- Current support level of Toncoin appears to offer a favorable risk/reward profile.

- The price action of TON targets the $10 mark.

As a seasoned analyst with over two decades of market experience under my belt, I find the current support level of Toncoin [TON] quite intriguing. Historically, TON has shown resilience and rarely dips below its one-year moving average, except during bear markets. Given the current bullish phase in the crypto market, this could present a promising entry point for long-term investments.

Lately, the value of Toncoin (TON) has shown a noticeable change in its movement pattern, sparking interest among both investors and financial experts.

The historical trend indicates that the price of TON seldom drops below its moving average over a year, with significant dips usually occurring only during downward market trends (bear markets).

In a generally optimistic crypto market, the one-year average could offer an advantageous entrance opportunity, providing a robust balance between risk and potential gain for long-term investors.

Is there a good chance that the growth in TON’s user base could lead to a significant surge or increase in its value?

Prediction amid growing holder count

Based on the present trend, it appears that TON is looking optimistic for future investment opportunities. Furthermore, the swift increase in the number of Toncoin holders catches the eye when considering its current performance and market dynamics.

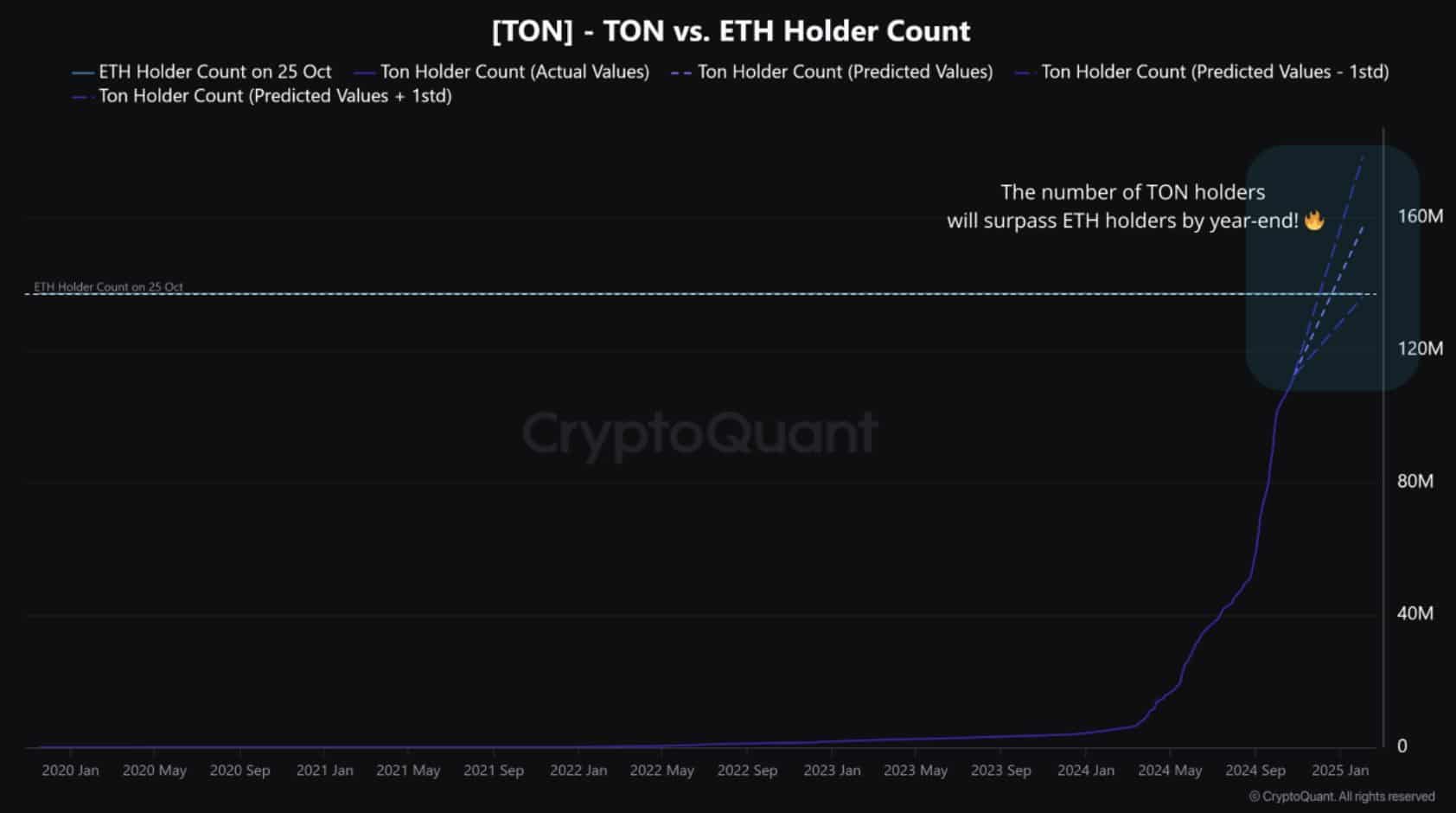

It seems that data suggests TON could potentially overtake Ethereum in terms of the number of users holding it. At present, Ethereum boasts around 137 million holders, while TON has grown to 112 million. Over the last month, approximately half a million new TON holders have been added daily.

If the current growth trend continues, TON might overtake ETH holders by the end of December. But if the growth slows down, achieving this milestone could be delayed until early 2025.

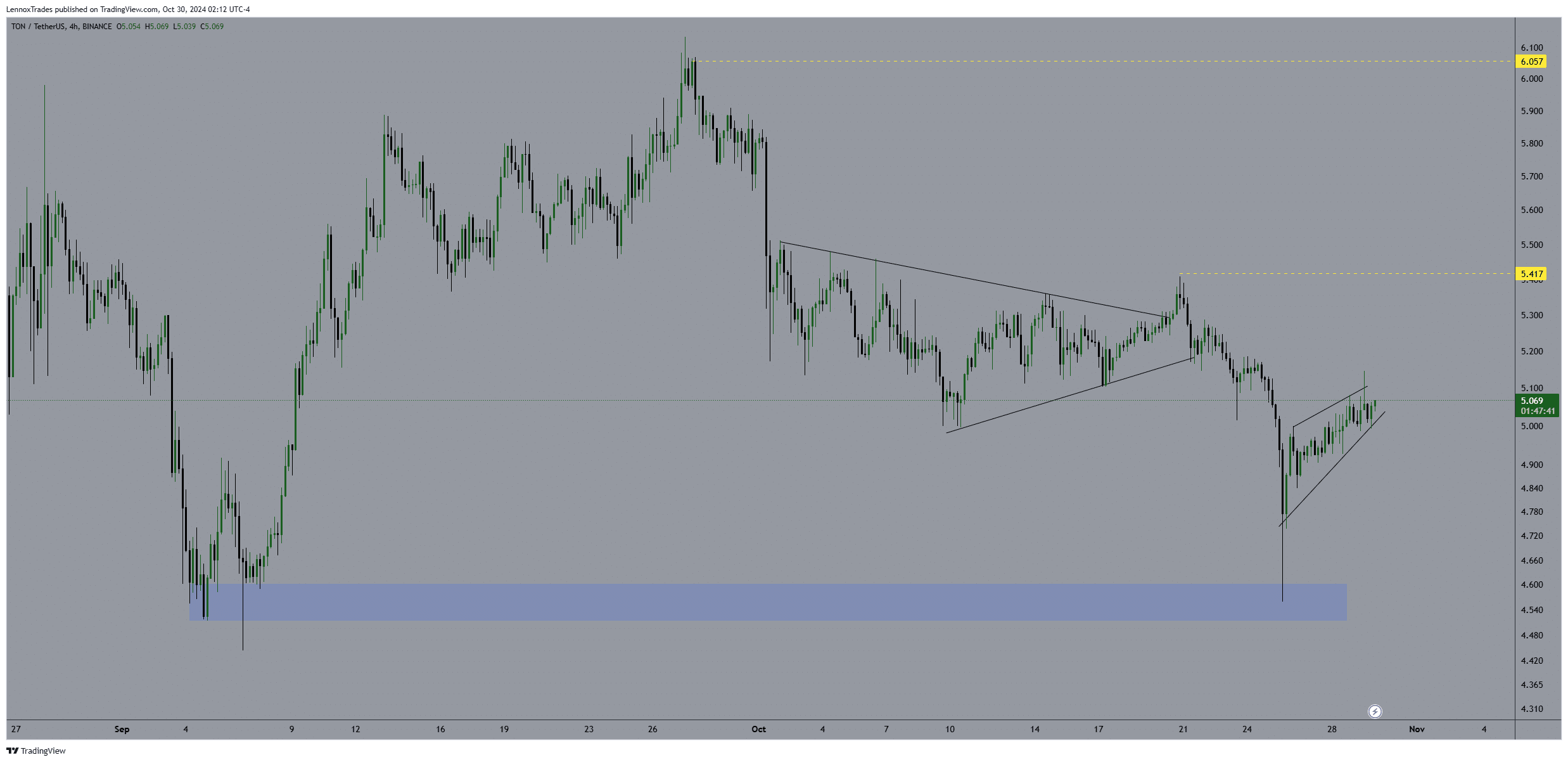

Regarding its price fluctuations, Tron’s (TON) latest trend shows some inconsistency. Analyzing the TON/USDT 4-hour chart, it appears that following a breakout from a descending triangle formation, there has been a noticeable decline in its price.

The pattern set a significant floor near $4.50, acting as a crucial foundation. After experiencing a drop, TON subsequently bounced back and created an ascending triangle, typically interpreted as a bearish configuration, implying potential for price decrease.

Key resistance for TON lies around $5.41, a point it has struggled to sustain. If TON breaks above this level, it could target the next significant resistance at $6.05.

If TON doesn’t manage to surge ahead, there’s a possibility it might fall back to the $4.50 support point. Currently, TON is being traded at around $5.15, and indications show a potential increase towards $5.71. Should TON surpass the $5.71 mark, it could potentially push for a significant move up to $10.

TON fees and supply

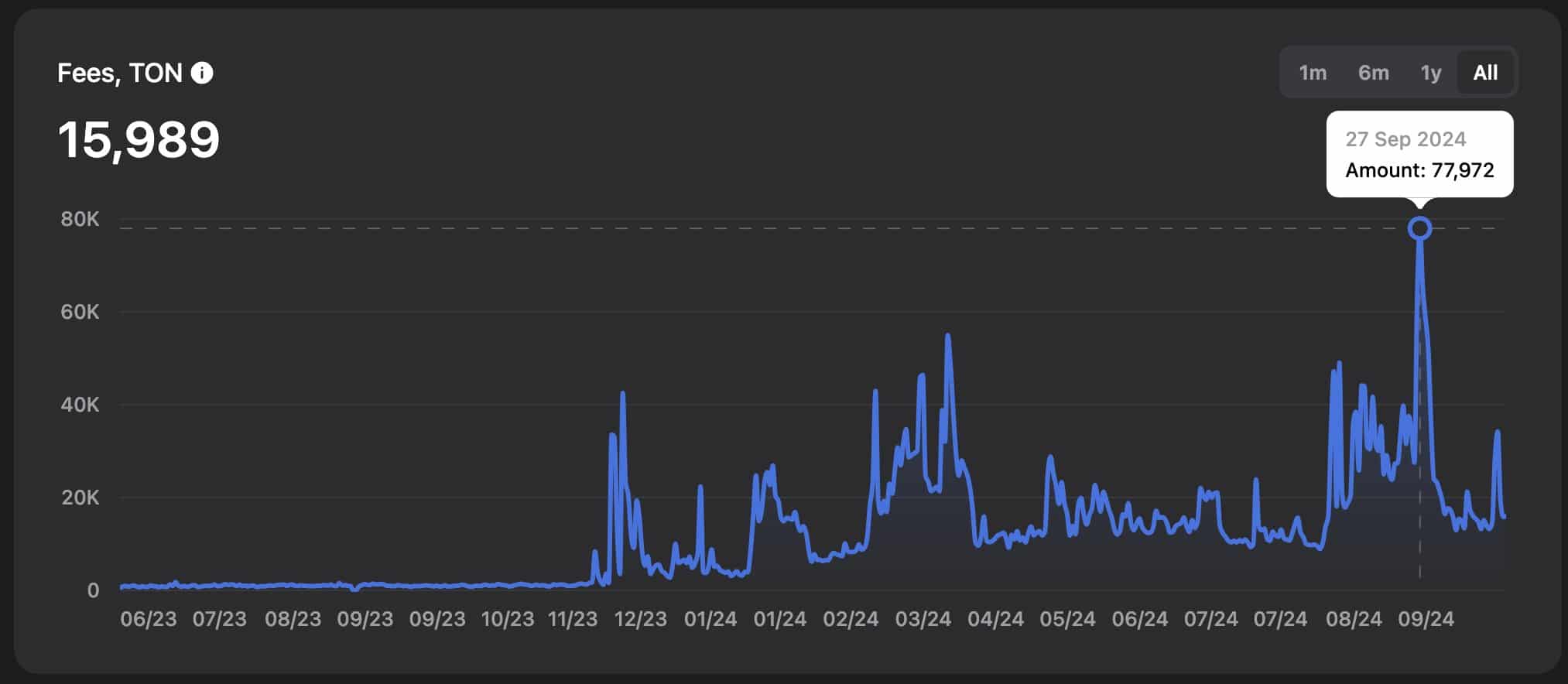

On September 27th, Toncoin’s blockchain history saw a significant milestone as users collectively paid the highest transaction fees of 77,972 TON, which amounted to approximately $451,457 when each TON was valued at $5.79.

This trend indicates a growing interest in Toncoin’s blockchain offerings, suggesting that it may have significant long-term expansion possibilities.

At present, the total number of TON tokens in circulation is 5.11 billion, while Solana has only 587.38 million. If TON’s fully diluted valuation (FDV) ever equals Solana’s, its price might rise to approximately $20.47.

The increasing number of users for Toncoin, combined with positive sentiment among supporters, could present an attractive investment prospect.

If the positive momentum continues as expected, it’s crucial that there’s consistent demand and a move beyond resistance points for a substantial rise in value.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-10-30 19:04