Tariffs Takedown: Will Trump’s Trade War Send Bitcoin and Altcoins into a Tailspin?

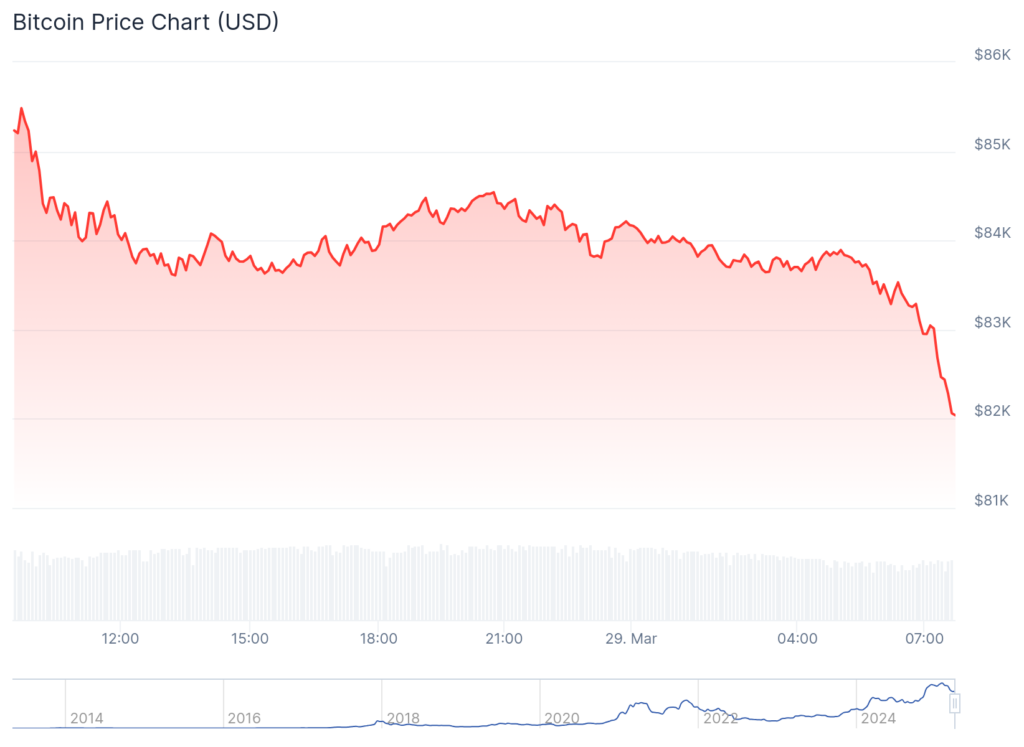

As the crypto market continued to hemorrhage blood, like a wounded animal, Bitcoin and top altcoin prices took a nosedive, plummeting from the lofty heights of $89,000 to a mere $82,000 on Saturday morning. 🤯

Meanwhile, the market cap of all digital coins shrunk to a paltry $2.73 trillion. It’s like watching a balloon deflate, folks! 🎈

So, what’s behind this crypto carnage? Well, buckle up, folks, because we’ve got two potential catalysts that could send Bitcoin and altcoins into a tailspin next week.

The Trump Tariff Tango

Next week, President Donald Trump’s “Liberation Day” arrives, and with it, reciprocal tariffs on the top U.S. trading partners. It’s like a game of chicken, folks, with Trump daring his trading partners to blink first. 🤺

The tariffs aim to challenge what Trump views as unfair levies on US goods and non-tariff barriers. But, economists warn that these tariffs will hurt American manufacturers by raising their costs and affecting their overseas business. It’s like a punch to the gut, folks! 😩

The European Union is reportedly considering concessions, while China plans countermeasures. It’s like a game of cat and mouse, with neither side willing to back down. 🐈

Therefore, on Tuesday, expect Bitcoin and altcoin prices to react to these tariffs. In theory, these assets will likely continue falling when Trump unveils his tariffs. But, hey, who knows? Maybe market participants have already priced in the tariffs, and these assets will bounce back like a rubber ball! 🏀

The Jobs Report Jamboree

The other key catalyst for Bitcoin and altcoin prices will be Friday’s nonfarm payrolls data from the US. It’s like a high-stakes poker game, folks, with economists polled by Reuters expecting the data to show that the economy created 128,000 jobs in March. That’s a big drop from the 151,000 it created a month earlier. The unemployment rate is expected to rise to 4.2%. 🤔

Historically, crypto and stock prices have reacted to job numbers because of their impact on the Federal Reserve. The Fed is tasked with maintaining stable inflation and low unemployment rates. It’s like a delicate balancing act, folks! 🤹♀️

These numbers come as Wall Street is divided on what to expect from the Fed this year. Some analysts expect it will maintain rates steady this year because of the stubbornly high inflation, while others see it cutting later this year as Trump’s tariffs trigger a recession. It’s like a game of musical chairs, folks, with everyone trying to guess the next move! 🎶

Read More

2025-03-29 17:09