- Toncoin’s risk exposure ratio has been rising, signaling market confidence

- Market indicators suggested TON could see a trend reversal and make gains

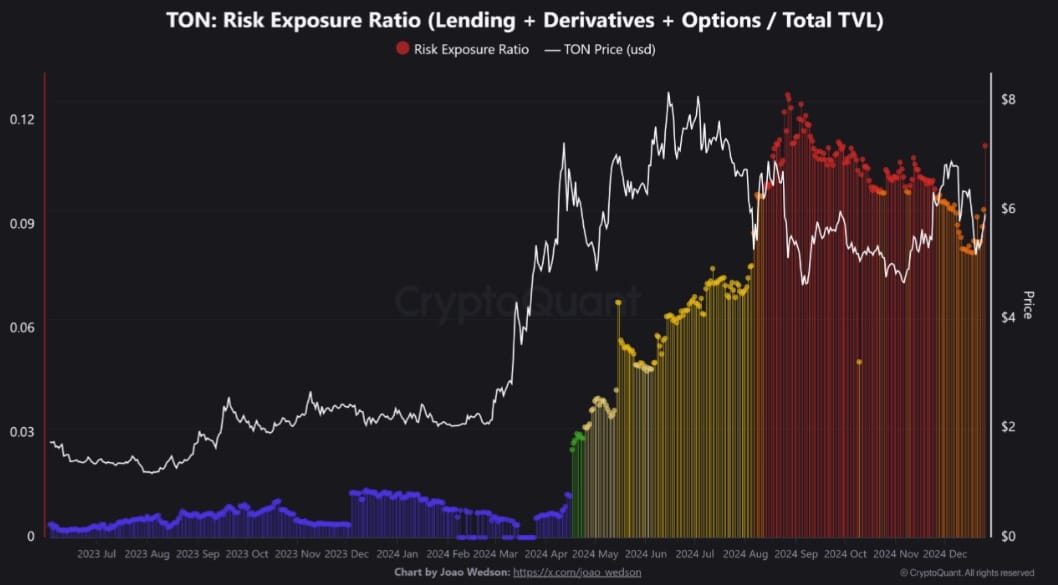

As a seasoned researcher with years of experience navigating the volatile world of cryptocurrencies, I find myself intrigued by the recent developments surrounding Toncoin (TON). The rise in TON’s risk exposure ratio, as highlighted by Cryptoquant analyst Joao Wedson, is a fascinating observation. While it may cause some to shy away due to concerns about market volatility, I see it as a sign of growing market confidence and bullish sentiment.

Over the past week, Toncoin [TON] experienced a modest rebound on its price graphs. During this span, the cryptocurrency climbed from a nearby minimum of $4.7 to a maximum of $6.09. Nevertheless, over the last three days, there has been a slight pullback in its value. At the moment of writing, Toncoin is being traded at $5.66 – representing a decrease of 0.98% over the previous 24 hours.

This, after the altcoin depreciated by 10.81% on the monthly charts.

As a researcher, I’ve observed an intriguing trend in the market that seems to have caught the attention of various analysts, including Cryptoquant’s Joao Wedson. His recent analysis reveals a surge in TON’s risk exposure ratio, a signal that could suggest an upswing in its potential bullishness.

Toncoin’s risk exposure ratio rises

According to Wedson’s assessment, the risk exposure ratio for Toncoin indicates a moderate level of risk present within the Toncoin network at this time.

Based on his explanation, it appears that the increase we’re seeing can be attributed to the fact that a large chunk of TON’s Total Value Locked (TVL) is invested in sectors like lending, derivative trading, and options. These areas carry high risk when it comes to market liquidity.

Given the recent surge in Toncoin’s price, there has been a persistent increase in the risk exposure ratio. This trend suggests that more money is flowing into financial instruments like loans and derivatives on a leveraged basis, indicating increased investment in Toncoin.

While the hike could potentially raise some stability questions, it could also symbolize market assurance. The increasing interest in derivatives and leveraging indicates a surge in market optimism, which is a clear indication of investor confidence in the market’s trajectory and their positive outlook on its trend.

On the flip side, heavily leveraged networks can amplify losses when market conditions are downward. Consequently, this characteristic might appeal to speculative traders who see increasing demand as an opportunity to profit from derivative markets.

What does it mean for TON’s price?

As a crypto investor, I’ve noticed an increase in the risk exposure ratio, which might indicate that I should exercise caution due to its correlation with heightened market volatility. However, this rise could equally imply growing confidence and optimism among investors, hinting at a potential bull run.

We can see this bullish sentiment and market confidence through the sustained decline of supply on exchanges.

This has dropped from 1.9 million to 1.82 million over the past week – A sign of increased accumulation as investors transfer TON tokens into private wallets for self-custody.

In the past three days, it appears that whales have become optimistic as their net flow of TON tokens has turned positive to 122.33 million tokens. This means that whales are buying more tokens rather than selling them, suggesting an accumulation trend among these large holders.

A hike in capital inflows from whales shows market confidence.

In summary, Toncoin’s DAA price disparity has persisted positively during the last seven days. This suggests that the recent price increases are backed by an increase in active addresses, indicating a robust and healthy market with solid foundations.

To summarize, it appears that the rise in risk exposure ratio is enticing more speculative investors to join the market. If this pattern persists along with increased investment, Toncoin (TON) may see further growth and potentially revisit its previous high of $6.2. Conversely, if cautious investors choose to exit the market due to anticipated volatility, TON could experience a drop to around $5.4.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-12-28 16:07