- Bitcoin and Ethereum Spot ETFs were major catalysts for crypto prices and holders’ conviction

- Rising DeFi popularity might catch participants by surprise next year

As a seasoned crypto investor with a decade of experience under my belt, I can confidently say that the past year has been nothing short of extraordinary for the digital asset market. The approval of Bitcoin and Ethereum Spot ETFs was undoubtedly a game-changer, opening up new horizons for mainstream investors and bolstering the confidence of existing ones like me.

Having closely followed the industry since its inception, I’ve seen countless twists and turns, but few events have had such a profound impact as the ETF approval. The emergence of financial giants like BlackRock and Fidelity into the crypto space was a testament to the maturing market, lending it much-needed credibility and legitimacy.

The DeFi boom that swept across the crypto landscape this year took many participants by surprise, myself included. The rapid growth of platforms such as Polymarket and World Liberty Financial has shown us just how powerful decentralized finance can be in disrupting traditional financial systems. While there may still be skeptics, the rising total value locked (TVL) across various chains speaks volumes about DeFi’s potential to reshape the future of finance.

The presidential elections also played a significant role in putting crypto on the map. Candidates’ stances on digital assets and their willingness to embrace blockchain technology have had a direct impact on market sentiment. The promise of regulatory clarity and a pro-crypto administration has been music to many investors’ ears, although we’ll have to wait and see if those promises are fulfilled.

In conclusion, the crypto landscape is evolving at an unprecedented pace, with new opportunities and challenges emerging constantly. It’s an exciting time to be a part of this revolutionary movement, and I can’t help but wonder what next year will bring. As for my personal investment strategy, I’m keeping a close eye on DeFi projects and their potential to disrupt traditional finance, while also staying nimble enough to adapt to the ever-changing market conditions.

Oh, and as always in crypto, remember: “Don’t trust, verify!” – Satoshi Nakamoto (or was it someone else?)

As a cryptocurrency enthusiast with over five years of investing and trading experience under my belt, I can confidently say that this past year has been nothing short of extraordinary in the world of digital assets. From Bitcoin’s [BTC] halving to the Ethereum [ETH] Spot ETF approval, these events have significantly impacted my portfolio and shaped my perspective on the future potential of blockchain technology.

In addition, the quantum computing threat and brief headlines surrounding Bitcoin have kept me on my toes, reminding me that this rapidly evolving landscape requires constant vigilance and adaptability. All in all, these highlights of the year serve as a testament to the excitement and volatility that comes with investing in cryptocurrencies, making it an unpredictable yet exhilarating journey for those willing to take the leap.

This year in crypto

The most significant advancement was the approval of Bitcoin Spot ETFs, which happened following some misleading reports that led to considerable fluctuations in Bitcoin’s price. For instance, an incorrect report from Cointelegraph in October 2023 triggered such volatility. On January 10th, 2024, it was announced by the U.S. Securities and Exchange Commission (SEC) that Spot Bitcoin exchange-traded funds (ETFs) had been approved.

As an analyst, I found myself swept up in the frenzy on Crypto Twitter recently. The buzz was palpable, fueled by the prospect of Bitcoin becoming accessible to millions of mainstream investors. Two heavyweights in the financial world, BlackRock and Fidelity, have entered the scene with their massive ETF funds, holding 550,000 and 200,000 Bitcoins respectively. This influx has undeniably added a positive momentum to the overall sentiment within the cryptocurrency market.

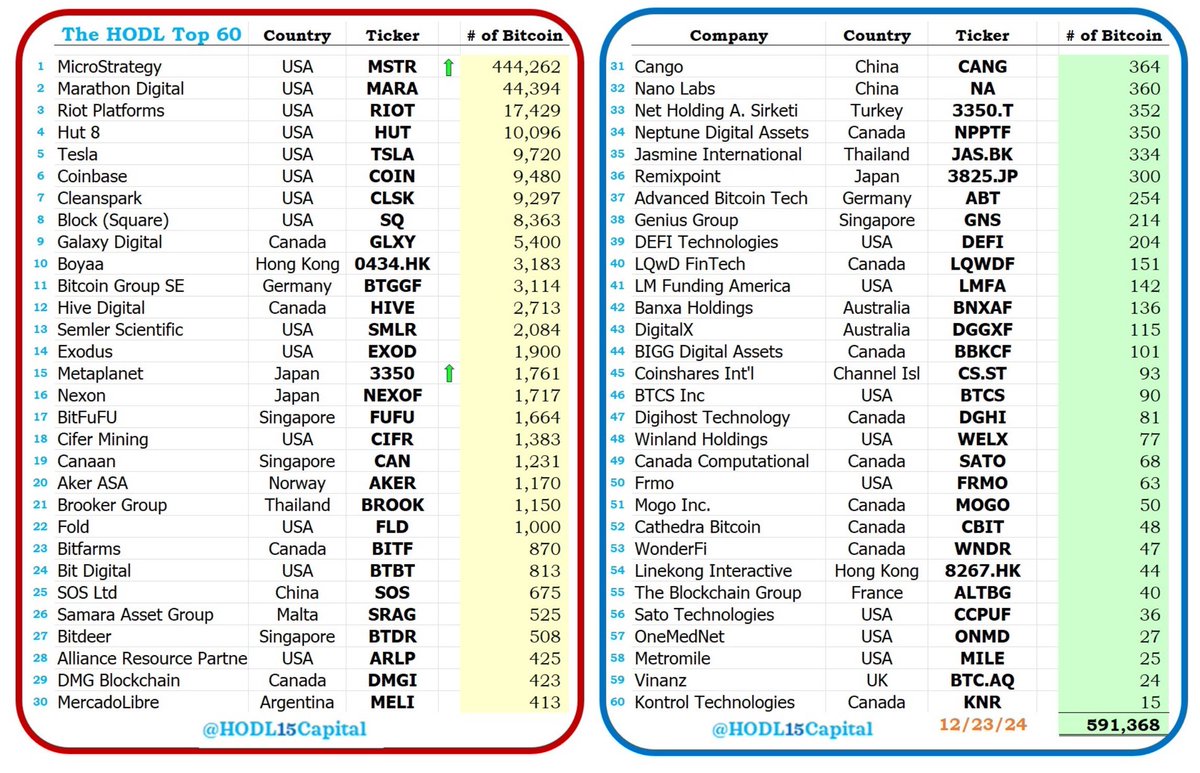

Previously confined to a specialized market, Bitcoin has now become accessible to the general public. These investments are governed by some of the most influential figures in the financial sector. Michael Saylor, Co-founder and ex-CEO of MicroStrategy, is one such investor who has been aggressively purchasing Bitcoin. Other businesses are also following suit and accumulating Bitcoin.

The Ethereum Spot ETF approval was also a boost to the industry.

U.S. Presidential elections bring crypto to the fore

2024’s presidential race ignited numerous discussions about each candidate and their potential administrations. Trump’s support for cryptocurrency, his attendance at related events, and his campaign pledges all signaled a pro-crypto stance, significantly enhancing the overall positive outlook towards crypto.

Indeed, the newly elected President has expressed plans to position the United States as a global leader in cryptocurrency. It’s expected that policy changes will be implemented to provide clearer regulations in this area. Moreover, it was announced that Donald Trump intends to dismiss SEC Chair Gary Gensler, who is known for his criticism of cryptocurrencies and aggressive regulatory stance. Gensler’s tenure was scheduled to end on the same day as Trump’s inauguration.

Whether he follows through on those promises remains to be seen.

Polymarket and other markets gain prominence

At the time of elections, the prediction market using cryptocurrencies, Polymarket, became quite trendy. This platform lets users profit or lose based on the results of global events. During those elections, it heavily predicted a Trump victory, which ultimately proved correct.

Read Bitcoin’s [BTC] Price Prediction 2025-26

At the end of September, Trump along with his three offspring unveiled World Liberty Financial – a digital finance platform focusing on decentralized money markets. Supporters view this move favorably, while detractors pointed out the potential conflict of interest. The clear transactions involving crypto tokens like Chainlink [LINK] and Aave [AAVE] by WLF were evident due to the transparency provided by blockchain technology, leading to an increase in the value of these digital coins.

In a nutshell, the overall DeFi sector is flourishing, with clear signs of resurgence evident as the total value locked (TVL) increases across various platforms. Currently, the TVL stands at around $120 billion, approaching the $170 billion peak it hit towards the end of 2021 during the previous cycle.

To wrap things up, Uniswap [UNI], the globe’s leading decentralized exchange (DEX) on Ethereum, broke records during November. The trading volume for its Layer-2 solution reached an impressive $38 billion, outdoing the previous high of $34 billion it recorded in March 2024.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-12-29 03:04