- Toncoin dropped by 24% recently, but analysts project a potential 280% surge in the current bull cycle.

- Key metrics like whale transactions and Open Interest provide insight into Toncoin’s near-term price trajectory.

As a seasoned analyst with over two decades of experience navigating financial markets, I have witnessed numerous bull and bear cycles. The recent dip in Toncoin’s price is not unfamiliar territory, but it’s important to maintain a balanced perspective when analyzing market trends.

As a crypto investor, I’ve noticed that Toncoin [TON] has been going through some tough times after a string of impressive showings earlier this year. This digital currency peaked at an all-time high (ATH) of $8.25 back in June, but since then, its value has been on a steady downward trend.

Currently, TON is being exchanged at $5.23, showing a 36.3% decline from its All-Time High (ATH) and a 24% decrease over the last fortnight. This continuous slide underscores the volatile nature of the crypto market, even for assets that have a robust history.

Despite these fluctuations in prices, market experts continue to be hopeful about Toncoin’s prospects during this bullish trend. For example, a CryptoQuant analyst named Burak Kesmeci has pointed out a potential substantial rise for TON using the SMA365 Heatmap indicator as evidence.

As per Kesmeci’s analysis, the present price point of $5.14 is considered a “cool zone,” which typically corresponds to local minimums during bull markets in history. This suggests that TON could experience an upward trend once market conditions become more stable.

Price heatmap and Toncoin bullish targets

Kesmeci’s analysis points out three possible price predictions for Toncoin: $8.74, $15.93, and $19.53. These figures are calculated based on the SMA365 Heatmap, a method that employs moving averages to forecast market trends.

In a bull market, these targets might increase even more as prices pick up speed. The analyst predicts that Token (TON) could see a significant jump of approximately 280% during a bull run primarily driven by the altcoin sector.

Although these predictions appear promising, they underscore the necessity of keeping a close eye on market trends.

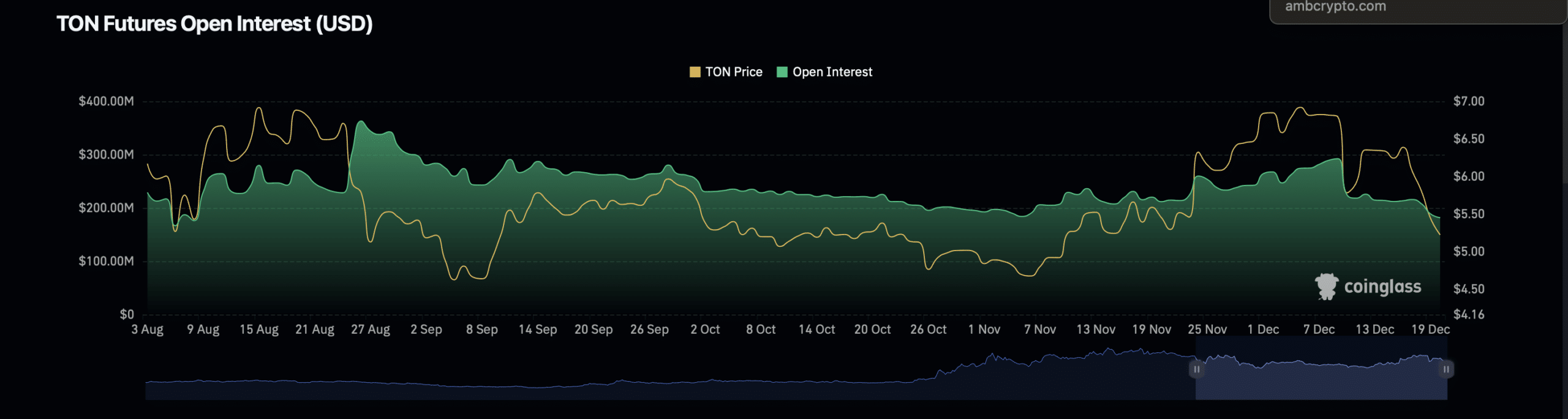

Besides the price chart, other vital indicators provide clues about Toncoin’s short-term direction. The Open Interest (OI) figures from Coinglass reveal a decrease of 1.50%, resulting in a present market capitalization of approximately $182.96 million.

Currently, the trading volume of TON’s Options Instrument (OI) has risen by 11.37% to hit a total of $342.66 million. This moderate growth in derivatives markets could indicate a level of caution among investors, possibly stemming from recent market fluctuations.

Whale activity and market implications

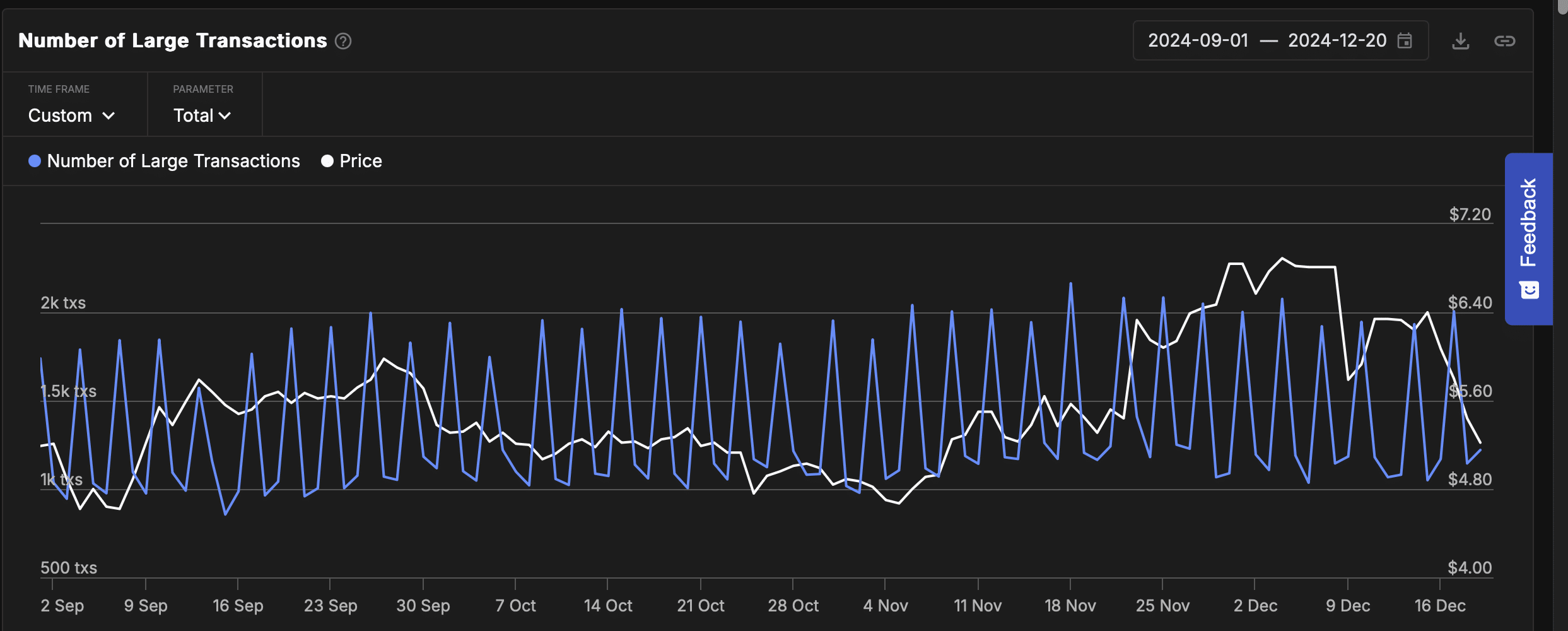

A significant decrease in large-scale investor activity, as indicated by whale transactions, is a notable aspect affecting TON’s price prediction. As per IntoTheBlock data, the number of whale transactions for TON dropped substantially, from over 2,000 on December 17th to around 1,220 by December 19th.

As an analyst, I’ve noticed a drop in the number of transactions from high-net-worth investors, suggesting they might be scaling back their activity, which could mean less buying pressure or perhaps profit-taking at current Toncoin levels. A decrease in ‘whale’ transactions can carry both positive and negative implications for Toncoin’s price movement.

Read Toncoin’s [TON] Price Prediction 2024–2025

One possibility: Whale trading activity can help stabilize markets by limiting abrupt changes due to big trades. However, if whales remain inactive for an extended period, it might signal a lack of faith in immediate market growth.

As a result, the market may experience periods of consolidation before the next significant move.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-12-20 21:43