- Chainlink broke out of a descending channel, retested $15 resistance, and targets $23 next.

- On-chain metrics and liquidation data support sustained bullish momentum for $LINK’s rally.

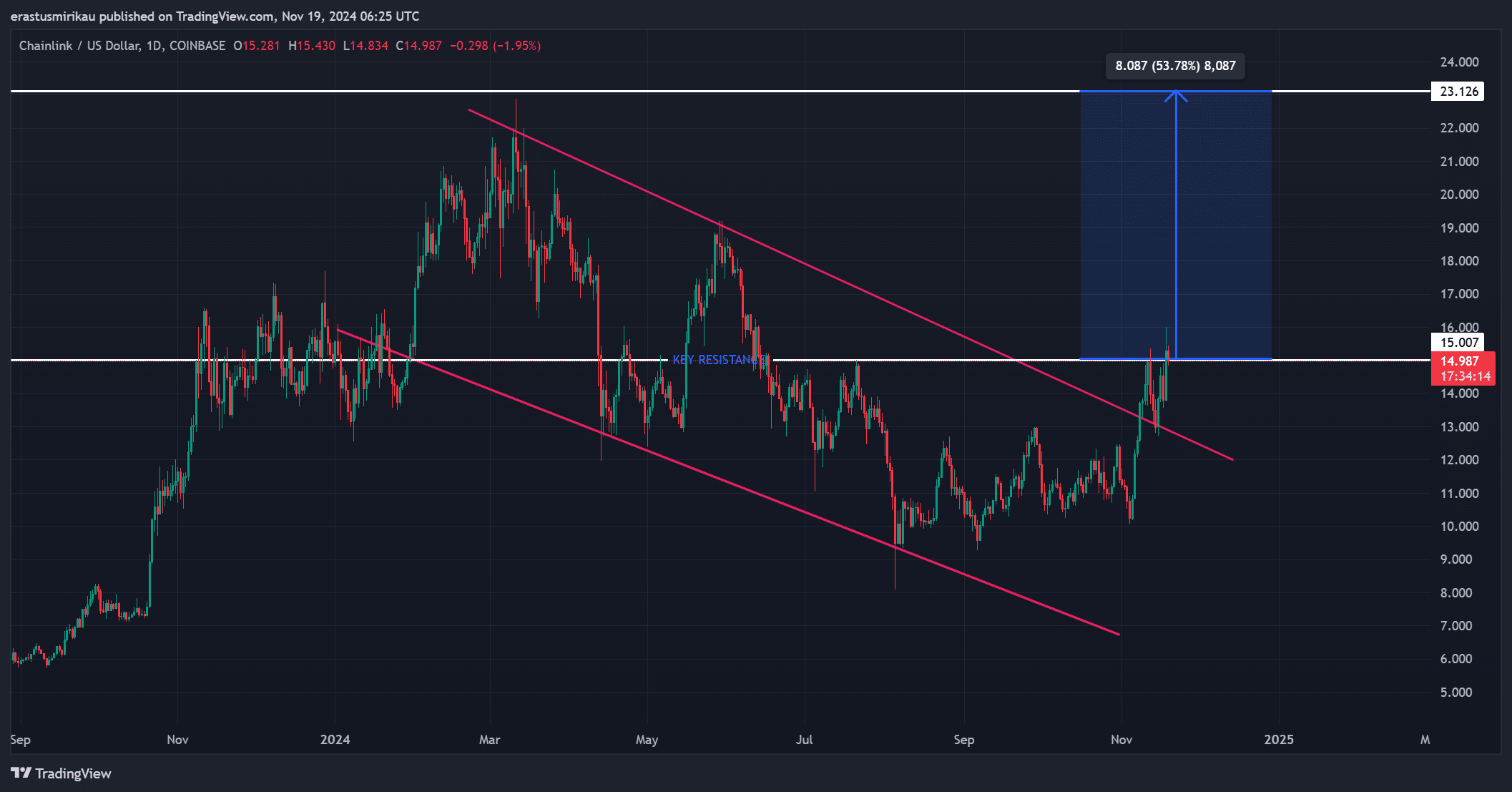

As a seasoned researcher with years of experience navigating the cryptocurrency market, I must say that Chainlink (LINK) has caught my attention lately. The decisive breakout from its long-term descending channel and the subsequent retest of the $15 resistance have piqued my interest in this token’s potential rally towards $23.

After a prolonged period of decline, marked by a downward channel, Chainlink’s token [LINK] has made a powerful breakthrough, indicating a significant change in the trend’s direction. This breakout follows several months of compression and bearish influences, hinting at a possible reversal of the current trendline.

Currently, LINK is being exchanged for approximately $14.97 per unit, representing an increase of 2.77% over the past day. Its total market capitalization stands at about $9.39 billion.

The trading volume has significantly increased by 86.04%, reaching a total of $981.98 million, indicating a growing interest in the market. As the price is being tested against the $15 resistance level, it appears that $LINK could be on its way to reach a projected rally target of around $23.

LINK retesting key levels with strong bullish momentum

Testing the $15 resistance area again, which is a vital pricing point, strengthens the notion of $LINK’s bullish surge. This level, serving now as a launchpad, may potentially catapult the token towards an increase of 53%, reaching for the next resistance at $23.

Historically, such outbursts often precede prolonged uptrends, and a return to $15 serves as a powerful indication. As a result, investors are keenly observing if $LINK will hold above this price point in the forthcoming trading periods.

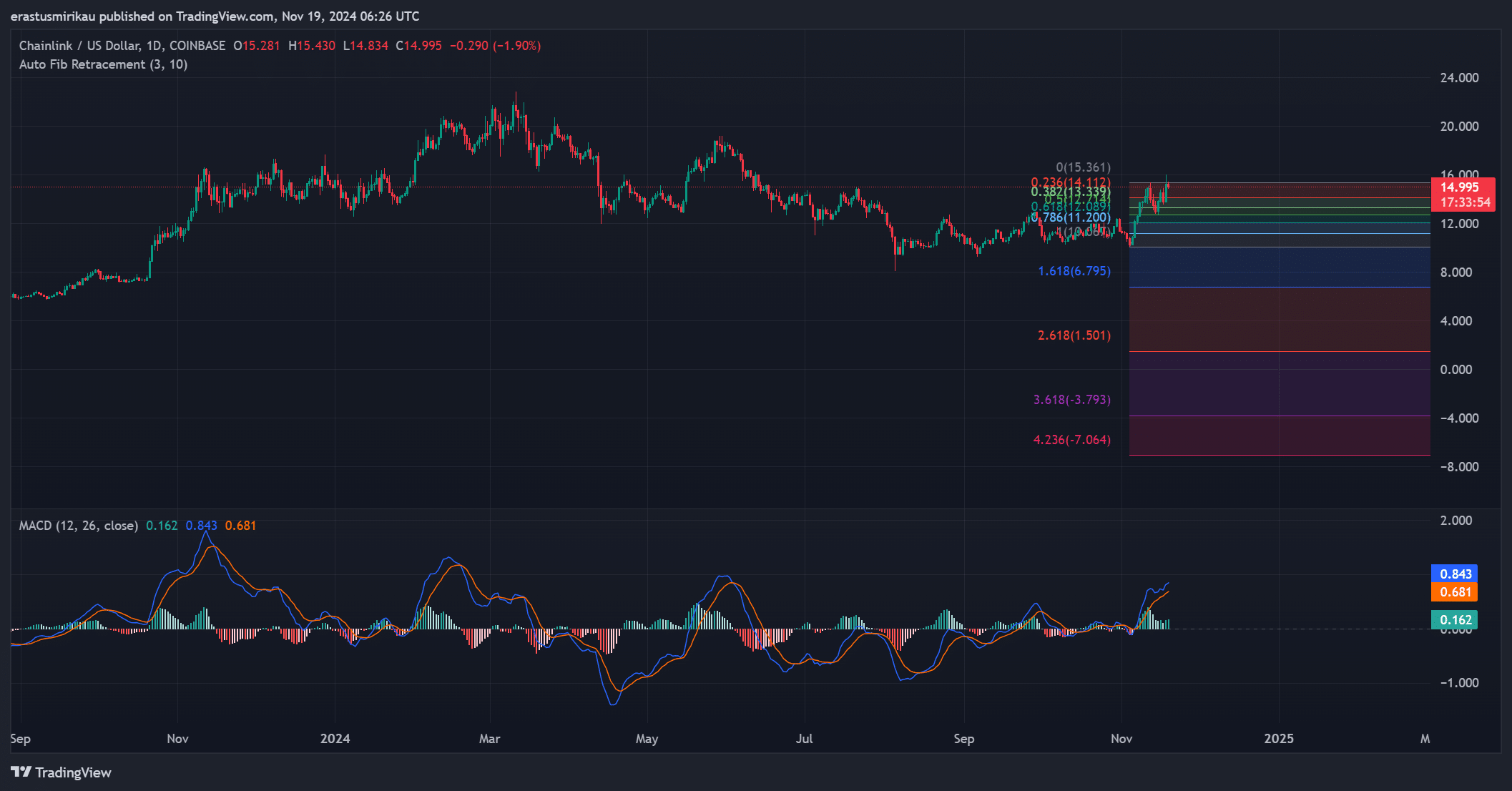

Momentum indicators like the MACD (Moving Average Convergence Divergence) offer extra signs for potential upward trends. In the current situation, the MACD line and the signal line are moving further apart, a sign known as divergence. Moreover, the histogram, represented by green bars, is also increasing. This pattern implies that buying strength is gradually building up, possibly indicating an uptrend might be on the horizon.

Furthermore, examining Fibonacci levels based on past lows and the recent breakout indicates that the $23 mark could serve as a significant resistance point, reinforcing its relevance within the larger trend of price movement.

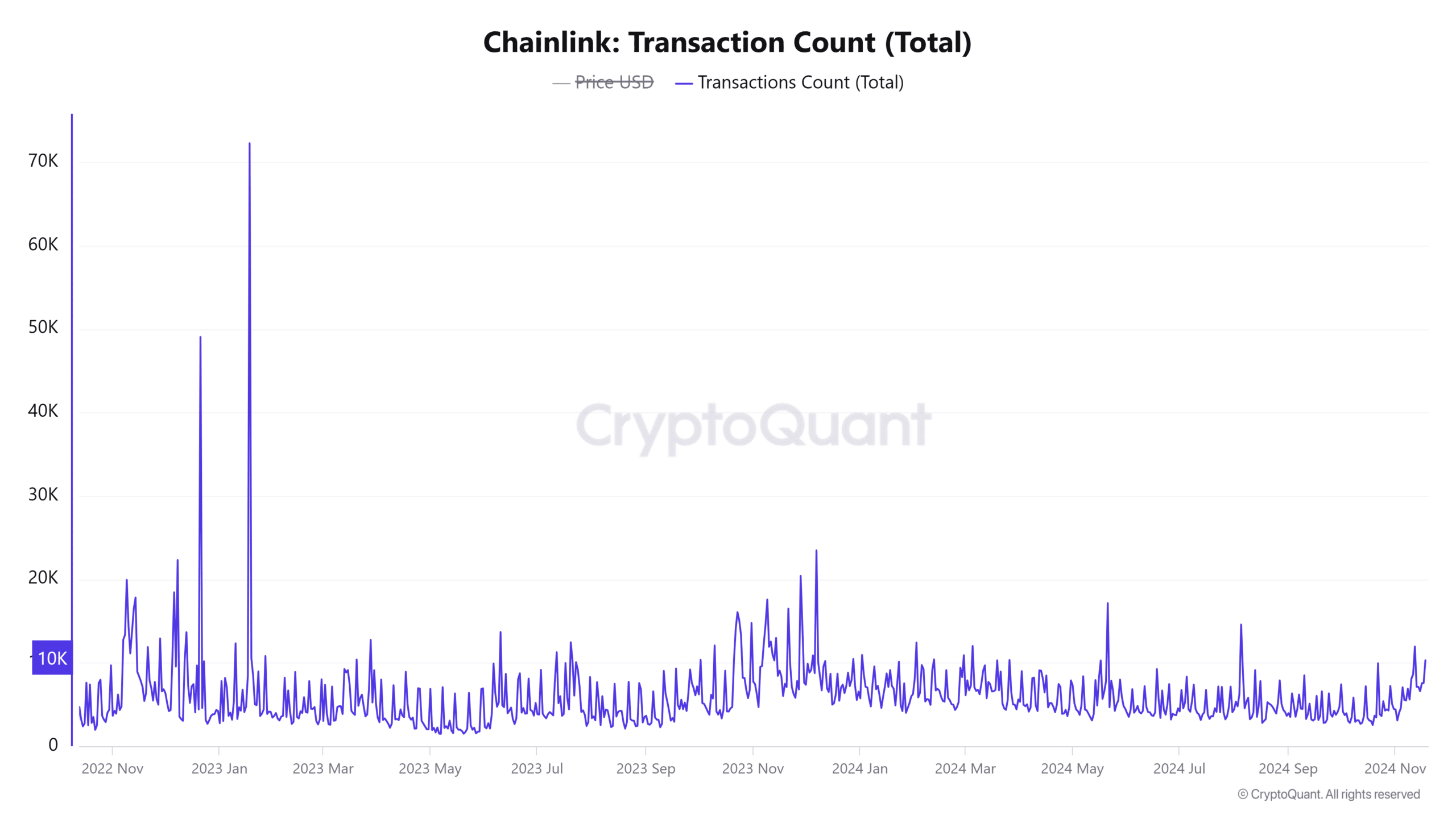

LINK on-chain activity reinforces positive outlook

As a researcher observing the Chainlink network, I’m noticing a notable uptick in activity. Over the past day, the number of active addresses has risen by approximately 1.24%. This surge suggests an increased level of interaction and engagement within our network, lending support to the optimistic outlook.

In the same timeframe, we’ve seen a 1.76% increase in transaction count, bringing it up to 13,065. This surge in activity suggests more frequent use of the network, a trend that typically corresponds with rising prices.

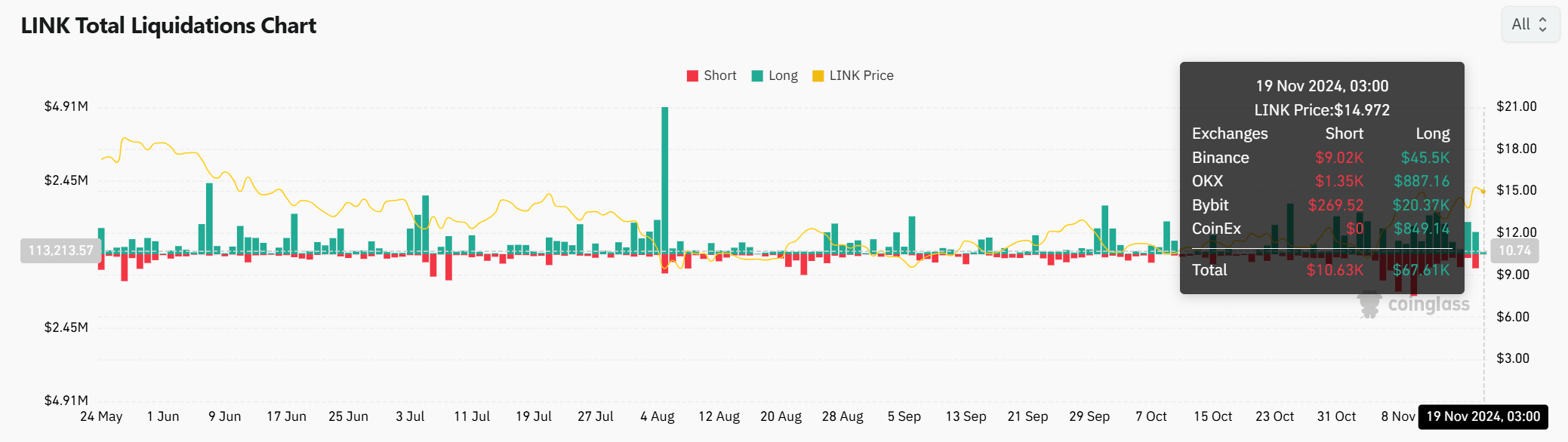

Liquidation data highlights bullish sentiment

The information about liquidation shows that most traders believe the value of LINK will rise. The total amount for long positions (betting on price increase) is $67,610, which is much greater than the $10,630 for short positions (betting on price decrease), demonstrating a strong belief in the market.

Based on my years of trading experience, I have noticed that when there is a significant imbalance in the market, it often indicates that traders anticipate further price increases. This additional layer of optimism in the current outlook can be quite exciting and potentially profitable for those who are able to capitalize on it. However, it’s essential to remember that markets can be unpredictable, so it’s crucial to always do thorough research and manage risk appropriately when making investment decisions.

In summary, it appears that Chainlink (LINK) has successfully broken free from its downward trend line and reconfirmed its position above the $15 mark. This could indicate a strong potential for LINK to achieve its projected target of around $23.

Based on robust technical signals, escalating on-chain interactions, and optimistic market liquidations, this upward trend seems durable. Consequently, it’s plausible that LINK could reach around $23 soon, as long as it maintains a steady position above $15.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- PI PREDICTION. PI cryptocurrency

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- PGA Tour 2K25 – Everything You Need to Know

2024-11-20 00:08