-

BNB remained in the $400 price range.

The RSI showed that BNB was still in a strong bear trend.

As a seasoned analyst with years of market observation under my belt, I must say that the recent performance of Binance Coin [BNB] has been nothing short of challenging for its holders and traders alike. The prolonged bearish trend, as evidenced by the RSI dipping below 30, is a clear sign of market distress and a call to exercise caution when making investment decisions.

Recently, Binance Coin [BNB] has seen a significant drop in value over the past few days, reflecting the general market trend as prices have been decreasing for six straight days.

Over an extended period, this downward trend led to a large number of BNB being sold off, indicating a high degree of market anxiety among its owners.

Binance crashes below key zones

As a researcher, I observed that the downward trend for BNB began on July 31st, marked by a significant decrease of more than 2% from its previous value. Consequently, the price dipped down to approximately $576.

For six straight days, there was a continuous downward trend for BNB, resulting in it losing approximately 26% of its worth during this span.

On August 5th, there was a significant one-day decrease of about 6.48%, causing the price to fall roughly to $464.

Over a series of setbacks, the BNB‘s Relative Strength Index (RSI) dipped below 30. Yet, recent figures indicate a minor rebound, as BNB has surged by more than 3%, causing its price to rise into the $478 zone at the present moment.

Consequently, the Relative Strength Index (RSI) of BNB has experienced a slight rise and now hovers slightly above 30. However, the current uptick does not seem to weaken the dominant bearish trend for BNB.

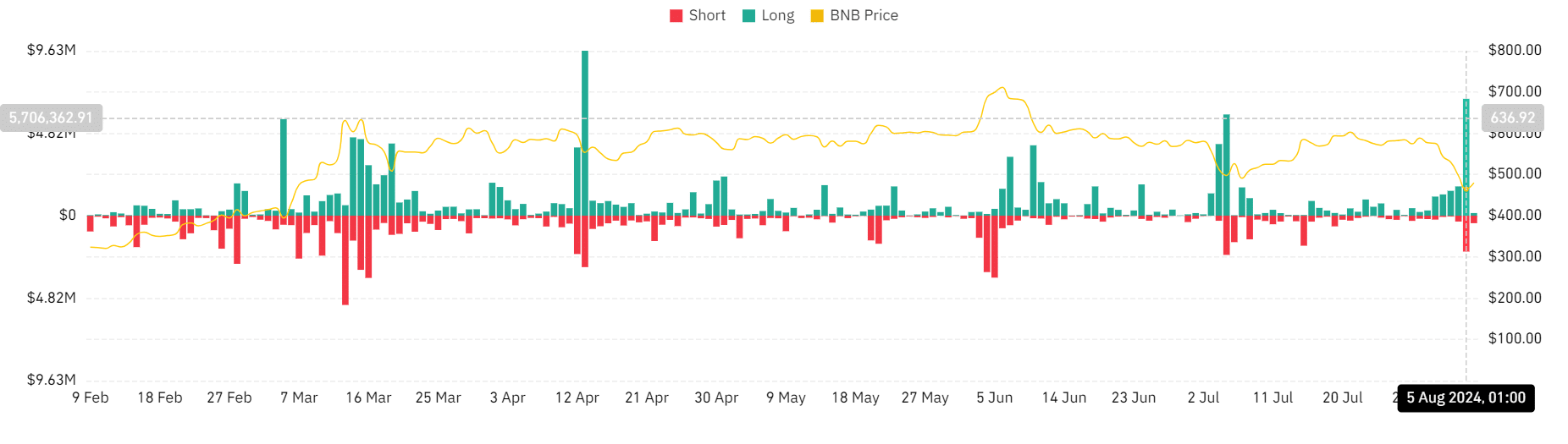

Binance Coin sees record liquidations

Due to a recent drop in BNB‘s value, there has been a substantial increase in the number of forced trade closures (liquidations) among traders, as indicated by data from Coinglass. Over this time frame, the total liquidation volume for BNB surged close to $9 million.

This marked the highest liquidation volume recorded since April.

Upon scrutinizing the figures, I noticed that long positions took a significant hit, amounting to approximately $6.8 million in total liquidations. This implies that numerous traders were likely betting on an upward trend or price stability in the crypto market.

As an analyst, I’d rephrase that statement as follows: When traders wager against the market, they often execute quick liquidations that equate to approximately $2.1 million in my analysis.

BNB descends into negative sentiments

At the current moment, the Funding Rate for BNB was sitting at -0.0170%. This figure offered a telling sign of the overall market mood, which seemed to lean heavily towards bearishness.

Read Binance Coin’s [BNB] Price Prediction 2024-25

As a crypto investor, I found myself in a situation where a negative funding rate meant that the sellers were dominating the market’s momentum. This situation made it more expensive to hold long positions compared to maintaining short ones. Essentially, it was advantageous for those trading with short positions since they were being compensated for their trade.

Although there’s been a slight uptick in BNB prices lately, the ongoing negative Funding Rate suggests that this rise hasn’t been enough to change traders’ overall viewpoint from bearish to bullish.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- PI PREDICTION. PI cryptocurrency

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

2024-08-07 08:09