As someone who has been closely following and participating in the cryptocurrency market for several years now, I can confidently say that the role of crypto liquidity providers is nothing short of remarkable. Having navigated through various market fluctuations myself, I’ve come to appreciate their vital contribution to maintaining a stable and efficient trading environment.

The growing interest in cryptocurrencies and the broadening of worldwide financial markets have sparked a high need for easily accessible funds to keep a balance during the trading of investment assets. Consequently, there has been a noticeable surge in the requirement for crypto liquidity providers, who offer numerous services designed to distribute liquidity evenly across different markets.

As a seasoned investor with years of experience in the dynamic world of cryptocurrency, I have come to appreciate the importance of liquidity providers (LPs) in this rapidly evolving market. In my journey, I have encountered various LPs and learned about their roles, functions, and classifications.

Key Takeaways

- Crypto liquidity providers offer a wide range of services related to the supply, processing, storage, and distribution of crypto asset liquidity.

- Institutional players account for a large share of the total number of all crypto liquidity providers in the market.

- The main objective of crypto liquidity providers, among other things, is to stabilize the value of assets at a given point in time.

What is a Crypto Liquidity Provider?

A crypto liquidity provider is an essential player in the cryptocurrency world, whether they’re individuals or organizations. Their role involves boosting market liquidity by consistently offering both buy and sell orders at various price points for digital assets. These providers are key to maintaining the seamless operation of crypto exchanges and trading platforms, enabling efficient market transactions.

Through constant supply of buying and selling orders, crypto liquidity providers maintain a steady market by preventing drastic price fluctuations and enabling traders to execute trades swiftly with minimal delay or substantial price differences. This consistent pricing and asset accessibility is vital in drawing more market participants and fostering a robust trading environment where investors can comfortably buy and sell digital assets with trust.

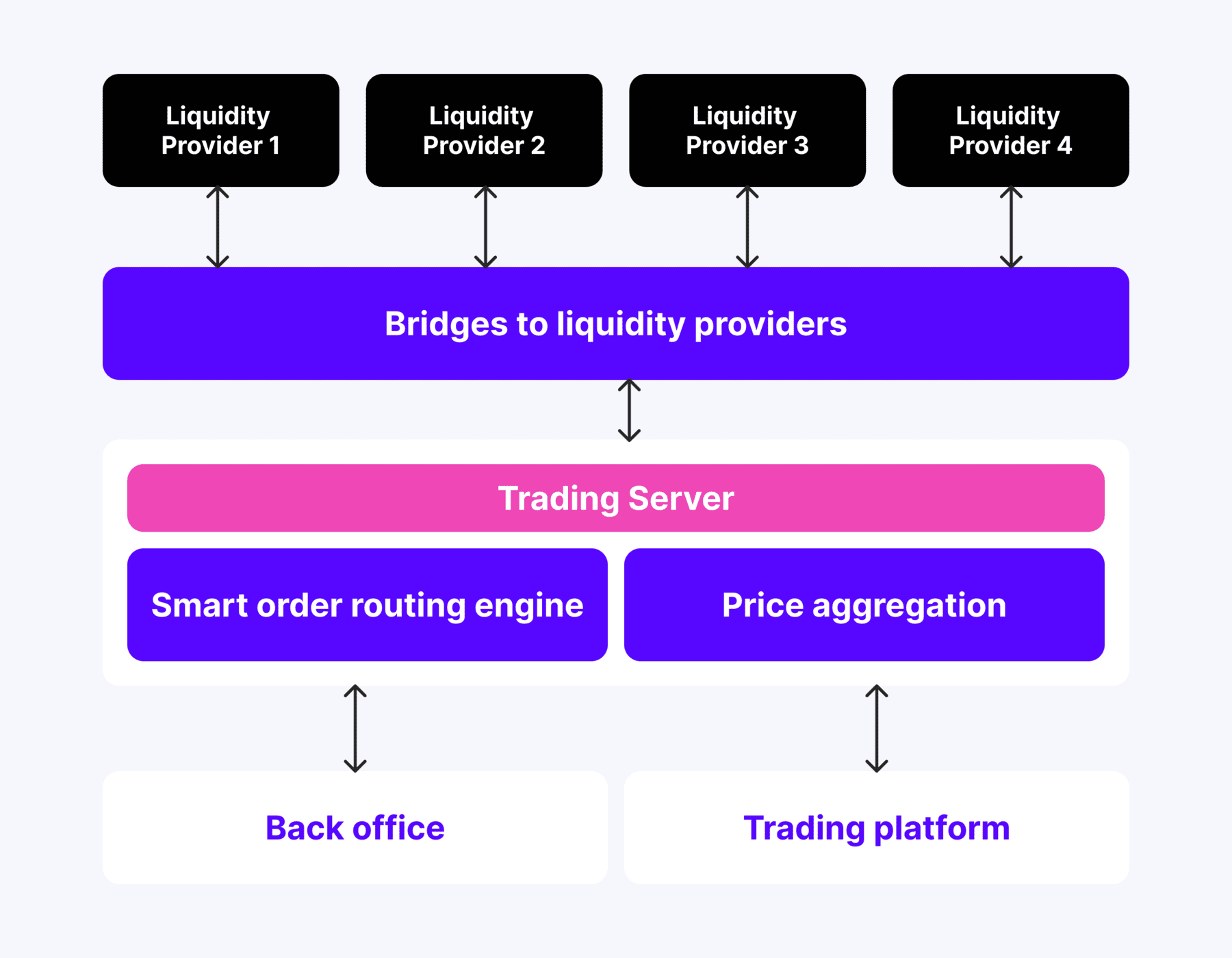

Crypto liquidity providers function in a similar manner as those in other markets, aggregating and distributing liquidity. However, their system for rebalancing liquidity across assets is unique because of the presence of large liquidity pools. In these pools, additional crypto liquidity is accumulated over time and then redistributed to assets with lower liquidity levels.

Key Functions of a Crypto Liquidity Provider

Crypto liquidity providers function as versatile service platforms, providing a comprehensive suite of services aimed at addressing liquidity gaps in cryptocurrencies that experience low trading volumes and minimal investment activity. Given these unique circumstances, these services possess distinct features that set them apart, such as:

1. Continuous Liquidity Provision

Crypto market liquidity providers play a crucial part by keeping a steady flow of buying and selling orders for various cryptocurrency combinations. By constantly offering to buy and sell assets, they ensure there’s constant activity in the market, making trading seamless and unbroken. Their presence helps reduce potential issues like liquidity shortages and price discrepancies, and guarantees that both buyers and sellers are readily available at all times.

2. Price Discovery and Price Stabilization

Market facilitators, or liquidity providers, play a vital part in ensuring financial markets operate smoothly. They continuously provide competitive buying and selling rates, using current market information. This helps establish precise asset prices. Their consistent presence helps maintain price stability, limit drastic swings, and create a more foreseeable and efficient market environment. Consequently, it leads to a more organized and steady marketplace, which benefits all market participants alike.

3. Efficient Order Execution

Crypto liquidity providers excel in quickly executing transactions to get the best deals as fast as possible. They use advanced trading tools and complex algorithms to optimize trade routing and completion, thus minimizing discrepancies between the expected and actual transaction price (slippage), and improving the user’s overall trading experience.

4. Market Making

Market facilitators play a crucial role in financial systems by stepping in as dealers. They persistently buy and sell assets, maintaining small differences between their purchase and sale rates. This continuous trading activity is key to keeping the market active and well-supplied, ensuring that there’s plenty of room for executing significant trade volumes without significantly affecting prices.

5. Customized Liquidity Solutions

Crypto market participants like exchanges, institutional investors, and others can benefit from custom-made liquidity solutions created by liquidity providers in the cryptosphere. These solutions are designed to address each client’s specific demands, such as tailored crypto pools, API connections, and specialized services. The goal is to cater to their unique needs effectively.

6. Risk Management

Trustworthy providers of cryptocurrency liquidity emphasize establishing robust risk management systems to mitigate possible dangers and unpredictable factors, all while maintaining compliance with regulatory guidelines. This approach is crucial for preserving the market’s honesty and resilience.

As an analyst, I can say that their services typically involve rigorous anti-money laundering (AML) and know-your-customer (KYC) compliance procedures, which are aimed at strengthening and facilitating our clients’ overall regulatory adherence. By strictly following these guidelines, liquidity providers significantly contribute to maintaining a secure and transparent ecosystem within the cryptocurrency sector.

Fast Fact

Cryptocurrency liquidity is particularly fluid because the values of the assets it’s meant to balance can change rapidly.

Types of Crypto Liquidity Providers

As a researcher delving into the intricacies of various markets, I can’t stress enough the pivotal role that liquidity plays in preserving the smooth flow of trading activities, including the rapidly evolving crypto market. To guarantee and enhance transaction effectiveness, numerous mechanisms have been crafted over time. These mechanisms are essentially embodied in the unique functionalities of services dedicated to the provision of liquidity, its aggregation, and various operations tied to its utilization.

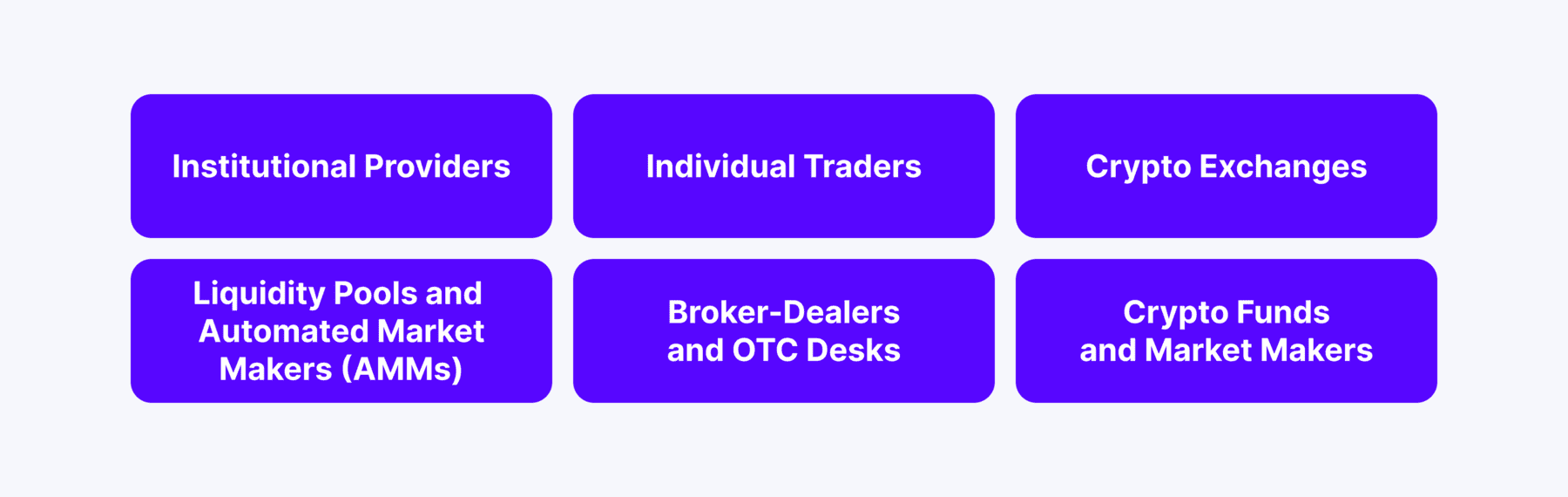

There are the following types of crypto liquidity providers:

1. Institutional Providers

Representative institutional providers operate as hedge organizations – these are investment companies and financial entities that hold substantial capital. These organizations apply sophisticated trading methods, frequently using high-speed trading (fast trading) and automated trading systems. The goal of these entities is to ensure a smooth flow of trades within the market.

In my experience as a crypto investor, I’ve noticed some groups composed of proprietary trading firms that operate with their own funds for trading activities and maintaining market liquidity. These firms are renowned for their innovative trading technologies and intricate strategies designed to ensure liquidity across various financial markets.

2. Individual Traders

Individual traders can be categorized into two main types: professional and algorithmic.

Skilled investors regularly supply market liquidity across various trading sites, leveraging their resources and know-how. They heavily depend on their extensive market insights and trading abilities to carry out transactions and accumulate earnings within the financial sector.

Instead, let’s consider algorithmic traders as people who use computerized systems and mathematical models (algorithms) for trading. They are skilled in creating and deploying automated trading software (trading bots) to execute trades swiftly. These traders take advantage of technology to analyze market trends and make trades based on pre-set conditions, aiming to profit from quick market fluctuations.

3. Crypto Exchanges

Digital asset marketplaces, like crypto exchanges, facilitate buying and selling of various digital currencies. These platforms can be categorized into two primary groups: centralized exchanges (CEXs) and decentralized exchanges (DEXs).

Decentralized Marketplaces like Binance, Coinbase, and Kraken function by keeping extensive lists of buy and sell orders, known as order books, and helping users complete transactions. These platforms usually have specialized teams within their operations that act as market makers, providing the necessary liquidity to keep trading active.

Decentralized platforms such as Uniswap, SushiSwap, and Balancer function uniquely by utilizing user-created liquidity pools. These pools are vital for facilitating trades within the platform, with users being able to deposit their digital assets into these pools in exchange for rewards.

4. Liquidity Pools and Automated Market Makers (AMMs)

Decentralized exchanges (DEXs) rely on liquidity pools, which are vital parts that enable smooth trading transactions. Users, often called liquidity providers (LPs), deposit their tokens into these pools to assist in trading activities. As a reward for their contribution, LPs receive transaction fees generated within the pool.

On the contrary, automated market makers (AMMs), like those employed by Uniswap and SushiSwap, utilize complex algorithms to handle their liquidity pools and set asset prices. These algorithms are engineered to maintain constant liquidity and facilitate efficient price exploration, thereby offering smooth trading encounters for users.

5. Broker-Dealers and OTC Desks

As an analyst, I cannot overlook the pivotal part that broker-dealers assume in the realm of securities trading. They essentially function as agents, representing their clients’ interests effectively. In the context of cryptocurrencies, these broker-dealers serve a significant purpose by supplying liquidity through the execution of substantial trades on behalf of institutional and retail clients.

Over-the-counter (OTC) platforms, however, are renowned for their subtle and expert handling of sizeable trades. Their primary role is to offer liquidity for deals that, when performed on open markets, might trigger considerable price shifts. As intermediaries between buyers and sellers, OTC desks guarantee seamless execution of large transactions without causing market disturbances.

6. Crypto Funds and Market Makers

Investment options known as crypto funds specialize in handling cryptocurrencies. These funds function as key players in the market by engaging in regular trading and facilitating transactions, thereby providing necessary liquidity.

Market participants, either standalone entities or trading desks within bigger financial organizations, perform an essential function by providing market fluidity through the continuous provision of buying and selling options for cryptocurrencies.

Top Crypto Liquidity Providers

In present times, the cryptocurrency market serves as a substantial income stream, enabling trade using diverse financial tools. To ensure a consistent and dependable income, crypto trading platforms utilize crypto liquidity poolers. Here are some prominent crypto liquidity suppliers that could be beneficial for partnership.

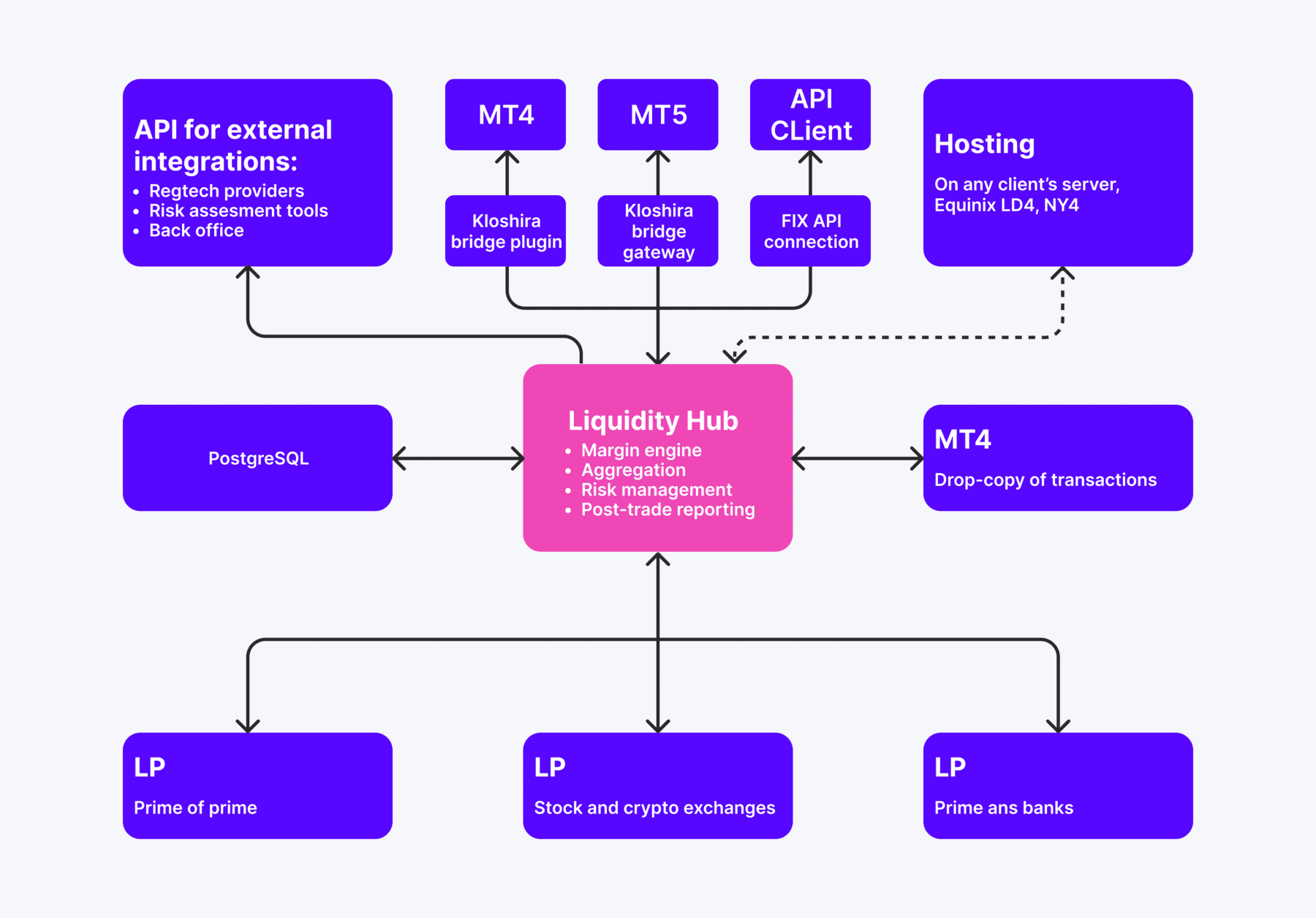

1. B2Broker

B2Broker Group is a well-known name in the financial sector, known for its top-tier services as a provider of PoP (Payment Order Flow) solutions. Recognized worldwide as one of the foremost providers of cryptocurrency liquidity, this company plays a significant role in the industry. As the trusted supplier of Forex, CFD, and crypto liquidity and technology to numerous entities such as brokers, crypto exchanges, hedge funds, and institutional clients, B2Broker has solidified its position as a major market player. Its main objective is to meet the unique liquidity needs of exchanges, brokerages, and startups in the cryptocurrency sector, ensuring smooth operations within this digital realm.

2. Leverate

Leverate excels at creating custom investment technologies and crypto liquidity options designed specifically for brokers. These solutions grant access to top-tier services and advanced technologies that effectively manage market risks. The broker provides various business solutions across the board through LXSuite, expert assistance, and the progressive Sirix platform, delivering clients a seamless and productive trading journey.

3. Vortex

As a researcher in 2023, I’m proud to be associated with Vortex – an innovative algorithmic market maker and token consulting firm that I joined at its inception. Our exceptional client retention rates have earned us the prestigious title of top market maker in the same year. What sets Vortex apart from other competitors is our comprehensive approach as a full-service token partner. We offer unparalleled support for listings, business growth, marketing, and fundraising, making us an indispensable partner for any project in the token space.

As a crypto investor, I appreciate the constant market presence that Vortex provides thanks to their advanced liquidity provision algorithms. Even in turbulent market conditions, they’re always there, ensuring a strong market presence 24/7. Their dedication to client satisfaction is evident through their hardworking trading team, who tirelessly strive to meet each client’s unique price and profit objectives.

4. Kairon Labs

Founded towards the end of 2018, Kairon Labs is a reputable company that focuses on market making and advisory services for digital assets and exchanges. They excel in providing liquidity for both cryptocurrency and foreign exchange markets. Their institutional-grade solutions and quantitative trading strategies are powered by their own advanced software.

Through connecting to its extensive ecosystem of crypto exchanges, investors, and service providers, Kairon Labs was established as a specialized algorithmic trading platform for digital currencies in 2019. The firm’s dedication to providing high-quality liquidity solutions to virtual asset issuers gives it an edge in the market, making it a reliable choice for those requiring dependable market-making and consultancy services.

5. Interactive Brokers Crypto

Interactive Brokers’ Crypto platform offers a cutting-edge approach to crypto trading, boasting competitive prices. Fees for transactions begin at just 2%, enabling users to buy and store popular digital assets such as Bitcoin, Bitcoin Cash, Ethereum, and Litecoin with ease.

On this platform, users can store US dollars in a digital wallet, trade multiple tokens issued by Paxos Trust Company, and benefit from round-the-clock cryptocurrency trading services. Paxos Trust Company manages all digital asset transactions and storage, ensuring a secure and dependable trading environment. Furthermore, Interactive Brokers’ platform offers a smooth trading experience, enabling investors to expand their portfolios by trading cryptocurrencies alongside conventional assets like stocks, options, and ETFs.

Conclusion

The proper operation of cryptocurrency markets hinges significantly on crypto exchange liquidity providers who perform an indispensable function. They contribute crucially to market stability by handling order processing, reducing price fluctuations, improving the trade experience, offering diverse trading options, carefully managing risks, and supporting cryptocurrency exchanges. Their active participation is crucial for smooth and efficient market functioning.

FAQ

What is a crypto liquidity provider?

A crypto liquidity provider is someone who adds fluidity to the cryptocurrency market by offering both buying and selling options at different price points. By doing so, they help keep the market running smoothly, decrease price fluctuations, and ultimately improve the overall trading process for everyone involved.

How do crypto liquidity providers work?

Liquidity providers maintain a steady flow of buying and selling orders for cryptocurrencies across various trading platforms. They may choose to work manually or employ automated tools to handle their transactions. By doing so, they help ensure that traders can swiftly execute their trades at reasonable prices, thereby upholding market stability and efficiency.

How do centralized exchanges provide liquidity?

Decentralized markets offer fluidity thanks to extensive order books managed by market intermediaries and the platform itself. By collecting orders from a diverse group of users, they guarantee a sufficient number of buy and sell orders at different price points, making transactions seamless.

How do decentralized exchanges (DEXs) provide liquidity?

Decentralized Exchanges (DEXs) offer liquidity by allowing users to add their digital assets into shared pools called liquidity pools. Automated Market Makers (AMMs) oversee these pools, using sophisticated algorithms to determine prices and execute transactions. Those who contribute to the pools are rewarded with trade fees generated within the pool.

Why is liquidity necessary in cryptocurrency trading?

As a analyst, I can’t stress enough the importance of liquidity. It plays a pivotal role in minimizing market volatility, boosting overall market efficiency, cutting down on transaction costs, and ultimately, enhancing the quality of the trading experience for all participants.

Read More

2024-08-09 16:38