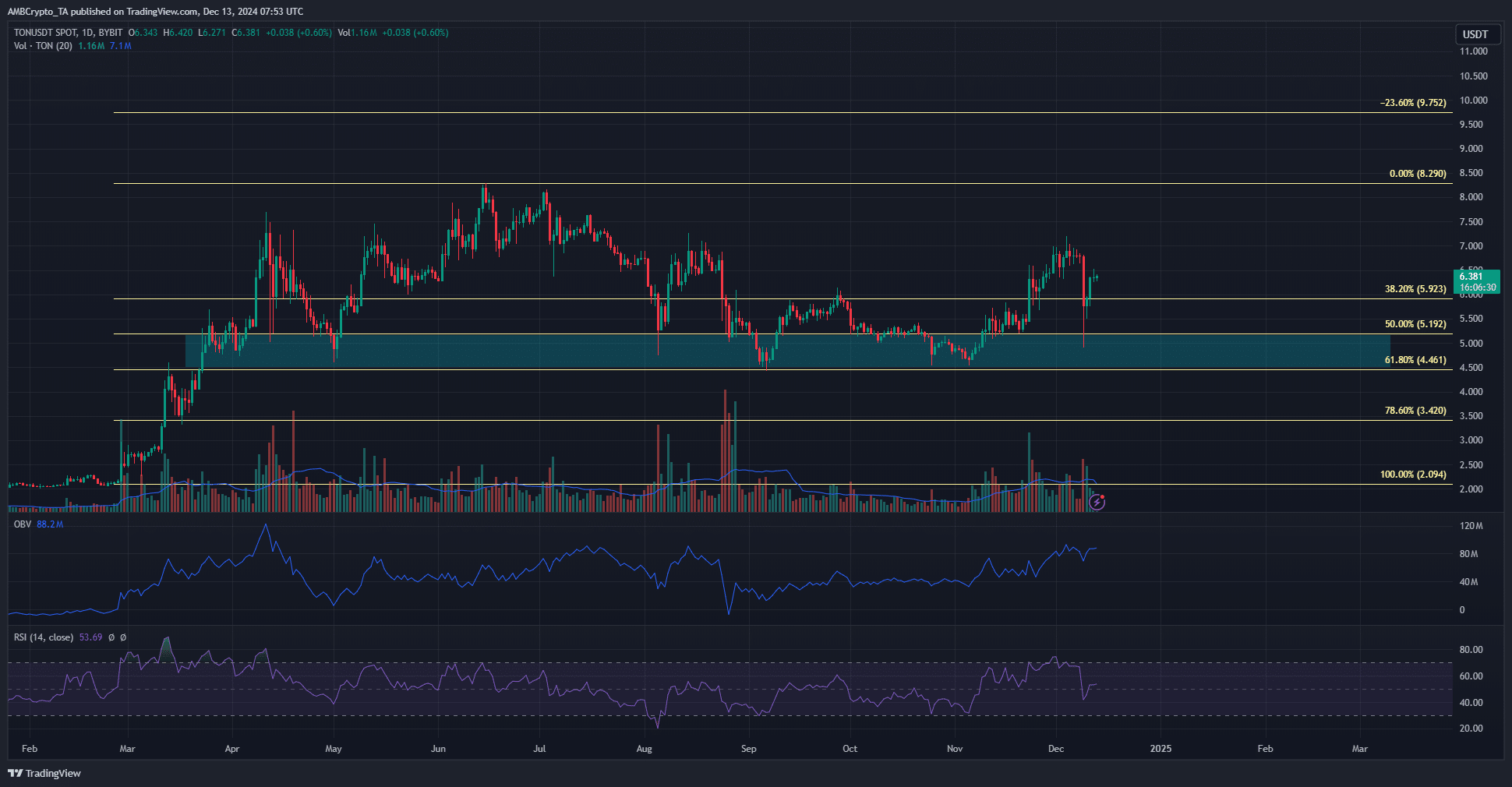

- The momentum of Toncoin remained bullish but has weakened compared to the previous week.

- Sustained demand was seen in recent weeks, but it might not be enough to break the $7.3 and $8.3 resistance zones.

As a seasoned researcher with years of experience navigating the cryptocurrency market, I find myself intrigued by Toncoin’s recent performance. While the bullish momentum has slowed compared to the previous week, the sustained demand and swift recovery after Monday’s dip are promising signs. However, breaking the $7.3 and $8.3 resistance zones might require heavier demand than we’ve seen in recent weeks.

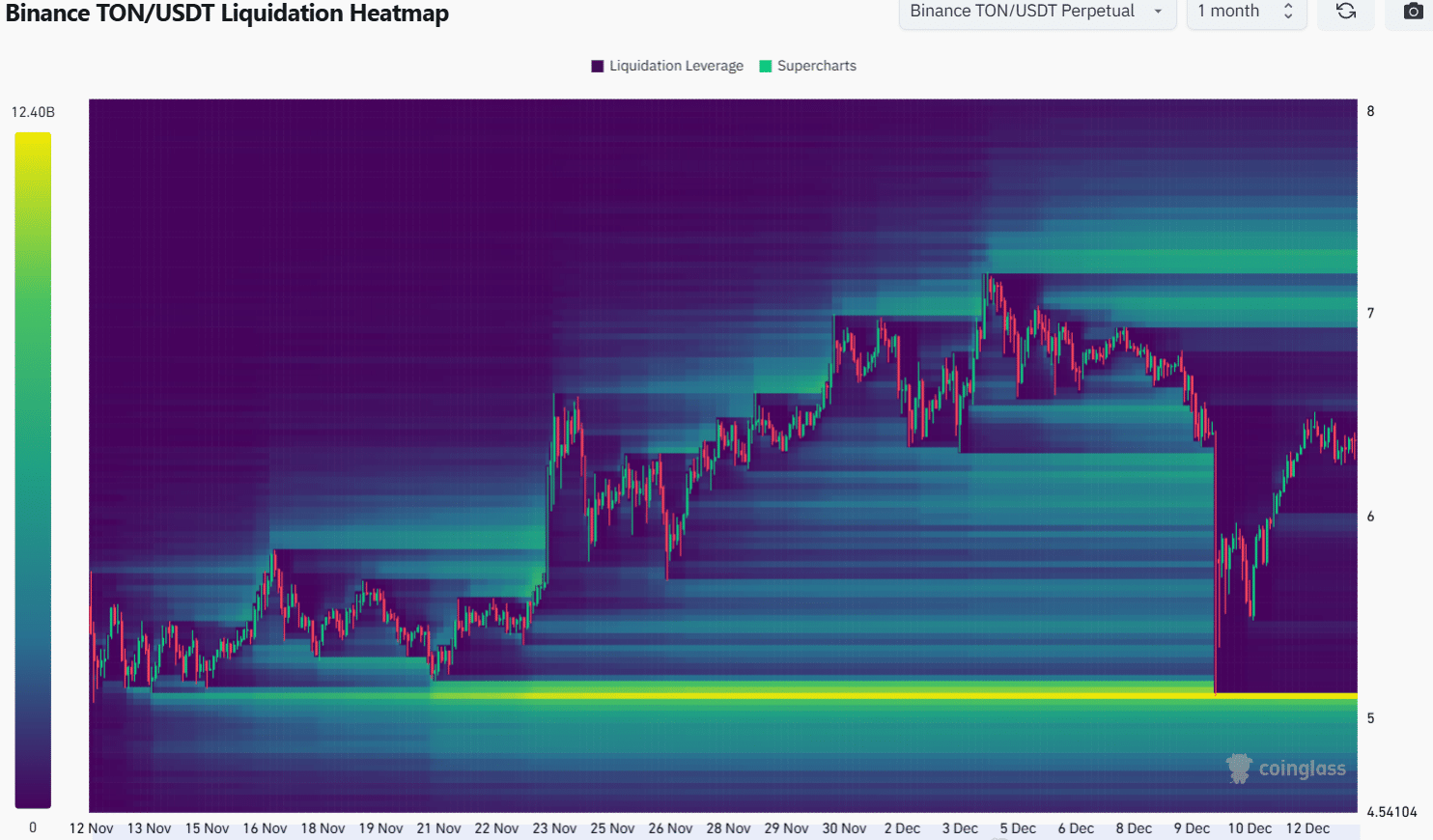

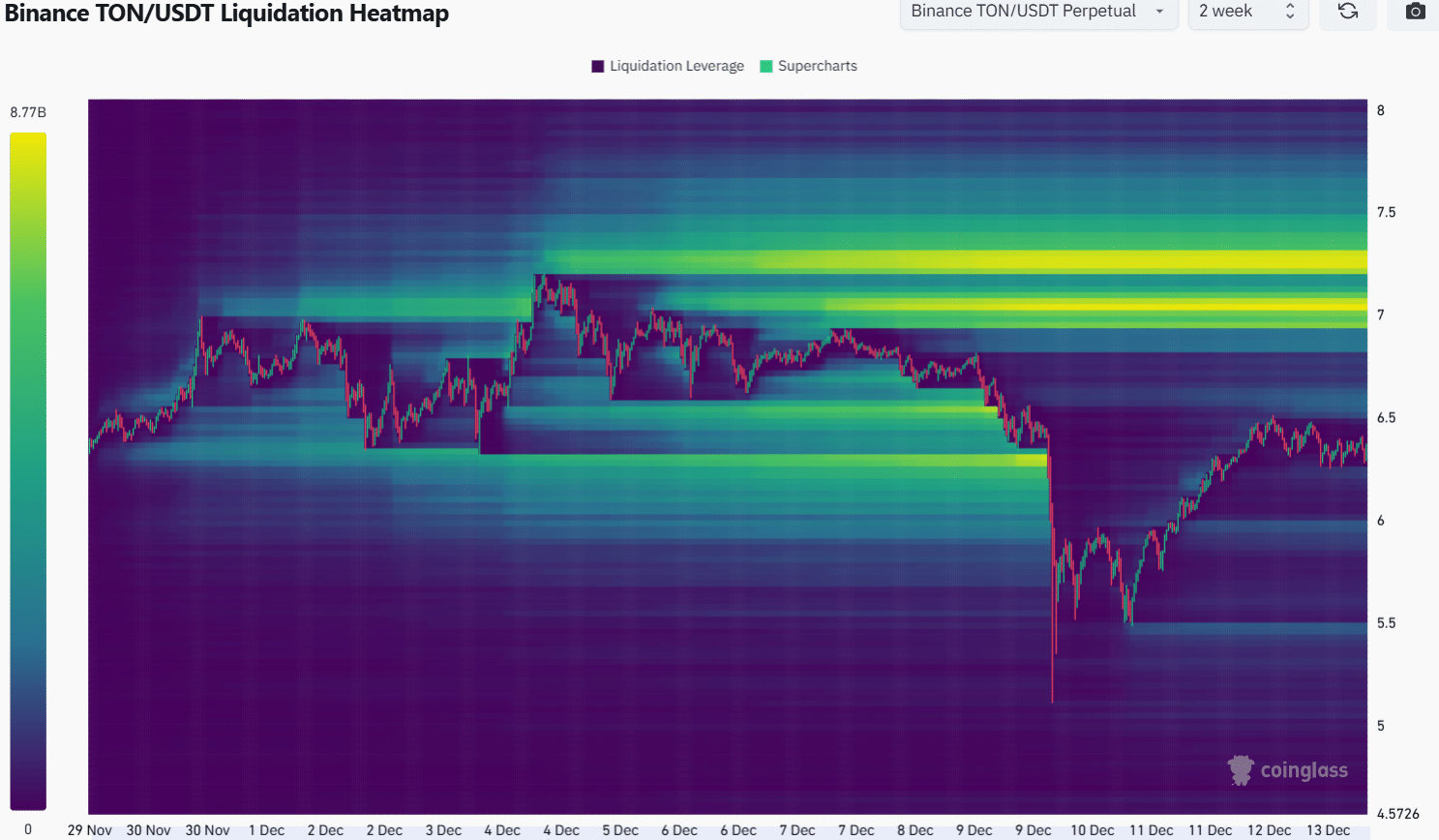

On December 9th, Toncoin [TON] experienced a nearly 20% increase in value following its quick fall to approximately $5.3 earlier that day. The price fluctuation was noticeable across different exchanges, with Binance recording a low of $5.3 and Bybit showing a slightly lower dip at $4.91. Despite the occurrence of a liquidation cascade, the subsequent recovery on shorter timeframes has been quite impressive.

Bitcoin (BTC) hasn’t solidified the $101,000 to $103,000 range as a support level yet. Contrastingly, the market cap of alternative coins (altcoins) has been consistently climbing since November. Following the significant correction on Monday, further growth in this sector seems likely.

Toncoin finds support around the $5 demand zone

Previously, the $5.9 price point acted as a barrier that the market couldn’t surpass in September and November. However, this barrier has now transformed into a source of support. On Monday, there was a significant volatility that nearly shattered this support, but the bulls have since regained their footing.

Over the past month, the upward trend of the OBV (On-Balance Volume) has been evident. Despite a significant amount of selling occurring earlier this week, this upward momentum persisted without any interruption.

A concern for TON bulls was the performance over the past 12–14 weeks. While the $4.5-$5 demand zone has been stoutly defended, the $6.9-$7.1 resistance zone has not been breached. Heavier demand for Toncoin would be necessary to push the asset on a long-term uptrend and toward new all-time highs.

Looking at the daily graph, the Relative Strength Index (RSI) stands at around 53. While momentum has decelerated compared to a week prior, it still indicates a generally positive trend.

Short-term rally targeting $7 in sight

Over the past month, a significant cluster of potential selling points, or liquidation levels, emerged near $5.05 to $5.15. This level was put to the test on Monday, but prices have since bounced back. Remarkably, the concentration of liquidity around the $5 price point remains noticeable.

If the price of Bitcoin falls below $98,600, it might fuel temporary pessimism within the market and potentially cause the value of TON to decrease as well.

Given the current situation, it seemed improbable for the price to fall to $5 due to a pool of available funds near $7, which is relatively closer to the current market values. Over the course of two weeks, the liquidation heatmap indicated that the areas around $7.05 and $7.3 were likely short-term bullish price zones.

Is your portfolio green? Check the Toncoin Profit Calculator

It’s yet uncertain if the supporters of Toncoin can push the price beyond the current resistance area, but for now, the short-term forecast leans towards a rise in the Ton price.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-12-14 01:11