- Toncoin’s total inflow into exchanges has surged by 37.54% over the past day

- Ton hiked by 1.83% on the daily price charts.

As a seasoned researcher with years of experience under my belt, I find myself closely watching Toncoin [TON] amidst the ongoing market volatility. The altcoin has been oscillating between $5.1 and $5.5 for weeks now, making moderate gains while most other cryptocurrencies have soared to new highs.

💥 Trump Tariff Shockwave: EUR/USD in Crisis Mode?

Find out what experts predict for the euro-dollar pair this week!

View Urgent ForecastFor the last few weeks, Toncoin (TON) has found itself trapped within the price bracket of around $5.1 to $5.5. Unlike many other cryptocurrencies that have been surging due to Bitcoin‘s positive influence, TON has experienced only modest growth.

Currently, as I’m typing this, Toncoin is being traded at approximately $5.55. This represents a 1.83% increase compared to the previous day. Moreover, over both the weekly and monthly periods, Toncoin has experienced growth, rising by 4.91% and 6.85%, respectively.

Despite the recent gains, TON remained approximately 32.84% below its ATH of $8.24. Therefore, although the altcoin has recorded some gains on price charts, the overall market sentiment remains bearish.

What do TON’s charts suggest?

Based on AMBCrypto’s assessment, Toncoin was facing significant outflow of buyers due to pessimistic feelings during an upward trending market.

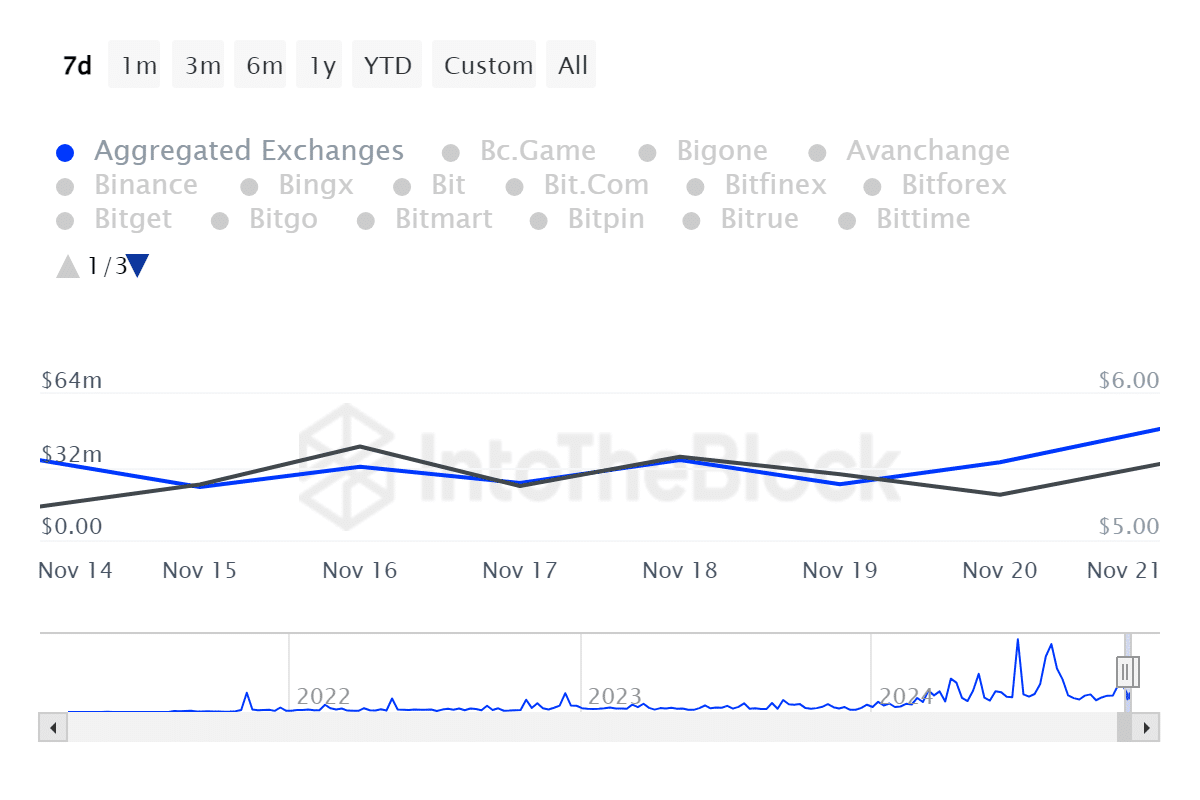

The increase in selling pressure can be observed through the growing amount of assets flowing into exchanges. As per IntoTheBlock’s data, exchange inflows have spiked by approximately 37.54% within the last 24 hours. This surge has brought the total to $48.69 million from its previous low of $34.05 million during this timeframe.

When the flow of investments into exchanges significantly increases, this often indicates that investors are losing confidence. As a result, they move their assets to sell them in order to reap maximum profits or minimize potential losses.

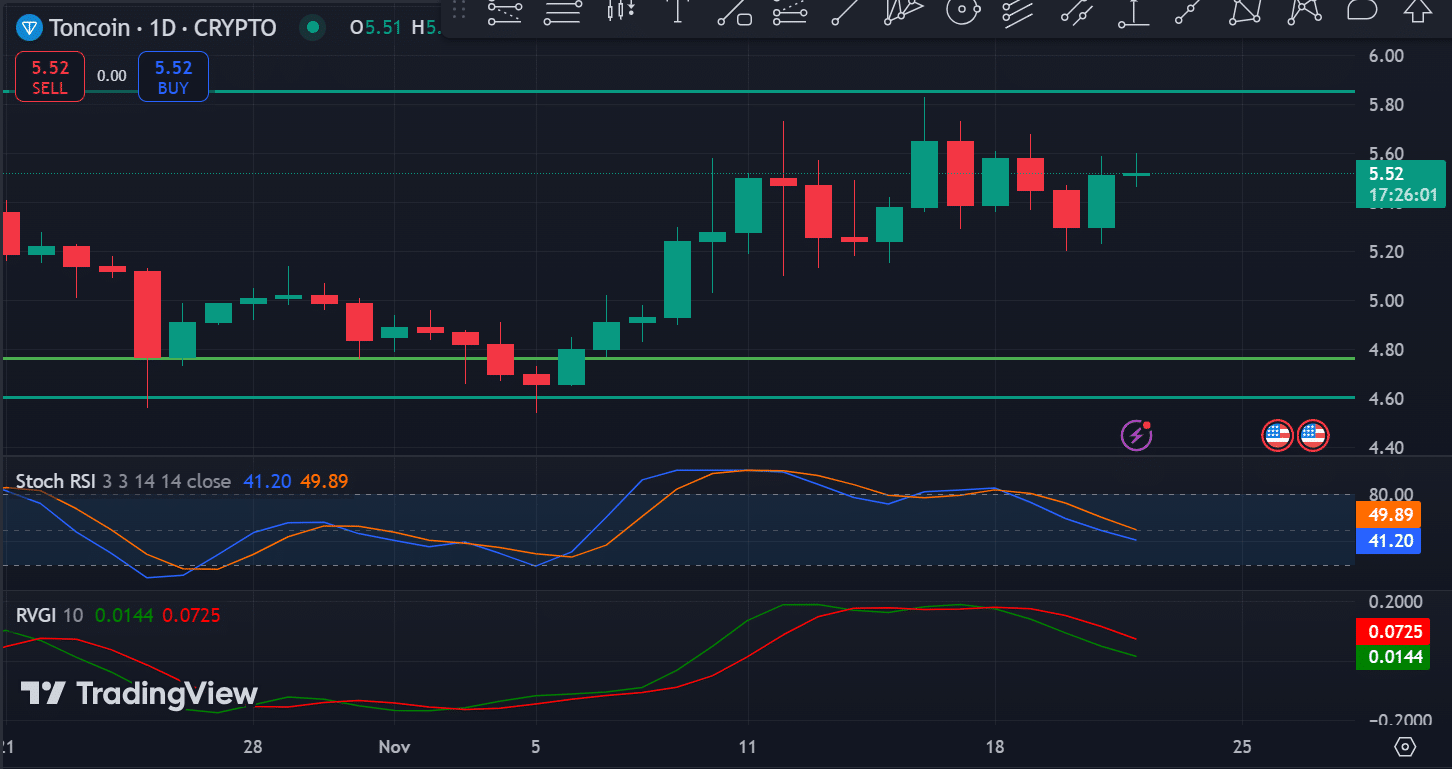

Furthermore, a bearish crossover on Toncoin’s Stochastic RSI occurred several days back, indicating that sellers have taken control of the market. Consequently, its value has decreased from 85 to 39 over this timeframe.

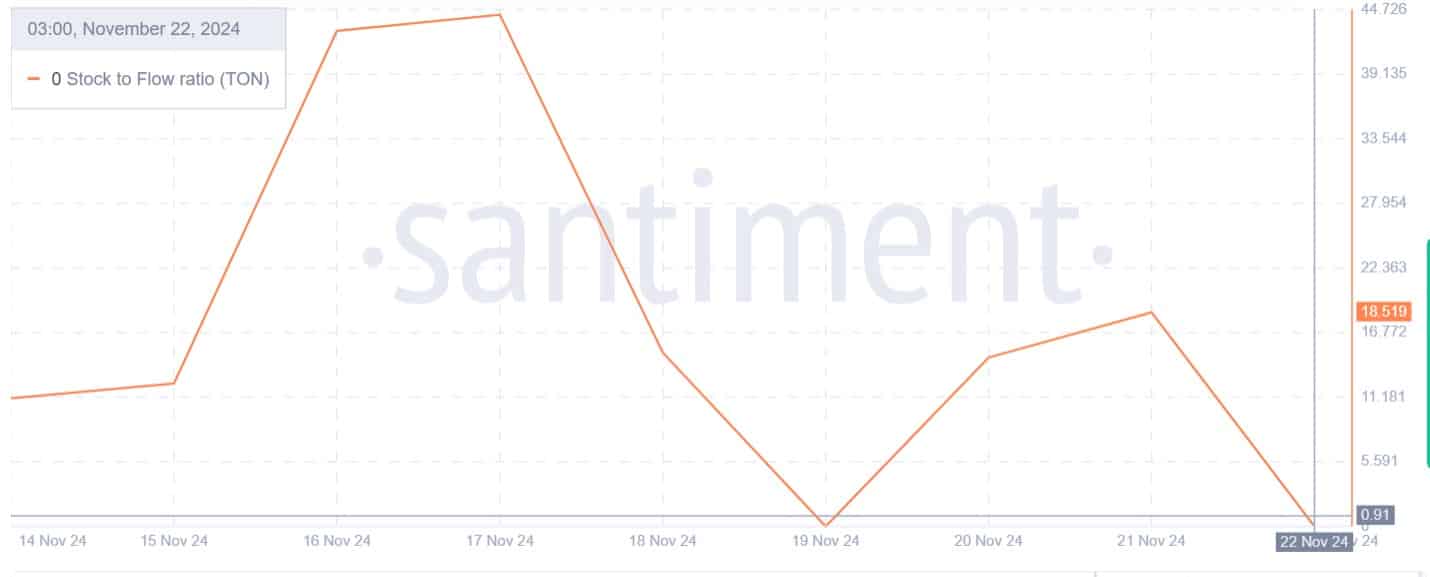

Upon closer inspection, I’ve noticed a significant drop in Toncoin’s Stock-to-Flow (SFR) ratio from 44.28 to zero within the last week. This dramatic decrease in SFR indicates that we might be dealing with an oversupply situation for this altcoin. Typically, an increase in supply without a corresponding rise in demand can lead to downward price trends.

If the flow increases but the stock stays the same or decreases, it leads to an excess supply. This surplus causes scarcity to decrease dramatically, leading people to perceive Toncoin’s value as dropping substantially.

What next for the altcoin?

As a researcher observing the TON market, I’ve noticed an upward trend in its price charts. However, the appearance of a long-legged doji in my daily analysis suggests buyer indecision. This candlestick pattern indicates that both buyers and sellers were vying for control in the market, with neither side managing to gain a decisive advantage.

Nevertheless, it appears that the market favors sellers more, a fact suggested by the recent bearish crossover of the Relative Vigor Index (RVGI) four days back.

Should these negative feelings persist, the value of TON might decrease to around $5.2, a point with robust support. On the flip side, if the recent buying efforts are successful, this cryptocurrency could break free from its current range and surge towards $6.6, where it encounters substantial resistance.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-11-23 06:31