-

TON experiences a bullish surge with an 8% increase and a promising ‘golden cross.’

A healthy RSI and increased social volume suggest the rally might continue, supported by investor interest.

As a researcher with experience in analyzing cryptocurrency markets, I find the recent surge in Toncoin (TON) prices intriguing. The 8% increase and the ‘golden cross’ indicate a potential long-term uptrend, but it is crucial to consider various factors before making any definitive conclusions.

As a researcher studying the cryptocurrency market, I’ve observed an intriguing development with Toncoin (TON) over the past two days. The bulls have regained control, resulting in a noteworthy 8% price increase at present. This unexpected uptick can be attributed to heightened buying pressure and a sudden shift in traders’ market sentiment.

It’s yet unclear if TON has the ability to maintain its current surge and surpass significant resistance points, thereby initiating a fresh upward trend.

Checking TON’s next move

In simple terms, the short-term moving average of 50 days has lately surpassed the longer-term moving average of 200 days. This occurrence, known as the “golden cross,” is often interpreted as a positive sign in financial markets, suggesting the possibility of an extended upward trend.

The exponential moving average mirrors price trends effectively and presently lies above the 50-day moving average, amplifying bullish indicators.

As an analyst, I’d interpret the current 62 RSI reading as a sign that there is potential for further price increases before the asset reaches an overbought state. Furthermore, the occurrence of a golden cross indicates a bullish market trend, which suggests a significant shift in investor sentiment towards optimism and buying activity.

Over the last five days, there has been a significant surge in both the social activity and influence of TON. Historically, such heightened social engagement has frequently signaled an upcoming price rise.

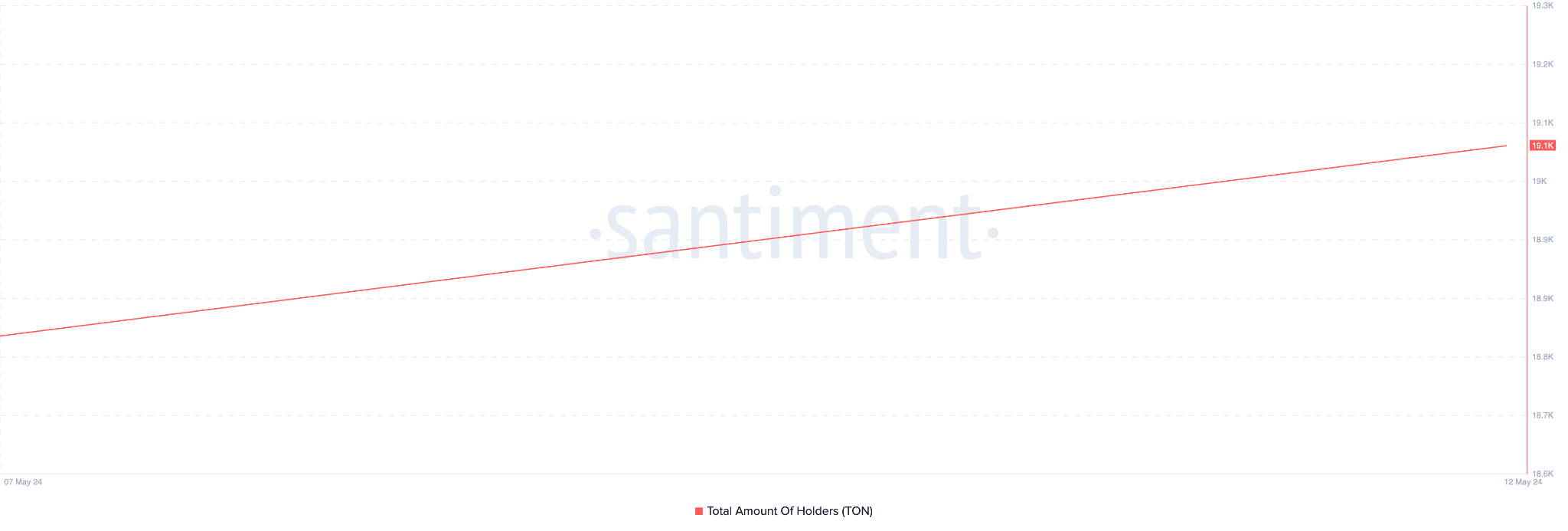

The number of investors owning TON is on the rise. This growing pool of holders indicates a positive outlook, as it suggests that more individuals are becoming interested in investing in this asset.

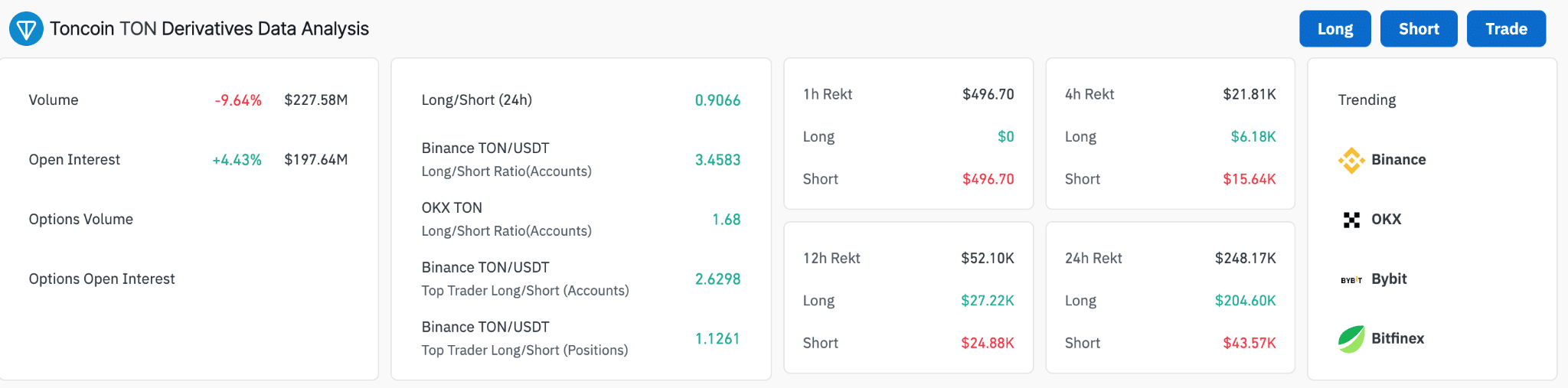

The trading volume for TON‘s derivatives has dropped according to the data, potentially signaling a relaxation after a prolonged spell of increased activity. This decline could be a result of the recent price rise.

Is your portfolio green? Check the Toncoin [TON] Profit Calculator

In simpler terms, the number of derivatives being sold short slightly outpaces the number being bought long by a small margin (a ratio of 0.9066). This indicates that short selling is presently more popular than long positions in the derivative market.

As a crypto investor using Binance, I’ve noticed an intriguing trend in the platform’s long/short ratio data. With a robust 3.4583 bias towards long positions among user accounts, it seems that a larger number of traders are placing wagers on potential market rallies compared to those preparing for declines.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-06-13 05:11