As a seasoned crypto enthusiast who has navigated the rollercoaster ride of digital assets for years, I can confidently say that dollar-cost averaging (DCA) is one of the most valuable lessons I’ve learned along the way. This strategy, which I’ve applied religiously, has helped me avoid the perils of market timing and ensured a steady growth of my crypto holdings, even during the wildest market swings.

Creating a robust cryptocurrency investment portfolio isn’t merely selecting a handful of coins and crossing your fingers for positive outcomes. It requires strategic planning, intelligent distribution of your investments, and constant vigilance to ensure success.

This piece is designed to offer you useful tips on building and managing a resilient collection of cryptocurrencies. We’ll delve into important tactics that can assist in matching your investments with your financial goals and risk preferences.

Adhering to these principles could help you build a wiser and structured strategy for crypto investments, possibly improving your future financial returns.

Key Takeaways

- Craft a stable foundation for your crypto portfolio by realising your risk resistance and investment goals.

- Embrace diversification by allocating your investments across different asset classes within the crypto market, including established coins, DeFi tokens, and stablecoins.

- Utilise effective portfolio management techniques like dollar-cost averaging and rebalancing to minimize risk and capitalize on market opportunities.

What is a Crypto Portfolio?

A crypto portfolio is a collection of various digital assets an investor holds. Like traditional investment portfolios, it includes different types of assets to spread risk and potentially increase returns over time.

Investing wisely in cryptocurrencies means spreading your investments across various types of digital currencies, aiming for a balanced approach that reduces risk while enhancing possible rewards.

A well-balanced investment portfolio aims to distribute funds among different kinds of assets, minimizing the influence of volatility that’s characteristic of the highly uncertain and unpredictable digital currency market.

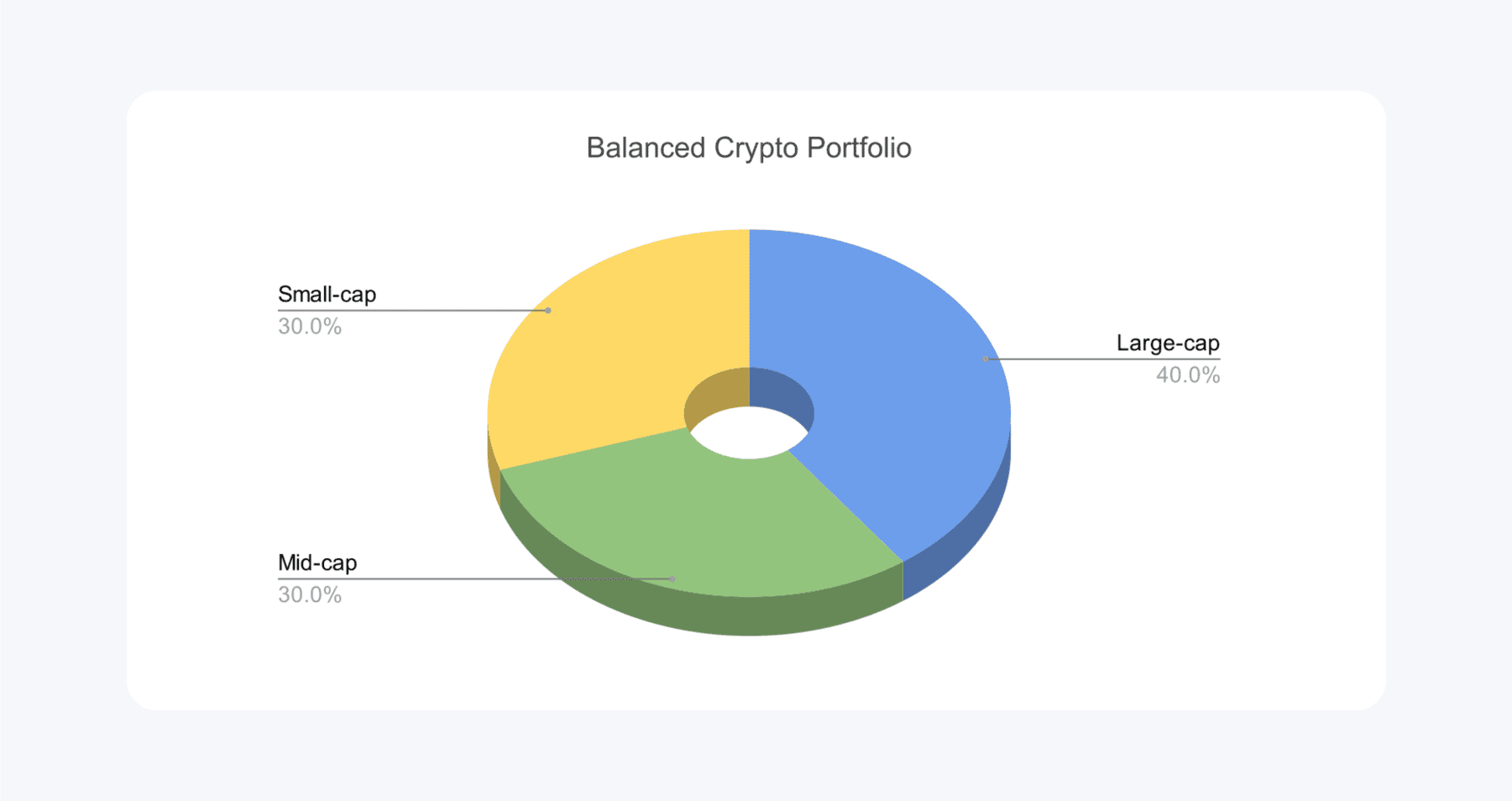

A key aspect of balance is diversification. Instead of investing all your money into one or two cryptocurrencies, a well-balanced portfolio contains a mix of different types of coins, such as:

- Large-cap coins, like Bitcoin (BTC) and Ethereum (ETH), are more established and generally less volatile.

- Mid-cap coins like Solana (SOL) or Cardano (ADA) have growth potential but come with more risk.

- Small-cap or speculative coins are newer and riskier but may offer high rewards if they succeed.

A successful crypto portfolio carefully allocates assets based on the investor’s risk tolerance:

- High-risk assets: These may include newer, smaller coins or altcoins that have the potential for explosive growth but come with higher risks.

- Low-risk assets: These include more established cryptocurrencies like Bitcoin or Ethereum that are considered less volatile.

- Stablecoins: Holding a portion of the portfolio in stablecoins like USDT or USDC provides stability since their value is tied to fiat currencies, helping protect your capital during market downturns.

As an analyst, I advocate for a strategic approach in constructing a balanced portfolio, where the allocation of investments in various digital coins is guided by my personal financial objectives. This way, the right amount is invested in each type of digital currency to align with my long-term investment goals.

For instance, a conservative investor might allocate 50% to large-cap coins (BTC, ETH), 30% to mid-cap altcoins, and 20% to speculative coins. A more aggressive investor might lean more heavily toward speculative assets, but in both cases, the portfolio is structured to suit individual risk tolerance.

A successful crypto portfolio isn’t static; it needs regular adjustments or rebalancing. As the market changes and certain coins increase or decrease in value, rebalancing ensures that the portfolio maintains its desired structure.

As a researcher analyzing my investment portfolio, I might decide to adjust my holdings when an asset like Bitcoin significantly increases in value, making up a disproportionate portion of my total assets. To ensure a balanced portfolio, I could choose to sell some of the appreciated Bitcoin and invest those funds into other diverse assets to maintain a well-balanced investment strategy.

As a crypto investor, I find it wise to maintain a diversified portfolio that encompasses both long-term investments and short-term trades. My long-term holdings typically consist of established large-cap cryptocurrencies, which I believe will gradually increase in value over an extended period. On the other hand, my short-term strategy involves trading with more volatile assets to seize immediate profit opportunities.

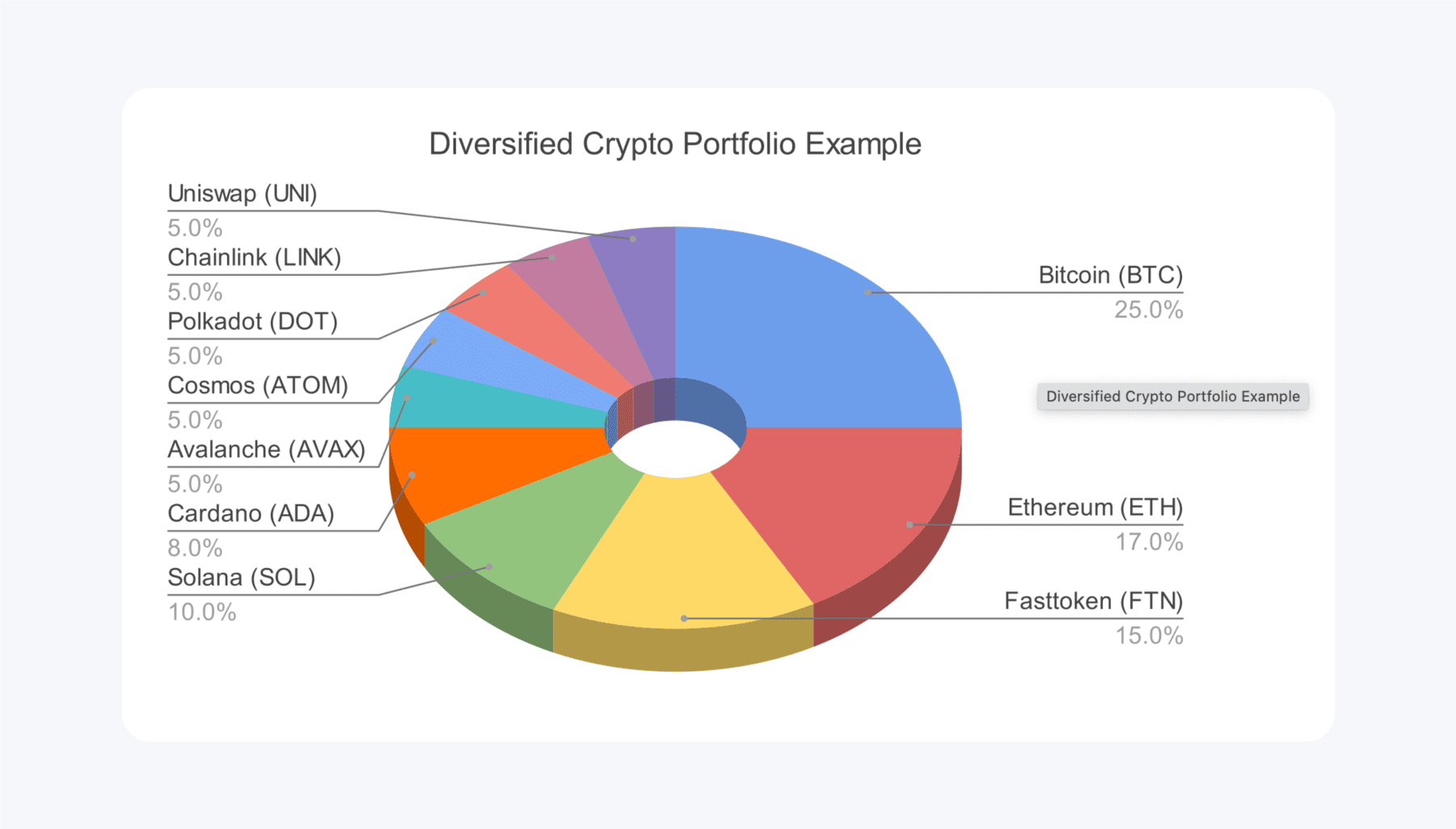

A diversified portfolio that spreads investments across various asset classes such as large-cap, mid-cap, small-cap stocks, and stablecoins, minimizes the risk of substantial investment loss due to the volatility of a specific coin. This strategy also offers numerous growth prospects because different coins don’t necessarily move in sync, providing a broader range of opportunities for investment gains.

Fast Fact

A successful approach to arranging a cryptocurrency portfolio involves spreading investments among multiple currencies, taking market capitalization into account, and allocating funds to areas such as decentralized finance (DeFi), non-fungible tokens (NFTs), and smart contract platforms.

Building a Millionaire Crypto Portfolio

Although there’s no definitive roadmap to turning into a cryptocurrency millionaire, many prosperous investors typically exhibit the following characteristics:

- They focus on the long-term potential of projects rather than short-term price fluctuations.

- They stay informed about market trends and new technologies.

- They diversify their portfolios and never invest more than they can afford to lose.

- They understand that building wealth takes time, and they avoid making impulsive decisions based on FOMO (fear of missing out) or FUD (Fear, uncertainty, and doubt).

Here is some advice on creating a successful cryptocurrency portfolio, along with a simple, step-by-step process to help you get started.

Realize Your Investment Goals

Prior to delving into cryptocurrency investments, clarify your aims. Do you seek steady long-term development, quick short-term profits, or a combination of both? Your objectives will serve as a compass for your investment tactics and risk level.

Understand Your Risk Tolerance

When it comes to investing in cryptocurrencies, you should be aware that they can be quite unpredictable, providing potential for significant gains but also involving considerable risks. The kind of investor you are will determine the makeup of your crypto holdings, such as the proportion of risky assets like new altcoins or management tokens compared to safer options like Bitcoin and Ethereum.

Having a good grasp of your tolerance for risk is essential, as it will guide you in determining how much investment you should put into digital assets, ensuring that your decisions are well-informed.

In an industry as volatile as the cryptocurrency market, where circumstances can shift swiftly, it’s crucial to remember that high-risk assets offer potential for substantial gains but also pose a threat of substantial losses. To ensure lasting prosperity, it’s essential to tailor your portfolio according to your risk tolerance level.

Mix Your Crypto Portfolio

A well-balanced crypto portfolio involves diversification across various crypto assets. Limiting your exposure to just one asset class, such as Bitcoin, may limit your growth potential and increase the overall risk of your portfolio.

By diversifying your portfolio with cryptocurrencies like Ethereum, stablecoins, and alternative coins, you can mitigate risk and benefit from different sectors within the ever-evolving digital currency market.

Diversification plans often include combining investments that have varying levels of risk, such as safe options like Bitcoin and Ethereum versus newer, more risky tokens in the marketplace.

However, adding governance tokens, security tokens, and utility tokens from different blockchain projects can offer growth potential and risk mitigation.

By spreading investments across various assets, this type of portfolio diversification keeps any one investment from controlling the whole portfolio and provides a buffer against market fluctuations.

Practice Dollar-Cost Averaging

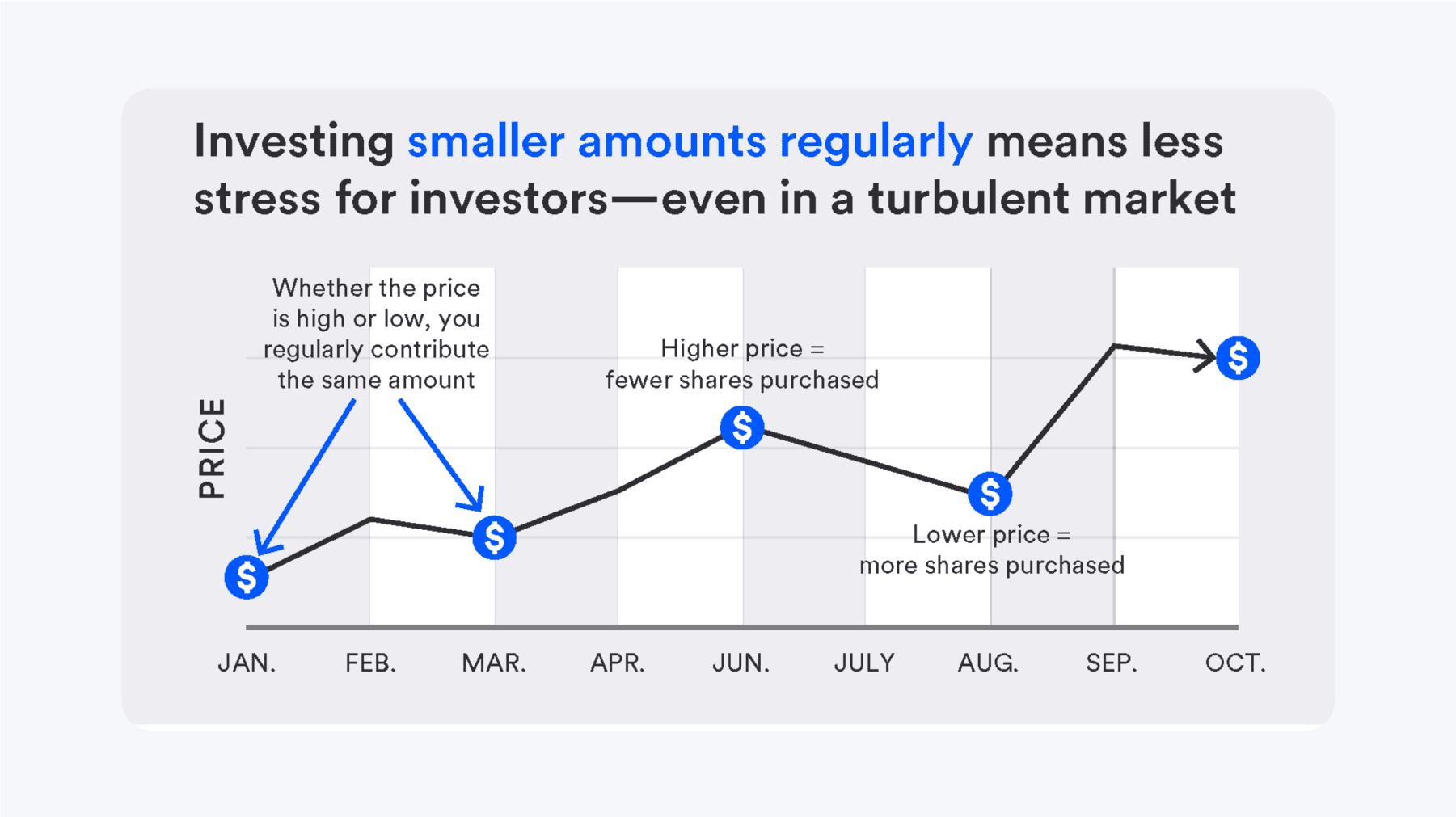

One of the most reliable crypto portfolio tips is to practice dollar-cost averaging (DCA). This investment strategy involves regularly buying a fixed amount of cryptocurrency, regardless of market conditions.

Investing this way allows you to avoid attempting to predict market movements and instead distribute your investments gradually over a period of time, thereby reducing overall investment risk. This strategy, known as Dollar Cost Averaging (DCA), is particularly beneficial in the crypto market due to its inherent volatility, making large, one-time investments potentially risky.

Investing through dollar-cost averaging allows you to adhere to your cryptocurrency investment strategy consistently and reduces the impact of emotional decisions. This can help prevent instances where you might buy at a high price during market rises and sell at a loss during market falls.

Integrating Dynamic Consolidation Algorithm (DCA) into your cryptocurrency investment plan could gradually grow your digital assets, all while mitigating the risks typically connected with substantial, single transactions.

Use Portfolio Tracking Tools

Keeping tabs on the performance of your expanding cryptocurrency portfolio is crucial, and utilizing a reliable crypto portfolio tracker can be incredibly beneficial. A top-notch, no-cost portfolio tracker will enable you to closely watch fluctuations in real-time prices, identify market prospects, and assess the overall performance of your investments.

Besides manually managing your cryptocurrency investments, you might consider using specialized software that provides sophisticated tools such as risk analysis, suggested distribution of assets, and tax documentation assistance.

Using a portfolio tracker, you can effortlessly keep tabs on your investments and maintain the optimal balance in your portfolio by incorporating new investments. Additionally, these tools enable you to modify your investments according to market fluctuations or evolving financial objectives.

Stay Updated

Savvy crypto enthusiasts consistently keep abreast of recent advancements within the dynamic world of digital currencies. The crypto market is persistently innovating, frequently introducing fresh crypto ventures, innovative smart contracts, and groundbreaking blockchain technologies.

To ensure the success of your investment approach, always carry out independent research prior to making fresh investments. By monitoring industry pioneers and examining current market scenarios, you’ll gather invaluable knowledge about potential future market movements.

Crypto investors should also consider the influence of the stock market and traditional finance on the crypto ecosystem. By understanding the broader financial landscape, you can better anticipate how macroeconomic factors, such as interest rates and inflation, may impact the crypto markets.

Review and Rebalance Your Portfolio Regularly

Maintaining a varied cryptocurrency investment portfolio isn’t something you do just once. Regular monitoring is crucial to keep the balance right and make sure it stays in line with your financial objectives.

Over time, certain assets may outperform others, leading to an imbalanced portfolio. For instance, if Bitcoin’s market cap rises significantly, it may represent an outsized portion of your overall portfolio, potentially increasing your risk.

Restoring balance in an investment, such as your crypto portfolio, means you might need to offload assets that have been performing exceptionally well and instead invest those funds into underachieving or more secure assets. This step is vital for keeping a balanced portfolio that can endure market fluctuations while still tapping into long-term growth opportunities.

Mitigate Risk Through Stable Assets

Another important tip for successful crypto portfolio building is to include stablecoins. These digital assets are pegged to fiat currency and tend to exhibit less volatility than other cryptocurrencies. Stablecoins can provide a safety net during market turbulence, ensuring that a portion of your portfolio retains value even in bear markets.

Consider Staking or Earning Interest

Several digital currencies present chances for yield farming or passive income options. Staking is the process of keeping your funds in a wallet to aid the network’s functioning and receive incentives, while earning interest usually entails loaning out your assets on a decentralized finance (DeFi) system. Both strategies can offer supplementary income sources, contributing to the expansion of your investment portfolio without active management.

Final Takeaways

Nurturing a successful cryptocurrency collection involves combining careful analysis, strategic planning, and continuous monitoring. Adhering to these guidelines and keeping abreast of the rapidly changing crypto market can help you establish a strong portfolio tailored to your investment ambitions and risk levels.

As a crypto investor, I always keep in mind that the world of cryptocurrency involves inherent risks. It’s crucial for me to approach investments with caution and prudence, ensuring I never stake more than I’m willing to potentially lose.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-10-30 19:11