- TON has declined by 14.64% over the past month.

- Market fundamentals indicated a shift in market sentiment, from bearish to bullish.

As a seasoned analyst with years of experience navigating the crypto market’s volatile seas, I have seen trends rise and fall, bulls and bears come and go. Over the past month, we’ve witnessed a remarkable upswing, with Bitcoin reaching new heights, but the recent cooling down has left some altcoins like Toncoin in the doldrums.

For about a month now, the cryptocurrency market has seen a significant rise, pushing Bitcoin‘s [BTC] price up to a recent peak of $69k.

Over the last seven days, the market has seen a downturn, as most cryptocurrencies have dropped in value. This means that the recent losses have now surpassed any gains made during the month.

Among the popular alternative cryptocurrencies, Toncoin (TON) had been particularly notable. After reaching its peak for the month at $5.8, TON has undergone a considerable drop in value.

Currently, Toncoin is being exchanged for approximately $4.95 per coin. Over the last 24 hours, its value has dropped by around 2.42%.

As a crypto investor, I’ve noticed that the value of my altcoins has dropped by 14.64% over the past month, and this downward trend seems to be continuing, as there’s been a further dip of 6.06% in the last week.

Significantly, recent market trends have sparked discussions among cryptocurrency enthusiasts about the potential future path of altcoins.

One well-known cryptocurrency analyst, Ali Martinez, proposed that the present situation with TON indicates a potential buying opportunity.

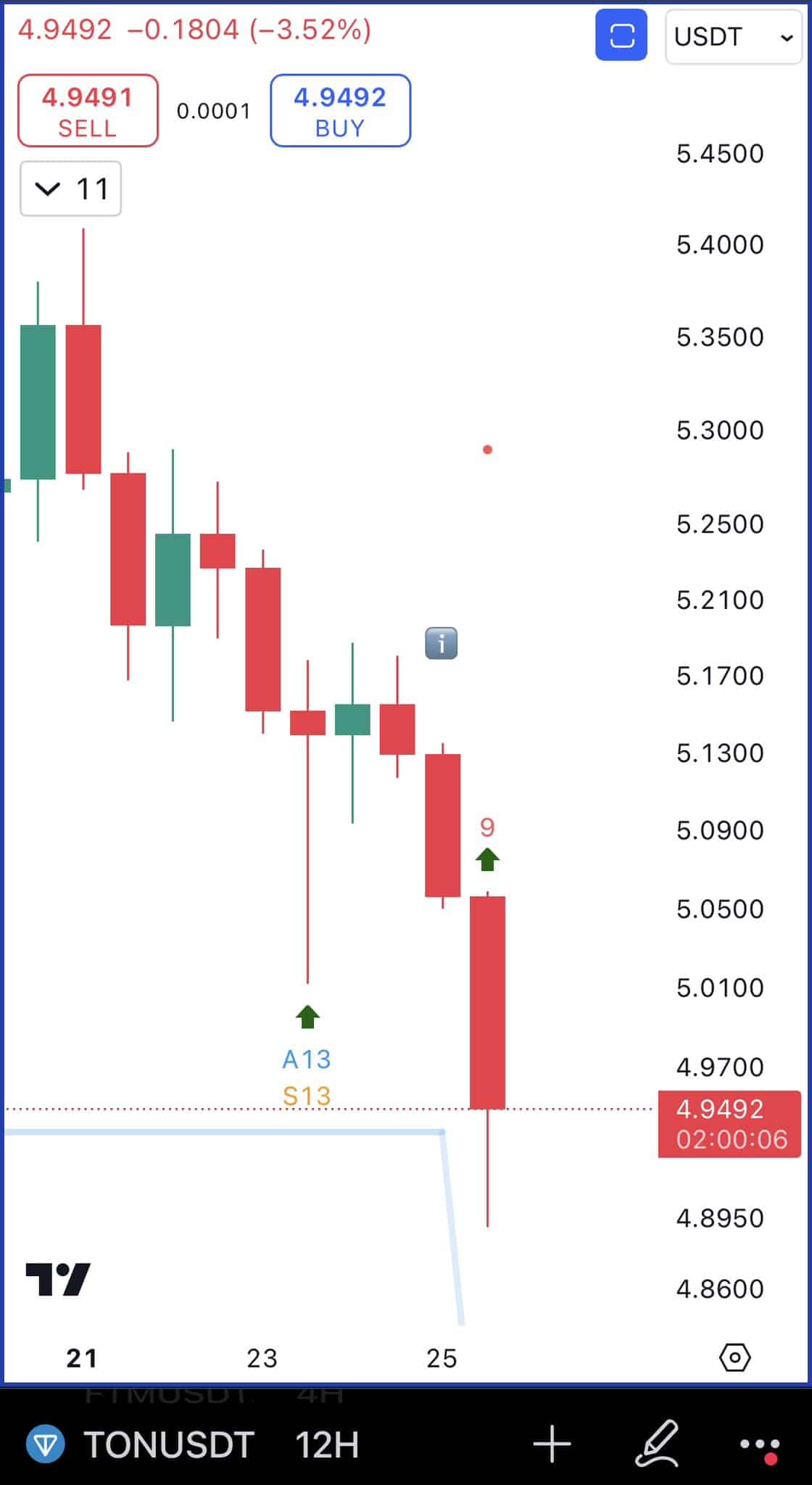

TON shows a buy signal

According to Martinez’s interpretation, TD Sequential indicated a buy signal on Toncoin’s 12-hour graphs, implying a possible price increase in the short term.

In simpler terms, when sellers’ influence weakens (losing momentum), it serves as a caution sign. This allows potential buyers to jump into the market at reduced costs, thereby building up purchasing pressure instead.

Over the last day, more trading has been happening due to the emergence of a buy signal. As a result, TON’s trading volume significantly increased by approximately 126%, reaching $313.1 million. This trend suggests that many traders have been buying at reduced prices.

If the market follows through, the prices will rebound and see further gains on price charts.

Gains ahead?

Despite TON facing a prolonged downturn, the present circumstances seem to favor the bears, implying that the altcoin might soon witness an uptick.

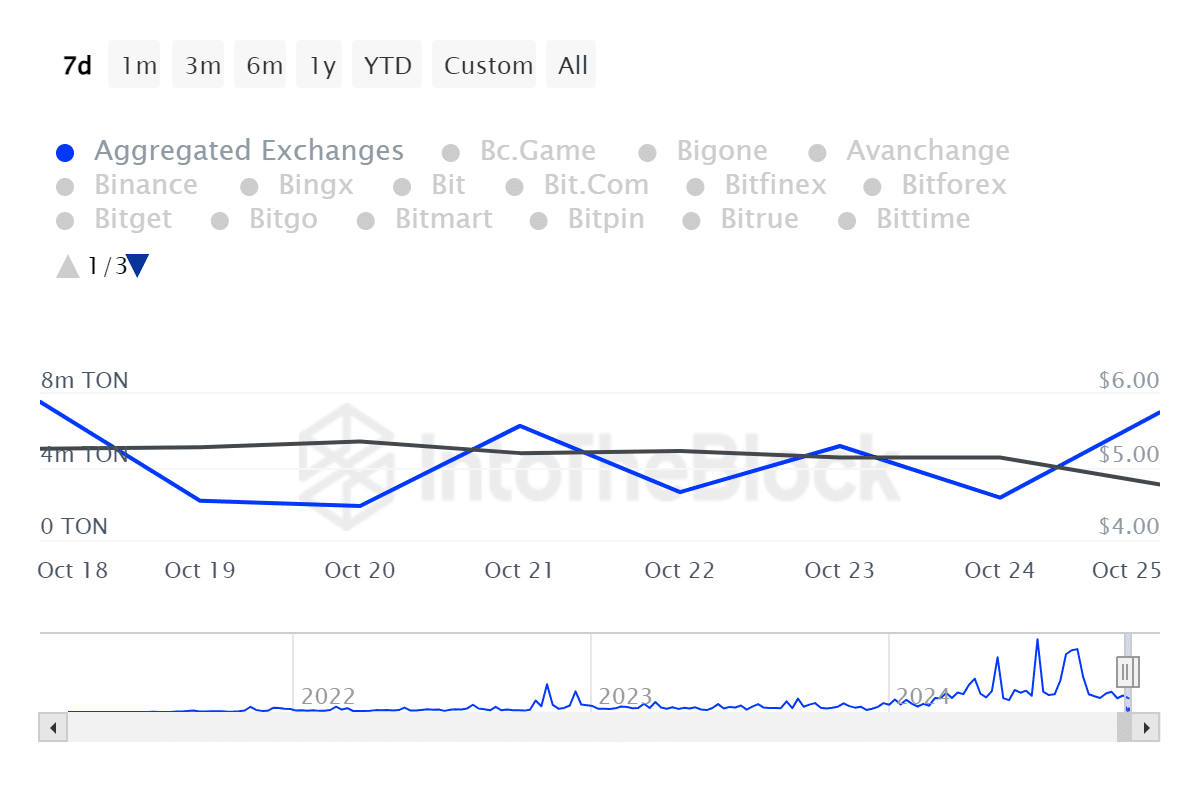

For example, Toncoin’s large holder’s Netflow Ratio has declined from a monthly high of 289% to 70%. This showed a shift in sentiment, with large holders accumulating their assets as they anticipated more gains.

Such a decline suggested market confidence.

Furthermore, the total Toncoin outflows on Combined Exchanges saw a significant rise, climbing from a minimum of 1.86 million coins to a high of 7 million.

It appears that many investors are transferring their Ton from exchanges into offline storage, suggesting a high level of confidence in the altcoin’s future outlook.

Read Toncoin’s [TON] Price Prediction 2024–2025

Essentially, the overall market opinion about TON was transitioning from negative (bearish) to positive (bullish) at that moment. If this trend continues, we can expect TON to regain a higher position.

In the upcoming period, the altcoin might strive to surpass a resistance point of approximately $5.4. If it manages to break through this barrier, Ton could potentially reach $5.8. Conversely, if buyers don’t gain control, there’s a chance for a downward trend that could take Ton down to around $4.02.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-10-27 07:04