Top 9 Crypto Bridges to Use in 2025

Crypto has changed since its inception. In today’s crypto industry, taking full advantage of decentralized finance often means interacting with multiple blockchains. Having a reliable bridge is indispensable for moving tokens between these platforms.

However, there’s a problem: many users use popular options like the Portal Token Bridge or Synapse Bridge for these transfers. While they are solid choices, plenty of other platforms are out there—many of which might offer even better features for your needs.

In this article, we’ve rounded up the best crypto bridges of 2025. We’ve carefully evaluated them based on factors like supported networks, security, fees, and overall functionality, making finding the perfect platform for cross-chain transfers easier.

What are Crypto Bridges, and Why are they Important for Web3 and DeFi?

Crypto bridges (or blockchain bridges) are software protocols that connect different blockchains, allowing them to communicate and work together, much like a bridge connecting two separate islands.

They work by linking two separate blockchains, making it possible to move assets and data between them seamlessly. These bridges use shared liquidity pools and smart balancing systems to ensure smooth and efficient transfers. The liquidity pools hold native assets for multiple blockchains simultaneously, allowing quick and easy swaps.

With a crypto bridge, you can transfer your assets directly between blockchains in just a few clicks, saving you from the hassle of using a centralized exchange, where you’d have to deposit your assets, trade them, and then withdraw them again.

Using bridges reduces delays and eliminates the need to trust a centralized exchange. Plus, since centralized exchanges often charge hefty fees, decentralized bridges can help you save money on transactions, besides the fact that most decentralized apps don’t require KYC.

Top 9 Best Bridges in Crypto

Across.to

Launched in 2021, Across Protocol is a popular cross-chain solution using intents, and we consider it the best platform for bridging at the time of writing. And that’s especially because intents-based frameworks are gaining traction in the bridging space, and Across often offers the fastest and cheapest bridge options.

What sets Across apart is that it only transfers real, canonical assets, not wrapped or synthetic tokens. It operates on chains with official bridges to ensure genuine token transfers.

Supported Chains

There are over 17 supported chains available: Aleph Zero, Blast, zkSync, Optimism, Base, Arbitrum, Soneium, Ethereum, Polygon, Ink, Mode, Redstone, Scroll, World Chain, Zora, Lisk, and Linea.

Security

Across Protocol prioritizes user security with several key features:

- UMA’s Optimistic Oracle – The protocol relies on UMA’s optimistic oracle, which uses a one-step dispute mechanism. Anyone can propose answers to specific questions, and if undisputed within a short time frame, the answer is verified.

- Dataworker Proposals – The Dataworker submits proposals to the optimistic oracle for valid refunds and optimal reallocations of liquidity provider (LP) capital, improving capital efficiency while maintaining security.

- Canonical Token Transfers – Across exclusively handles genuine (canonical) assets, avoiding the risks associated with synthetic or wrapped tokens.

Fees

Across Protocol charges liquidity provider fees based on whether the relayer takes repayment from the origin or destination chain. If repayment happens on the origin chain, no fees are charged; otherwise, a fee based on liquidity utilization is applied.

Additionally, relayer fees are set by users to incentivize relayers, covering costs like gas, opportunity costs, and capital risk. These fees are reflected in the difference between the transaction’s input and output amounts.

Pros

- Fast Transactions – The relayer network ensures quick cross-chain transfers.

- Low Fees – Competition among relayers keeps costs low. Gas-optimized for near-zero bridge fees.

- High Security – Backed by UMA’s optimistic oracle with strong dispute mechanisms.

- User-Friendly – Easy-to-use interface, great for beginners.

- Genuine Assets – Only transfers real assets, avoiding synthetic token risks.

Cons

- Limited Blockchain Support – Works with a small number of blockchains.

- Relayer Reliance – Performance depends on the quality of relayers.

Stargate

Stargate, built on LayerZero, is a fully composable cross-chain bridge protocol enabling seamless native asset transfers between blockchains.

Unlike traditional bridges that rely on inefficient wrapped or intermediate tokens, Stargate eliminates this need, allowing users to transfer native tokens directly.

Powered by unified liquidity pools shared across chains, it ensures instant guaranteed finality and delivers a streamlined, one-step cross-chain bridging experience.

Supported Chains

Currently, we have identified over 18 supported chains on the Stargate platform: Arbitrum, Avalanche, Base, BNB Chain, Ethereum, Fantom, Kava, Linea, Mantle, Metis, Optimism, Polygon, Hemi, and others.

Security

Stargate incorporates robust security measures to establish trust and reliability in its cross-chain bridge operations:

- Unified Liquidity Pools – Stargate’s use of shared liquidity pools prevents fractured liquidity issues, ensuring smooth transactions without the risk of failure or reversion due to insufficient liquidity on the destination chain.

- Instant Guaranteed Finality – By eliminating the need for wrapped tokens, Stargate ensures that all transactions are final and cannot be reverted, even in scenarios with high transaction volumes.

- ∆ Algorithm – Stargate’s proprietary Delta (∆) algorithm optimizes liquidity pool rebalancing to prevent exhaustion during concurrent transactions.

- LayerZero Security Foundation – LayerZero provides a strong security backbone by enabling decentralized and verifiable message delivery between blockchains.

- Audited Smart Contracts – Stargate’s codebase undergoes regular audits to identify and mitigate vulnerabilities.

Fees

Stargate charges a flat 6 bps transaction fee, with 5 bps allocated to the protocol treasury and 1 bp to veSTG holders. Gas fees, paid in the native gas token, cover LayerZero’s execution fee and costs for verifying messages via the Decentralized Validation Network (DVN).

In V2, Stargate introduced dynamic fees managed by the AI Planning Module (AIPM), which ensures optimal liquidity distribution across pools and adjusts costs based on demand. When liquidity in a specific pool is low, rebates are offered to incentivize rebalancing and maintain smooth operations.

Pros

- Native Asset Transfers – Seamlessly transfers native assets without wrapped tokens.

- Blockchain Support – Works with multiple EVM-compatible Layer 1 and Layer 2 chains.

- User-Friendly – Easy-to-use interface for smooth bridging.

- Cost Transparency – Estimates slippage and gas costs before transfers.

- Liquidity Rewards – Earn STG tokens by providing liquidity.

- High TVL – Trusted platform with significant total value locked.

Cons

- Dynamic Fees – V2’s dynamic fees may confuse some users.

- Liquidity Risk – High demand could still lead to liquidity pool exhaustion.

- Gas Fees – Extra gas fees for LayerZero execution and verification.

Rhino Fi

Rhino.fi is an easy-to-use multi-chain platform that lets you access top DeFi opportunities all in one place. Built on StarkEx Validium Layer 2 technology, your tokens are securely linked to Ethereum’s blockchain, the second largest in the world, giving you full control over your assets.

Rhino.fi is self-custodial, meaning only you can access deposit tokens. The Rhino.fi team can never touch your funds. If Rhino.fi ever goes offline, you can still withdraw your tokens to the Ethereum mainnet through the Data Availability Committee.

Supported Chains

With Rhino Fi, you can bridge to over 27 major chains, such as Ethereum, Arbitrum, Avalanche, Avalanche Nova, Optimism, zkSync, Base, Linea, BNB Chain, TON, Tron, Polygon, and many others.

Security

The most relevant security aspects of Rhino.fi are:

- Self-Custody – Users can fully control their tokens and withdraw funds through the Data Availability Committee, even if the platform shuts down.

- StarkEx Validium Layer 2 – This technology leverages Ethereum’s security, meaning tampering with funds would require breaching Ethereum’s blockchain.

Fees

Rhino.fi offers low trading fees, ranging from 0% to 0.3%. If you provide liquidity (maker), fees start at 0.15%; if you take liquidity (taker), fees start at 0.20%. These fees drop as your 30-day trading volume increases, with the best fees (0% for makers and 0.14% for takers) at over $30 million in volume. Swap fees are a flat 0.30%; transfer fees depend on the token and are updated regularly.

Pros

- Self-Custody – You have full control of your tokens.

- High Security – Built on StarkEx Validium Layer 2 with Ethereum’s blockchain security.

- Wide Chain Support – Access DeFi on over 27 chains.

- Emergency Withdrawals – Withdraw funds even if the platform goes offline.

Cons

- Variable Transfer Fees – Fees depend on the token and can change.

- Volume-Dependent Fees – Best fees are only available with high trading volumes.

- Challenging for Newbies: New users may initially find it a bit complex.

Rubic Exchange

Rubic Exchange is a multichain DeFi platform designed to be a one-stop solution for decentralized trading. It enables users to perform cross-chain swaps seamlessly, offering instant swaps and access to the best rates through its DEX aggregator.

With support for major swap protocols and global accessibility, Rubic empowers users to trade effortlessly across different networks. Completely decentralized, Rubic operates without requiring KYC, ensuring user privacy and convenience for traders worldwide.

Supported Chains

Currently, Rubic Exchange supports over 27 chains. Some popular options on Rubic are TON, Tron, Linea, Base, Arbitrum, and others.

Security

Some great security features that we can find at Rubic Exchange are:

- Decentralized Architecture – Rubic operates without external servers, relying solely on blockchain and frontend interactions, significantly reducing attack vectors like DDoS.

- One-Click DeFi – Solves DeFi complexity by combining multiple steps (wallet connections, token swaps, and bridging) into a single “one-click” process for users.

- Secure and Audited – Fully audited contracts ensure reliability and safety.

- SDK and White-Label Tools – Provides integration solutions for dApps and wallets with fee-sharing incentives.

Fees

Currently, Rubic charges $2 for cross-chain swaps and $1 for on-chain swaps, plus standard gas fees.

Pros

- Easy to Use – One-click swaps simplify complex DeFi processes.

- It supports 27+ Blockchains and works with many popular chains like TON, Tron, and Arbitrum.

- Secure – Fully audited contracts and decentralized architecture ensure safety and privacy.

- High Transaction Volume – Over $1.24 billion in transactions, showing reliability.

Cons

- Fees – $2 for cross-chain swaps and $1 for on-chain swaps, plus gas fees.

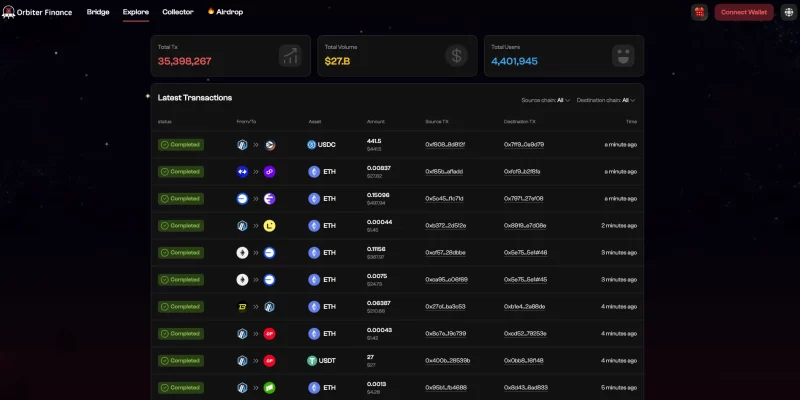

Orbiter Finance

Orbiter Finance is one of the top cross-chain bridges in the crypto space right now, designed to make transferring assets between Ethereum’s layer 2 networks smooth and cost-effective.

By leveraging cutting-edge ZK-rollup technology, Orbiter Finance enables fast, low-cost, and secure transfers between Ethereum’s Layer 2 networks. The platform takes advantage of the robust security of Ethereum layer 1, ensuring that transactions remain safe while benefiting from lower costs and greater scalability.

Notable investors, including Tiger Global and OKX Ventures, are backing the platform’s growing success and showing strong support for its potential to improve the broader Ethereum ecosystem.

Supported Chains

Orbiter supports over 70 chains, including Ethereum, Arbitrum, Polygon bridges, Optimism, Immutable X, Base, Linea, BNB Chain, TON, Tron, Ink, etc.

Security

The most relevant security aspects related to Orbiter Finance are:

- Zero-Knowledge Proofs (ZKPs) – Orbiter uses ZKPs to verify transactions without revealing sensitive data, ensuring privacy and secure cross-rollup transfers.

- Cross-Rollup Transactions – Transfers between Layer-2 solutions are protected by the security measures inherent to the networks, including ZK rollups and optimistic rollups.

- Decentralized Architecture – Orbiter’s decentralized design reduces reliance on single points of failure, boosting overall platform security.

Fees

Orbiter Finance charges a protocol fee of 0.00023 ETH for bridging assets between blockchains. A trading fee of 0.2% to 0.3% is applied depending on the trade.

Pros

- Innovative and Efficient – Orbiter Finance leverages ZK roll-up technology for fast, low-cost, and secure transfers between Ethereum’s Layer 2 networks.

- Strong Security – It Utilizes Zero-Knowledge Proofs (ZKPs) and cross-rollup transactions to ensure secure, private asset transfers with robust protection.

- Wide Support – Supports over 70 chains.

- Strong Backing – Investors like Tiger Global and OKX Ventures lend credibility and confidence in its potential within the Ethereum ecosystem.

- High Performance – Transfers are up to six times faster and more cost-effective than traditional cross-chain bridges.

Cons

- Security Concerns – The lack of post-launch security audits raises concerns about platform safety.

- Lack of Team Transparency – Limited information on the team behind the project.

deBridge

deBridge is a well-known cross-chain protocol enabling seamless transfer of tokens and arbitrary data between blockchains. Built on a decentralized validator network, it ensures trustless validation and strong security.

By utilizing off-chain transaction validation and Arweave-based data availability, deBridge delivers a highly efficient and scalable solution for cross-chain interoperability.

Supported Chains

deBridge supports over 18 chains, including Arbitrum Bridge, Base, Ethereum, Gnosis, Optimism Bridge, and other major blockchain networks.

Fees

deBridge charges a flat fee for every cross-chain message transfer, paid in the native gas token of the source blockchain (e.g., ETH on Ethereum). Half of these fees reward deBridge validators, ensuring decentralization and protocol reliability. Fees for each message are visible in the deBridge Explorer or via the DebridgeGate smart contract.

Security

Some important security features that we can find at deBridge are:

- Decentralized Validator Network – Validators verify all cross-chain transactions independently, ensuring trustless validation and protocol security.

- Arweave Data Availability – Validator signatures are securely stored on Arweave, ensuring data persistence and availability.

- Delegated Staking and Slashing – Validators and delegators are incentivized to maintain high standards with staking rewards and the risk of slashing for misbehavior or downtime.

- Transaction Finality – Validators wait for sufficient block confirmations to ensure transaction finality, minimizing risks from probabilistic blockchain models.

Pros

- Fast and Efficient – Near-instant settlement with faster finality than traditional systems.

- Advanced Trading Features – Gasless limit orders, zero slippage, and unlimited market depth for seamless cross-chain trades.

- Strong Security – Decentralized validator network, Arweave-based data availability, and slashing mechanisms ensure reliability and safety.

- Wide Chain Support – Supports 18+ major chains, including Ethereum, Solana, and BNB Chain.

- No Locked Liquidity Risk – Eliminates the need for liquidity pools, reducing risk exposure.

Cons

- Flat Fee Structure – This may be costly for small transactions.

- Complexity for Beginners – Advanced features like staking and gasless orders can confuse new users.

- Validator Dependency – System reliability heavily depends on validator performance.

Hop Protocol

Hop Protocol is designed to facilitate fast, seamless token transfers between various Ethereum layer 2 networks. It enables near-instantaneous asset movement, making it one of the best cross-chain bridges for Ethereum Layer 2 scaling solutions.

Operating on a non-custodial model, Hop ensures that funds are never controlled by a single entity, safeguarding liquidity providers and users. The protocol has undergone Solidified and Monoceros Alpha audits, further reinforcing its security and reliability.

Supported Chains

Currently, the Hop Protocol supports various Ethereum scaling solutions, including Polygon, Gnosis, Optimism, Arbitrum One, Arbitrum Nova, Base, Linea, and Polygon zkEVM.

Security

Hop Protocol ensures secure asset transfers across blockchains with the following features:

- On-chain Security – Hop uses the security of the blockchains it connects to, ensuring all important actions, like transferring assets and verifying data, happen transparently and cannot be changed.

- Minimal Trust – Hop reduces the need for trusted middlemen by using a decentralized network of nodes to manage communication between blockchains, keeping things more secure and less reliant on one single party.

- Proof-of-Transfer – Hop uses a unique method to confirm that assets are transferred correctly across blockchains, ensuring that transactions are valid.

- Bonding and Penalties – Hop requires nodes to form bonds to encourage honesty. If they act dishonestly, they lose their bonds.

Fees

Hop Protocol fees depend on several factors. There are no AMM fees, but each transfer’s fees will be shown. They depend on network costs and will be displayed when you initiate the transaction.

Slippage can occur due to liquidity changes, but it’s less of an issue as liquidity grows. Bonder fees range from 0.05% to 0.30%, compensating bonders for liquidity and risk. Gas fees for destination chain transactions are included in the fee estimate.

A minimum fee of $0.25 applies to prevent spam.

Pros

- Optimized for Ethereum Layer 2 – Best for cross-chain transfers within Ethereum’s Layer 2 ecosystem.

- Instant Transfers – Token transfers are almost instantaneous.

- Supports Leading Solutions – Works with popular Ethereum Layer 2s like Polygon, Gnosis, and Arbitrum.

- Non-Custodial – Users retain full control over their assets.

Cons

- Limited to Layer 2 – Supports Ethereum Layer 2, not many Layer 1 or other blockchains.

- Depends on Liquidity – Transfer costs and slippage can vary based on available liquidity.

- Still Growing – Newer protocol with less adoption compared to other solutions.

MemeBridge

MemeBridge is a popular cross-chain bridge solution that enables the effortless transfer of digital assets

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2025-01-27 13:46