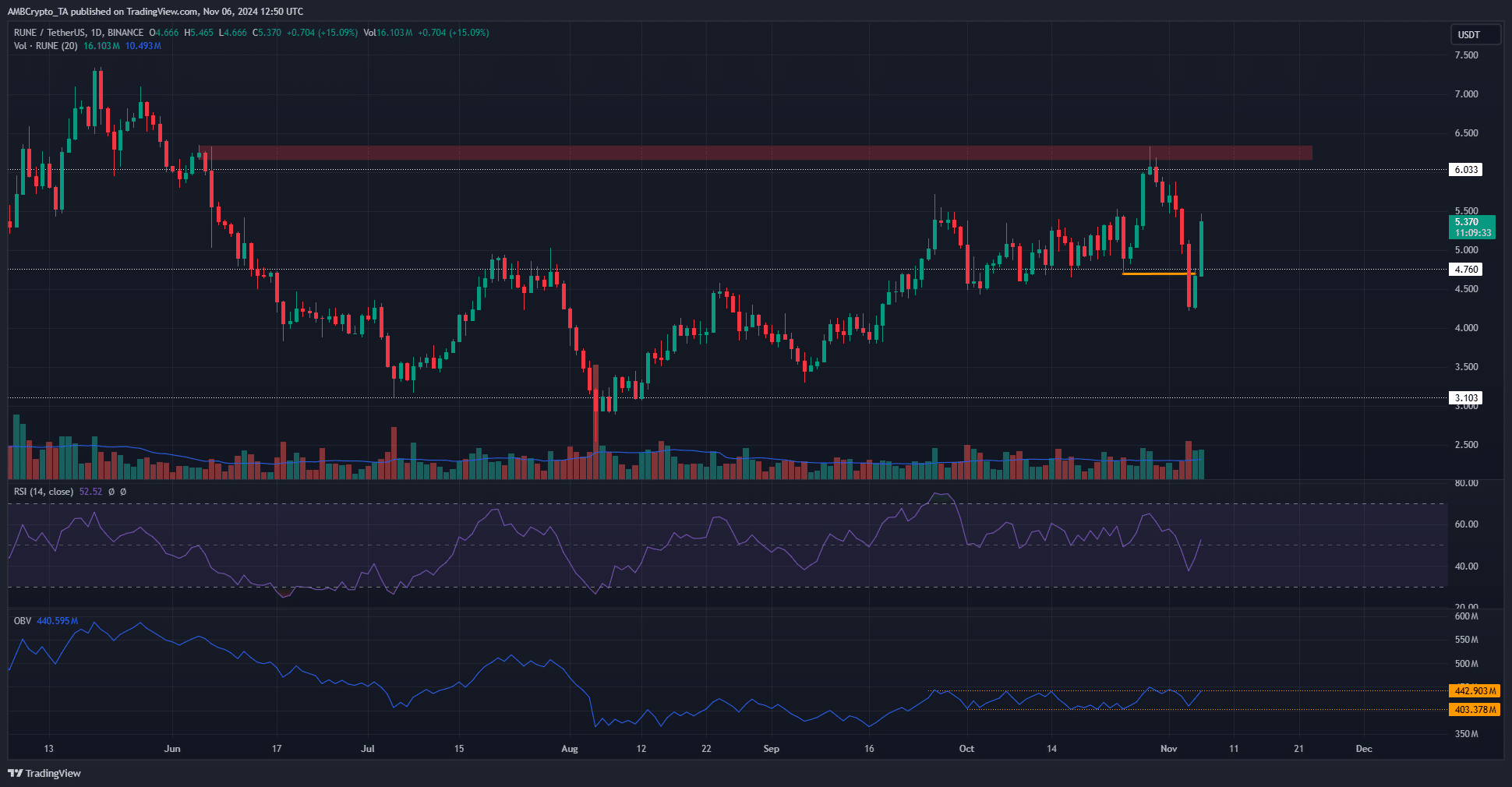

- THORChain had fallen below the past month’s demand zone at $4.5.

- Its quick recovery showed that sellers were not dominant.

As a seasoned crypto investor with battle-tested nerves and a knack for deciphering market trends, I must admit that the recent surge of THORChain [RUNE] has piqued my interest. The 17.15% spike within 24 hours, coupled with Bitcoin’s [BTC] new all-time high against the U.S. Dollar, has sent ripples throughout the crypto sphere, making it hard not to be enthralled by this bullish momentum. However, I’m not one to jump on a bandwagon without considering the finer details.

In the last 24 hours, THORChain’s RUNE token experienced a 17.15% increase, and optimism about cryptocurrencies is surging across the market following Bitcoin hitting a new record high of $75.4k against the U.S. Dollar.

On Monday, the market displayed a significant downturn, with sellers taking a strong stance. However, the buyers moved swiftly to alleviate concerns about a potential trend reversal towards bears.

Has the cost surpassed the $4.76 mark, indicating a promising short-term trend, yet can buyers sustain and grow from here onwards?

Bearish market structure break for THORChain

On a day-to-day basis, RUNE has been gradually climbing upwards since the significant drops in August. This upward trajectory persisted until the 4th of November, maintaining a bullish market pattern.

As an analyst, I’ve observed a rough patch for Bitcoin [BTC], with its value dipping to around $66.8k following a rejection at the $73.6k mark, which we encountered six days prior.

After this refusal, there was intense selling activity on RUNE which caused the price to drop from the bearish resistance level of around $6.3 in June down to approximately $4.22 within a week.

It represented a 33.3% drawdown, and flipped the market structure bearishly.

Concerningly, the stronghold established by THORchain over the last month near the $4.5 level has been broken. However, it’s worth noting that the On-Balance Volume (OBV) has remained relatively stable within a small range.

This indicates that it’s probable for RUNE to transact between $4.5 and $6.3, provided the On-Balance Volume (OBV) stays within the specified boundary.

Further clues of a range formation

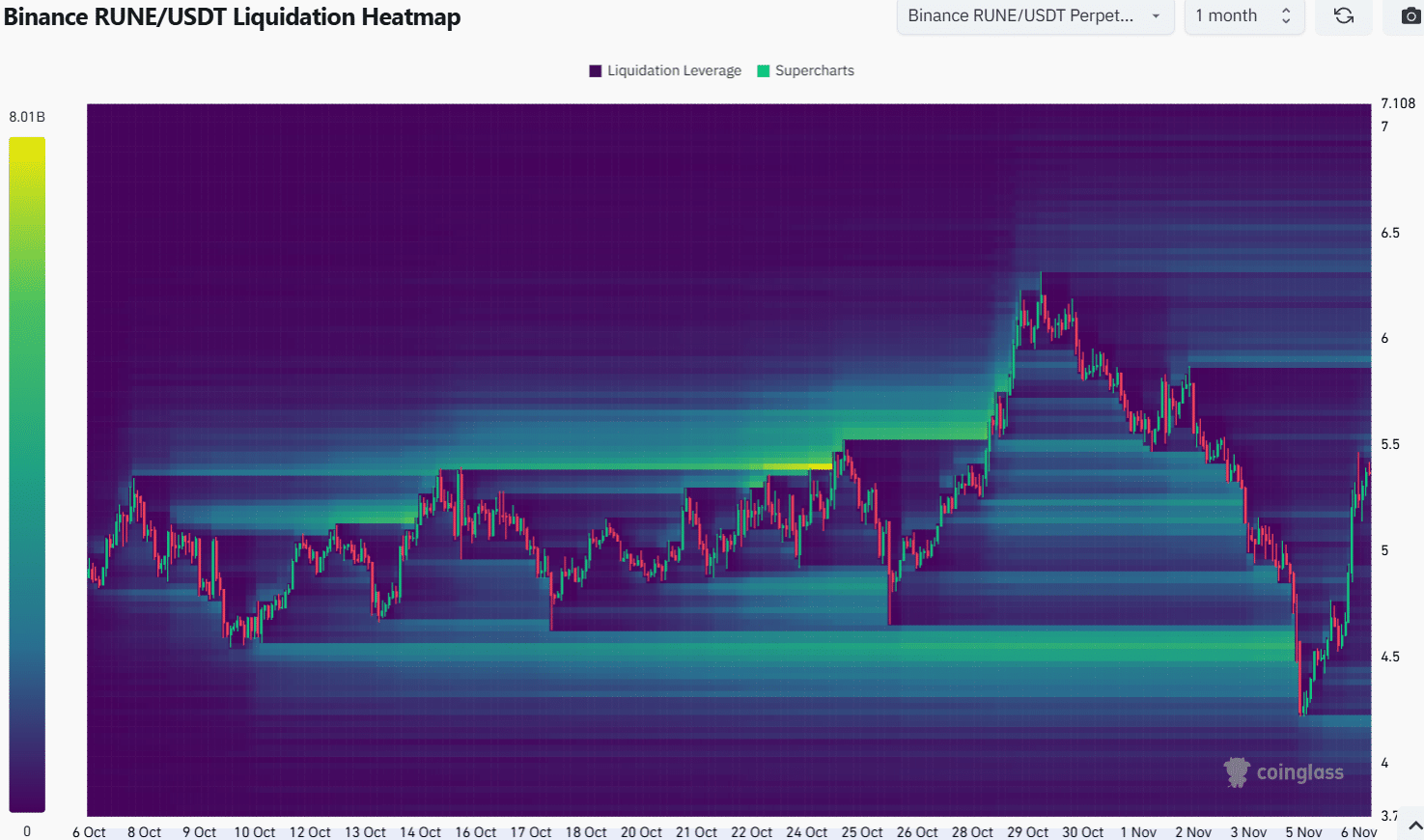

The heatmap indicating liquidation revealed that the concentration of liquidity amassing near the price point of $4.5 was significantly reduced during the latest market correction.

From this area, the sudden surge could indicate that the action was primarily fueled by liquidity rather than an extensive wave of sell-offs in the active market.

Read THORChain’s [RUNE] Price Prediction 2024-25

Currently, there isn’t a distinct reserve of liquidity that is drawing RUNE. The price range between $5.8 to $6.2 holds potential for further increases, yet it may not do so promptly.

It seemed more probable that the price of RUNE might fall towards $6, providing an opportunity for short sellers to accumulate, after which it could potentially rise again to target and eliminate these short positions.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-11-07 07:03