-

TON rose briefly to a new all-time high on 15 June

Bullish bias towards the altcoin appeared to be significant on the charts

As a researcher with extensive experience in the cryptocurrency market, I have closely monitored TON‘s price action and technical indicators. Based on my analysis, TON’s brief rise to a new all-time high on 15 June was an impressive display of bullish sentiment among traders.

On the morning of June 15th, the widely used cryptocurrency Toncoin (TON), associated with Telegram messaging app, reached a new peak price for the first time in its history.

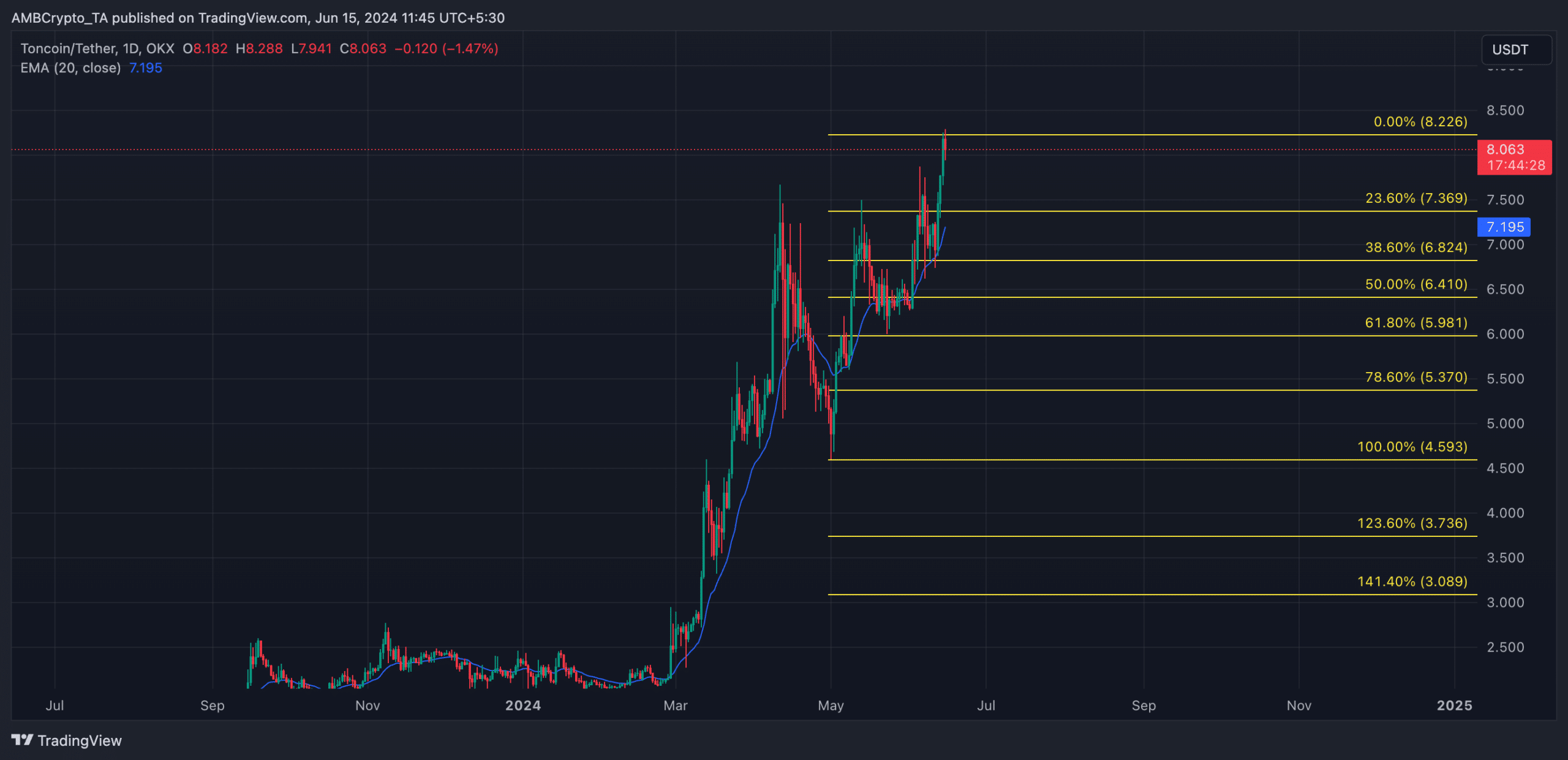

Based on CoinMarketCap’s data, the value of the altcoin momentarily surpassed $8, reaching a peak of $8.24 during trading. However, this increase was followed by a correction, and at the current moment, TON‘s price is $7.96, marking a 3% decrease since it reached its all-time high.

TON is not done climbing

As an analyst, I have evaluated the token’s behavior on the daily chart and observed that, despite a slight increase in selling pressure causing TON‘s price to retreat from its recently achieved all-time high, the bullish sentiment remains robust within its market.

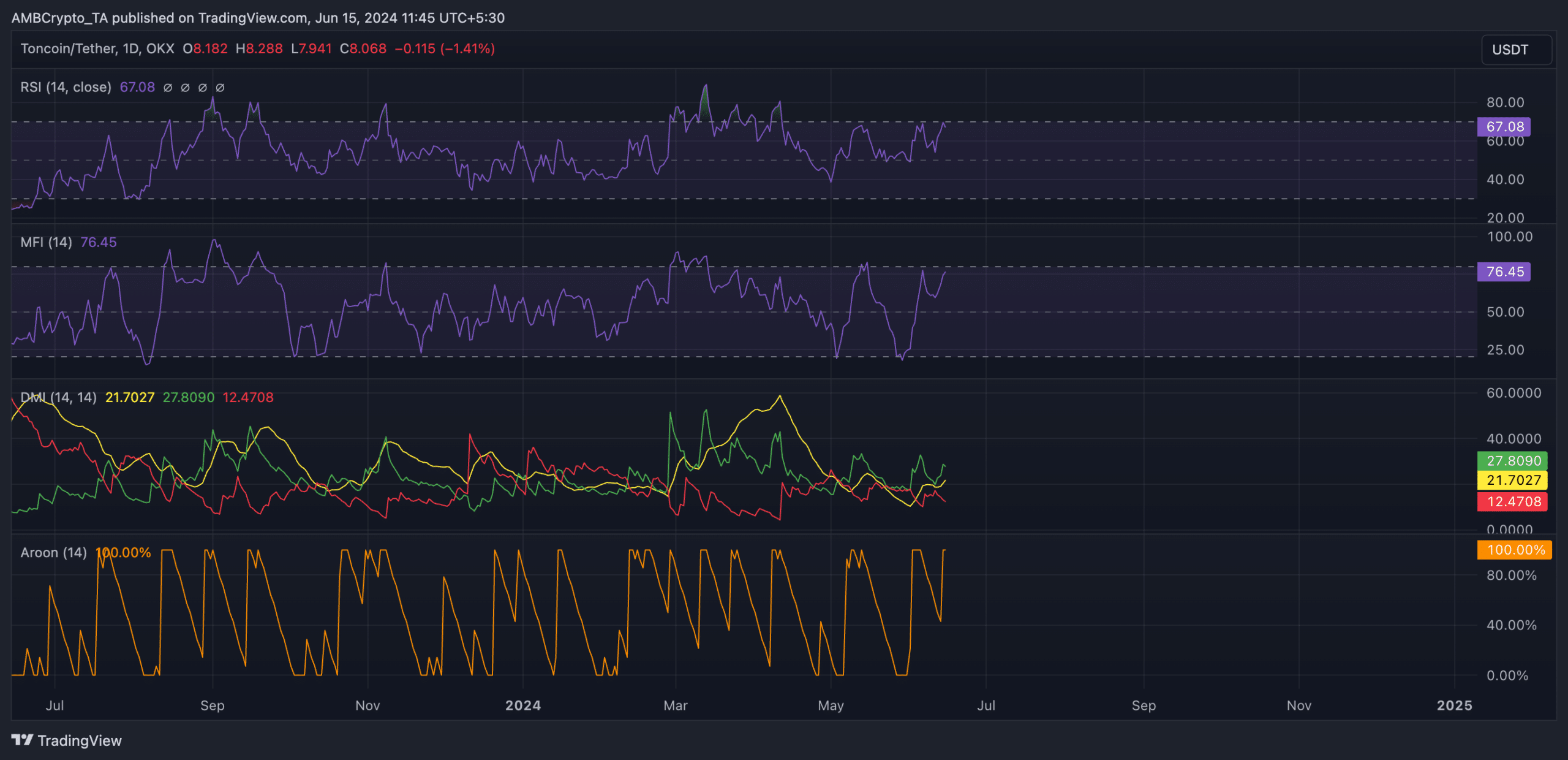

At the moment of composition, TON‘s significant technical indicators showed a positive trend. The Relative Strength Index (RSI) stood at 65.80, and the Money Flow Index (MFI) read 76.42, both values being above their respective median lines.

As a researcher studying market indicators, I can explain that TON‘s Relative Strength Index (RSI) and Moving Average Convergence Divergence (MFI) are crucial tools for assessing overbought and oversold conditions in the asset’s price trend. At present, these indicators indicate that TON’s traders lean more towards accumulating rather than distributing based on the readings at their current values.

Additionally, the readings obtained from TON‘s Directional Movement Index indicated that the positive directional index, represented by the green line, was higher than the negative index, signified by the red line.

The DMI (Directional Movement Index) of an asset quantifies the power of its pricing trend. When the positive DMI value surpasses the negative DMI value, it indicates a prominent uptrend in the market. This bullish sign implies that bearish forces hold minimal influence over traders’ decisions.

At present, TON‘s Aroon Up Line attained a full reading of 100%, signifying a robust uptrend based on the Aroon indicator’s assessment. This technical analysis tool helps determine an asset’s trend direction and potential turning points. When the Aroon Up Line nears 100, it suggests that the current upward trend is powerful and the latest peak was achieved not long ago.

Is your portfolio green? Check the Toncoin [TON] Profit Calculator

As a crypto investor, I’ve observed that TON‘s weighted sentiment recently registered a value of 1.6. This indication suggests that the majority of conversations surrounding this altcoin on social media have taken on a predominantly optimistic tone.

Additionally, this implied that traders of TON harbored a strong belief and anticipation that its value would continue to rise in the near future.

If this happens, TON may rally to reclaim its all-time high and surge past it.

However, if invalidated, the altcoin’s price might drop to $7.36 on the charts.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- PI PREDICTION. PI cryptocurrency

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

2024-06-15 13:11