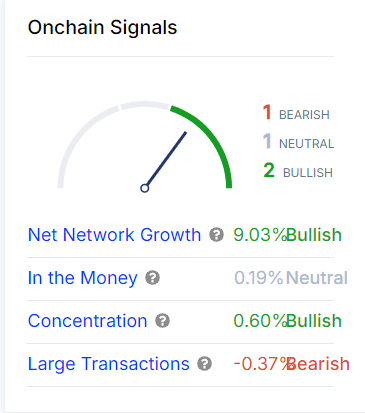

- Toncoin’s network growth was up 9.03%, with whales accumulating, but large transactions showed bearish activity.

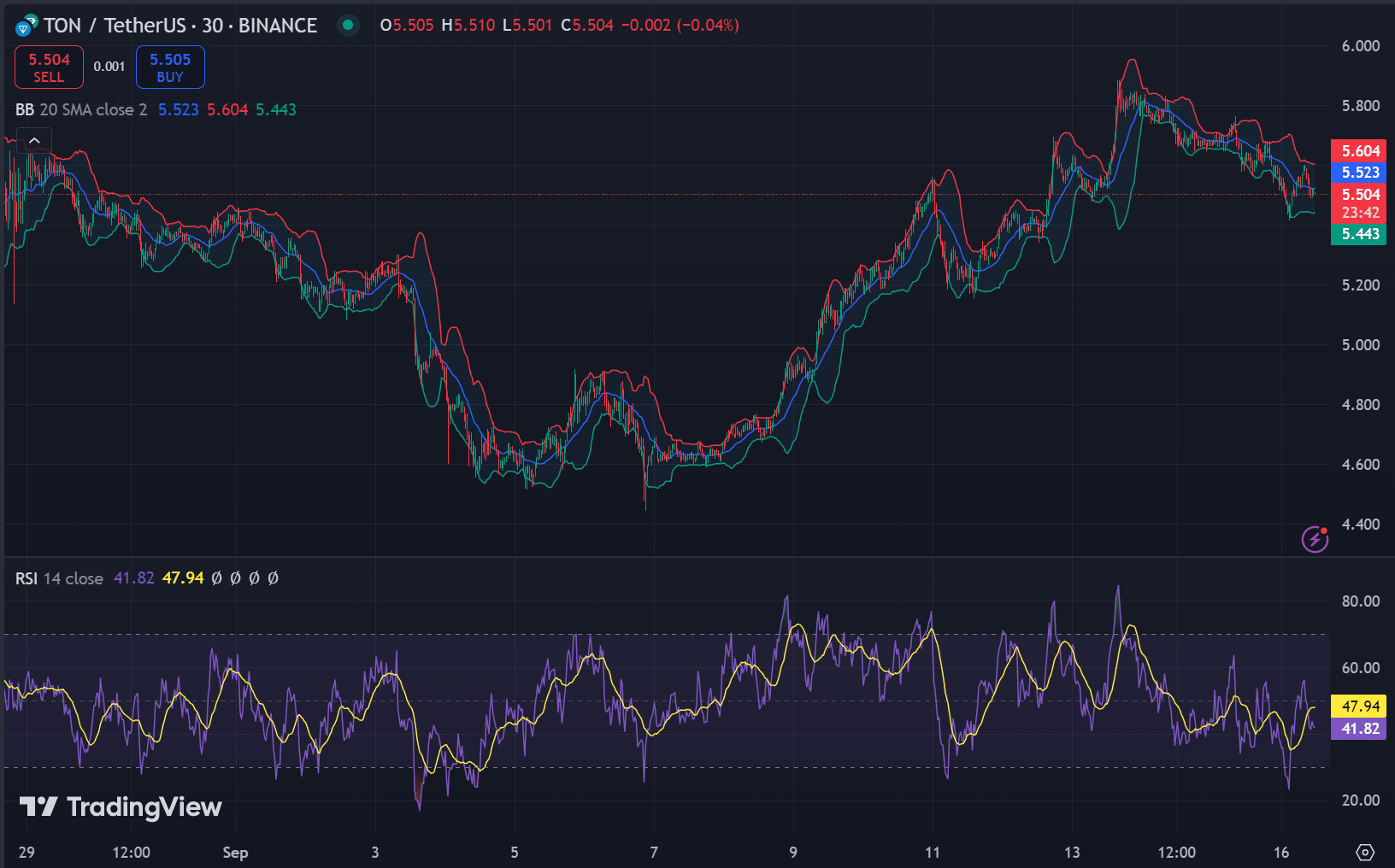

- Technical indicators, including RSI and Bollinger Bands, suggested potential volatility as volume spiked.

As a seasoned researcher with years of experience analyzing various digital assets, I find Toncoin [TON] to be intriguing at this juncture. The network growth of 9.03% and whale accumulation are undeniably positive signs, but the decline in large transactions and neutral “In the Money” indicate a market hesitant to make decisive moves.

Currently, Toncoin [TON] is receiving attention due to a noticeable decline from its previous peak of approximately $8, now standing at $5.51 at the moment of reporting.

By examining mixed signals from various on-chain and technical analysis tools, investors are trying to determine if this situation signifies an extended downtrend or if the asset might rebound shortly.

Is network growth enough?

At the current moment, the expansion of Toncoin’s network was particularly noteworthy, registering a 9.03% rise. This upward trend suggests an ongoing influx of new users joining the network, signaling heightened curiosity and investment.

Yet, even with this growth, a lack of substantial demand might not be sufficient to turn around the declining pattern on its own.

In the meantime, it appears that the concentration has increased by 0.60%. This suggests that large whale investors might be buying more, acting as a stabilizer during volatile times. Their actions show faith in the asset’s long-term prospects.

In the current state, the “In the Money” stood at 0.19% which indicates that numerous holders have neither gained nor lost money yet. This implies a market equilibrium, suggesting that traders are cautious and unwilling to take substantial actions until more defined patterns or trends appear.

A noteworthy trend is the 0.37% decrease in significant transactions, implying less involvement by key figures and hinting at uncertainty among them regarding major actions within the present market scenario.

Technical indicators: RSI and Bollinger bands

Looking from a technical viewpoint, the Relative Strength Index (RSI) stood at approximately 41.82, which is getting close to oversold levels. This might indicate that Toncoin could experience a brief rebound soon, but it doesn’t necessarily signal a prolonged reversal yet.

According to Bollinger Bands analysis, Toncoin appears to be in a phase of tightening, as its price is approaching the lower bound of $5.43. This lower limit might suggest potential support, implying that volatility could potentially rise.

The upper band was at $5.60, and a breach of this level could signal upward momentum.

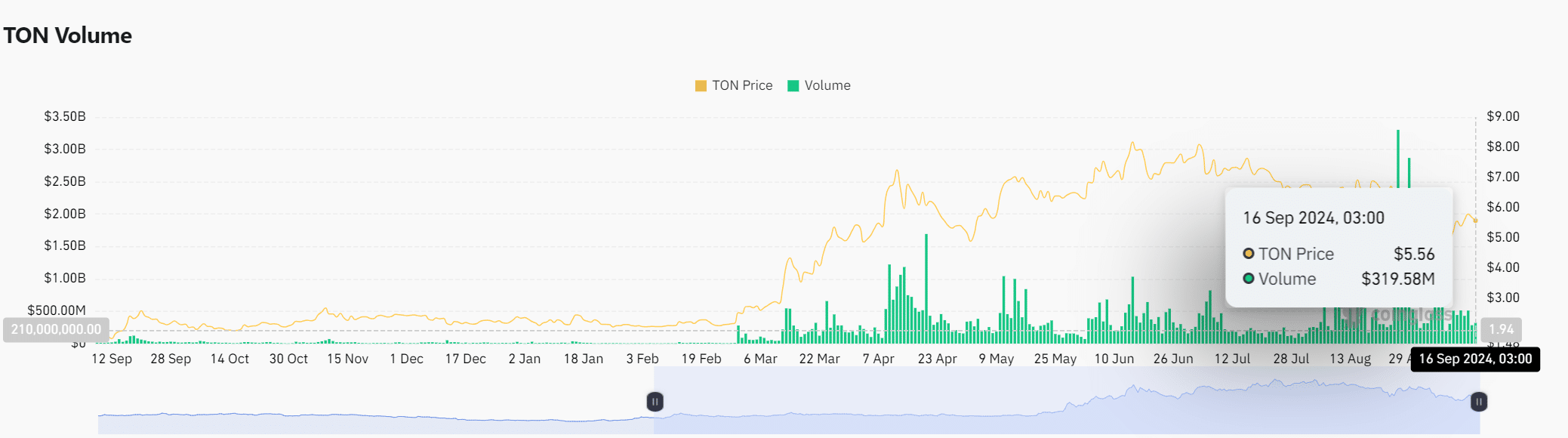

Volume spike and effects on TON

Although the cost decreased, there was a 7.92% rise in trading activity, totaling approximately $319.58 million, as per data from Coinglass.

This uptick in volume suggested increased market activity, which could lead to significant price swings in the near future.

Toncoin’s signals painted a somewhat ambiguous picture. On the upside, there was progress in Network Expansion and increased Whale hoarding. However, the drop in significant transactions and the neutral “In the Money” status served as a reminder to exercise caution.

Read Toncoin’s [TON] Price Prediction 2024-25

Combined with technical signals like RSI and Bollinger Bands, Toncoin looked to be at a key point.

The possible direction of the market might be affected by an increase in trading activity and a potential burst through the current period of stabilization.

Read More

- OM PREDICTION. OM cryptocurrency

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Oblivion Remastered – Ring of Namira Quest Guide

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Ian McDiarmid Reveals How He Almost Went Too Far in Palpatine’s Iconic ‘Unlimited Power’ Moment

- Quick Guide: Finding Garlic in Oblivion Remastered

- Ryan Reynolds Calls Justin Baldoni a ‘Predator’ in Explosive Legal Feud!

- Bitcoin: The Dashing Drama of Saylor’s 21 Rules! 💰✨

- Sophia Grace’s Baby Name Reveal: Meet Her Adorable Daughter Athena Rose!

2024-09-17 08:08