-

TON has declined in the last 24 hours.

Metrics showed that more sellers were active compared to buyers.

As a researcher with extensive experience in cryptocurrency markets, I find the recent trends in Toncoin (TON) intriguing. The 24-hour trading data shows that Toncoin experienced a substantial spike in volume, with a significant increase of over 80% within this time frame. This rise in trading activity is noteworthy as it could lead to heightened price volatility.

Over the past 24 hours, Toncoin (TON) has experienced a substantial increase in trading activity, attracting close attention from market analysts. With heightened trader engagement, it is essential to closely examine this behavior to anticipate possible price trends.

Furthermore, derivative metrics for Toncoin have also displayed interesting trends.

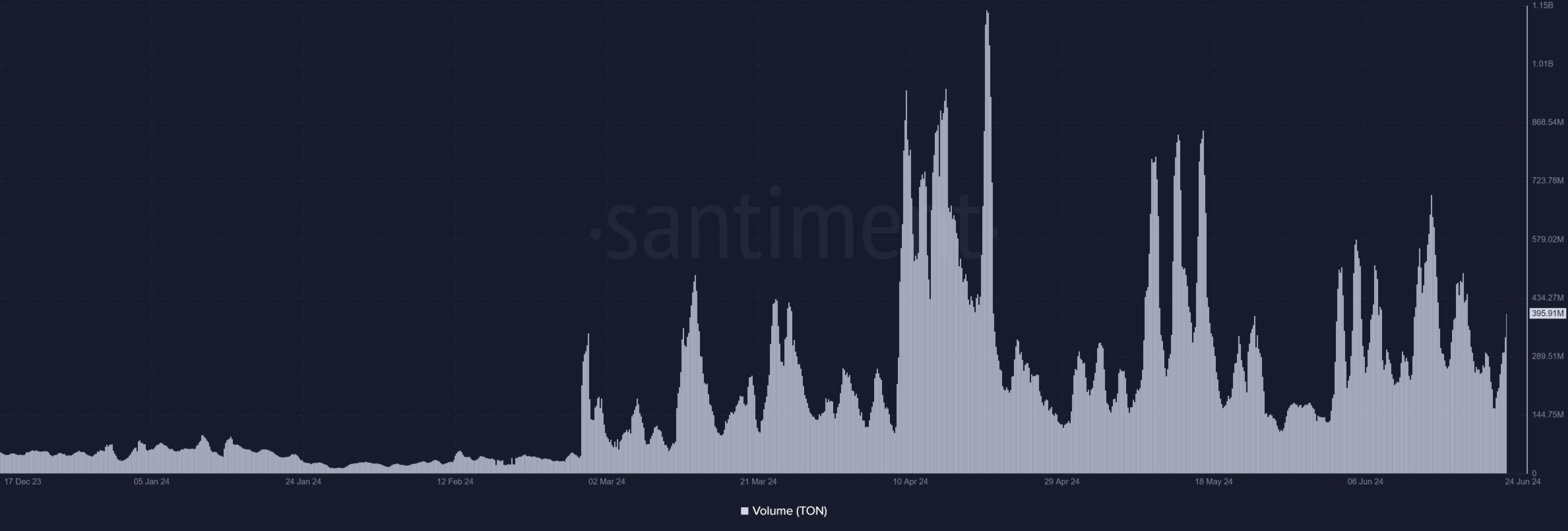

Toncoin volume sees a 24-hour spike.

As an analyst, I’ve examined the latest data from CoinMarketCap and noticed a significant surge in Toncoin’s trading volume within the past 24 hours. The data reveals an impressive jump of more than 80% compared to the previous period.

I’ve observed an impressive surge in trading volume recently, with it currently sitting at around $398 million. Previously, we had experienced a lull in activity where the volume dropped beneath the $200 million threshold.

This finding is backed up by data from Santiment. The trading volume amounted to $270 million as markets closed on the 23rd of June.

The sudden surge in trading volume in a short time span is worth noting, implying active market participation and potentially causing greater price fluctuations.

Sellers dominate Toncoin activities

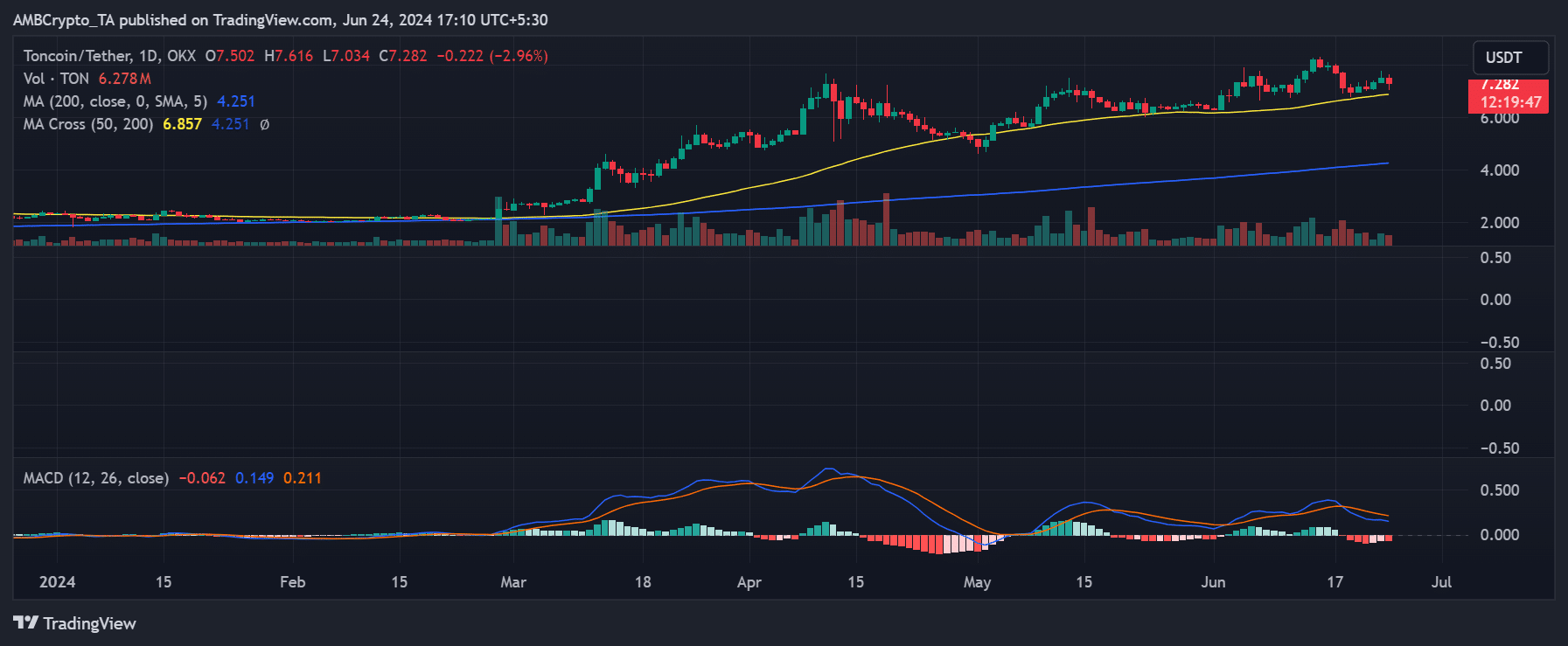

As a crypto investor, I’ve closely monitored Toncoin’s performance based on AMBCrypto’s analysis of its daily time frame chart. While there was a minor setback in the last 24 hours, the overall trend displayed optimistic signs. By the end of 23rd June, TON had closed trading at an impressive increase of over 2%, settling around $7.5.

The most recent figures indicate a change of direction for TON, which saw a nearly 3% decrease and resulted in a trading value around $7.2.

The latest assessment of Toncoin’s price trend indicated that it was sitting above its short-term moving average, represented by the yellow line. Notably, this line functioned as a support for the coin, approximating around $6.8.

Despite recent drops, the price continues to be buoyed above its most recent minimum levels.

Although its value has dropped from a previous peak, the decrease in Toncoin’s price may indicate that sellers are putting pressure on the market. This selling pressure could lead the price to touch the support level. If this level manages to keep the price afloat, it might result in stability or even a rebound.

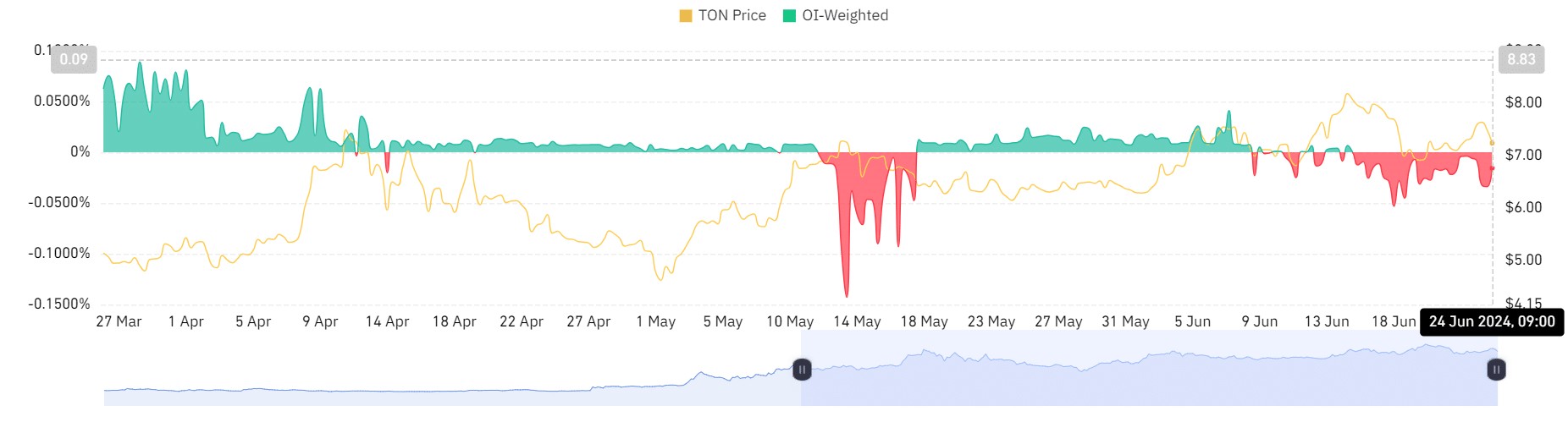

High open interest, low funding rate

As an analyst, I’ve noticed some captivating trends in Toncoin’s derivative metrics. One noteworthy development is the surge in Open Interest within the last 24 hours. The figure currently hovers around $306 million based on Coinglass data.

The current Open Interest level for TON‘s derivative contracts is the most elevated we’ve seen in recent months. This data suggests an uptick in trader involvement, potentially reflecting heightened speculation or risk management strategies through these financial instruments.

Despite a rise in Open Interest, the market mood stays pessimistic based on the funding rate’s assessment. The funding rate, calculated by taking the weighted average, remains under zero at approximately -0.015.

Read Toncoin (TON) Price Prediction 2024-25

As a crypto investor, I would interpret a negative funding rate as meaning that short sellers are having to pay long holders to keep their positions open. This situation suggests that there’s a larger number of sellers in the market compared to buyers.

The rising fascination with Toncoin derivative trading indicates a surge in demand, yet the broader market outlook remains negative. Traders may be bracing for potential price drops.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-06-25 06:15