-

TON witnessed a massive surge in price, however, its volume declined significantly.

Network Growth and Velocity grew as well.

As a researcher with experience in the cryptocurrency market, I’ve witnessed firsthand the intricacies of price movements and their correlation with network growth and holder behavior. In the case of Toncoin (TON), the recent surge in price was noteworthy, but the significant decline in trading volume raised some questions.

As a crypto investor, I’ve noticed an impressive 7% price increase for Toncoin [TON] within the past 24 hours. Yet, the trading volume has noticeably decreased, indicating fewer transactions are taking place in the market.

TON’s price grows

A modest surge in price indicates several potential scenarios. One possibility is a short squeeze, where increasing prices compel short sellers to purchase back the TON token, but there are few sellers left to further drive up the price.

An alternative explanation could be that big investors are purchasing significant amounts of TON at above market value, causing the price to rise despite relatively low trade volumes.

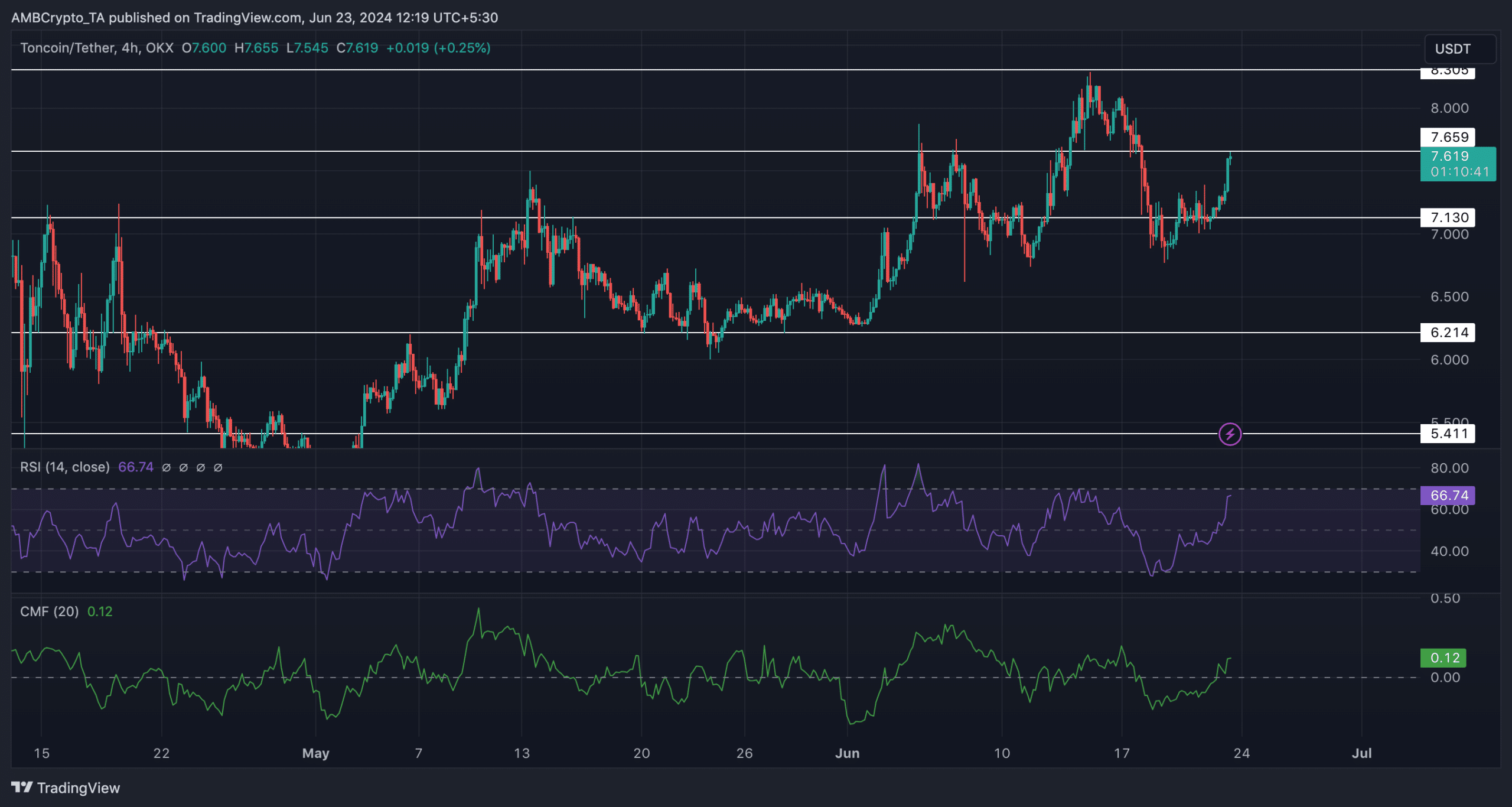

As a crypto investor, I’d say that currently, TON is being traded at a price of around $7.62. However, this price point faced resistance at $7.659, causing it to weaken even more.

Should there be increased buying demand for TON in the future, its price may once again reach its record high.

The Relative Strength Index (RSI) for TON stood at 66.4, suggesting robust buying power fueling the upward trend of TON.

As a researcher observing the financial markets, I’ve noticed an intriguing development regarding Toncoin. Alongside its rising price, the Chaikin Money Flow (CMF) has also experienced substantial growth over the past few days. This indicator reflects the amount of money flowing into or out of a security based on its closing price and volume. In simpler terms, it suggests that there’s been a noticeable influx of investment capital into Toncoin recently.

In it for the long haul

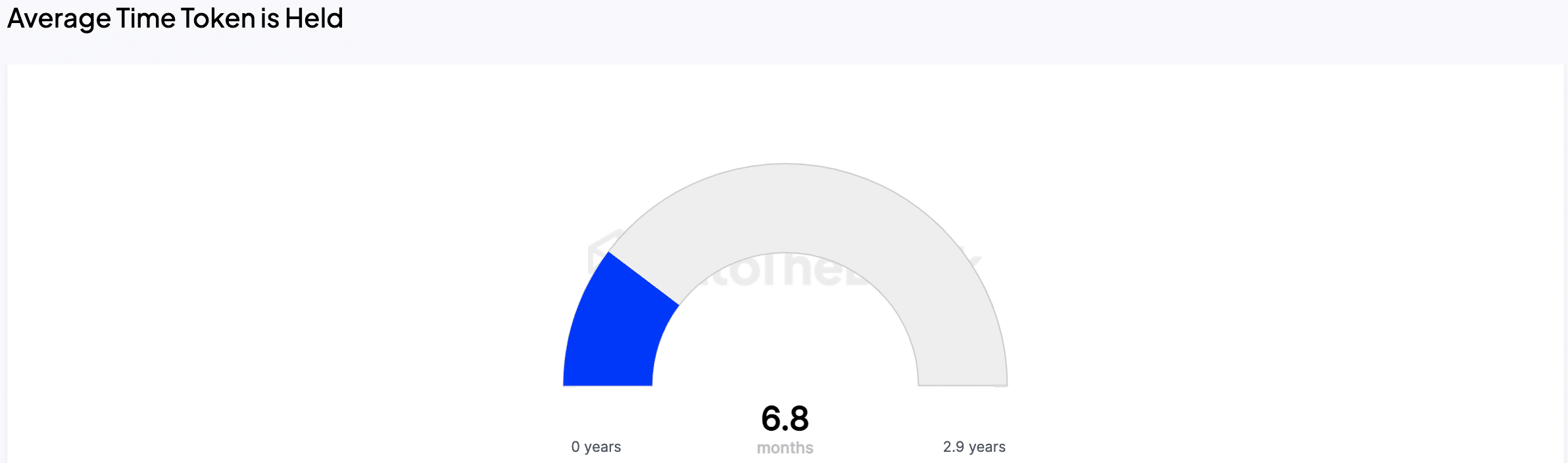

As a crypto investor, I’ve noticed that based on the analysis by AMBCrypto using IntoTheBlock’s data, the average investor in TON has held onto their tokens for approximately 6.8 months. This implies that a significant number of us are in this for the long haul.

As a bullish investor in TON, I personally hold onto my coins even during temporary price drops. By not selling during market fluctuations, I decrease the circulating supply of TON, potentially leading to an increase in its value due to scarcity.

In simpler terms, individuals who plan to keep their Ton coins for extended periods are generally unfazed by temporary market fluctuations. Consequently, this stability among long-term investors can reduce the price swings in TON. Fewer sellers seeking immediate profits lead to a more tranquil market scenario.

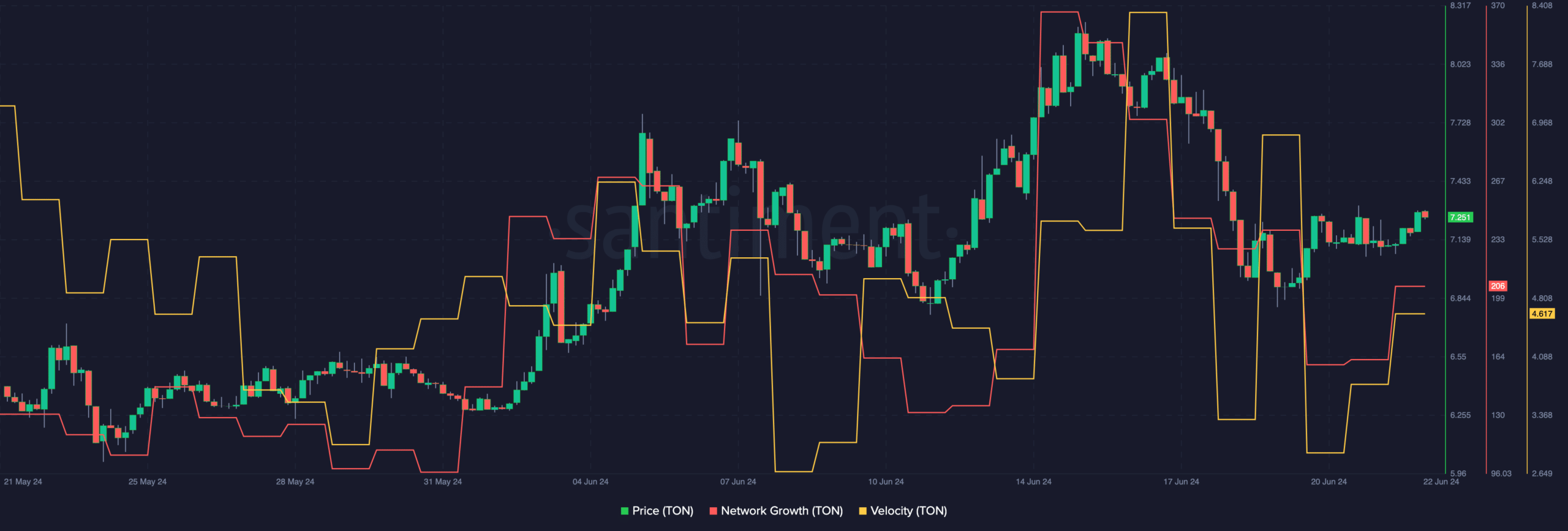

In the past few weeks, the expansion of the TON network and the pace at which its tokens were being used had slowed down. Yet, following a recent increase in TON’s value, both network growth and token velocity have picked up speed.

Newcomers were increasingly expressing curiosity towards TON, while its trading activity saw a notable uptick in frequency.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-06-23 19:03