- Toncoin technical analysis showed some bullishness.

- The on-chain and futures market metrics showed firm bearish conviction for the near-term.

As a seasoned crypto investor with a few battle scars and a hearty laugh line from navigating the volatile cryptospace, I must admit that Toncoin [TON] has been testing my patience lately. While the technical analysis hints at some bullishness, the on-chain and futures market metrics tell a different story – one of firm bearish conviction for the near term.

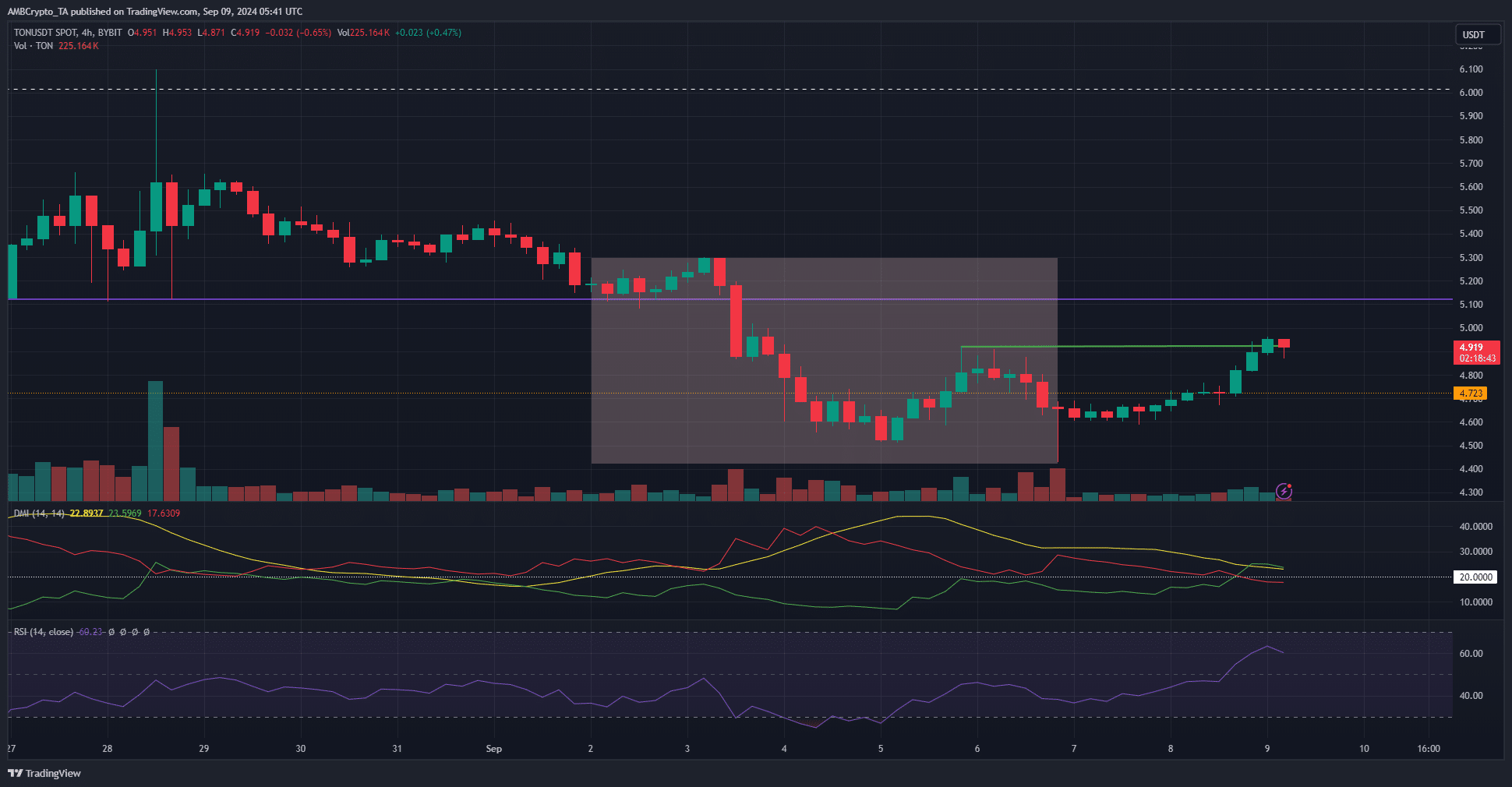

Last week, Toncoin [TON] showed signs of recovering some of its recent losses. On a 4-hour chart, it displayed a bullish market pattern, yet it seemed doubtful that there would be an immediate rebound according to AMBCrypto’s analysis.

The darkened box signified the recent trading activity for the past week. During the weekend, the price managed to climb upwards, but it’s expected that this increase won’t persist. Since mid-July, the trend for TON has been downward, and on-chain indicators suggest that a recovery may be challenging.

Accumulation and distribution amongst whales

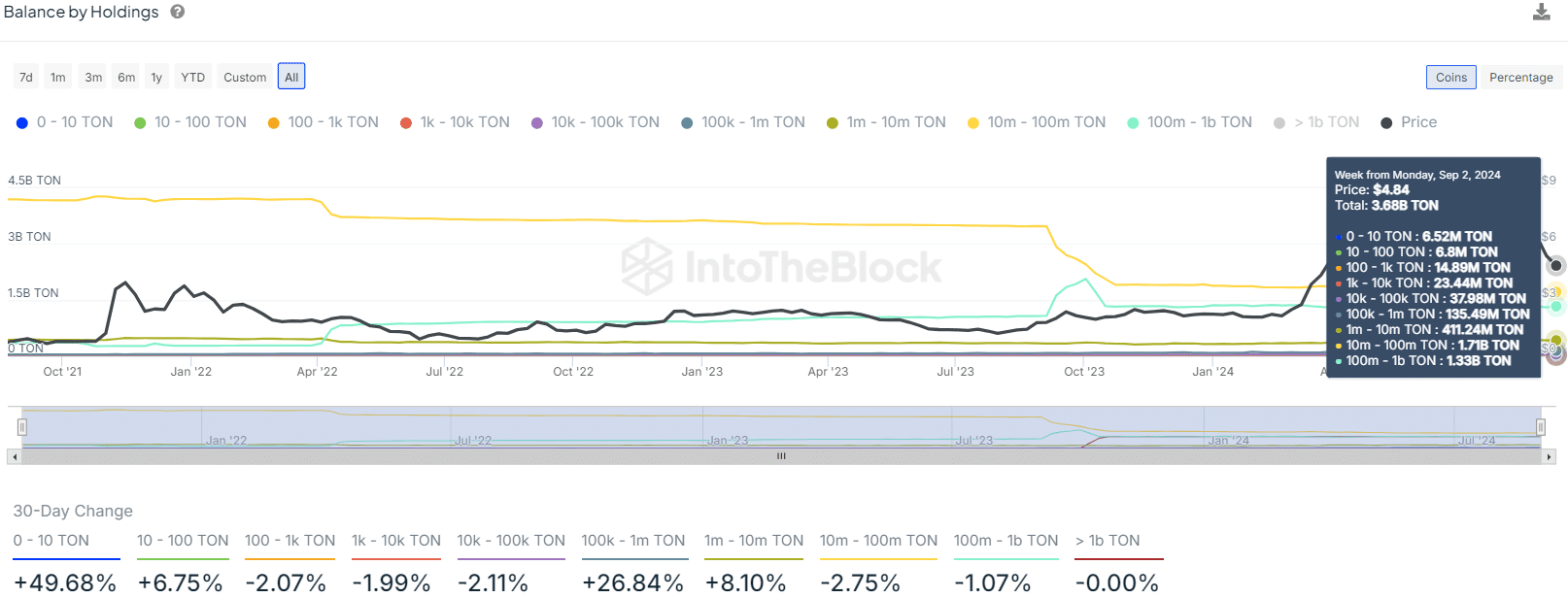

Over the past month, large crypto wallets holding between 100,000 to 1 million tons increased by approximately 26.84% and 8.1%, suggesting that bigger investors (known as ‘sharks’) and smaller ‘whales’ have been buying more coins. On the other hand, larger whale addresses, which typically represent even bigger investors, have been distributing their holdings instead of accumulating.

The balance in their speeches decreased by 2.75% and 1.07%. This suggests that the demand for TON may continue to outweigh the supply, maintaining selling pressure.

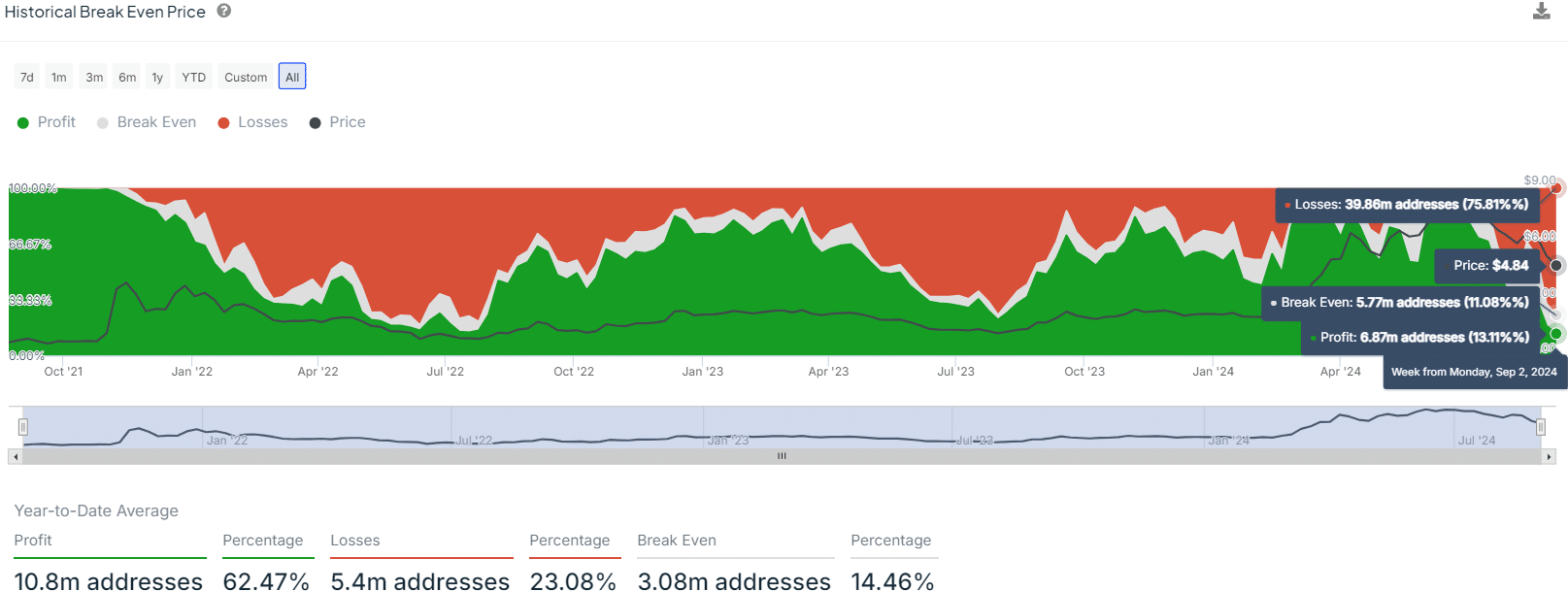

Examining the past point where costs equal returns revealed that numerous locations enjoyed profits during the price surge in April and May. However, since then, the price movement has started to change direction.

75.81% of the addresses that recently purchased TON saw their investment decline, meaning they might choose to sell when they reach break-even point. Any subsequent increase in price could encounter significant selling activity due to this high number of investors looking to cut their losses.

Further evidence that a short-term TON recovery was unlikely

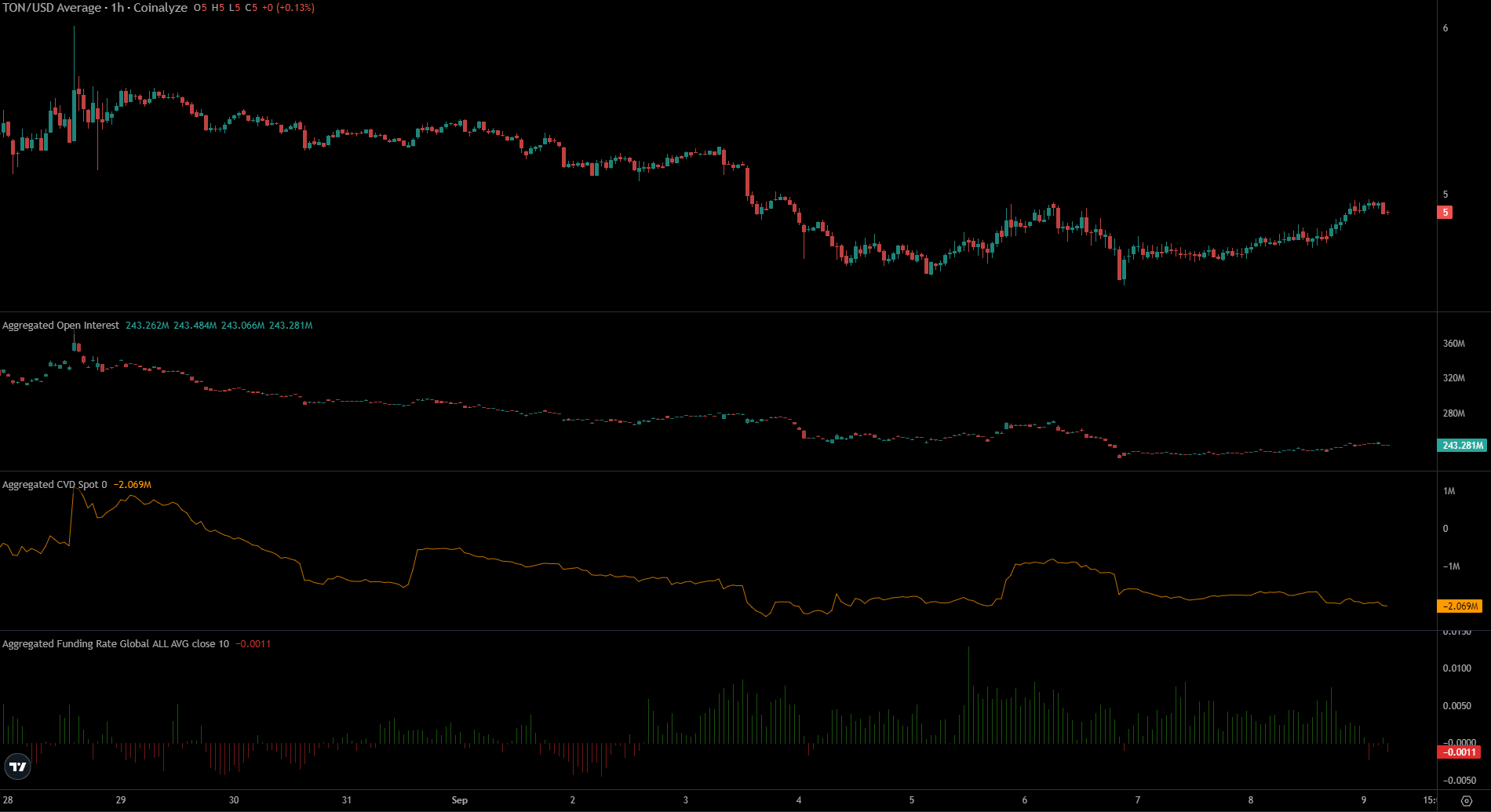

Open Interest increased by approximately $13 million starting from September 6th, as the prices fluctuated from $4.4 to $4.92.

Read Toncoin’s [TON] Price Prediction 2024-25

Instead, the changing funding rate suggested that most traders were betting against Toncoin, as they began to sell it short, indicating a bearish market sentiment.

The decrease in activity related to Cardiovascular Disease (CVD) at that location can be attributed to less demand in the market due to decreased purchasing interest. In essence, it appears that Toncoin may face challenging times over the next fortnight.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-09-09 16:07