-

BTC halving cycle relevance will be over by 2028, says exec

Analyst projected this cycle’s top target of $200k-$260k, possibly by 2025-end

As a seasoned crypto investor with over a decade of experience in this rollercoaster ride, I find myself both intrigued and cautiously optimistic regarding the latest predictions about Bitcoin’s future. On one hand, we have Charles Edwards, who suggests that this halving cycle might be the last to significantly impact BTC‘s price rally. His argument makes sense, given that the inflation rate of BTC is already below gold, and the mining industry has become more efficient over time.

In simpler terms, past instances of Bitcoin‘s halving events have typically led to significant price increases. This trend has caused many analysts and market participants to anticipate a sharp price surge following each halving event.

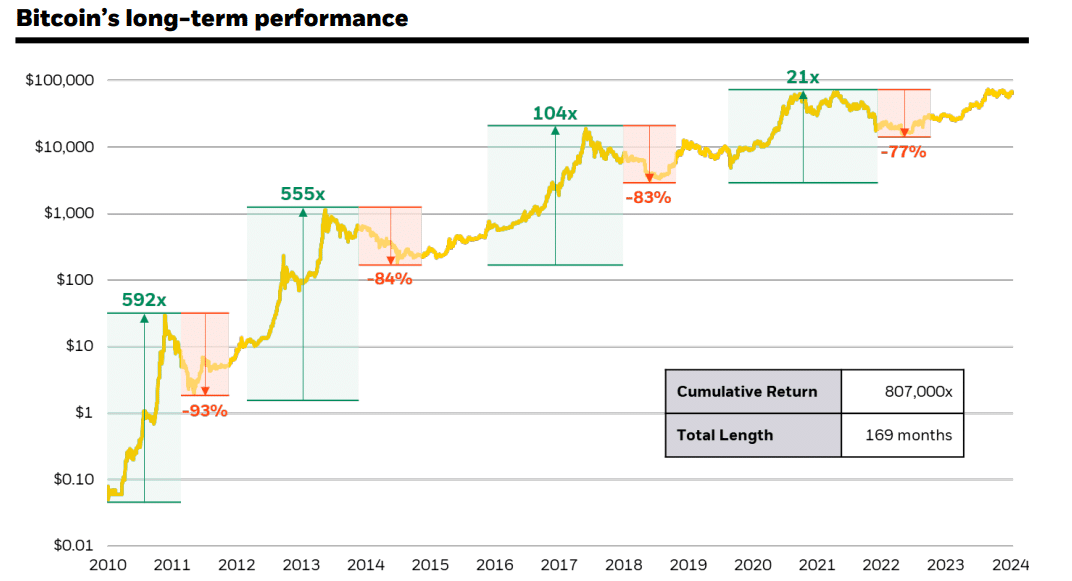

Based on a recent Blackrock analysis, Bitcoin’s worth has skyrocketed approximately 592 times since it first emerged in 2009. Remarkably, significant exponential growth was also observed following each of the last three halving occurrences.

Back in 2013, Bitcoin offered an astounding return of 555 times the initial investment, and in 2017, investors enjoyed a substantial 104-fold increase. Following the halving that occurred in 2020, it delivered a 21-fold gain. It’s anticipated that this pattern might reoccur after the halving event in 2024.

The last impactful BTC halving?

Nevertheless, Charles Edwards, the founder of cryptocurrency venture capital firm Capriole Investments, posits that this could potentially be the final halving event to trigger a steep upward trend in Bitcoin’s price. In his words, he stated:

“This is the last Halving cycle that matters.”

Edwards posits that the upcoming halving event may not significantly affect Bitcoin since it’s currently regarded as one of the hardest assets, characterized by a minimal inflation rate even lower than that of gold.

In the upcoming halving, there may not be significant impact since Bitcoin’s inflation rate is lower than that of gold. As a result, a drastic price decrease for Bitcoin might not have a major effect.

Edwards admitted that the current market cycle has not fully accounted for potential mass adoption by nations, but he pointed out that by 2028, the halving cycles might no longer hold significance.

Price surges won’t be significant due to the fact that the upcoming halving events are widely anticipated and the Bitcoin mining sector has become incredibly efficient. I predict that the four-year halving pattern won’t hold true in four years.

Here, it’s worth noting that market cycle analyst Stockmoney Lizards projected a possible price target of $200k—$260k per BTC for this cycle top. This could happen by Q4 2025.

In short, there is still more room for BTC growth before it hit this cycle top.

On Friday, the most significant digital asset briefly touched $66,000 before settling at a value of approximately $65,900 at the time of reporting. This places it just 8% shy of its peak level at $71,000.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Quick Guide: Finding Garlic in Oblivion Remastered

- BLUR PREDICTION. BLUR cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

2024-09-28 15:03