-

TON experienced a 5% price rise, with a surge in investors and renewed bullish momentum.

A majority of TON holders were in profit, reinforcing the strong bullish sentiment.

As a researcher with a background in cryptocurrency analysis, I’ve been closely monitoring Toncoin [TON] and have observed an intriguing trend over the past few days. The altcoin experienced a 5% price increase, which signaled renewed bullish momentum among investors.

Over the last 24 hours, Toncoin (TON) has experienced a 5% price rise, indicating a resurgence of buying interest and positive market sentiment.

The increasing trajectory of this asset has ignited hope amongst investors, as they anticipate reaching new peaks for the given altcoin.

TON bulls make a comeback

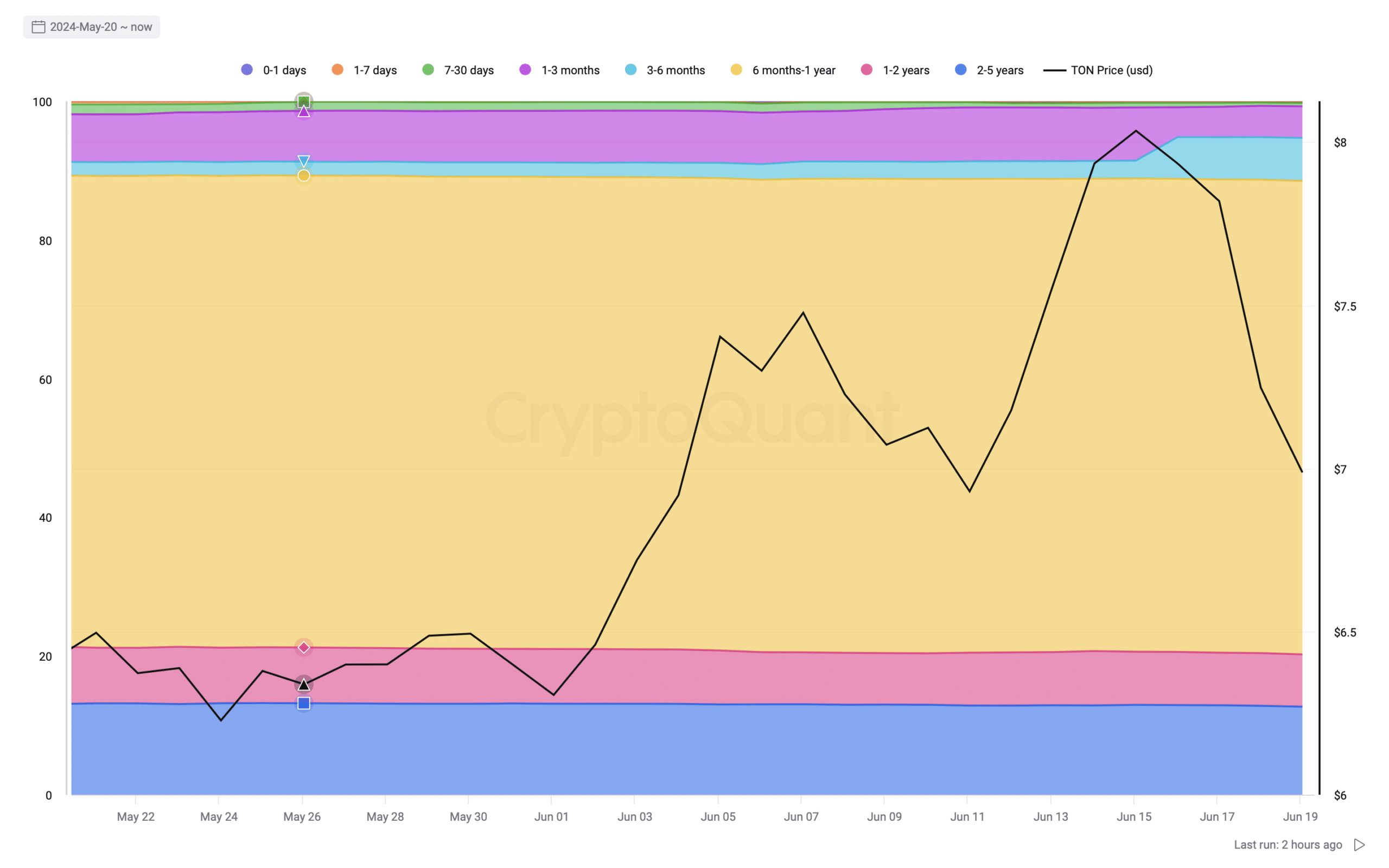

As a researcher studying TON‘s price movements, I observed that the cryptocurrency’s surge led to an influx of new, bullish investors in the market. Consequently, the shorter duration HODL waves (ranging from 0-1 days to 7–30 days) were significantly impacted.

As a researcher studying the distribution of TON token ownership, I’ve observed that a significant portion of these tokens have been held for extended periods. Specifically, approximately 60% of the tokens have been in possession of individuals who have held them for between one and two years, while another 25% have been owned by those who have held them for between two and five years.

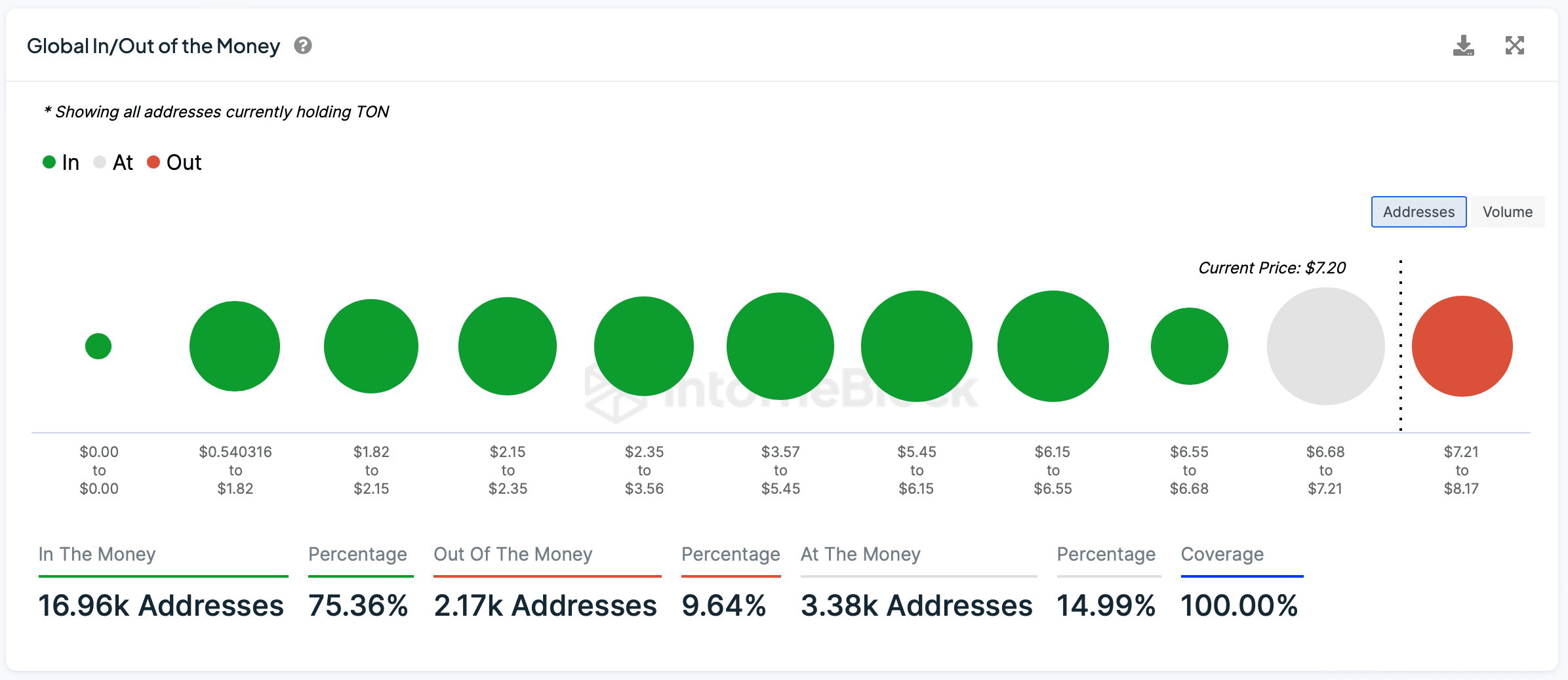

As a market analyst, I would express it this way: At the moment of reporting, the vast majority of investors were sitting on profits since their assets’ values surpassed their initial purchase prices. This significant number of profitable holdings indicated a bullish outlook amongst current investors.

In other words, those holding options at the current market price faced no gain or loss, and their actions to either dispose or retain these assets could significantly influence near-term price fluctuations.

They may look to lock in profits or prevent losses with any major price fluctuations.

TON has low volatility

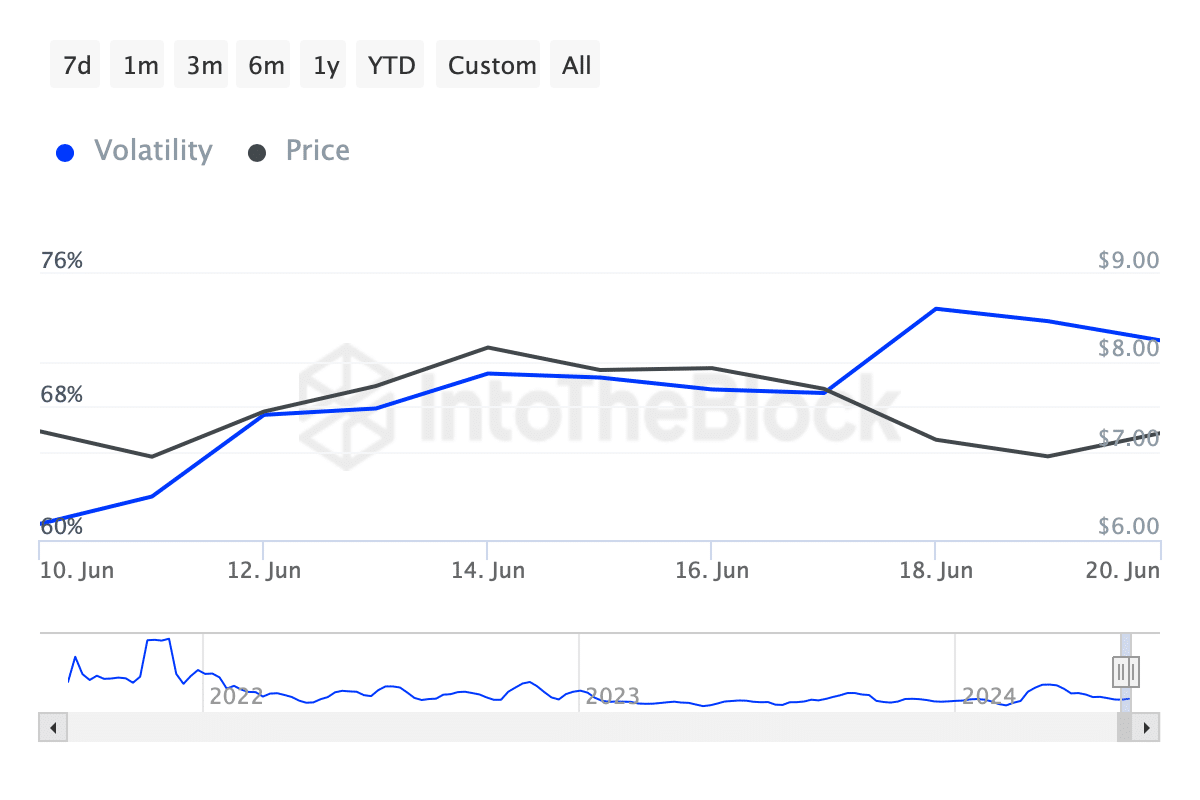

The fluctuation in Toncoin’s value initially remained quite stable, hovering around 60%. However, as the price surged to its maximum point, volatility spiked up to approximately 68%. Later on, once the price settled down, volatility marked a significant decrease.

With decreasing volatility, there might be a pause where the bulls gather strength for a significant price increase. Similarly, TON‘s decreasing NVT (Network Value to Transactions) ratio may signal good network health and heightened usage.

The decrease signifies that the market evaluation is gradually aligning with the actual trading volume, potentially resulting in less volatile price swings.

Is your portfolio green? Check the TON Profit Calculator

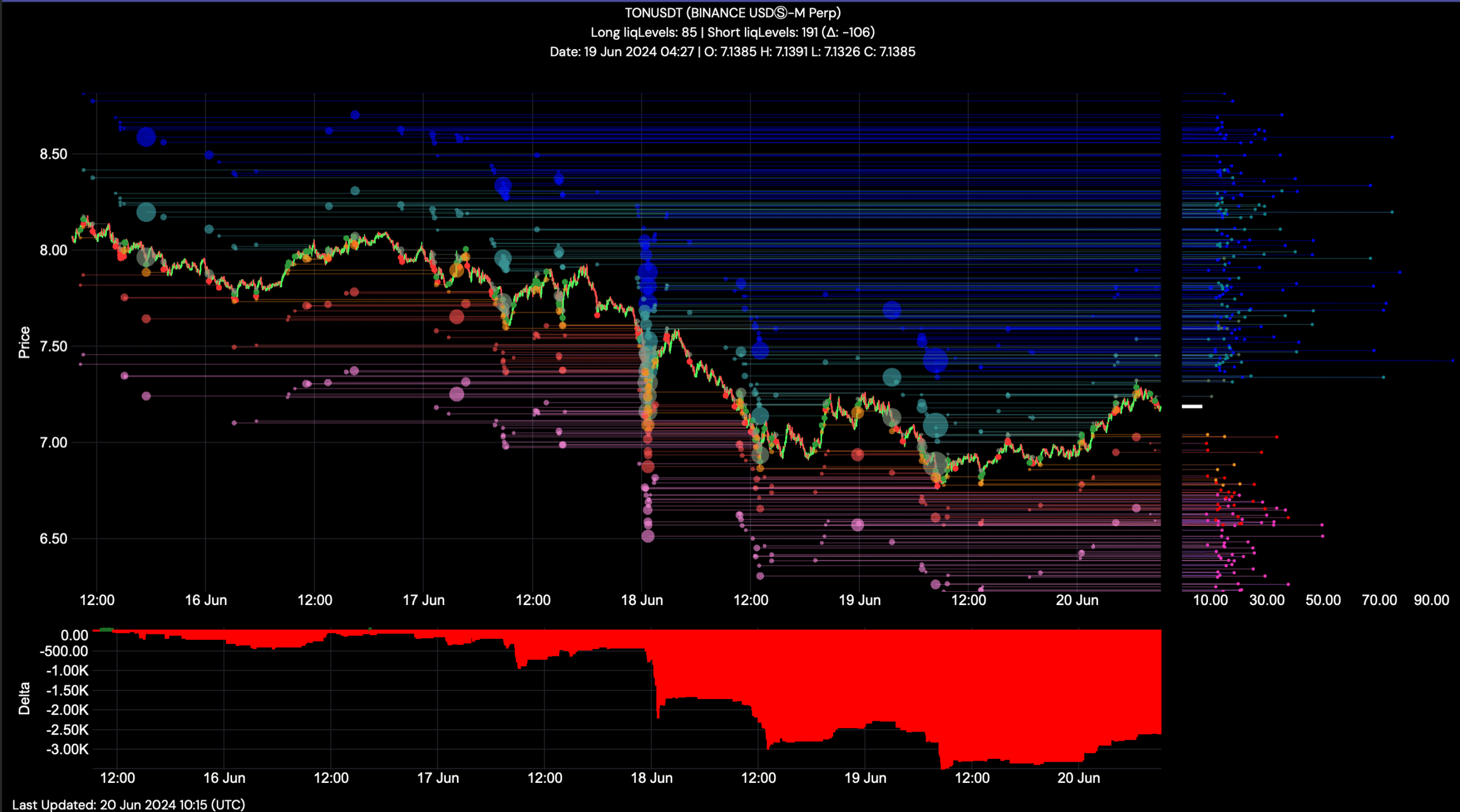

In the last seven days, the value of TON has risen and fallen between $6.50 and $8.50, with a general trend upward. It’s important to note that there is a significant amount of sell orders stacked up above $8, which could potentially serve as a barrier for further price increases.

As a researcher studying market trends, I’ve observed that the net difference between buying and selling pressure has been predominantly negative recently. This implies that sellers have been more active in the market, exerting stronger influence. However, despite this selling pressure, the price has still managed to increase. This suggests that buyers have also been present, albeit in smaller volumes, and their impact was sufficient to initiate a bull run.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-06-20 19:03