-

ETH reclaimed $2500 after last week’s Fed pivot and boosted the ETH/BTC pair.

Per Cowen, ETH/BTC could bottom if the pair reclaims the 50-day MA short-term trend.

As a seasoned analyst with over two decades of experience in the financial markets, I find myself cautiously optimistic about Ethereum [ETH] and its relative performance against Bitcoin [BTC]. While it is true that ETH declined by 25% in Q3 and hit a record low on the ETH/BTC pair, last week’s Fed pivot has certainly given Ethereum a boost. The rally to reclaim $2500 and the net inflow of $8.2 million in US spot ETH ETFs are positive signs that should not be ignored.

Despite the launch of a U.S. spot Ethereum ETF in the third quarter, there appears to be reduced enthusiasm for Ethereum [ETH] among investors. As a result, ETH dropped by 25% during this period and reached an all-time low when compared to Bitcoin [BTC], as indicated by the ETH/BTC pair that monitors Ethereum’s performance in relation to Bitcoin.

The recent shift in the Federal Reserve’s stance (last week) appears to have boosted the value of altcoins, enabling them to surge back above $2500 after a successful three-day rally.

Over the last two trading days, there was a significant increase, along with an accumulated investment of approximately $8.2 million, into U.S. spot ETH ETFs.

When will ETH/BTC bottom?

Yet, despite this perspective, crypto expert Benjamin Cowen remained wary regarding Ethereum’s potential for growth and the possible bottom for ETH/BTC.

According to Cowen, the low point for ETH/BTC might continue to evade us if this pair cannot regain its 50-day Moving Average (MA). He points out that similar trends from 2016 and 2019 could be indicative of this.

Following the decline of ETH relative to BTC in 2016 and 2019, the lowest point was reached when ETH/BTC surpassed its 50-day Simple Moving Average again. Therefore, if ETH/BTC remains below its 50-day SMA, there’s still a possibility that the pair could drop further.

But he added that the pair could recover if it bounced above the 50-day MA, which was at 0.04255.

When we pass the 50D Simple Moving Average, I believe it’s more probable than not that the lowest point has already been reached.

Price action above the 50-day MA typically signals a bullish short-term momentum.

Meanwhile, some whales were taking profits from recent ETH price appreciation. Per Spot On Chain, a familiar whale has sold 15K ETH worth $38.4 million on Kraken. The address has made two other sell-offs in Q3, each leading to ETH’s slight decline.

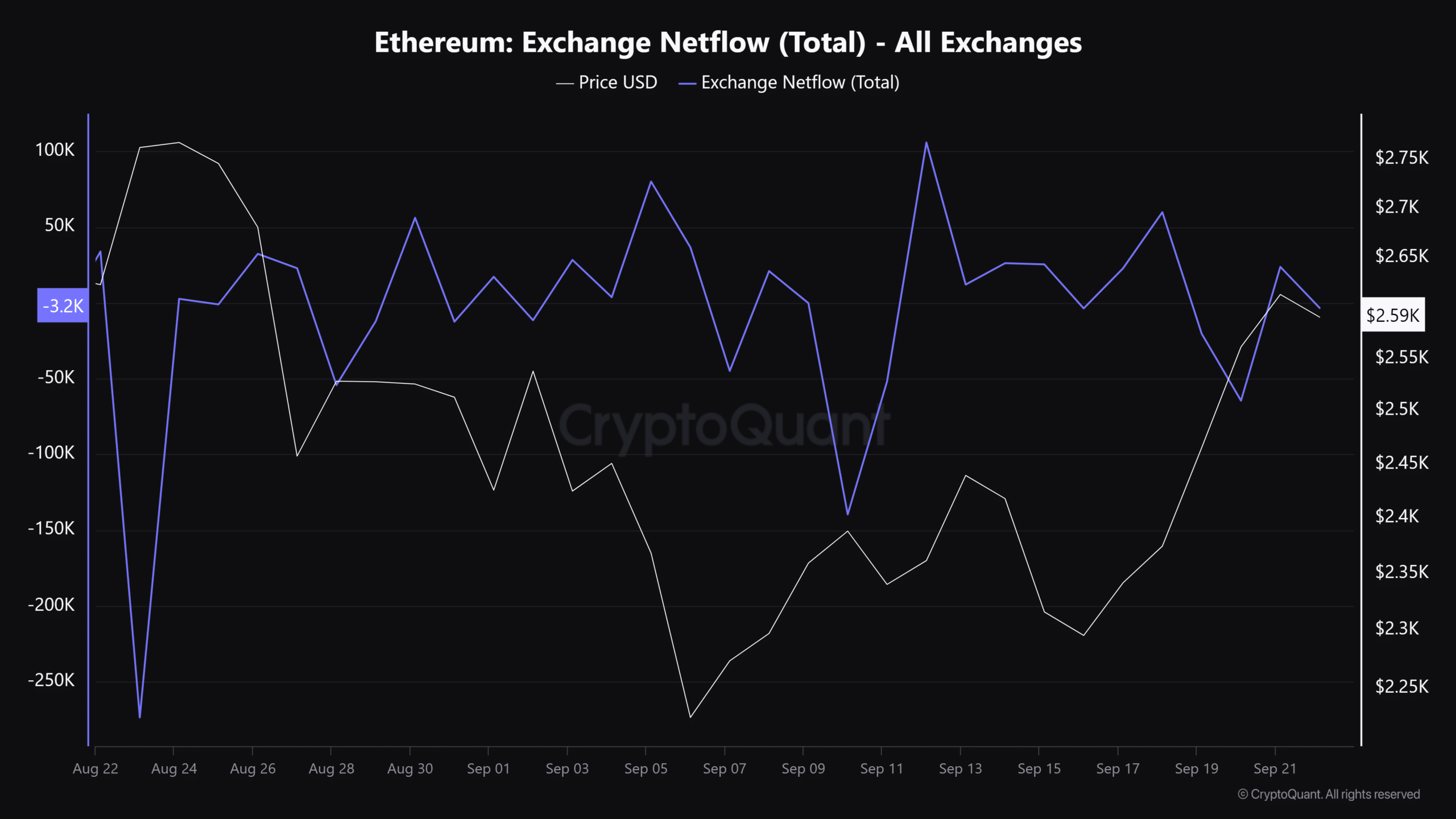

Even though there was a recent surge, the total flow of transactions on exchanges has gradually decreased, indicating that selling pressure on centralized platforms may have lessened slightly. As a result, the Ethereum price might continue its upward trend.

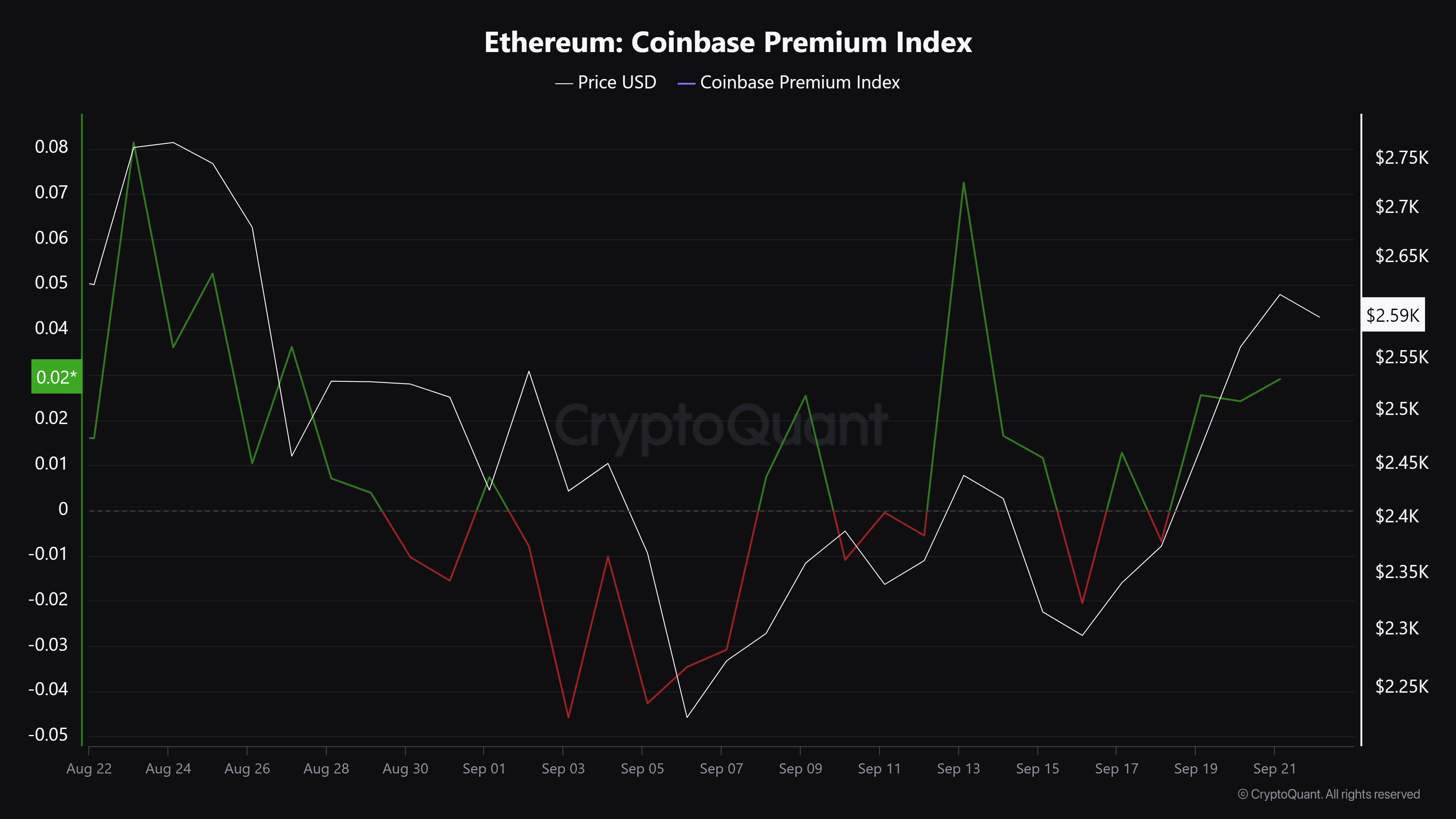

As the selling pressure on Ethereum lessened, there was a surge in American investor interest, evident from the Coinbase Premium Index and the increasing inflow of funds into US-based Ethereum Exchange Traded Funds (ETFs).

It’s yet unclear if the Ethereum recovery will persist once the excitement tied to the Federal Reserve rate cut fades away.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Here’s What the Dance Moms Cast Is Up to Now

2024-09-23 00:07