-

TON might rally to $8 if the price breaks out from the resistance level at $7.5

Metrics seemed to indicate a potential breakout

As a seasoned crypto investor with a keen eye for market trends and patterns, I believe that Toncoin (TON) is gearing up for a significant rally. Based on my analysis of the latest metrics, I see a potential breakout from the resistance level at $7.5, which could propel TON to reach $8 or even beyond.

At present, Toncoin is priced at around $7.35 according to market data. This represents a nearly 4% decrease in value over the past 24 hours. Additionally, Toncoin’s market capitalization was reported as approximately $17.8 billion. The recent price drop for Toncoin appears to be linked with fluctuations in trading volume as well.

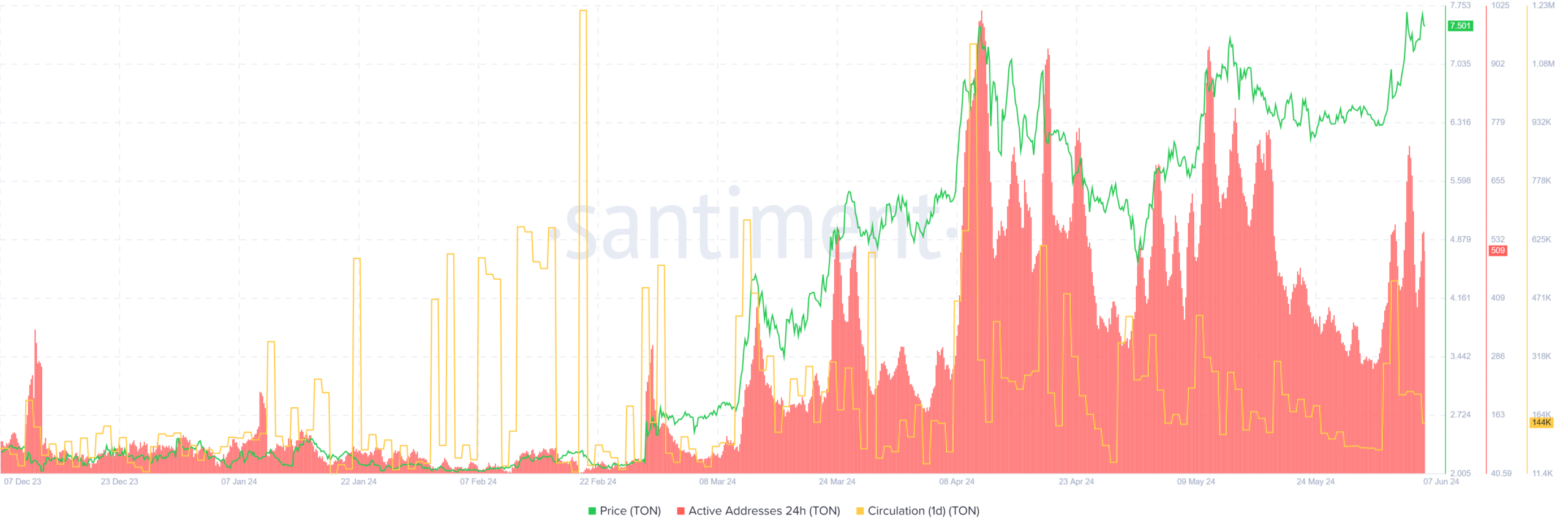

As a crypto investor, I closely monitor network activity and supply data to identify potential trends. Based on Santiment’s insights, Toncoin experienced a substantial increase in active addresses and circulating supply. This uptick could be an indication of an upcoming price surge since heightened network activity and increased liquidity often precede a bullish market movement.

The number of active addresses on Toncoin’s platform grew significantly, rising from approximately 50,000 in early May to over 75,000 at the current moment – a noteworthy 50% surge in new users engaging with Toncoin’s ecosystem. Meanwhile, the circulating token supply expanded gradually, increasing from approximately 1.9 billion tokens in late April to almost 2.3 billion as of now.

As the active addresses and circulating supply of TON continue to rise, there’s a high probability that the cryptocurrency will experience a significant surge once it manages to breach the $8 resistance mark. Historically, this barrier has thwarted several prior attempts at upward momentum.

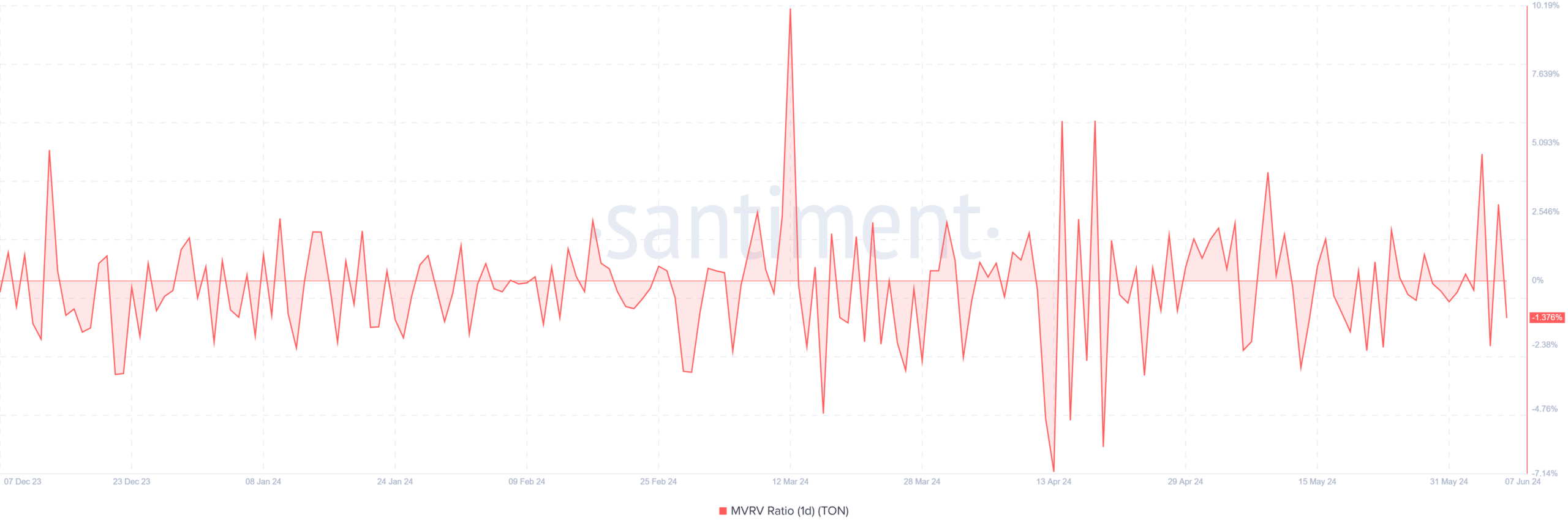

Market Value to Realized Value Ratio’s findings

As a researcher studying the cryptocurrency market, I delved deeper into Santiment’s MVRV (Maker’s Realized Value) data. Similar to my previous findings, this indicator showed notable spikes in late March and May. These spikes indicate that investors have been successfully realizing substantial unrealized gains and deciding to cash out. Currently, the MRVR is undervalued at around 3. If the buying pressure continues to mount on the charts, there’s a strong possibility of renewed bullish momentum.

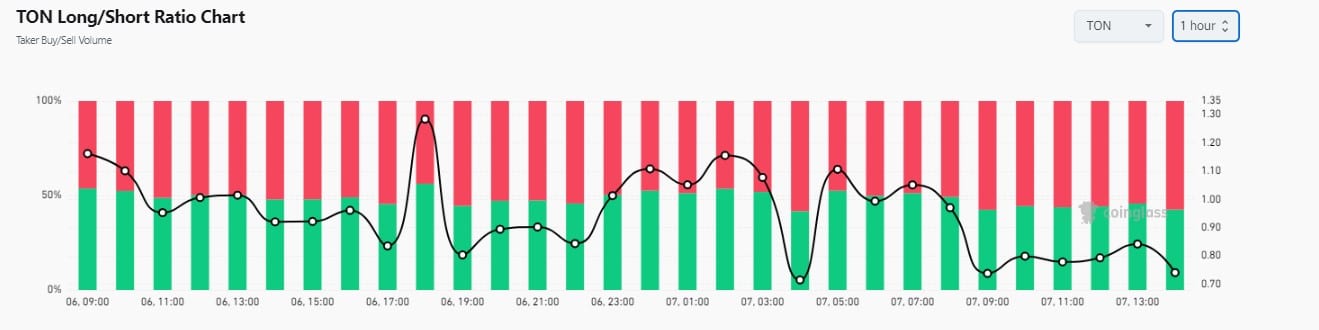

Tug of war between bulls and bears

The Coinglass long/short ratio shows that there have been frequent shifts between buying and selling over the past month. In some instances, the demand for long positions outpaced short positions significantly, causing the ratio to exceed 1.0. These periods of heightened long position activity momentarily overwhelmed the short positions.

What next for TON?

As a crypto investor closely monitoring the market trends, I believe that the increasing activity levels, coupled with the moderately priced MVRV (Maker-Taker Value Ratio), suggest a potential shift in favor of the bulls. The ongoing struggle between long and short positions adds to this optimistic outlook. Consequently, TON‘s price may soon break through the $8 barrier.

As a crypto investor, I can share that if the bearish sentiment gains traction, the price could potentially hover around the $7 to $8 range.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

2024-06-08 11:03