-

Bullish structure and changing momentum could guide TON prices higher

Metrics noted heightened profit-taking activity when the price hit $6.8 – A key resistance

As a seasoned researcher with years of experience analyzing cryptocurrencies and their market dynamics, I find myself optimistic about Toncoin [TON]. The bullish structure and changing momentum suggest that TON prices could indeed move higher. However, it’s crucial to keep an eye on Bitcoin [BTC] movements, as they seem to have a +0.75 30-day correlation with TON.

Last weekend, Toncoin [TON] encountered a roadblock at the $6.8 resistance level, but the supportive bulls have shown determination in their efforts. Currently, they are attempting to set a new upward trend, and the available data indicates that they could potentially be successful in doing so.

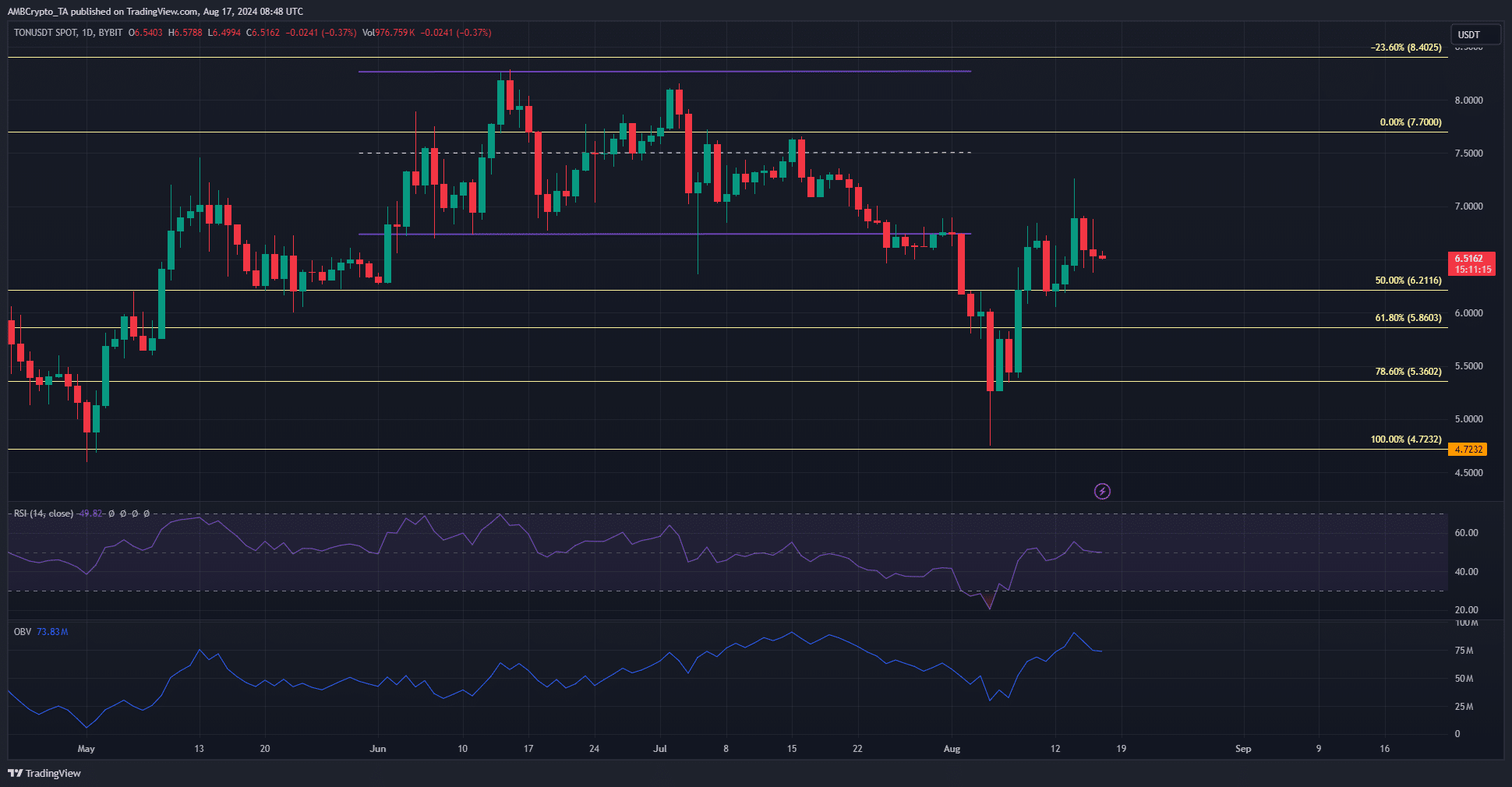

Over the past ten days, the one-day price chart has shown a bullish pattern, even though there was a dip to $4.72 earlier in August. Moreover, the On-Balance Volume (OBV) has noticeably increased, indicating a surge in buying interest and suggesting strong demand.

Additionally, the RSI showed that the momentum was on the verge of shifting bullishly.

Social sentiment could spur further gains for TON

As a crypto investor, I found the break above the $6.8 resistance level on August 14th to be pivotal. This shift in the daily market structure signaled a bullish trend and surpassed the trading range that Toncoin had been confined within from early June until late July.

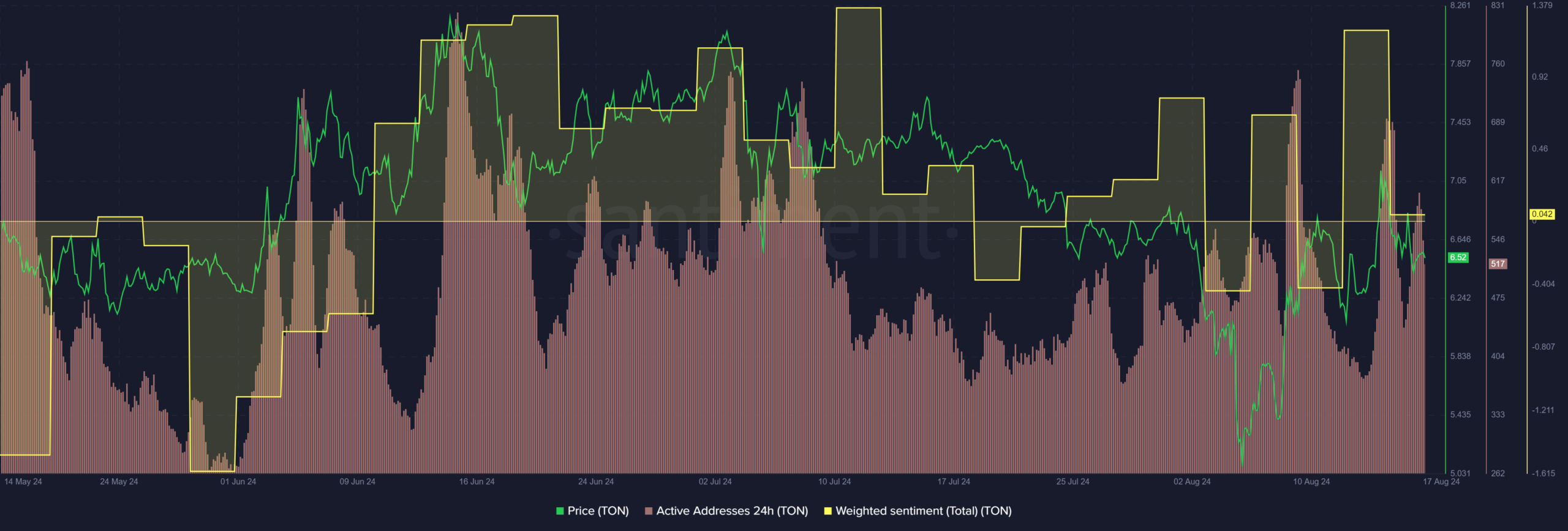

This bullish structure break was accompanied by strongly bullish online engagement.

In addition, it’s worth noting that the daily active address metric has been gradually increasing since mid-July. Combined with another key indicator, these trends suggest a strong possibility for ongoing demand and acceptance.

Does the recent distribution phase mark the beginning of a bearish reversal?

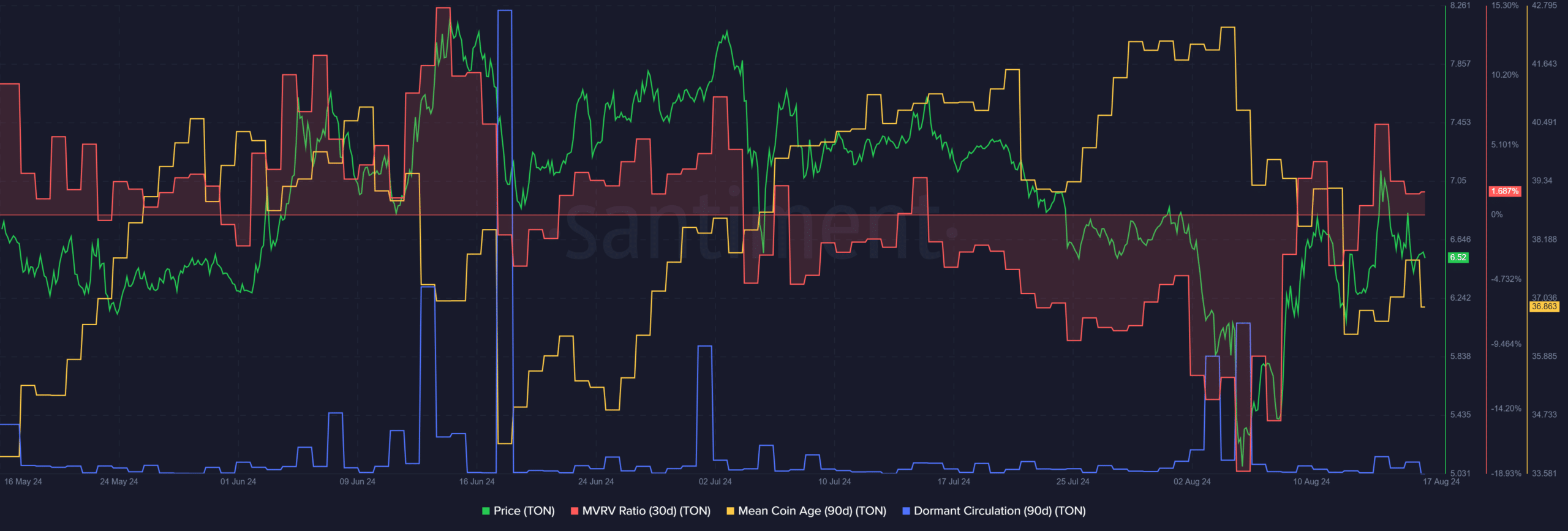

Over the last ten days, Toncoin has been climbing following its $4.27 test on August 4th. Notably, as its value increases, the average age of coins in circulation has decreased. This pattern often suggests that investors are taking profits from their holdings.

In simpler terms, it appears that there’s still potential for more profit-taking actions, as indicated by the 30-day MVRV being positive. On the other hand, the drop in the average age of coins suggests a distribution phase, but the MVRV doesn’t indicate a buying opportunity just yet.

In the past few days, the circulation of TON appears to have remained stable, which could help ease concerns about a potential distribution event.

Is your portfolio green? Check the Toncoin Profit Calculator

Overall, the technical and on-chain metrics suggested the token has more room for bullish growth.

Indeed, recent data from IntoTheBlock reveals a strong 0.75 correlation over the past 30 days between the price fluctuations of TON (TON) and those of Bitcoin [BTC]. As such, TON investors should be mindful of Bitcoin’s volatility or potential short-term trends changes, as these could impact the direction of TON’s price movement.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-08-18 08:07