- While THORChain’s price increased, its trading volume also surged.

- Metrics revealed that whales were having higher exposure in the market.

As a seasoned researcher who has witnessed countless market fluctuations, I must admit that THORChain’s [RUNE] recent performance has piqued my interest. The token’s impressive double-digit surge over the past 24 hours and the significant increase in trading volume is reminiscent of a well-orchestrated bull rally.

Over the past 24 hours, THORChain’s [RUNE] value has impressively risen by double-digit figures. During this period, there was also a significant increase in the token’s trading activity.

Instead, let’s examine more closely the factors that initiated the bull run for this token, and if we can expect this upward trend to continue.

THORChain begins a rally

According to CoinMarketCap’s findings, the price of RUNE saw an increase of approximately 16.5% over the last seven days. However, the good news doesn’t stop there – in just the past day, the value of this token has climbed by more than 13%.

Currently, as I pen this down, THORChain is being exchanged for around $3.70 each, boasting a total market value exceeding $1.2 billion. This positions it as the 55th largest cryptocurrency in terms of market capitalization.

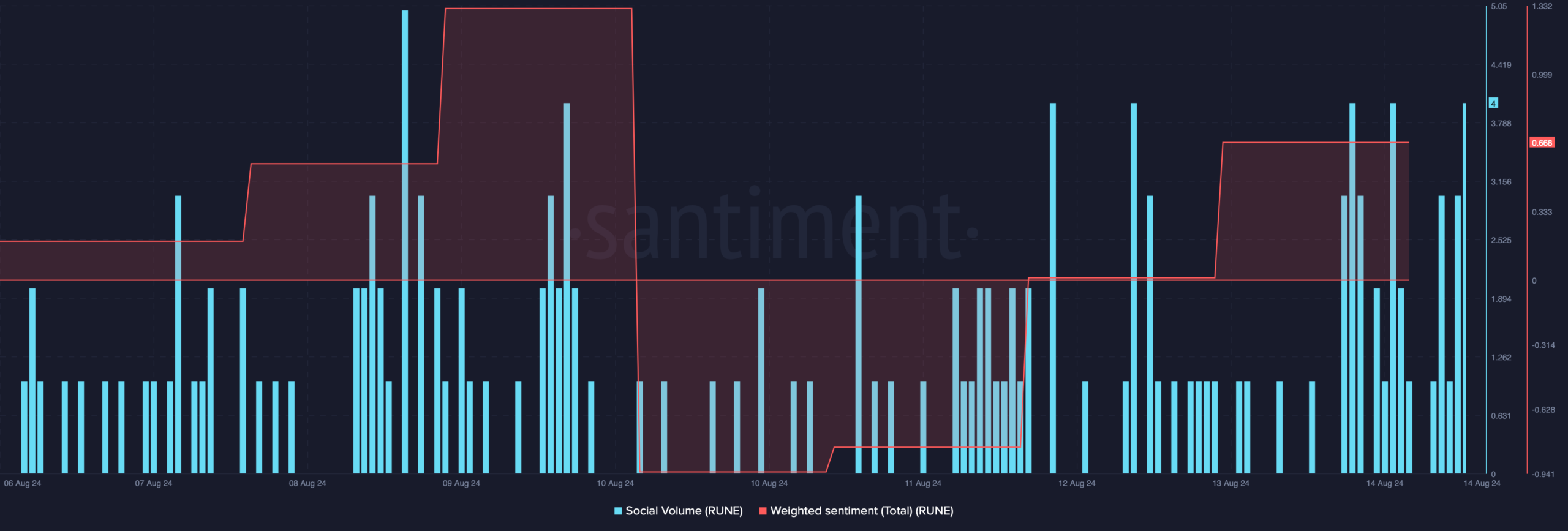

Due to the rise in price, the token’s Weighted Sentiment shifted towards optimism, implying that more buyers than sellers are currently active in the market.

The social activity level stayed elevated, indicating a growing interest in RUNE within the cryptocurrency community.

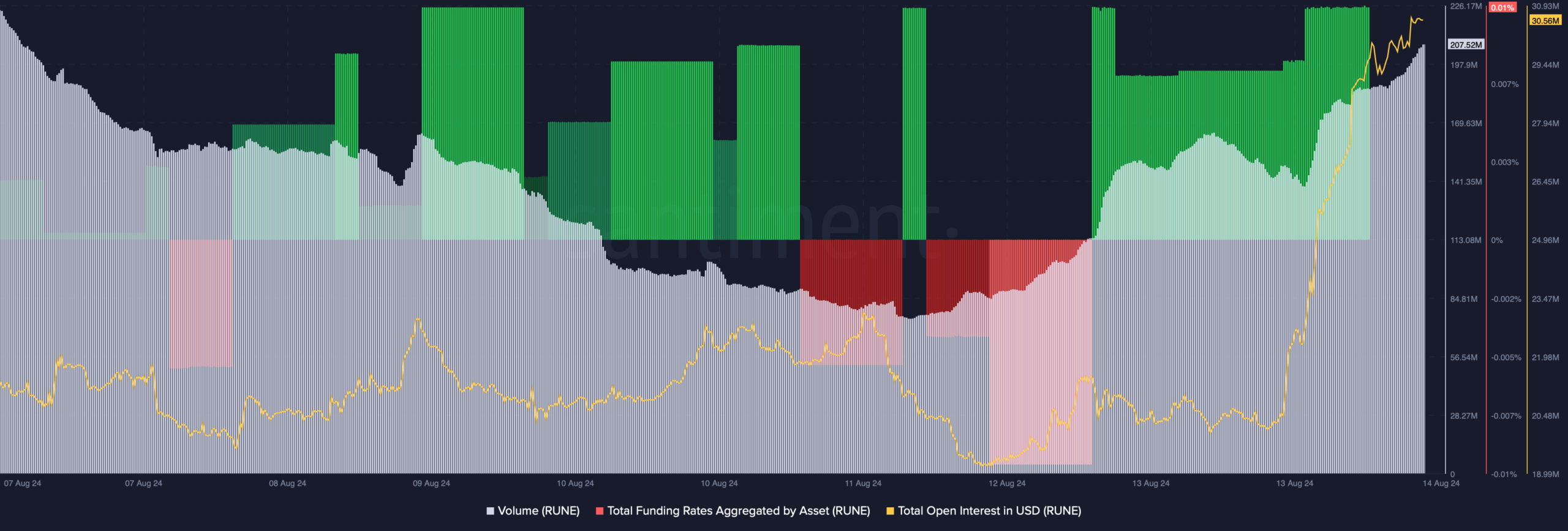

As I delved deeper into my analysis of the token’s performance, I noticed an intriguing correlation between its trading volume and price. Typically, when both the volume and price are on the rise, it provides a robust base for a bull run.

As an analyst, I noticed that the open interest has risen, suggesting a higher likelihood of the bullish trend persisting. Yet, it’s important to note that RUNE‘s funding rate has escalated as well, which could potentially indicate increased bearish sentiment among market participants. This calls for closer monitoring and careful analysis of market dynamics moving forward.

Generally, prices tend to move the other way than Funding Rates, which is a bearish notion.

Will the bull rally last?

At the current moment, according to AMBCrypto’s examination of Hyblock Capital’s data, the difference between large investors (whales) and regular investors (retail) in THORChain stands at approximately 96 units.

In this context, the range of this indicator spans from -100 to 100, where a value of 0 specifically signifies the presence of whales (large investors) and retail traders alike, both occupying identical positions.

As a researcher, I found that the value being significantly nearer to 100 suggests a higher long-exposure level among whale investors compared to retail traders.

Additionally, it’s worth noting that the Long/Short Ratio for RUNE saw a significant spike based on the data provided by Coinglass.

Based on my personal experience and extensive trading history, it appears that there were more long positions in the market than shorts, which suggests a strong bullish sentiment among traders. This is a pattern I have noticed often during periods of market optimism, where investors are confident about the future growth prospects of certain assets. However, it’s important to remember that markets can be unpredictable and trends can quickly reverse, so it’s essential to always approach trading with caution and maintain a disciplined strategy.

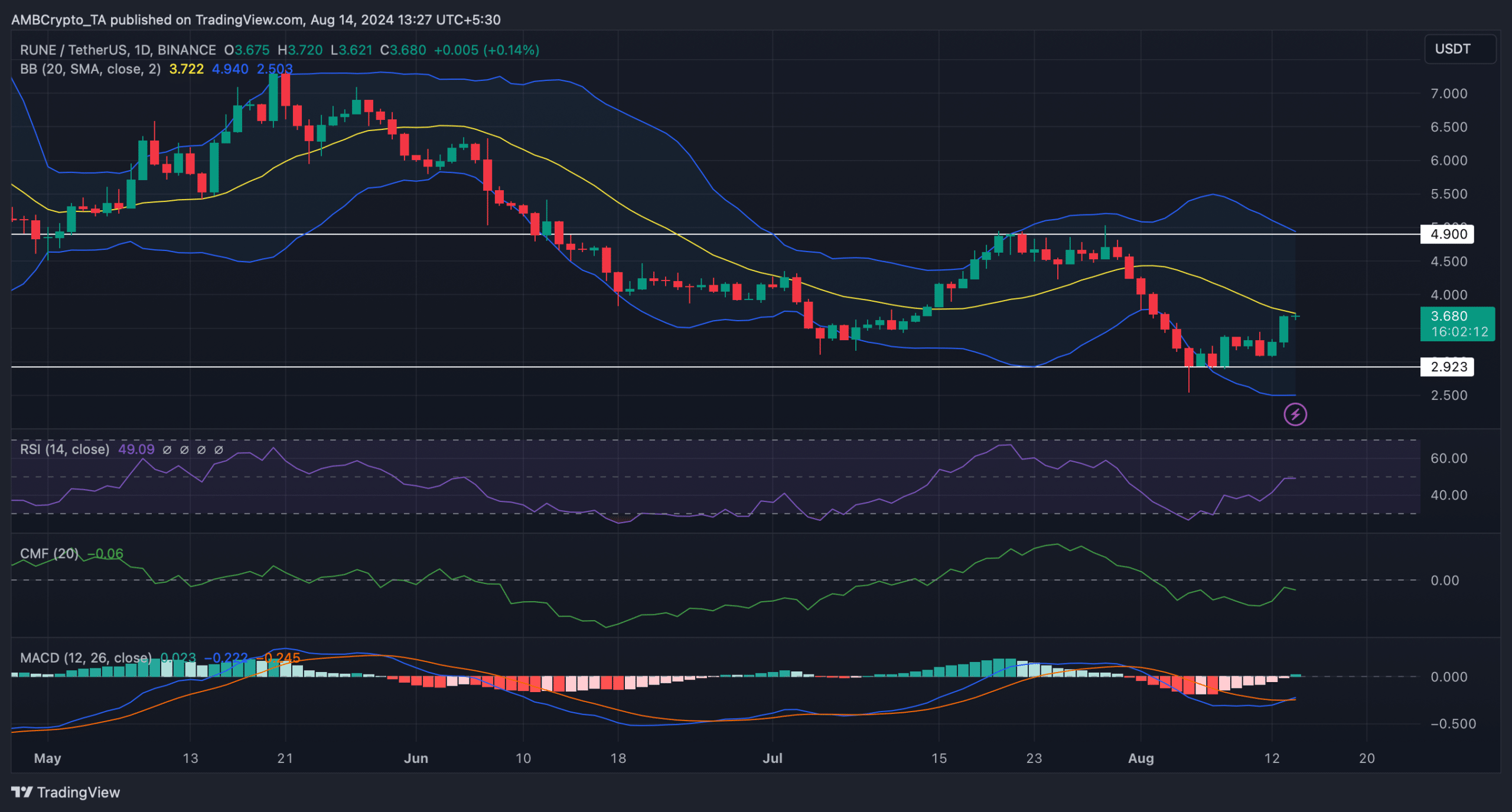

Later, we decided to examine the daily graph of THORChain to gain insight into if this upward trend would persist. Meanwhile, the technical indicator Moving Average Convergence Divergence (MACD) showed a bullish signal.

Read THORChain [RUNE] Price Prediction 2024-25

In simpler terms, the RUNE token’s price was approaching a level of resistance close to its 20-day average moving line (SMA), as shown by Bollinger Bands. If the token manages to surpass this level, it could potentially regain the price range of $4.9 to $5.

However, both its Relative Strength Index (RSI) and Chaikin Money Flow (CMF) registered slight downticks, indicating that the bull rally might come to an end soon.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-08-14 16:41