- Toncoin has lagged behind the rest of the bullish market.

- It has a bearish structure and was trading below key moving averages.

As a seasoned analyst with a decade of experience under my belt, I must say that Toncoin [TON] has been a bit of a head-scratcher lately. While it’s true that a 9.13% increase over the past week might have been impressive a few weeks ago, in this current bullish market, it feels like a participation trophy.

Toncoin [TON] was up by 9.13% over the past week.

A while back, those figures could be considered impressive, but the surge of Bitcoin [BTC] above $74k during the initial week of November has sparked intense optimism throughout the market.

It might seem like Toncoin is a good buying opportunity, since it hasn’t pumped yet.

In a rising or bull market, this observation holds true. However, when there’s little to no movement in the market while other assets are thriving, it could potentially indicate a hidden vulnerability or weakness.

Toncoin price prediction

Based on the Awesome Oscillator on a daily chart, the trend for TON has been more heavily weighted towards bears (bearish). However, the green bars on the histogram suggest that the bearish momentum has been decreasing, even though the indicator remains under the zero line, indicating the overall bearish sentiment still prevails.

It’s clear from the price movements, and the overall trend reflects a bearish market. Since late July, we have observed a succession of higher highs followed by even lower lows, which is a common characteristic of a bearish market structure.

As a researcher, I noticed that the OBV (On Balance Volume) remains below a level which previously acted as support. This implies that the selling pressure might still be dominant in the market. A break above $5.92 could potentially signal the beginning of a long-term bullish trend.

On the daily chart, the 50 and 100-day simple moving averages had not crossed each other in a bearish pattern yet, but Token (TON) was still below both of these averages. This suggests further potential weakness in the market.

Magnetic zone could drive short-term gains

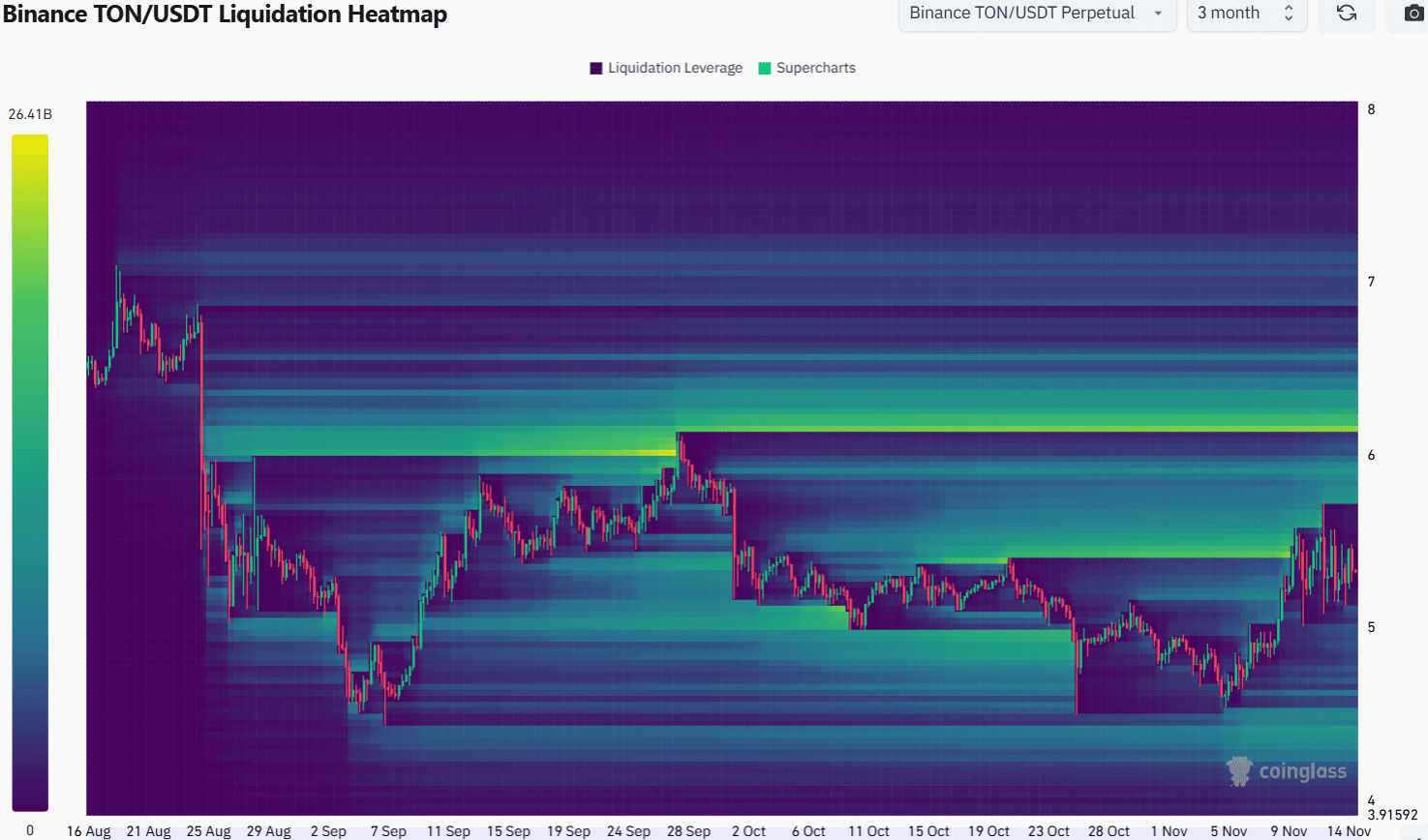

During a 3-month analysis, it was found that the grouping of TON’s liquidation points were located above the $6 value. More precisely, the $5.7 to $5.9 range and the $6.2 zone emerged as significant resistance levels above this price point.

Without significant boost in demand for TON, a downward trend might ensue following the ripple effect of these liquidity pockets. Meanwhile, the $4.47 area shows a more modest concentration of potential sell-off points towards the lower end.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Disney’s Animal Kingdom Says Goodbye to ‘It’s Tough to Be a Bug’ for Zootopia Show

- OM PREDICTION. OM cryptocurrency

2024-11-15 06:15