-

RUNE’s price dropped by 70% in the last six months alone

Most technical indicators hinted at a trend reversal

As a seasoned researcher with years of experience navigating the ever-changing crypto landscape, I find myself intrigued by the recent developments surrounding THORChain [RUNE]. While the hard fork introduced several promising updates, it’s disheartening to see the token’s price plummeting. The 70% drop in the last six months alone is a stark reminder of the volatile nature of this space.

Recently, THORChain’s [RUNE] underwent a significant hard fork, introducing new modifications to its blockchain. Despite this update, the hard fork failed to ignite optimistic market reactions as the token experienced substantial drops in value, registering double-digit declines. Therefore, it’s advisable to delve deeper into the current situation with RUNE.

THORChain’s latest hard fork

On September 4th, THORChain’s developers carried out a significant update, or hard fork, to their blockchain. This upgrade introduced several key improvements, including the elimination of outdated legacy code, an upgrade to the Cosmos SDK version, streamlining node states for quicker synchronization, and incorporation of support for Bitcoin Taproot addresses.

From my perspective as an analyst, despite the new hard fork bringing significant updates, it seems to have fallen short in attracting market bulls. This is particularly evident when considering that the token’s value has decreased by approximately 70% over the past six months. Intriguingly, over the last seven days, RUNE‘s price has seen a further decline, dipping into double-digit territory.

Based on data from CoinMarketCap, the value of RUNE dropped by approximately 11% within a single week. As I write this, its price stands at around $3.54 and boasts a market cap exceeding $1.18 billion.

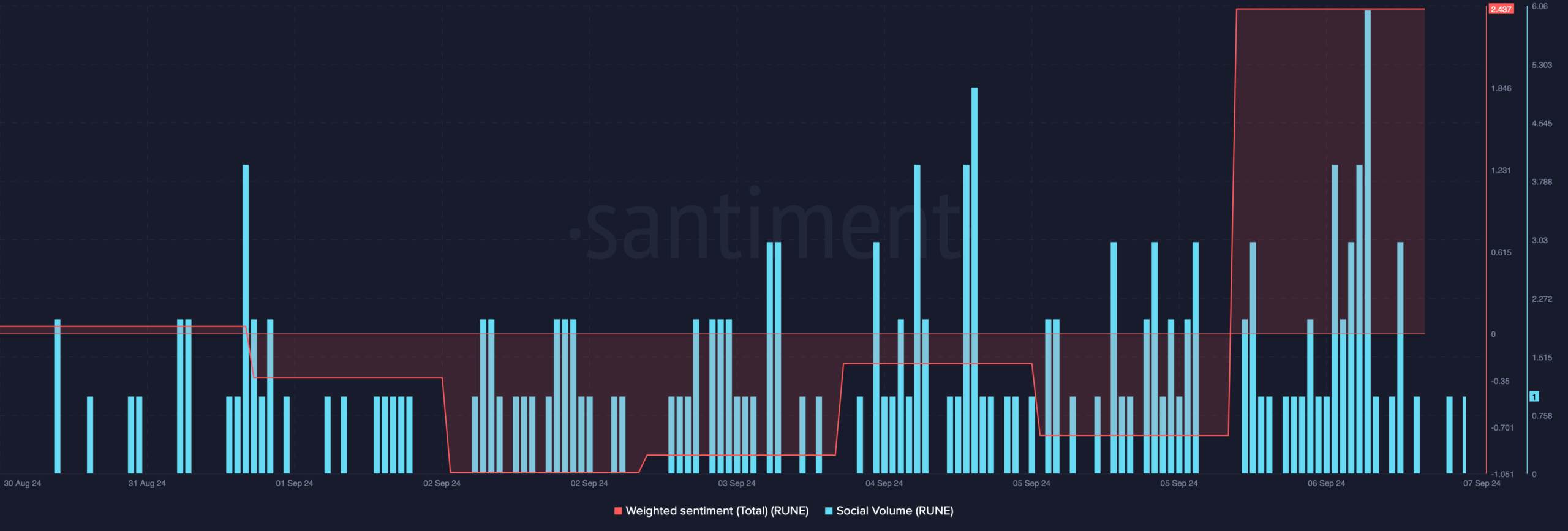

As a crypto investor, I found myself in an unusual situation recently: while the price of my token was falling, its trading volume was surprisingly increasing. Typically, when volume rises during a price drop, it can signal the start of a bear market rally. However, what intrigued me was that despite this downward price trend, RUNE‘s weighted sentiment actually climbed higher. This unexpected surge in bullish feeling suggests that there might still be some optimism among investors.

Its social volume also spiked, reflecting the token’s popularity in the crypto space.

Additionally, an analysis of Coinglass data by AMBCrypto showed another positive sign. From our perspective, the number of long positions in the market for RUNE exceeded the number of short positions, suggesting a bullish trend.

What to expect from RUNE?

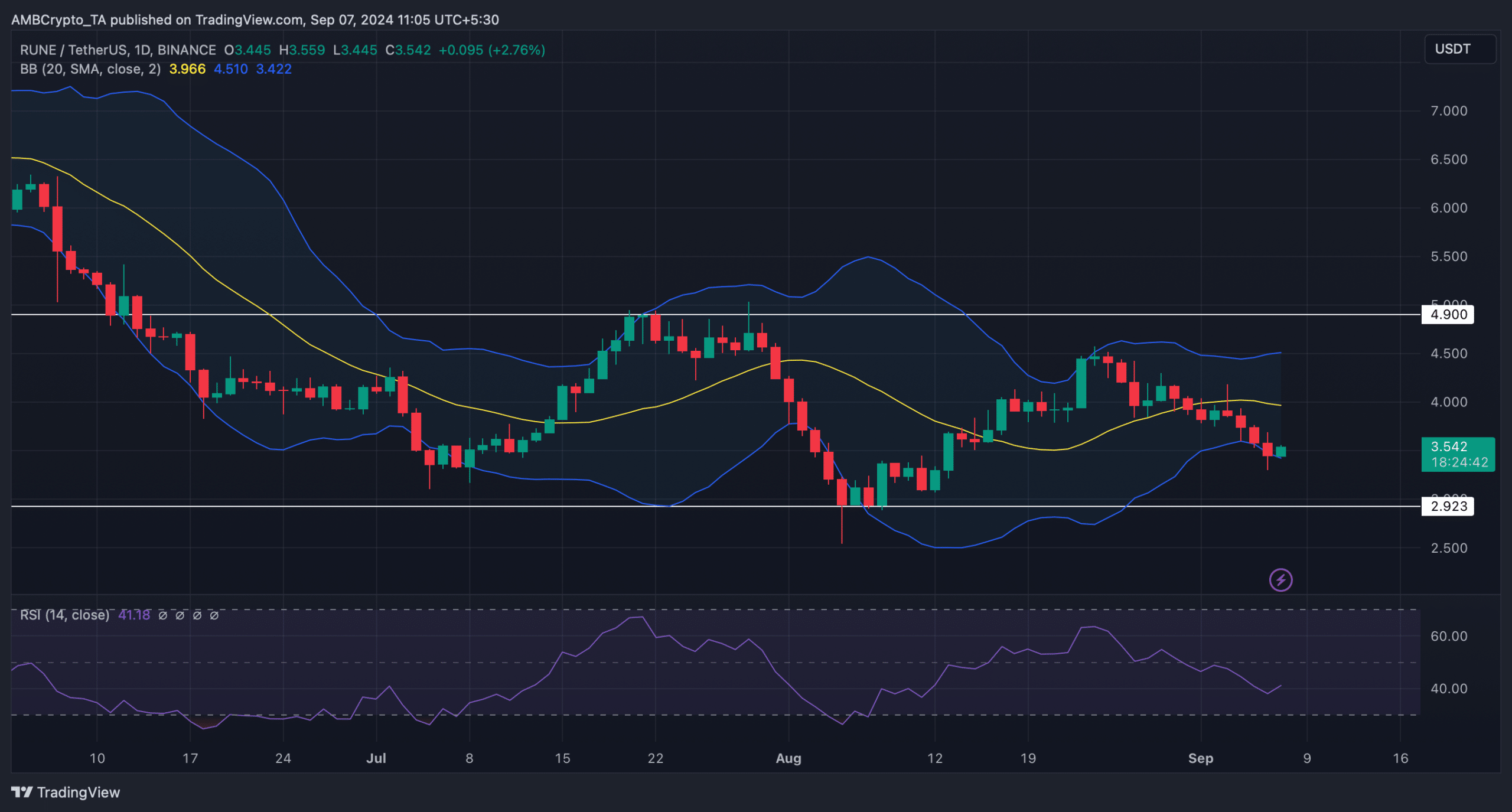

After examining the day-to-day graph, AMBCrypto sought to determine if bulls could potentially dominate in the upcoming period. Our evaluation indicates that the value of RUNE has been confined within a parallel trendline. Fortunately, there’s some optimistic information:

The token’s price reached the bottom boundary of the Bollinger Bands, a situation that frequently precedes price increases. Additionally, its Relative Strength Index (RSI) showed signs of an increase as well, indicating a possible imminent trend reversal towards bullishness.

Read THORChain [RUNE] Price Prediction 2024-25

Finally, AMBCrypto’s analysis of Hyblock Capital’s data revealed the altcoin’s upcoming targets.

According to technical analysis, if the bulls gain dominance, there’s a possibility that the value of RUNE could rise towards $4.22 over the next few days. Conversely, if there’s a continuous price decline, it could dip down to approximately $2.90.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2024-09-07 14:15