As a seasoned cryptocurrency trader with years of experience navigating the complex and ever-evolving world of blockchain technology, I’ve seen my fair share of decentralized exchanges (DEXs) come and go. However, the rise of Optimism DEXs and aggregators has truly piqued my interest.

By 2024, it appears that the increasing prominence of the Optimism network, a scalable solution on Ethereum recognized for its affordability and swift transaction speeds, is causing a significant shift in focus among traders towards decentralized exchanges (DEXs) and DEX aggregators built upon this platform. As an analyst, I am closely monitoring these developments.

In this piece, we delve into the leading Optimism-based Decentralized Exchanges (DEXs) and DEX aggregators that could be beneficial in 2024.

Let’s dive in!

Top 5 Optimism Decentralized Exchanges to Use in 2024 and Beyond

Uniswap V3 (Optimism)

- 24h Trading Volume (as of August 20, 2024): $20,497,688

- Pairs Accepted: 183+

- KYC/No-KYC: No-KYC

Uniswap stands out as one of the pioneering platforms for decentralized trading (DEX), making its debut in November 2018 and quickly becoming highly recognized within the Decentralized Finance (DeFi) community. It’s arguably the most widely used DEX available today.

In a simplified version, Uniswap, initially operating on Ethereum (later expanded to Optimism), was one of the pioneering applications to implement the Automated Market Maker (AMM) concept. Instead of relying on traditional order books, AMM uses liquidity pools and smart algorithms that determine market prices based on token supply and demand. This change enabled anyone to engage by adding tokens to these liquidity pools, receive incentives, and help in decentralized peer-to-peer trading activities.

Additionally, as it maintains its prosperity and adherence to decentralization principles, Uniswap introduced the UNI token, empowering the community with the ability to vote on crucial protocol matters.

Given these factors and more, we firmly believe that Uniswap stands out as the premier Decentralized Exchange (DEX) for the Optimism network. As such, it emerges as an outstanding selection for Ethereum layer 2 scaling solutions.

Pros of Uniswap

- Lower fees;

- Faster transactions;

- Increased scalability.

Cons of Uniswap

- Bridging asset costs;

- Potential liquidity fragmentation;

- Inherent security risks.

Velodrome Finance V2 (Optimism)

- 24h Trading Volume (as of August 20, 2024): $2,036,672

- Pairs Accepted: 183+

- KYC/No-KYC: No-KYC

A Velodrome is a decentralized exchange (DEX) established on the Optimism network, providing smooth and profitable trading opportunities. It’s recognized for its unique vote-escrow system, enabling users to secure their VELO tokens for different durations to acquire governance authority and partake in the distribution of rewards from the protocol.

In simpler terms, Velodrome functions based on an Automated Market Maker (AMM) system, offering pools for different digital currencies that users can trade. Additionally, users can contribute liquidity to earn fees and incentives, or they can take part in decision-making by locking their VELO tokens.

Pros of Aerodrome V2

- Fast transactions;

- Low fees;

- Innovative features.

Cons of Aerodrome V2

- Lower liquidity;

- New to market.

Clipper (Optimism)

- 24h Trading Volume (as of August 20, 2024): $125,839

- Pairs Accepted: 21+

- KYC/No-KYC: No-KYC

Clipper serves as a specialized decentralized trading platform, primarily catering to traders who frequently perform transactions under $50,000. What sets it apart is its commitment to enhancing fees and minimizing slippage for these smaller trades – an area that often goes unaddressed by other decentralized exchanges.

As an analyst, I’d rephrase it like this: Unlike many decentralized exchanges that cater to high-volume traders, Clipper is designed with retail traders in mind. It utilizes a unique Formula Market Maker (FMM) system, distinguishing itself from the commonly used Constant Product Market Maker (CPMM). The FMM mechanism provides more accurate pricing for smaller trades, offering a more refined trading experience for individual investors like myself.

Clipper’s liquidity pools consist of two main types: Core Reservoirs and Coves. Core Reservoirs are mixed-asset pools where providers receive a proportionate share of the overall earnings from the pool. On the other hand, Coves are smaller, more focused pools that have been tailored to maximize returns for specific trading pair combinations.

Pros of Clipper (Optimism)

- Low fees for small trades;

- Optimized pricing for small trades.

Cons of Clipper (Optimism)

- Limited liquidity compared to larger DEXes;

- Primarily focused on small trades.

Kromatika Finance

- 24h Trading Volume (as of August 20, 2024): $25,532

- Pairs Available: 70+

- KYC/No-KYC: No-KYC

Chromatika might not be a widely recognized Optimism DEX, but many view it as a groundbreaking decentralized exchange that streamlines trading by automating intricate procedures and introducing cutting-edge features.

As a researcher delving into the dynamic world of decentralized finance, I’m particularly excited about Kromatika – a platform that leverages Uniswap V3’s robust infrastructure. What sets Kromatika apart is its innovative automated limit orders, seamless gasless swaps, and the unique opportunity it provides for perpetual trading, offering up to 100x leverage.

Using automated limit orders allows traders to pre-set and control their transactions automatically, thereby enhancing their trading process by eliminating the need for hands-on management.

Through Biconomy’s technology, users can perform swap transactions without incurring gas fees, resulting in lower costs. Moreover, this platform facilitates perpetual trading with significant leverage, empowering traders to amplify their possible gains.

Pros of Kromatika Finance

- Automated limit orders;

- Gasless swaps reduce transaction costs;

- Offers high leverage for advanced traders.

Cons of Kromatika Finance

- May have limited liquidity for certain pairs as this DEX is relatively new;

- Some features might be challenging for beginners.

Rubicon (Optimism)

- 24h Trading Volume (as of August 20, 2024): $0

- Pairs Available: 1

- KYC/No-KYC: No-KYC

The Rubicon platform is a Decentralized Exchange, which operates seamlessly over both the Ethereum and Optimism blockchain networks.

It focuses on offering deep liquidity for traders and aims to make trading easy and efficient by providing access to a wide selection of trading pairs with strong liquidity.

Rubicon aims primarily at minimizing discrepancies, making sure transactions occur seamlessly at favorable costs. By drawing liquidity from various resources, it strives to establish a dependable and consistent trading environment for its users.

As a researcher, I’ve been exploring various Decentralized Exchanges (DEXs) built on the Optimism network, and although Rubicon might not appear active at first glance, upon closer analysis and comparison with other DEXs in this ecosystem, it seems promising enough to warrant deeper investigation.

Pros of Rubicon (Optimism)

- Deep liquidity pools;

- Efficient trading experience.

Cons of Rubicon (Optimism)

- Might have higher fees compared to some other DEXes;

- Not considered popular in the industry.

Top 5 Optimism DEX Aggregators to Use in 2024 and Beyond

1inch Network

1inch Network stands out as the premier Decentralized Exchange (DEX) consolidator, offering its services not only on the mainstream network but also on Optimism. It is recognized for delivering a sophisticated trading platform that guarantees users receive the most favorable pricing from numerous DEXs.

1inch streamlines trade executions by pooling resources from multiple liquidity providers, thereby reducing price discrepancies during transactions (price slippage) and promoting efficient trading, making it an attractive choice for traders aiming to maximize the effectiveness of their trades.

1inch provides an array of sophisticated trading options that extend beyond simple exchanges, including limit orders, stop-loss orders, and intricate multi-step token swaps. This versatility makes it a great fit for both novice and seasoned traders.

Beyond this, the platform 1inch also features a governance token known as 1INCH. Owners of these tokens can actively contribute to crucial protocol decisions, promoting active participation within the community and reinforcing a decentralized management structure.

Pros of 1inch

- Strong community focus;

- Yield farming opportunities;

- Wide range of trading pairs.

Cons of 1inch

- Governance complexity can be overwhelming for some users;

- Yield farming incentives can fluctuate.

Paraswap.io

Paraswap serves as a prominent DeFi aggregator, delivering seamless, affordable, and secure trading to its users within the Optimism network.

As a personal trading assistant, ParaSwap helps users secure the most advantageous rates by sourcing liquidity from a wide variety of decentralized exchange platforms, including those based on Optimism and beyond.

As a savvy crypto investor, I appreciate the smart workings of ParaSwap’s sophisticated routing system. This system examines numerous possible trading paths, considering aspects such as cost, transaction speed, and gas charges, to guarantee that my swap transactions yield the most favorable results.

Pros of ParaSwap

- Aggregates liquidity from multiple DEXes;

- Offers potentially better rates compared to single Optimism DEXs;

- User-friendly interface.

Cons of ParaSwap

- Might have higher gas fees due to complex routing;

- Reliance on underlying DEXs for liquidity.

OpenOcean

OpenOcean serves as a complete entry point into the world of Decentralized Finance (DeFi). Being a leading Web3 intermediary, OpenOcean provides an entire toolkit for both traders and developers, simplifying and streamlining DeFi for users of all skill levels.

The heart of OpenOcean lies in its advanced Best Rate Swap feature, which gathers liquidity from more than 285 providers on 23 different networks. This ensures that users can consistently obtain the most favorable prices when exchanging their tokens.

Beyond catering just to traders, OpenOcean also equips developers with potent development tools. The platform presents APIs and Software Development Kits (SDKs), enabling developers to incorporate OpenOcean’s sophisticated features into their projects, thereby improving their Decentralized Finance (DeFi) solutions by leveraging top-tier trading infrastructure.

Pros of OpenOcean

- Aggregates liquidity from over 285 sources across 23 networks;

- Offers a seamless trading experience with the Best Rate Swap function;

- Provides a wide array of developer tools, including APIs and SDKs.

Cons of OpenOcean

- Can be overwhelming for new users due to its advanced features;

- Relies on underlying DEXes for liquidity, which may affect performance.

Rubic

Rubic is also a captivating, decentralized platform that links users to the most advantageous rates from various cryptocurrency networks (boasting about it).

Through combining liquidity resources from more than 220 Decentralized Exchanges (DEX) and bridges, Rubic guarantees that you receive the best exchange rates for your token trades.

With access to over 15,500 trading pairs, Rubic offers unparalleled flexibility and choice.

Using Rubic’s intuitive layout, navigating and conducting trades becomes effortless. Just input the tokens desired for exchange, and Rubic swiftly offers the most favorable price and handles the trade execution immediately.

Pros of Rubic

- Aggregates liquidity from multiple DEXs;

- Offers a wide range of trading pairs;

- Prioritizes security.

Cons of Rubic

- Might have higher gas fees due to complex routing;

- Reliance on underlying DEXes for liquidity.

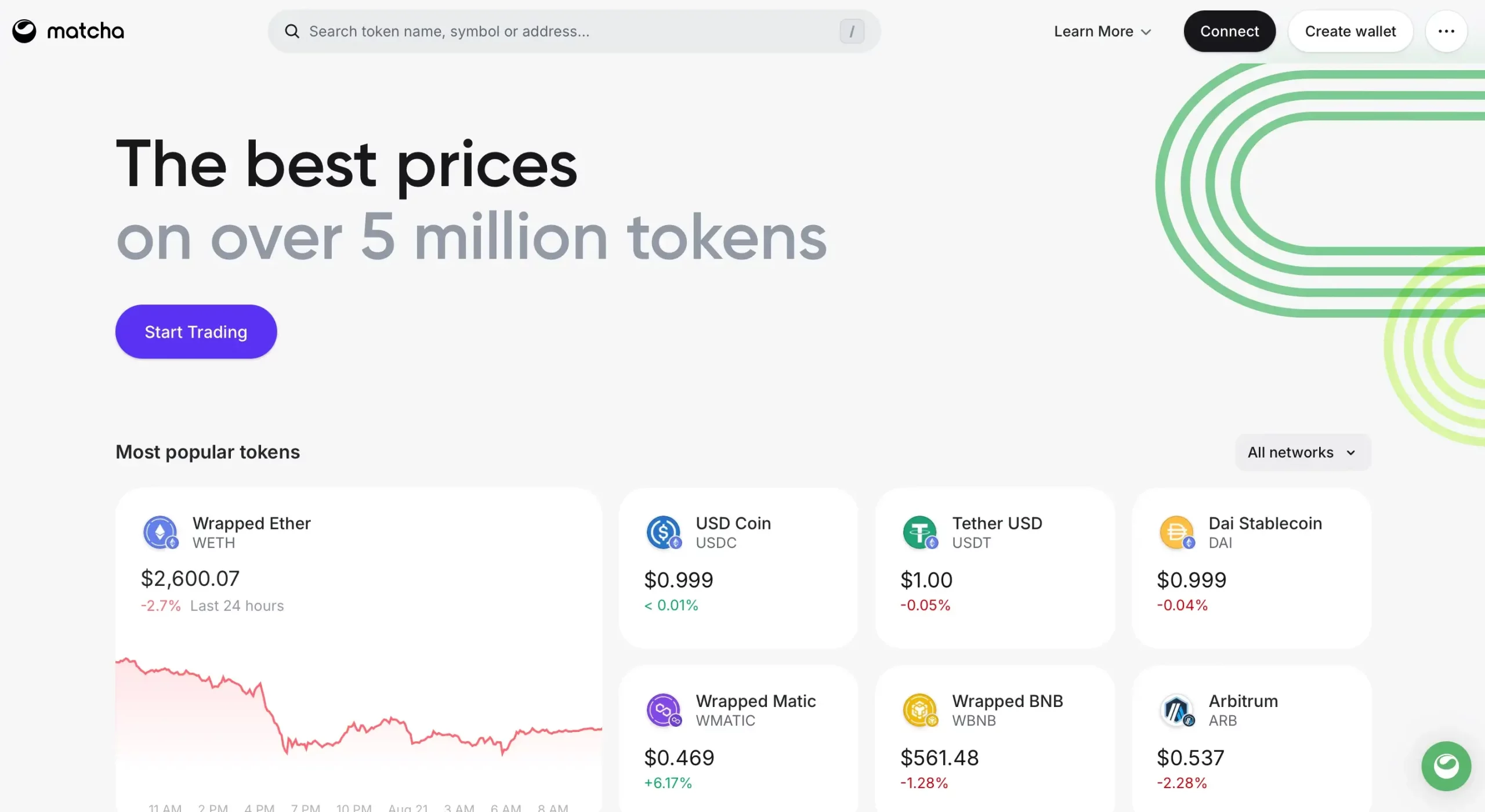

Matcha

Matcha functions as an elite, user-friendly platform that effortlessly connects traders with numerous digital currencies across various decentralized exchanges (DEXs).

0x-built Matcha, which is also Optimism-compatible, leverages cutting-edge tech for a seamless and efficient trading journey.

Matcha’s platform caters to more than 6 million tokens, including the OP token, offering a broad range of versatility for both experienced traders dealing with popular assets and adventurous investors exploring niche tokens.

Matcha’s advanced order routing system gathers liquidity from over 130 different providers to provide optimal pricing. By pinpointing the swiftest and least expensive paths for trading, it becomes a potent instrument for maximizing returns.

Pros of Matcha DEX Aggregator

- Extensive asset coverage;

- Includes limit orders and Matcha Auto for seamless trading;

- Leverages smart order routing for the best rates.

Cons of Matcha DEX Aggregator

- May require a steeper learning curve for new users;

- Platform performance relies on the underlying liquidity sources.

What is Optimism (OP)?

Optimism, or OP, is a scalability solution for the Ethereum network that boosts transaction speed and lowers costs by handling transactions away from the main blockchain, while still leveraging Ethereum’s security features.

This method employs optimistic rollups to group and compact transactions before sending them to the Ethereum primary network for verification. This strategy helps lighten the burden on Ethereum, resulting in quicker and less costly transactions for users of decentralized apps (dApps).

Optimism, often recognized for its dedication, sets aside a portion of its earnings from protocol transactions to finance projects that enhance the Ethereum network and contribute to broader public welfare initiatives known as retroactive public goods funding. This not only empowers Optimism as a means of expanding Ethereum’s capacity, but also transforms it into a platform that nurtures and fosters the expansion of decentralized applications and blockchain technology.

What is an Optimism DEX?

A Decentralized Exchange (DEX) running on the Optimism network, which is a scalability solution for Ethereum’s second layer, is commonly referred to as an “Optimism-based DEX.” This platform facilitates trades in a decentralized manner while leveraging the efficiency improvements offered by the Optimism network.

Optimism is designed to provide faster and cheaper transactions by reducing the load on the Ethereum mainnet. DEXs on Optimism allow users to trade cryptocurrencies directly from their wallets without relying on a centralized platform.

Choosing these Decentralized Exchanges (DEXs) is a smart move due to their ability to leverage Optimism’s scalability and affordable transaction rates, which makes them an economical option for traders seeking to bypass the higher costs usually linked with Ethereum Layer-1 transaction fees.

But an Optimism DEX Aggregator?

Instead of relying on a single Decentralized Exchange (DEX) on Optimism for liquidity, these aggregators scan multiple DEXs on the network to locate and provide the most advantageous prices for traders.

As an analyst, I can express this as: “By leveraging the Optimism ecosystem, I can help users secure the best trading deals by tapping into the most competitive pricing options available across multiple platforms.”

By automating searches for optimal deals, these aggregators streamline the process, giving traders more time and lowering their expenses.

FAQs

What is the Best DEX to Use?

The best-decentralized exchange (DEX) depends on your trading needs and preferences. Uniswap is a popular choice for its user-friendly interface, high liquidity, and wide token availability. 1inch stands out for its price optimization by aggregating liquidity from multiple sources, ensuring you get the best rates. SushiSwap offers additional DeFi features like yield farming, while Curve is known for its efficiency in stablecoin trading.

When selecting a DEX, also consider its integration with wallets like Coinbase Wallet or MetaMask. The best DEX for you will align with your trading goals, preferred network, and the specific features you need.

What is the Best Optimism Exchange?

When it comes to Optimism DEXs, our research suggests that Uniswap currently stands out as the top decentralized exchange on the Optimism network. However, the best exchange for you may vary depending on your specific needs. We recommend reading our full article and doing additional research to find the right fit for your trading goals.

What is the Best DEX Now?

At the moment, Uniswap is generally recognized as one of the top decentralized exchanges (DEX) thanks to its high trading volume, user-friendly design, and large liquidity pools. Yet, the ideal DEX can change depending on personal needs, trading habits, and the network you’re connected to. Exchanges such as SushiSwap, Curve, and 1inch are also frequently used, each providing distinct advantages and features. Selecting a DEX that fits your specific circumstances is crucial.

What is the Best Multi-Chain DEX?

The best multi-chain DEX depends on your specific trading needs. Popular options include Uniswap, PancakeSwap, and SushiSwap. DEX aggregators such as 1inch, ParaSwap, and KyberSwap can also offer competitive rates. Consider factors like fees, supported chains, token selection, and security when choosing.

Conclusion

With the increasing fame of Optimism’s network and blockchain technology, the related environment is blossoming at an astonishing pace. This explosion of curiosity has sparked a variety of Decentralized Exchanges (DEXs) and DEX aggregators within it, each offering unique attributes and advantages.

These trading platforms prioritize swiftness and minimal fees, catering to the growing demand for agility and productivity among traders who value efficiency and performance.

As additional choices emerge, you’ll discover an array of new resources to further improve your trading journey.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Rick and Morty Season 8: Release Date SHOCK!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-08-28 12:40