-

Data showed that ETH’s underwhelming performance has restricted money flow in the market.

Old coins were moving, indicating that selling pressure might continue.

As a researcher with experience in the crypto market, I’ve been closely monitoring Ethereum’s [ETH] performance and its impact on the wider market. Based on the available data and analysis from reputable sources like 10x Research, it appears that Ethereum’s underwhelming performance has restricted money flow into the market.

According to a recent analysis by 10x Research, Ethereum [ETH] faces the task of repeating its impressive gains from the previous bull market. The report indicated that Ethereum’s underlying strengths have deteriorated.

Ethereum’s current state is hindering the inflow of funds into the market at an accelerated pace. In simpler terms, for people new to the subject, 10x Research is a platform that offers in-depth institutional analysis on cryptocurrencies.

Based on their perspective, Ethereum (ETH) fueled the 2020-2021 cryptocurrency bull run. Yet, its underperformance compared to other altcoins holds back the market from achieving its maximum growth potential.

Is ETH dragging BTC and others back?

According to the company’s statement, Ethereum was anticipated to boost adoption, yet it hasn’t lived up to expectations. Moreover, the report pointed out that Ethereum’s strong correlation with Bitcoin [BTC] has negatively impacted Bitcoin as well.

It’s striking that Bitcoin (BTC) and Ethereum (ETH) exhibit a strong correlation, with an R-square of 95%. Ethereum’s tenuous fundamentals pose a challenge for Bitcoin by hindering substantial fiat currency investment into the crypto sphere.

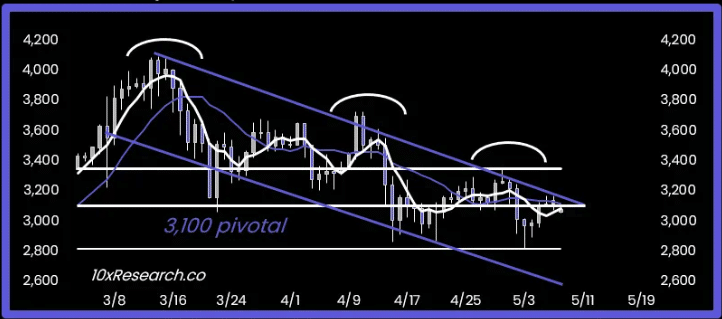

As a researcher, I’ve observed that Ethereum (ETH) was currently trading at around $3,128 based on the latest market data. Notably, 10x Research has identified the $3,100 region as a significant level for ETH price movements.

As a researcher, I examined the chart presented by the platform with great interest. The data indicated a potential downward trend in price, which could reach approximately $2,600 if corrective measures were neglected. Upon closer inspection, I discovered several compelling reasons supporting this prediction.

The traction stops, places the price in danger

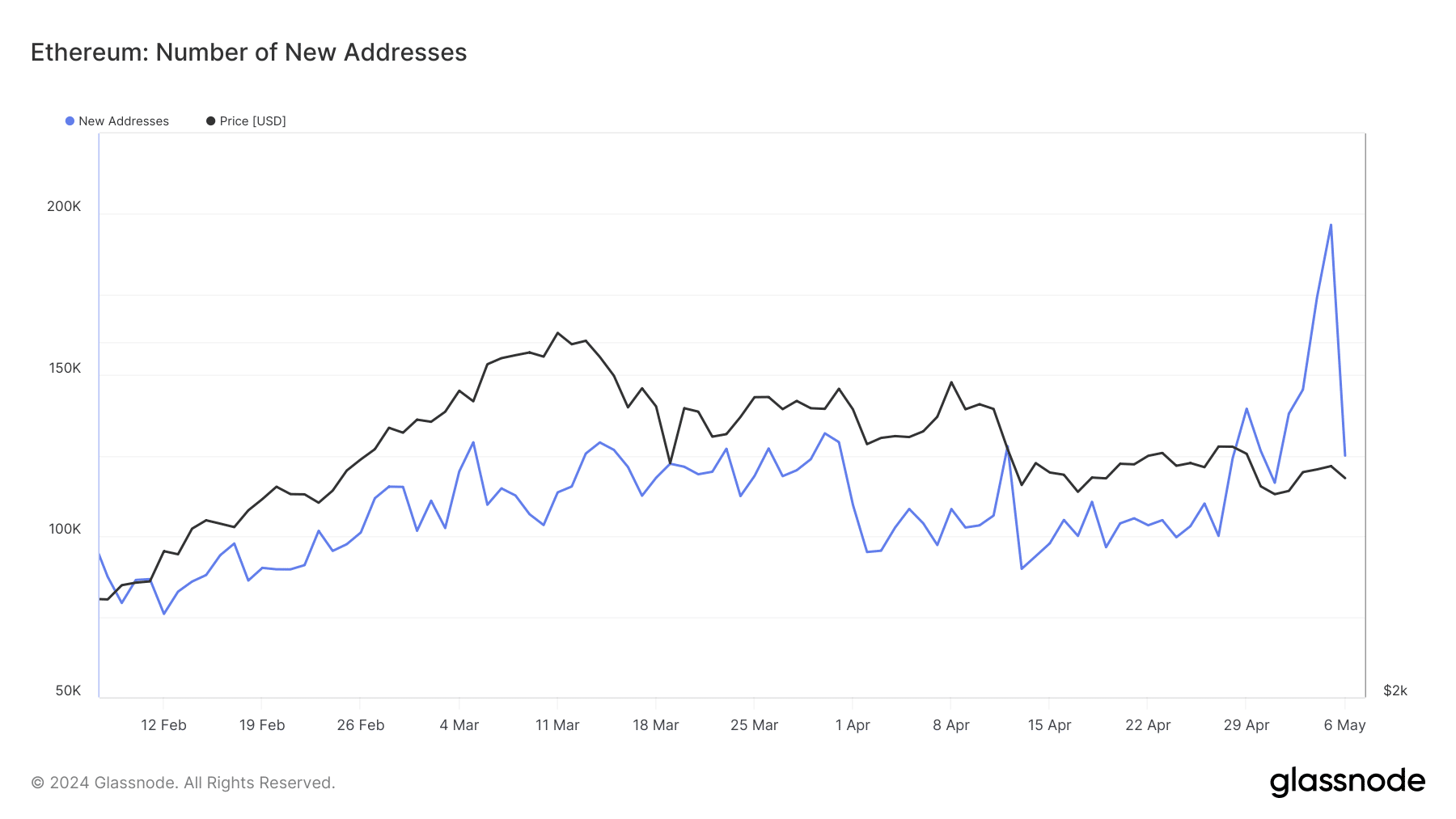

Initially, we pondered examining Ethereum’s growth in new addresses. Based on information from Glassnode, there were approximately 196,620 newly created Ethereum addresses on the 5th of May.

The figure represents the count of distinct addresses engaging in a transaction for the first time, but currently stands at approximately 125,008.

Should Ethereum’s growth rate falter, its situation becomes precarious, just as with the value of Ether itself.

If the number of Ethereum addresses keeps decreasing, I would caution that Ethereum could potentially slip below the $3,100 mark, as previously forecasted.

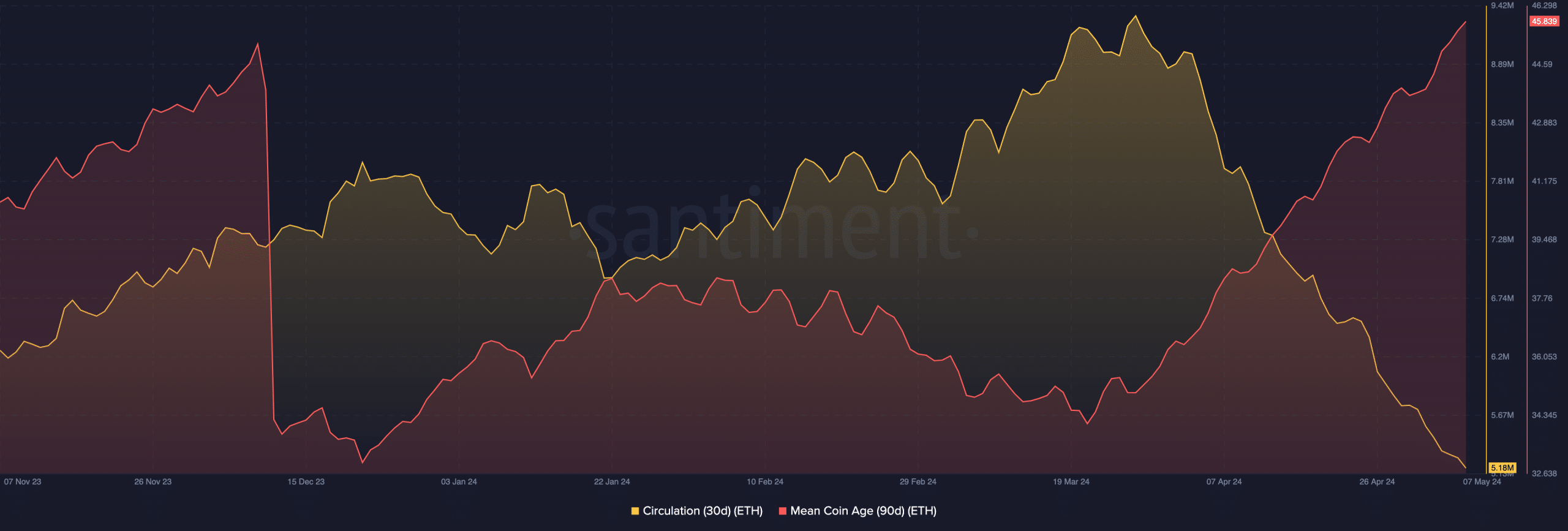

As a crypto investor observing Ethereum (ETH), I’ve noticed a trend: the daily supply of ETH in circulation has been shrinking since March. This means that less of the coins have been involved in transactions during this period.

Normally, a decrease in trading volume for Ethereum might indicate reduced demand for the cryptocurrency. Yet, it’s essential to consider that this could also mean that there are fewer Ethereum tokens available for sale.

We also examined the Mean Coin Age (MCA), which reflects how long ago coins were last spent or minted. A lower MCA implies more recent transactions, potentially signaling a build-up of coins and possibly predicting price increases ahead.

Read Ethereum’s [ETH] Price Prediction 2024-2025

The 90-day minimum deposit requirement for Ethereum transactions on its network surged to a remarkable 45.83. Such a significant rise suggests that Ethereum investors with a longer-term holding strategy may be transferring their coins.

The actions we’re seeing could indicate a possibility for sales. Consequently, Ethereum’s price recovery may take a back seat as it battles to advance further.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

2024-05-07 22:16