-

Within 24 hours, investor expectations switched from bearish to bullish.

TON’s price could continue to increase as net positioning jumped.

As a researcher with extensive experience in the crypto market, I’ve seen firsthand how quickly investor expectations can shift. Within just 24 hours, TON‘s price and market sentiment underwent a significant transformation.

In the rapidly evolving crypto market, an altcoin like Toncoin [TON] experiences constant shifts, not just limited to its market value.

Instead, it focused on the activities of traders in the market— specifically, the derivatives end.

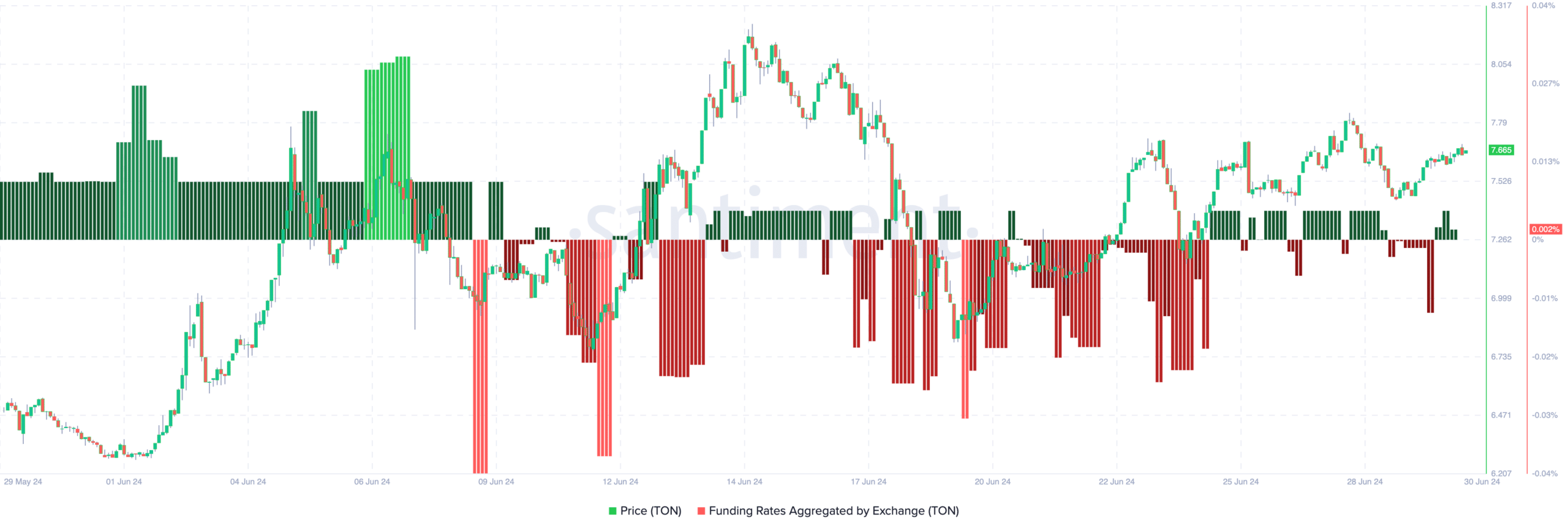

As a data analyst examining the market trends using Santiment’s insights, I noticed that TON‘s Funding Rate dipped to -0.012% on the 29th of June. However, I want to emphasize that this situation has changed since then, as the ratio currently stands at a positive 0.002%.

As an analyst, I would explain that the Funding Rate represents the fee paid to keep a position open in a cryptocurrency market. It serves as a reflection of market sentiment as well. When the rate is negative, this signifies a bearish outlook among traders.

Bears have turned bulls

In this situation, individuals holding short positions, anticipating a price drop, pay those with long positions, who are betting on a price rise, to maintain their opposing stances. Conversely, when the market is favorable, those with long positions end up compensating their short-position counterparts.

In other words, the significant shift in prices over a short timeframe indicates that many traders are now optimistic about Toncoin’s price growth and plan to capitalize on it.

At the moment of publication, the value of TON stood at $7.66. This represented a 2.01% rise in value over the past 24 hours. It’s worth noting that this slight decrease in price contributed to TON’s entry into the top 10 crypto market gainers.

At present, Toncoin has decreased by 6.97% compared to its peak price. This top price was attained on the 15th of June when it stood at $8.24.

As an analyst, I’ve observed that not only has the price of TON been rising, but the funding rate also indicated strong buying activity. Consequently, orders on the spot market surged, resulting in traders being remunerated for their held positions.

Money flow rises, putting TON on the right path

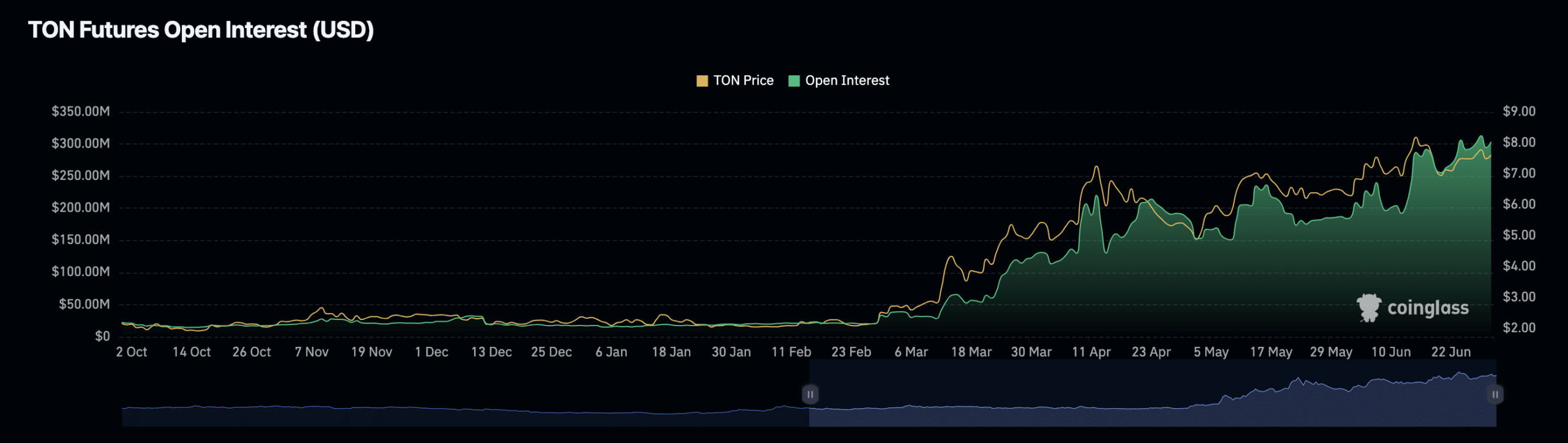

At this cost, it’s a bullish sign. Consequently, TON might make its way back up to around $8 in the near future. Nevertheless, it’s crucial to examine the Open Interest (OI) figures to strengthen this hypothesis.

The term “OI” represents the sum of all open contracts in a financial market. However, it’s crucial to keep in mind that this figure doesn’t provide information on whether there are more buying or selling positions. This is due to the fact that for every buyer (long position), there is an equal and opposite seller (short position).

In simpler terms, this means that the signal reveals whether net positioning is growing or shrinking. A growth signifies an upward trend in net positioning, whereas a decline implies the opposite.

As a researcher examining data from Coinglass, I discovered that the Open Interest for Toncoin amounted to $303.53 million. This figure represents an upward trend compared to the previous day, indicating heightened speculative activity in the market.

Realistic or not, here’s TON’s market cap in BTC terms

If the current trend persists in the upcoming days, it is expected that TON‘s price will primarily keep rising.

As a researcher studying the trends of this particular cryptocurrency, I’ve observed that if its Other IoM (On-chain Indicator of Money) decreases in the future, then it’s likely that the price will head downwards. Consequently, the value of the crypto could potentially drop to $7.25.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-06-30 20:07