-

Ethereum Foundation defended itself after a recent ETH sell-off sparked scrutiny

EF has been accused of a ‘lack of transparency’

As a seasoned analyst with over two decades of experience in the finance industry, I find myself intrigued by the ongoing saga surrounding Ethereum Foundation and its recent 35k ETH sell-off. The accusations of lack of transparency are not uncommon in the crypto world, but they seem particularly pronounced here given the Foundation’s influential role in the Ethereum ecosystem.

Today, Ethereum Foundation is making headlines due to backlash from the cryptocurrency community following a recent sale of 35,000 ETH on Kraken. Some members of the community have expressed their dissatisfaction with the timing of the sale, suggesting that the Foundation capitalized on the weekend market recovery to liquidate its holdings.

Others, such as the anonymous Ethereum main developer and promoter known as Anti Prosynth, raised concerns about how the Foundation could transfer funds without first providing prior notifications.

“Could we talk about the financial disclosures at Ethereum for a moment? I’m really puzzled; it seems quite unexpected that such changes are being made without any prior announcement.”

In a similar vein, Eric Conner, another member of the Ethereum’s core development team, expressed his frustration with the Foundation’s perceived lack of transparency.

However, it’s disconcerting and quite exasperating that the EF has maintained a veil of secrecy for a decade. It’s not unreasonable at all to expect straightforward financial statements or clear explanations regarding the flow and utilization of funds.

Ethereum Foundation defends itself

Contrarily, Aya Miyaguchi, as Executive Director of the Ethereum Foundation, explained that the recent sale of 35k ETH was an aspect of their “treasury operations” and some transactions are made using fiat currency only. In simpler terms, she stated that the organization had to sell Ether for certain activities, and they also handle payments in traditional currencies.

“Managing our financial resources is an essential aspect of our operations. Each year, EF allocates approximately $100 million, primarily sourced from grants and salaries. Some of these funds are distributed to recipients who can only process transactions in traditional currencies (fiat).”

She mentioned that due to the regulatory hurdles they encountered at the start of 2024, it wasn’t feasible for them to disclose their planned adjustments to funds ahead of time.

“For much of this year, we’ve been instructed to pause our treasury operations because of complex regulations. Unfortunately, we couldn’t reveal our plans ahead of time. However, moving forward, you can expect a strategic and phased approach to sales.”

In early 2024, the Ethereum network (EF) faced a thorough investigation by the United States Securities and Exchange Commission (SEC), which reportedly started following the network’s shift to Proof of Stake (PoS) in September 2022. The SEC was seeking to determine if Ethereum was a security, but eventually, they discontinued their probe and authorized U.S.-based spot Ethereum ETFs during the second quarter.

Despite Miyaguchi’s explanations, some individuals like Marc Zeller, the Founder of Aave [AAVE], found them insufficient.

According to Zeller, certain members of Ethereum’s development team, such as Geth (a widely used Ethereum client), may not be generating enough income to justify the $100 million yearly budget. He proposed disbanding the Ethereum Foundation once the forthcoming updates are implemented.

“The Geth team is working tirelessly yet they’re underpaid, with each member earning just 100 million dollars annually for their crucial contributions. When the Purge and Verge upgrades are complete, it’s high time to ponder the possibility of disbanding the EF.”

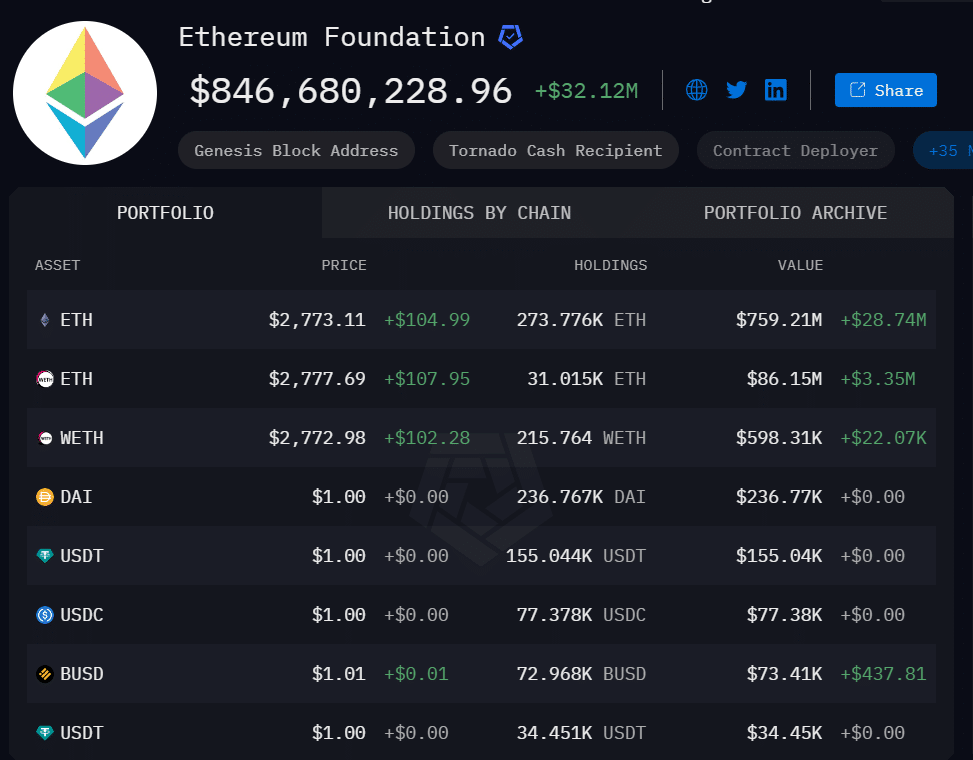

Based on information from Arkham, the recent sale has brought down the Foundation’s Ethereum holdings to approximately 273,000 coins. With today’s market values, these coins are valued at roughly 800 million US dollars.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- SOL PREDICTION. SOL cryptocurrency

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-08-25 08:08