-

TON has gained over 160% more than BTC so far.

TON has also seen more activity in some on-chain metrics.

As a researcher with a background in blockchain technology and market analysis, I find Toncoin’s [TON] performance against Bitcoin [BTC] intriguing. Based on my analysis of available data, TON has demonstrated remarkable growth this year, outpacing BTC by over 160% in terms of price increase and exhibiting more activity in some on-chain metrics.

Since the start of the year, Toncoin (TON) stands out as the sole Layer 1 Network that holds its ground against Bitcoin (BTC) in terms of competition.

TON has outpaced BTC by over 160% and boasts a higher number of active addresses.

As an analyst, I’ve observed notable milestones reached by the TON project. However, the trading community seems to express a sense of doubt towards this cryptocurrency. The overall sentiment towards TON has taken a turn for the worse.

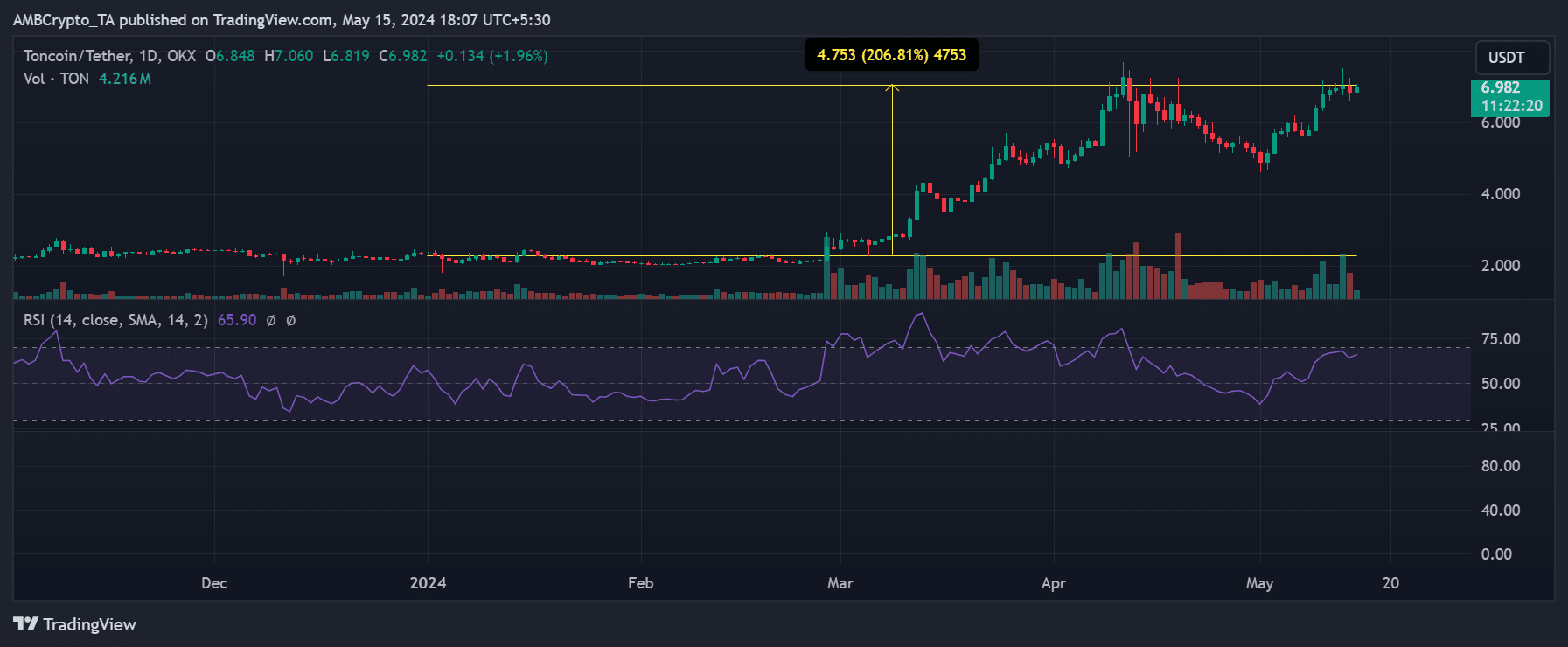

Toncoin gains more than 100% over Bitcoin

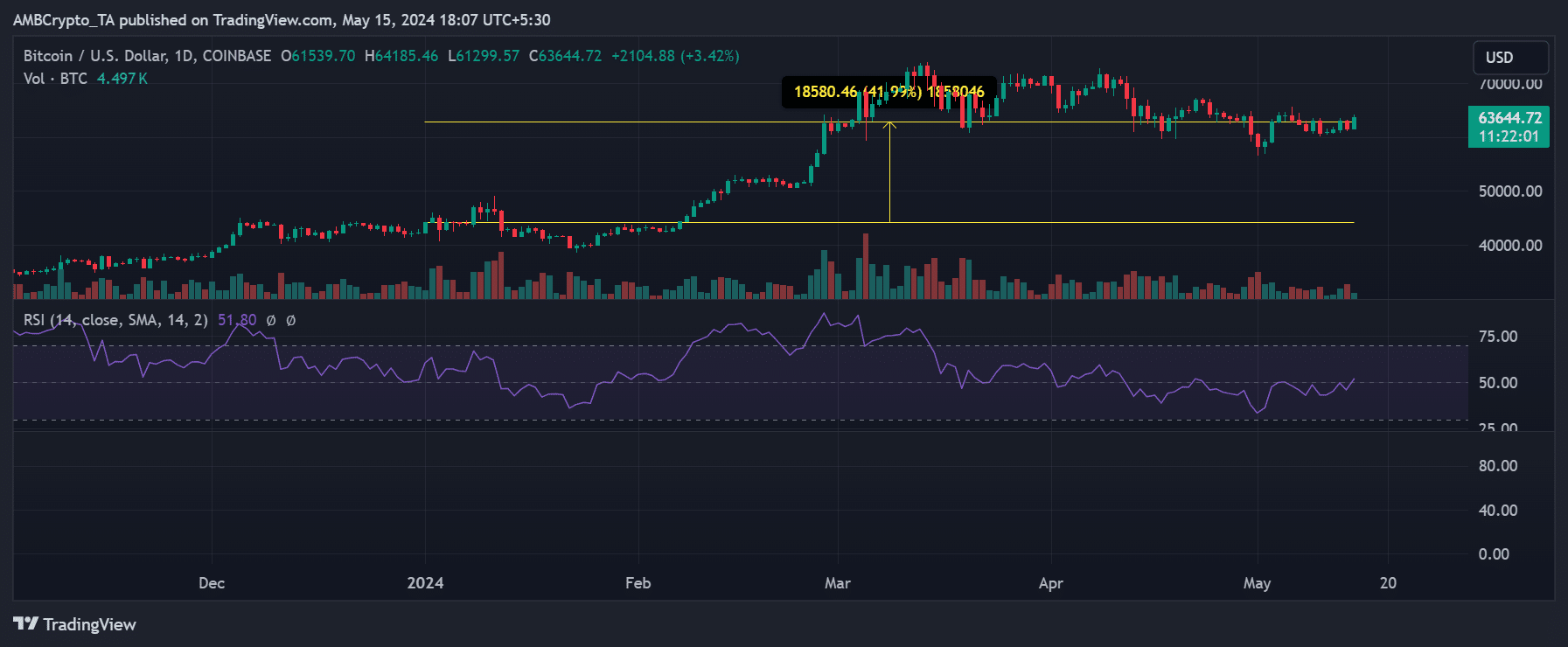

As a financial analyst, I’ve conducted a thorough comparison between Bitcoin and Toncoin’s price trends based on the data from AMBCrypto’s analysis. To my observation, Toncoin has displayed more significant price growth than Bitcoin, indicating a stronger upward trend for the former.

Starting off the year at roughly $2.3, TON has undergone significant price surges in more recent periods, currently sitting at around $6.8.

As an analyst, I’ve used the price range feature to observe a significant increase in TON‘s value. Specifically, there has been a surge of more than 200% since the beginning of the year up until now.

Instead of saying “Conversely,” you could phrase it as “On the other hand, Bitcoin started the year at roughly $44,220 and later reached around $62,400, which translates to a nearly 42% increase within this time frame.”

Comparing the charts, Toncoin exhibited nearly 160% more growth than BTC.

Additionally, the RSI analysis showed that Bitcoin (BTC) was beneath the neutral threshold during the evaluation period, implying a downward trend.

In contrast, Toncoin’s RSI was above 60, signaling a strong bull trend.

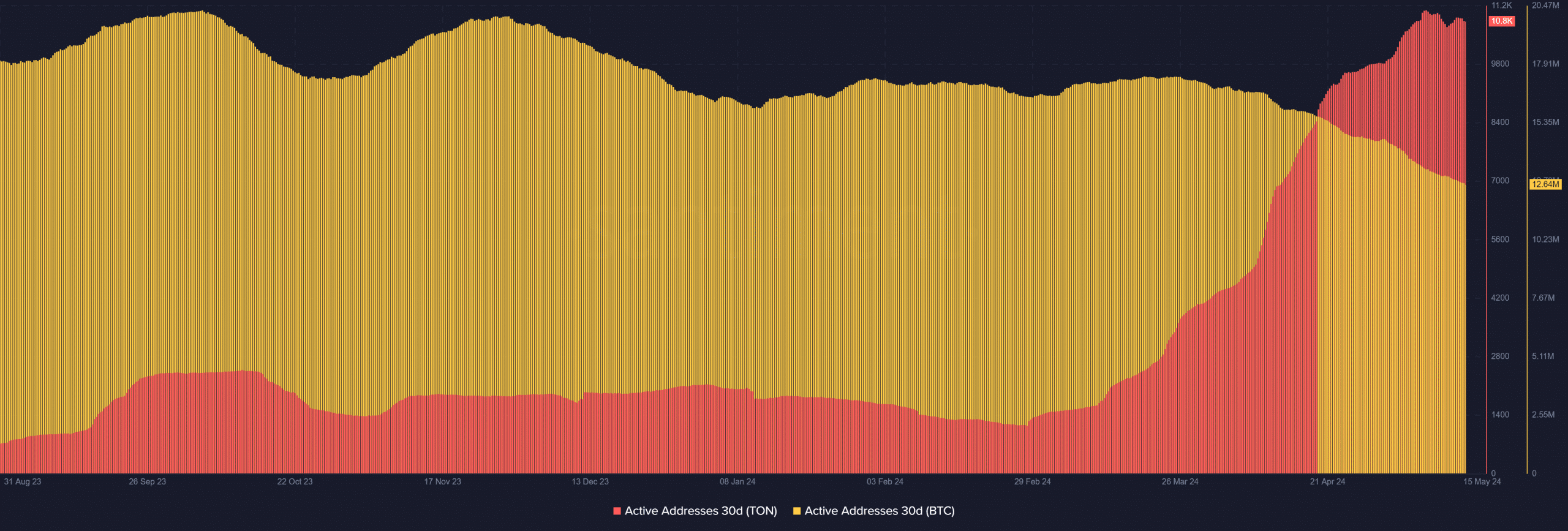

Toncoin sees more active addresses than Bitcoin

As a researcher studying Toncoin’s transactional activity, I have observed an impressive uptick in the number of active addresses within the past thirty days. This trend exceeds the comparable figure for Bitcoin.

Starting in March, the number of active Toncoin addresses started to gradually increase, reaching a peak in May and continuing at a high rate since then.

Since March, the number of active addresses on Toncoin has significantly grown. Currently, it exceeds 10,000, and at the moment of this writing, there are more than 10,800 active addresses.

While Bitcoin’s total number of active addresses is greater, it has been experiencing a downward trend recently.

On April 15th, approximately 16 million unique Bitcoin addresses were in use. However, by the time of publication, that figure had dropped to roughly 12.6 million.

The analysis revealed that while Bitcoin boasts a greater total number of active addresses, Toncoin is witnessing faster-paced activity and expansion.

Bitcoin edges Toncoin in sentiment

At the current moment, according to AMBCrypto’s analysis on Coinglass, Bitcoin’s funding rate reflects a favorable outlook.

Although there was a modest drop, the figure hovered near 0.0018%, implying that purchasing activity maintained its predominance in the trend.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As a researcher examining the data, I’ve noticed that Toncoin’s Funding Rate has shown a contrary indication. Specifically, the current Funding Rate stands at approximately -0.047%. This figure signifies a predominance of sellers in the market, suggesting a negative sentiment among traders.

As a researcher observing the market trends, I noticed that Bitcoin’s metrics indicated a higher proportion of investors anticipating a price hike. On the other hand, Toncoin saw a larger number of traders placing bets on a decrease in its value.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- PGA Tour 2K25 – Everything You Need to Know

- MrBeast Slams Kotaku for Misquote, No Apology in Sight!

2024-05-16 08:08