- Ton liquidation hits $7.2 million following Telegram founder arrest.

- Investors fear, uncertainty and lack of confidence have resulted to high selling pressure.

As a seasoned researcher with years of experience navigating the cryptocurrency market, I have witnessed my fair share of ups and downs. However, the recent turn of events surrounding Toncoin has left me quite concerned. The arrest of Telegram founder Pavel Durov has undoubtedly cast a long shadow over the altcoin community. The surge in liquidation to $7.21 million is alarming, especially given that it surpasses the record set during the market crash earlier this month.

The community surrounding Toncoin [TON] has felt intense strain following the arrest of Telegram’s founder, Pavel Durov, in France. It’s speculated that he could face a 20-year prison sentence. This news development has significantly affected the value and sentiment of the cryptocurrency tied to Telegram.

Ton liquidation spikes

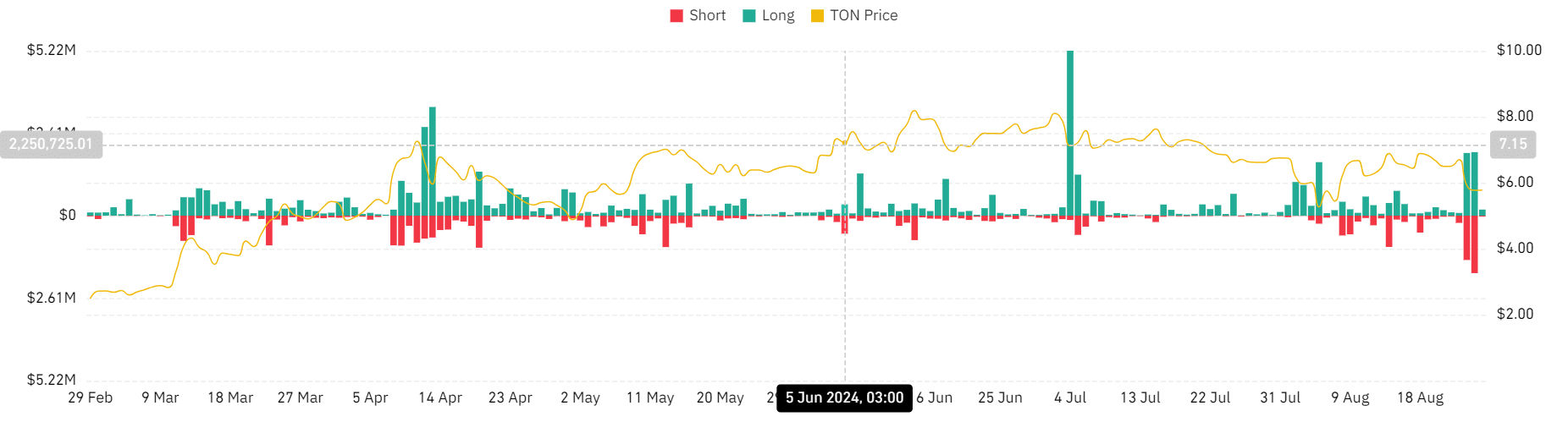

Based on information from Coinglass, Toncoin’s liquidation figure has reached an all-time peak. The total amount of liquidated positions for Toncoin stands at approximately $7.21 million. This exceeds the previously reported liquidation during the recent market downturn that occurred earlier this month.

On the 5th of August, a market crash saw unprecedented Ton liquidation amounting to $6.5 million, primarily affecting long positions. However, recent liquidations indicate a shift, with higher liquidations occurring for both short and long positions.

As a crypto investor, I’ve noticed that recent events of liquidation suggest a highly volatile market, one where prices can swing dramatically and rapidly. This volatility often triggers stop-loss orders and margin calls, resulting in forced selling or liquidation.

Impacts on Ton price charts

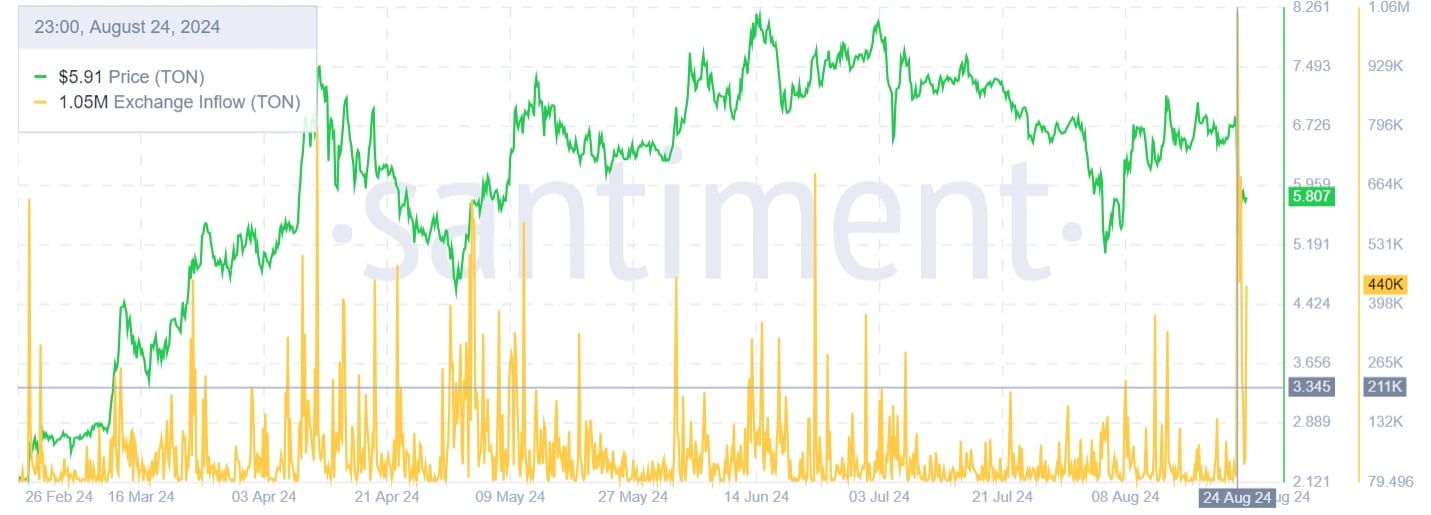

Due to recent legal troubles involving the creator of Telegram, the market value of Toncoin has dropped by about $2.9 billion, going from $17.1 billion to $14.2 billion. This decrease is due to a significant drop in trading activity, with a 27.3% decline in volume.

As a result of AMBCrypto’s examination, it appears that an increase in liquidations is causing Ton to trend downwards. Over the past week, Toncoin has experienced a significant drop of approximately 18.77%.

The evidence supporting this occurrence also comes from a decrease in the Relative Strength Index (RSI), specifically, it has dropped from 52 to 36 as we speak, indicating a potential shift in market momentum.

An RSI (Relative Strength Index) that’s decreasing indicates heavy selling activity on the altcoin, causing it to approach overbought levels. This implies higher doubt among investors regarding the altcoin’s future potential and reduced confidence in its value.

In the current state, the Directional Movement Index (DMI) has dropped from 23 to 16. This indicates an increase in selling activity, which appears to be driving altcoins towards a descending trend.

Over the last day, it appears that TON‘s downward trend has been quite substantial, as indicated by the shift of the index from negative to positive.

As we delve deeper, the surge in incoming trades suggests that Token holders anticipate a price drop and are therefore planning to offload their tokens. Consequently, due to unfavorable news, investors were compelled to transfer their assets to exchanges for selling purposes.

Consequently, it appears that unfavorable reports are influencing the overall market mood. This influence led to a significant increase in sell-offs, thereby creating more selling pressure. As a result, we saw a decrease in the total market value, trading activity, and individual prices.

Consequently, given the prevailing market mood, it’s likely that the altcoins could drop to the nearby support level of around $4.77.

Read More

2024-08-26 16:08