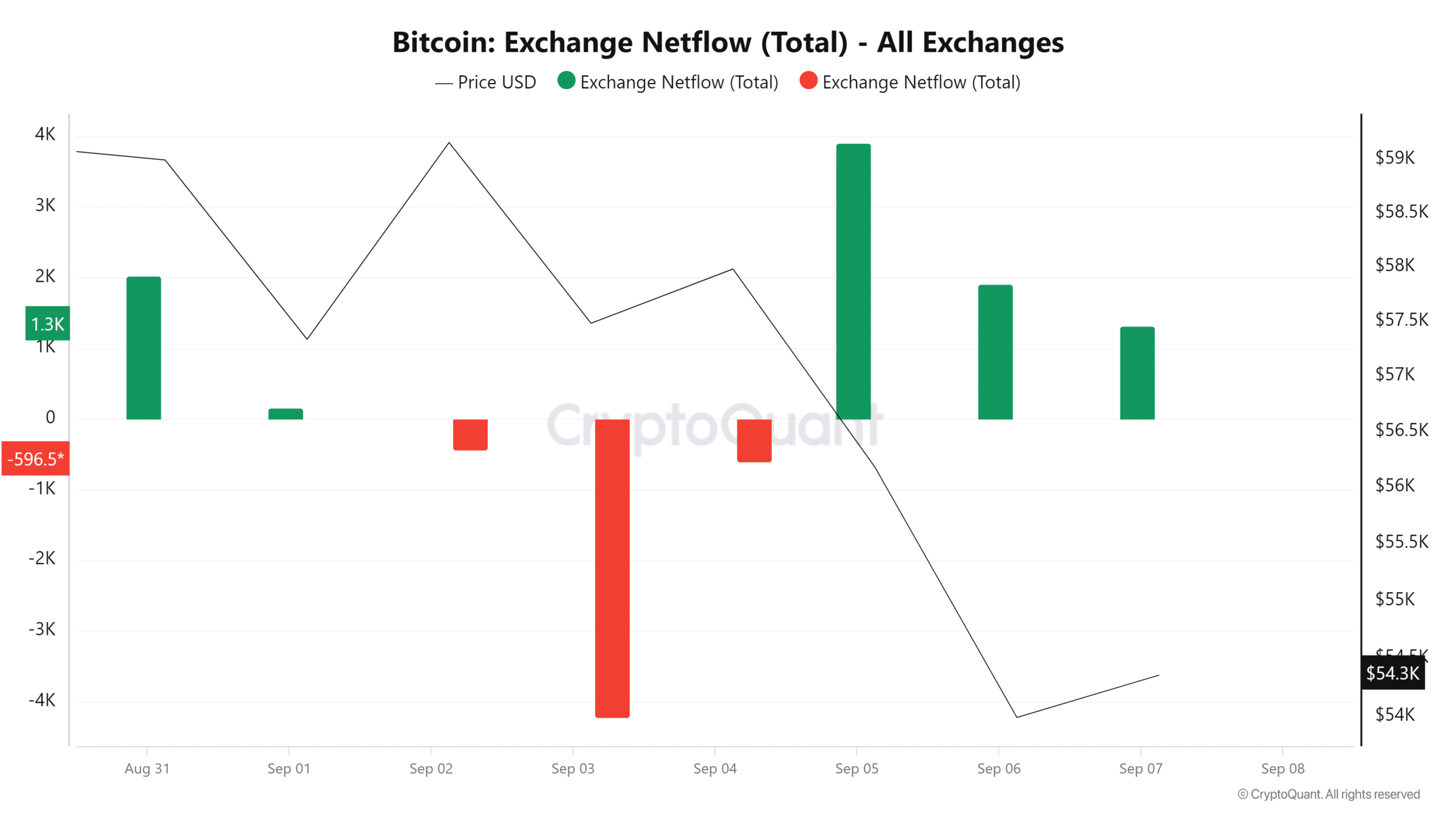

Over the last week, there has been a predominantly favorable trend in Bitcoin’s exchange transactions. Specifically, four out of the past seven days have shown positive exchange netflows, indicating that more investors are likely preparing to cash out their holdings. This increase in inflows into exchanges could potentially lead to selling, which would result in distribution if it occurs.

Given all these circumstances, it seems likely that if the selling pressure continues, Bitcoin may drop below the $50,000 mark.

Read More

2024-09-08 05:11