-

Toncoin’s address activity revealed that holders are moving in favor of long-term HODLing

TON potentially on the verge of another major rally, but price yet to feel the effects of the shift

As a seasoned researcher with years of experience in analyzing blockchain data, I must say that the recent trends observed in Toncoin’s address activity have piqued my interest. The shift from short-term swing trading to long-term HODLing is a significant development, one that could potentially set the stage for a bullish phase.

Could it be that Toncoin investors are gearing up for dominance? Recent analysis of blockchain data hints at this possibility, mainly due to the observed transition from quick, short-term trades to a more strategic long-term holding pattern.

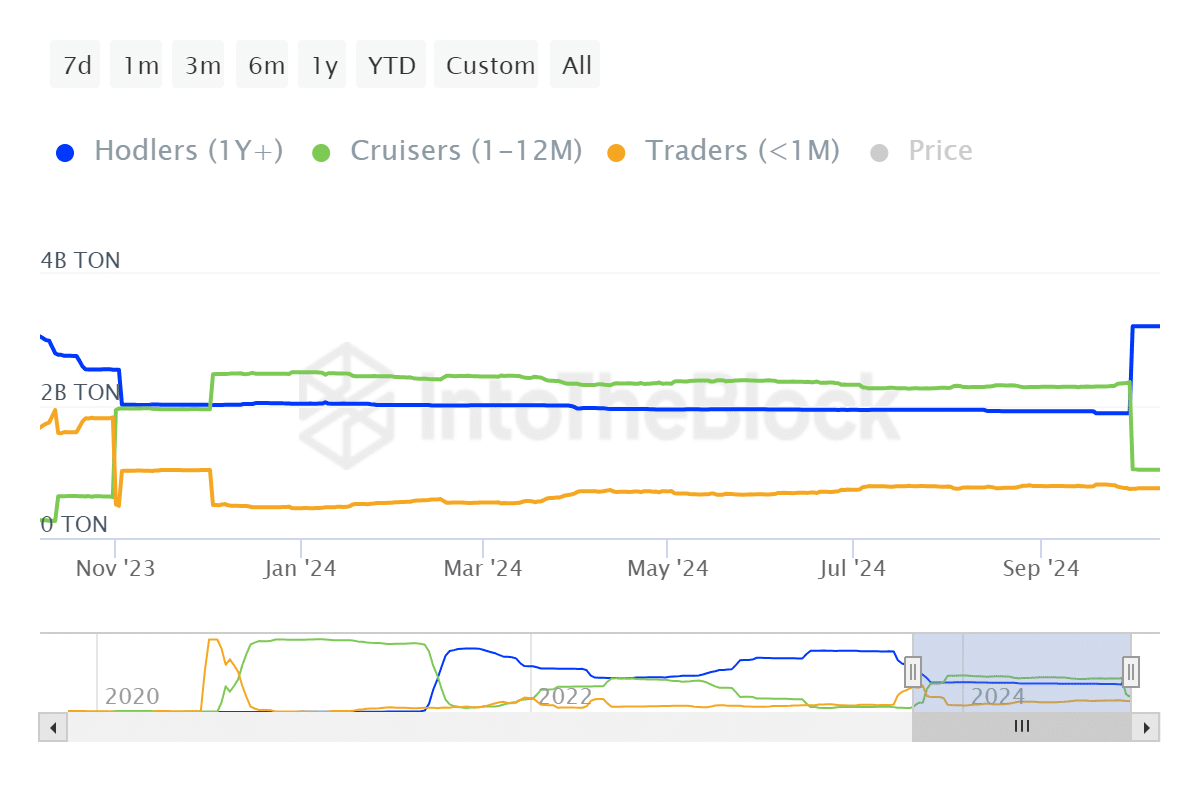

The graph shows an increase in Toncoin holdings by HODLers. At the end of September, Toncoin balances jumped noticeably from approximately 1.89 billion TON to 3.21 billion TON, as per the most recent data – An increase of around 1.32 billion coins, which is worth about $6.8 billion at the current exchange rate.

During the given timeframe, the total balances held by swing traders (cruisers) decreased from approximately 2.36 billion TON to about 1.03 billion TON. This reduction translates to around 1.33 billion coins, which is roughly equivalent to $6.94 billion. So, what does this imply for Toncoin?

Money leaving cruiser wallets was slightly more than money leaving HODLer accounts, potentially causing increased selling activity since October. Yet, this fact also highlights a significant observation – HODLers currently possess over three times the amount of funds that swing traders do.

It seems that there might be a change towards considering long-term perspectives more. Since swing traders hold less funds, their influence over short-term market fluctuations could be reduced.

Toncoin’s address activity points towards growing accumulation

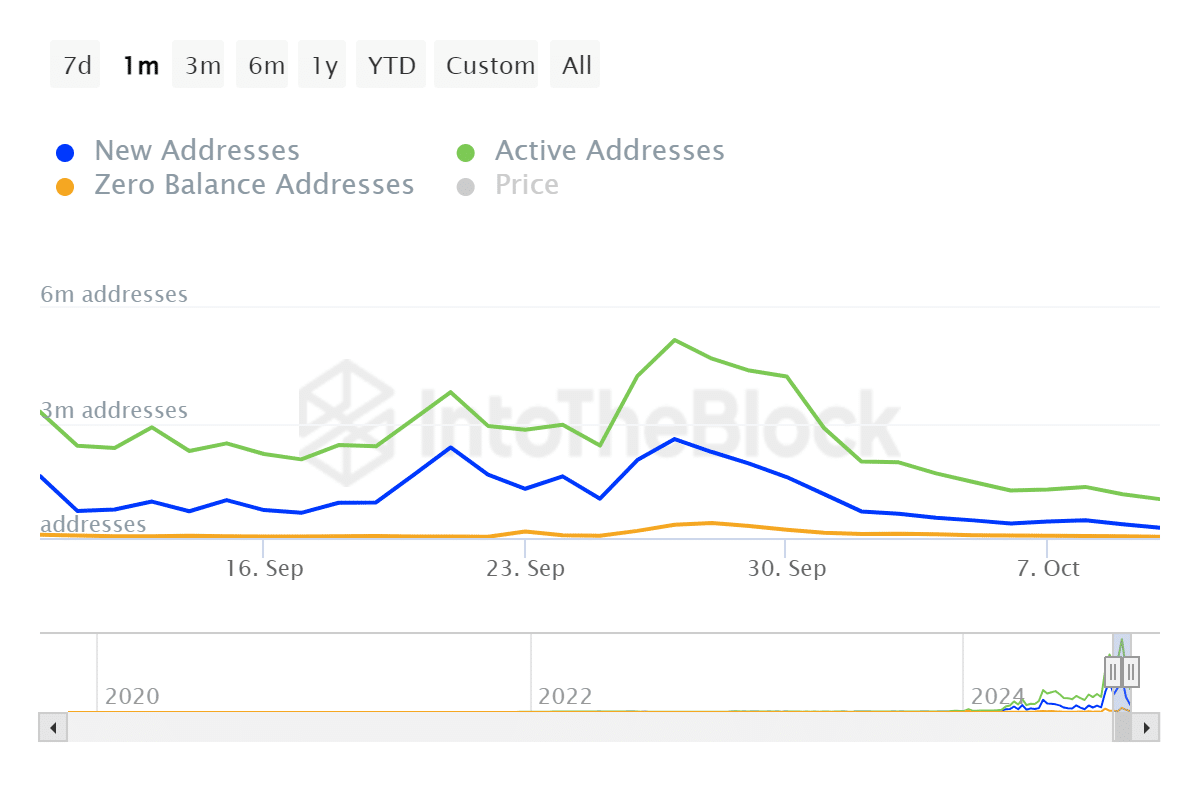

Daily active addresses also aligned with the shift towards a long-term preference. For example, the number of active addresses declined from 5.16 million addresses on 27 September to 1.01 million active addresses.

Speaking as a crypto investor, I’ve noticed an intriguing trend. On September 28th, there were approximately 392,000 zero balance addresses in the crypto realm. However, within two weeks, by October 10th, that number had significantly dropped to around 35,000. This suggests a possible shift or activity in these addresses.

The decrease in zero-balance addresses indicates that accumulation is becoming more popular. Ultimately, the number of new addresses dropped from 2.58 million at the end of September to just 265,000 on October 10, suggesting a lack of new demand that could boost Toncoin.

Nevertheless, it’s worth reporting that TON recently announced that it now has over 100 million holders.

Currently, while these recent results seem optimistic, it’s important to note that TON‘s actual market behavior has been bearish over the past fortnight. In fact, it dropped by about 15% from its peak in September. Interestingly, despite this dip, TON’s current price is still 16% higher than its lowest point in September.

As a crypto investor, I’ve been keeping a close eye on Toncoin, and my analysis indicates it might be gearing up for a significant comeback based on recent on-chain insights. However, the price movement seems to indicate that it hasn’t yet accumulated sufficient volumes to spark its next substantial bullish surge.

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Masters Toronto 2025: Everything You Need to Know

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

2024-10-12 13:11