Tokenized Assets Are Basically the New Gold… Or Are They?

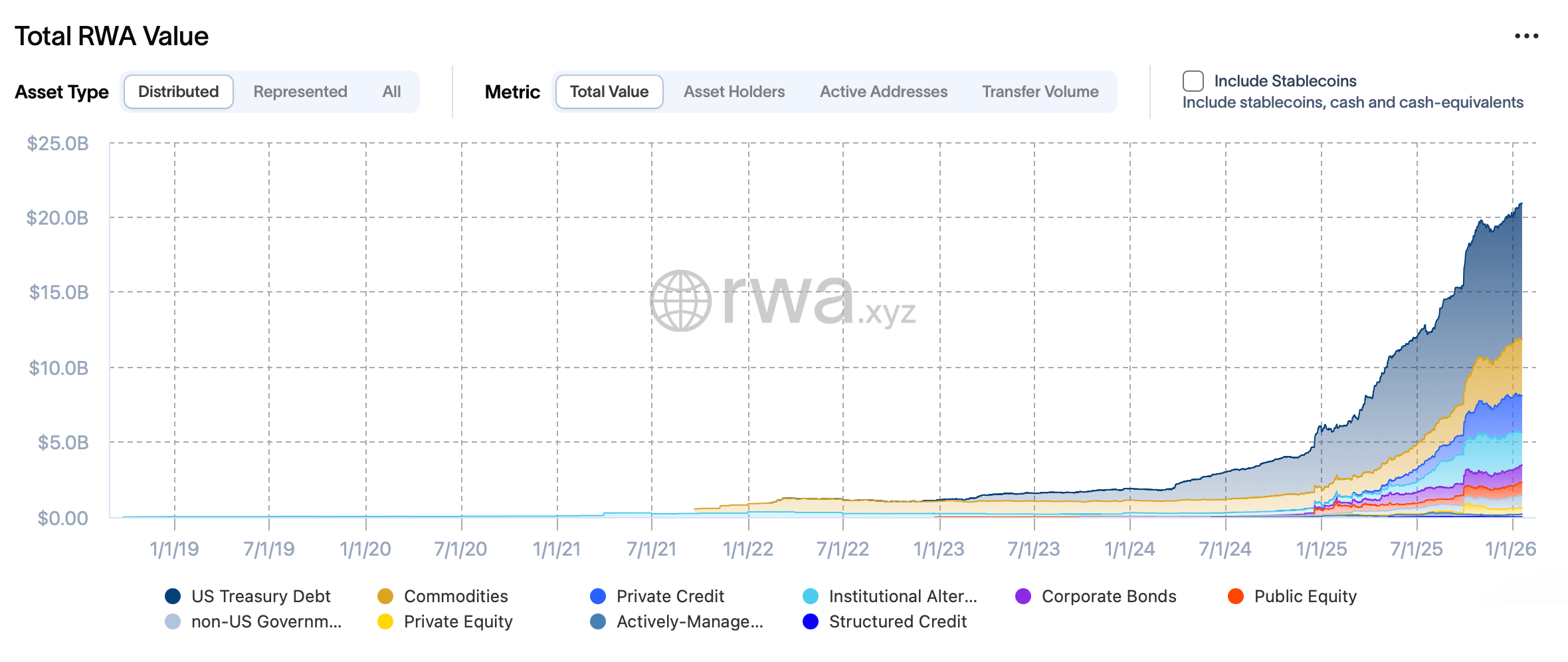

So, I gotta tell you, the latest data is in and guess what? Tokenized assets are booming. Over a billion bucks in just the first few weeks of 2026! Yeah, I said billion-who needs Hollywood when you’ve got this kind of action? Total value locked in the Real-World Asset (RWA) space shot past the $21 billion mark. I mean, come on, what are we doing here? Are we investing or just throwing Monopoly money?

RWAs Rack Up Billions as Treasurys and Gold Dominate Tokenization

Tokenization, right? It’s like taking your grandma’s china and turning it into digital collectibles-only, instead of “collectible,” it’s actually useful. You turn assets like bonds or art into tokens on a blockchain, which, let’s face it, is a fancy computer ledger. Fractional ownership, quick transfers, automated payments-sounds like a dream, or a nightmare, depending on your patience. Anyway, RWAs are just traditional stuff-like gold or bonds-migrating onto the blockchain, blending the old with the new. Never thought I’d see the day, but here we are.

Monday metrics: about 636,898 folks holding onto these tokens. That’s an 8.94% rise since mid-December. In the crypto playground, Ethereum is the big kid with $12.8 billion. BNB Chain? Still hanging in there with $2 billion. Solana, Liquid Network, and Stellar-the usual suspects-each claiming about a billion. Basically, everyone’s playing in the sandbox, but Ethereum still rules the castle.

And get this-out of the $21.35 billion, U.S. Treasury debt is the kingpin at $9.05 billion. Then there’s commodities with $3.77 billion, private credit, institutional funds, and a smattering of bonds and equities. Because nothing says “fun” like financial assets, right? The sector dipped a bit last October but bounced back with an extra $2.13 billion since November. The crown jewel? Tether’s XAUT, backed by good old gold. Because why not make your metal shine in crypto?

XAUT is at a market cap of $1.93 billion, right? Close behind are Paxos’ PAXG at $1.76 billion and Blackrock’s Treasury fund at $1.71 billion. It’s like a gold rush, but digital and slightly less dusty. And with gold climbing against the dollar, these tokens are just riding the wave-surf’s up!

All in all, 2026 looks like it’s the year of serious momentum for RWAs. Money’s flowing, holders are multiplying like rabbits, and the familiar big guns like Treasurys and gold are back in style. Will this pace keep up? Who knows! But one thing’s for sure: tokenization isn’t just some flash-in-the-pan experiment. It’s here, and it’s here to stay-like that one relative you can’t get rid of.

FAQ ❓

- What are real-world assets (RWAs)? It’s basically stuff like bonds, gold, and commodities that you turn into digital tokens on a blockchain-because who doesn’t want their assets to be digital, right?

- How big is the RWA market in January 2026? Over $21 billion, and counting-so much for small change.

- Which blockchain leads in RWA value? Ethereum’s sitting pretty with about $12.8 billion, leaving BNB Chain and Solana to nibble at the leftovers.

- What are the biggest RWA tokens right now? Tether’s gold-backed XAUT is king with $1.93 billion, followed by Paxos’ PAXG and a Treasury fund by Blackrock. Because apparently, everyone’s got gold on the brain.

Read More

- Best Controller Settings for ARC Raiders

- Gold Rate Forecast

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- How to Build a Waterfall in Enshrouded

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Meet the cast of Mighty Nein: Every Critical Role character explained

- How to Get the Bloodfeather Set in Enshrouded

- Untangling the Quantum Link: Observing Entanglement with Controlled Interactions

- 10 Best Shoujo Manga Writers

- Fatal Fury PS5, PS4 Will Return with a Second Season of DLC Fighters

2026-01-20 01:48