- Bitcoin, at press time, recorded gains of almost 11% on the weekly charts

- Analysts are eyeing $64,300 after a possible breakout from $61,625

As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market swings and trends. However, Bitcoin’s performance this September has caught my attention. Despite the initial downward trajectory, it’s impressive to see BTC defy historical patterns and post gains.

Bitcoin (BTC) has bucked traditional market trends and colorized September as blue instead, an unusual move for this cryptocurrency. Currently, it’s being traded at approximately $60,164, which represents a 3.94% increase over the past day and a substantial 10.96% growth in value over the last week.

Before these recent increases, Bitcoin had been trending downwards. The price of the cryptocurrency has stayed under $60,000 since August 29th. However, even with this upward movement, Bitcoin is still about 18% lower than its all-time high of $73,937 from March.

It’s not surprising that many experts are discussing Bitcoin after it managed to turn a profit in September despite historical trends. One such expert is Ali Martinez, who believes Bitcoin could reach $64,300 based on the increase in active addresses.

What does market sentiment say?

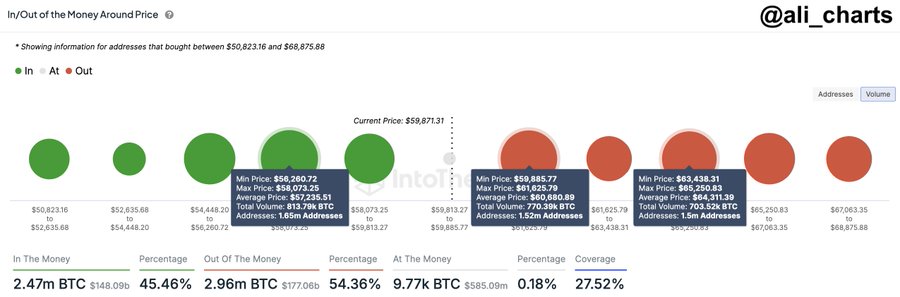

According to Martinez’s examination, he pointed out that approximately 1.52 million Bitcoin addresses contain more than 770,000 Bitcoins, with values ranging from around $59,885 to $61,625 each.

In this scenario, the given range signifies an area of potential resistance. This means that a large number of investors might opt to cash out and realize their profits at this zone. When numerous individuals hold assets at particular price points, these points transform into areas of resistance because these investors may decide to sell when the price nears where they initially purchased. Such market activity can generate selling pressure, which in turn hinders the rate of price increase.

If the crypto manages to break through the $61,625 barrier, as suggested by the analyst, it’s likely that we’ll witness additional growth. This suggests that any resistance at this price point would be overcome, setting the stage for further price increases. In such a scenario, the next potential level could be around $64,300.

If the price doesn’t manage to surpass the current resistance area and stays below $61,625, there might be a brief drop in price. This potential dip could push Bitcoin down to around $57,235 before making another upward push.

What do the charts say?

Starting from September 7th, when it closed at lower prices, Bitcoin has shown a robust upward trend. However, the approximately 1.52 million wallets pointed out by Martinez might choose to offload their holdings. Nonetheless, the current market climate could facilitate further price increases for Bitcoin.

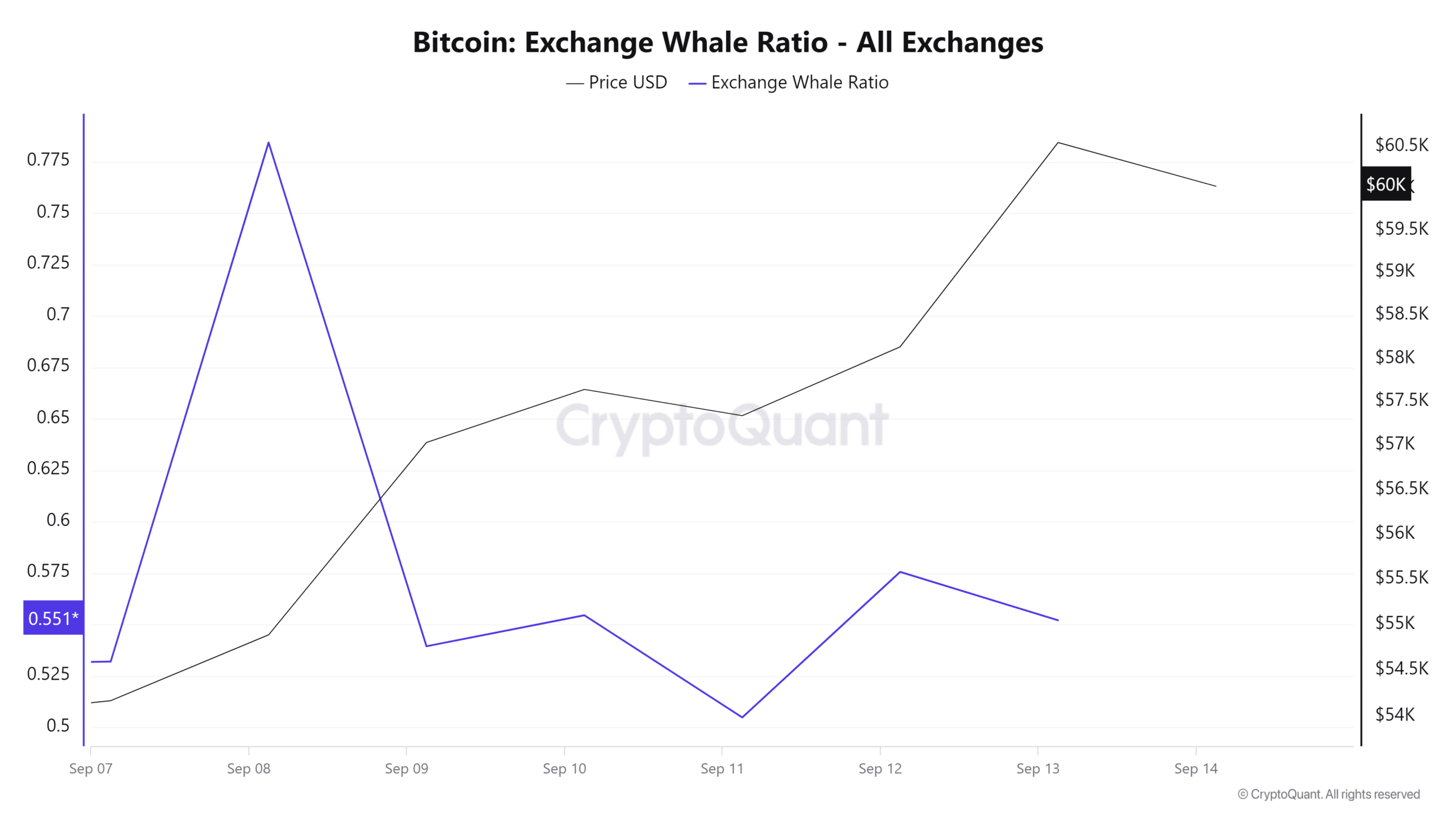

For instance, the whale exchange rate dropped from 0.7 to 0.5, indicating that major investors might not be planning to offload their assets soon.

This decrease indicates that whales are storing their resources in personal digital wallets. This kind of market activity suggests a positive, long-term perspective among whales, given their expectation of future price increases.

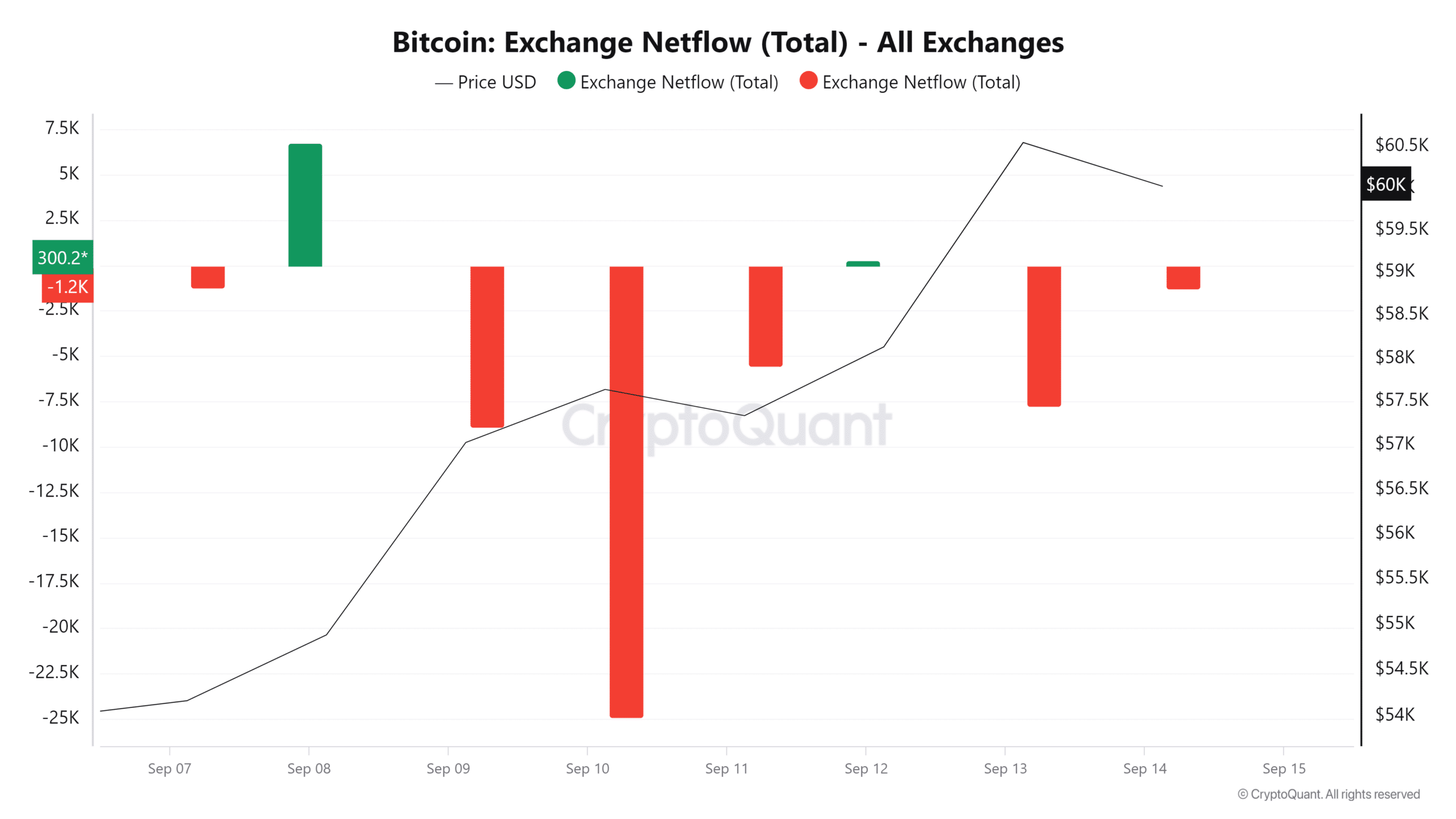

Additionally, Bitcoin’s exchange netflows have been largely negative since 9 September.

Investors pulling their assets off exchanges and into cold storage indicates a decrease in netflows, which can be interpreted as a positive or bullish sign. This is because it implies that holders do not plan to sell their assets immediately. Consequently, by reducing the amount of available assets on exchanges, they might increase demand, potentially causing prices to rise or move upward.

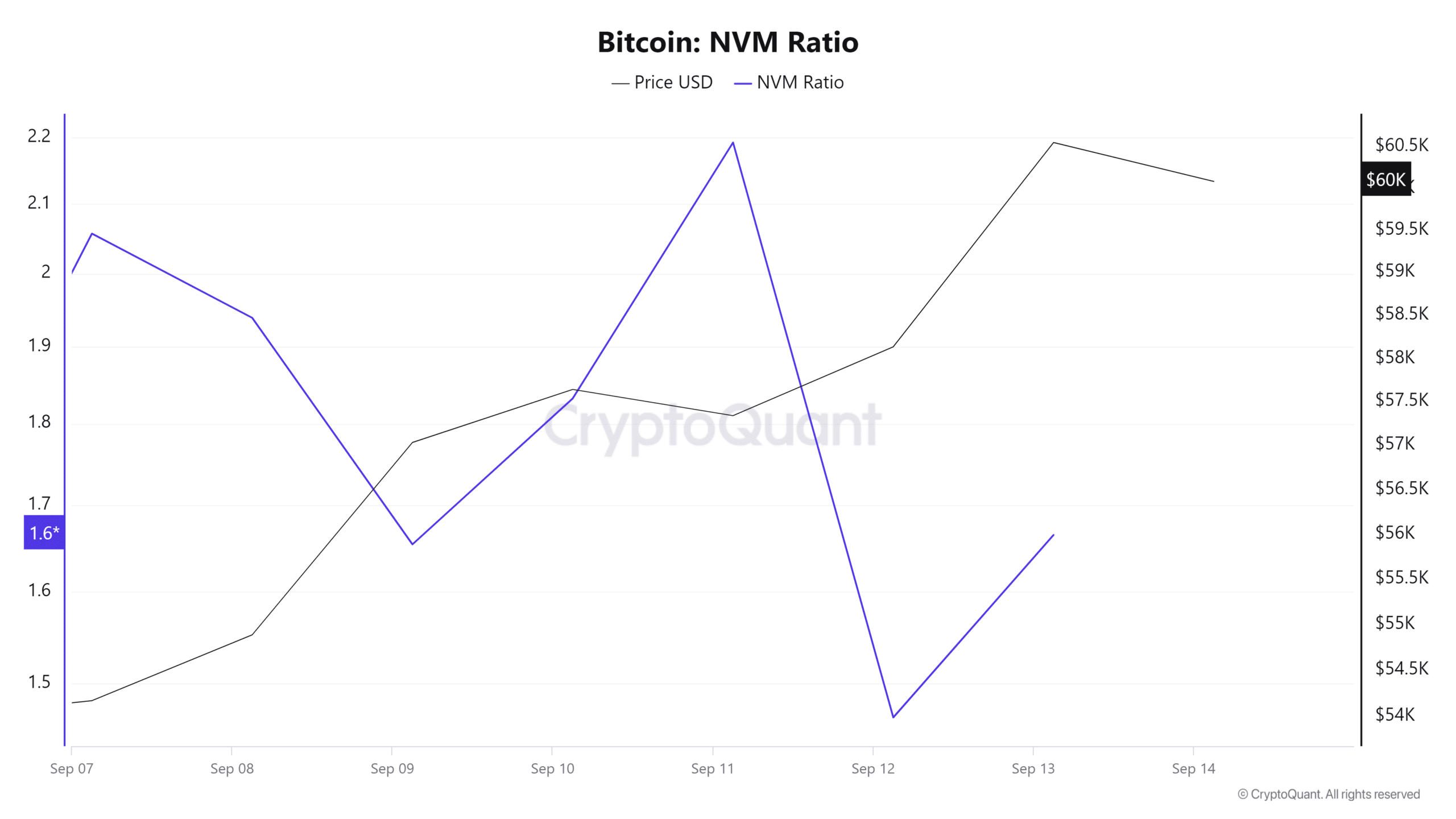

In summary, the decline in Bitcoin’s NVM ratio serves as a positive indication since it suggests an improvement in the network’s underlying strength.

As I observe the network’s reinforcement, it seems that the market has not fully incorporated the anticipated growth. This could indicate a build-up of interest or accumulation among investors, potentially hinting at an upcoming price surge.

Given the optimistic outlook towards it, should the current market trends persist, Bitcoin may try to break through the resistance at approximately $64,300.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Rick and Morty Season 8: Release Date SHOCK!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-09-14 19:03