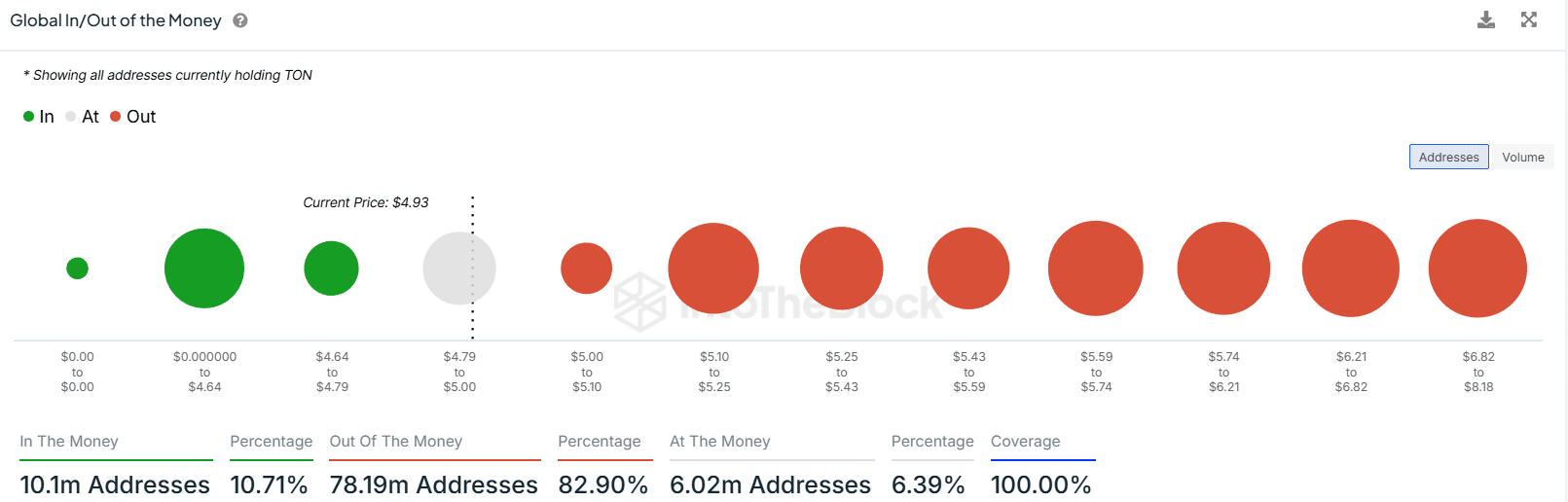

- Only 10.71% of TON holders were profitable at press time.

- Whales and large investors currently hold a substantial 91.52% of the total TON circulating supply.

As a seasoned analyst with years of experience navigating the volatile crypto market, I find myself cautiously optimistic about Toncoin [TON]. The bullish technical analysis and strong support level at $4.9 suggest a potential upside rally is on the horizon, but it’s important to remember that the crypto landscape can be as unpredictable as a roller coaster ride at an amusement park.

Despite the general downtrend in cryptocurrency prices, Toncoin [TON], associated with Telegram, seems optimistic and is ready for a significant surge as a result of its favorable price movements.

But it’s expected that a surge in TON will happen when the overall market mood transitions from a declining trend to an ascending one.

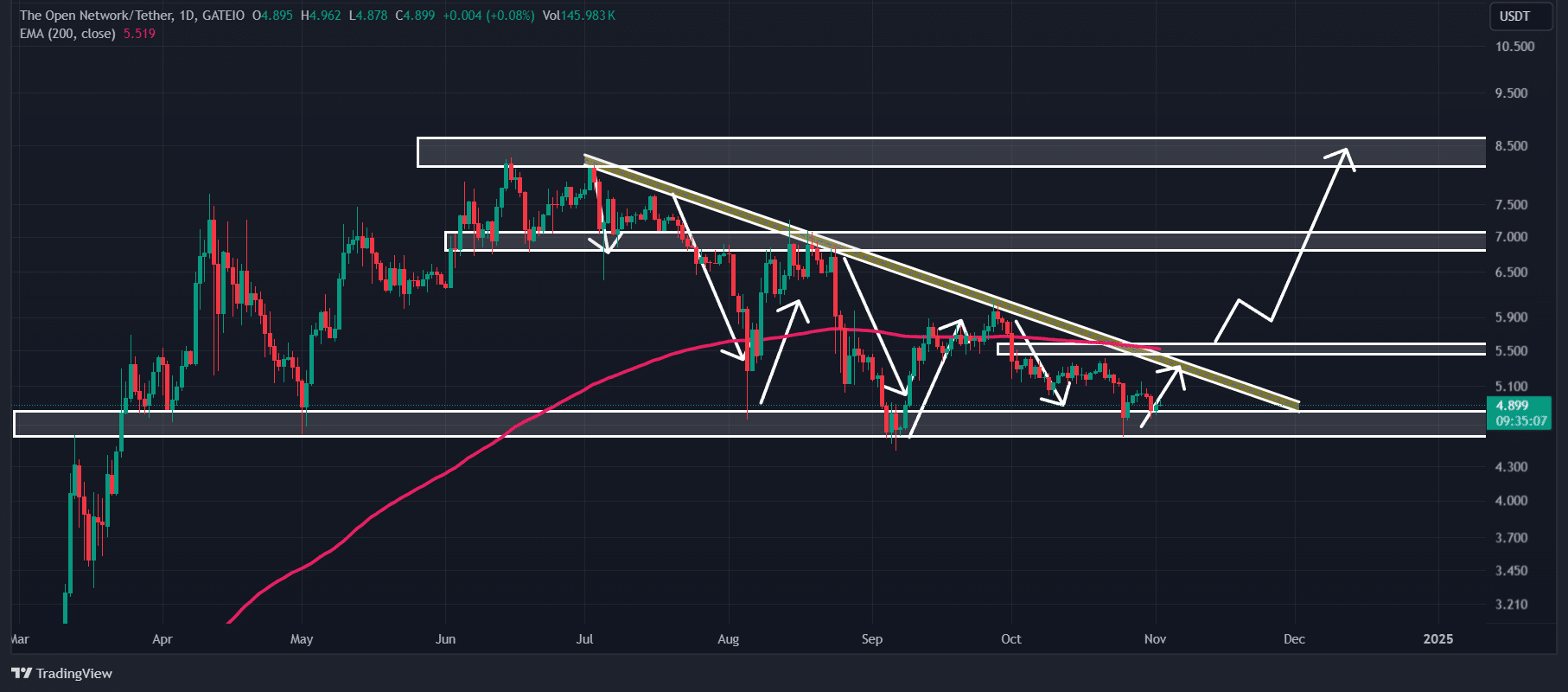

Toncoin technical analysis

As per AMBCrypto’s assessment based on technical analysis, The Open Network (TON) seems optimistic and is presently holding firm at a robust support point of around $4.9. Historically, this level has shown significant buying activity for TON, often leading to an upward trend.

Traders and investors are now expecting a similar move this time as well.

Beyond considering the support level, it appears that TON’s price has found itself in a tight band as part of a downward trending price movement, suggesting a potential breakout from this pattern could occur.

If feelings change and the cost surpasses its downward slope, ending the day’s candle above the $5.6 mark, there’s a solid chance that it could increase by approximately 40%, potentially reaching the $8.15 level in the upcoming days.

Right now, TON’s price is sitting beneath its 200-day Exponential Moving Average (EMA) on the daily chart. This moving average is a popular technical tool among traders and investors, helping them decide if an asset is experiencing an upward or downward trend.

Currently, at this moment, The Gram (TON) is hovering around the $4.91 mark without any changes in its value over the last day. Simultaneously, during this timeframe, the trading volume has seen a decrease of about 20%. This decline suggests less engagement from traders and investors, indicating potentially reduced interest or activity within the crypto market.

As a crypto enthusiast, I can’t help but feel optimistic about the potential growth of TON. However, one significant worry that lingers for retail investors like me is the high level of control held by ‘whales’ and large-scale investors in this space. This concentration of ownership could potentially impact the market dynamics and make it challenging for individual investors to influence or benefit equally.

TON whales and investors concentration

As reported by the on-chain analysis firm IntoTheBlock, approximately 87 significant investors, known as ‘whales’, currently possess a massive 91.52% of the existing TON supply. In contrast, retail investors own only around 8.48%, which is significantly less compared to the share owned by these larger-scale investors.

When there’s a significant accumulation of whales and big investors in an asset, it raises concerns about possible price manipulation or fraudulent activities.

In contrast to the large amounts held by whales and institutions, it’s currently the case that only about 10.71% of TON holders are making a profit, while an overwhelming majority of approximately 82.90% find themselves in a position where they are not making back their initial investment.

Furthermore, around 6.4% are currently profitable. If profits remain low, it’s likely that as prices rise, we might experience a significant drop (or “dump”) in price more frequently.

Read More

- OM/USD

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Solo Leveling Season 3: What You NEED to Know!

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- The Perfect Couple season 2 is in the works at Netflix – but the cast will be different

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

2024-11-03 12:07