-

LINK has formed a double-bottom pattern within a demand zone, as identified by the IOMAP data.

Additionally, analysis of traders’ activities reveals a surge in large transactions and a decline in NetFlow.

As a seasoned crypto investor with a penchant for spotting trends and patterns, I find myself intrigued by the recent developments surrounding Chainlink [LINK]. The double-bottom pattern forming within a demand zone, as highlighted by IOMAP data, is a bullish sign that catches my attention.

Although Chainlink [LINK] has seen a drop of 9.13% over the past day, and there’s a general sense of wariness in the market, the heightened trading activity might set the stage for an imminent increase in its worth.

In simple terms, AMBCrypto predicts that LINK could rise in the upcoming trading period, identifying crucial points to keep an eye on.

Chainlink enters bullish territory following key support level formation

The latest decrease in LINK‘s value has resulted in the creation of a double-bottom pattern – a favorable chart configuration that occurs when the price hits the same low at distinct instances prior to an uptrend.

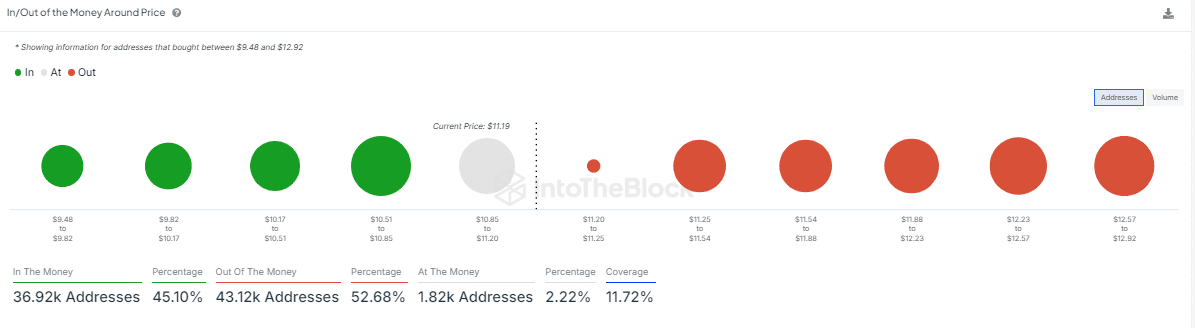

On the LINK market, we noticed an upward trend starting at approximately $10.84. This particular price point correlates with a substantial demand area, as per the In and Out of Money Around Price (IOMAP) analysis by IntoTheBlock.

According to the IOMAP data, it shows that the potential support areas lie within $10.85 and $10.51. At these levels, approximately 10,240 buyers have made orders for a total of 15.95 million LINK.

The intense purchasing behavior indicates that LINK might be experiencing an accumulation period right now, which could lead to possible price growth in the near future.

Traders maintain bullish stance on LINK

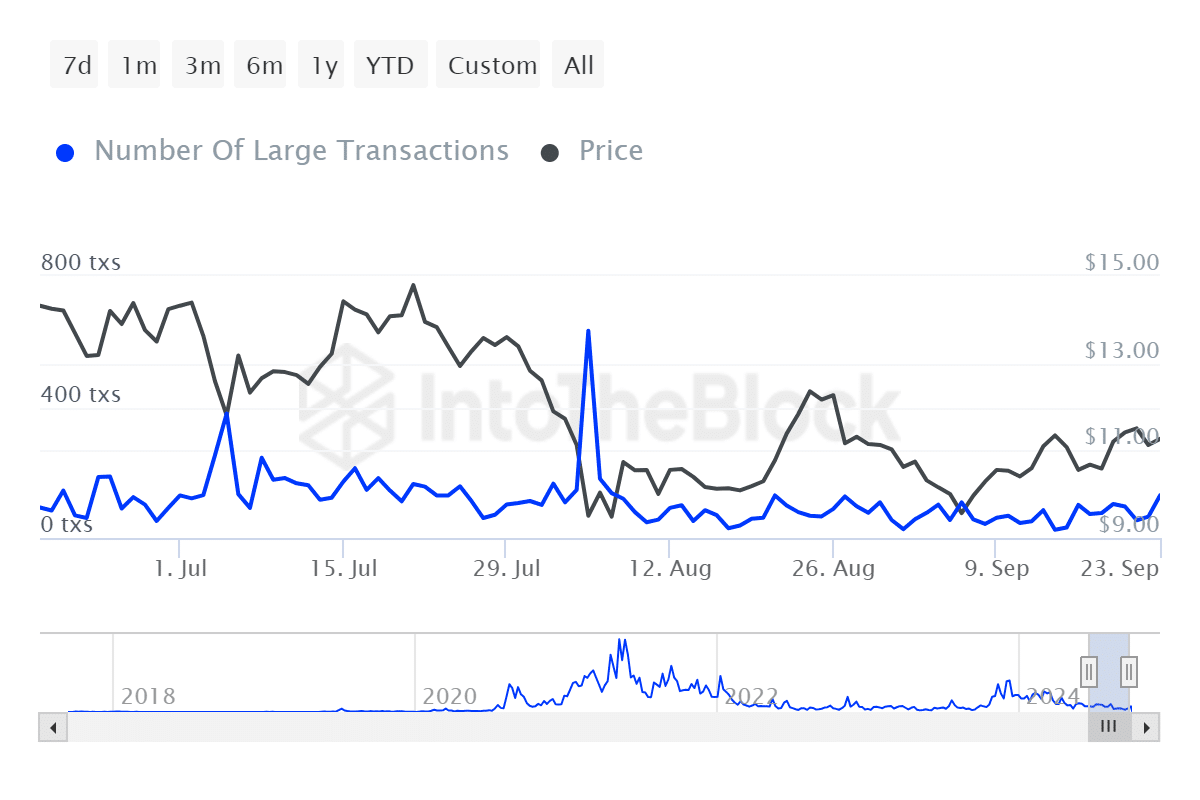

Recent data from IntoTheBlock reveals that traders are continuing to exhibit bullish behavior towards LINK, driven by trends observed in Exchange Netflow and large transactions.

Over the last seven days, a significant reduction in LINK holdings on cryptocurrency platforms, equivalent to approximately 386,670 LINK, has been observed. This downward trend suggests that investors are becoming increasingly optimistic about LINK’s future value increase.

Concurrently, we’ve seen an uptick in transactions worth more than $100,000, peaking at 196 such transactions over the course of seven days.

It appears that significant investors, frequently known as “whales,” are aggressively purchasing more LINK. This behavior lends credence to a positive outlook within the crypto market.

Predicting LINK’s next move: A trend up or down?

In light of the present market trends, if the indicated demand level on the chart stays steady and optimism continues, we estimate that LINK could potentially reach a new high of approximately $12.98.

Read Chainlink’s [LINK] Price Prediction 2024–2025

On the flip side, if the demand zone doesn’t hold up, the buying interest weakens, and LINK breaks through this significant support level, there’s a potential danger that its price could drop to a lower value of around $9.28.

If the general market shows signs of decline, and Bitcoin starts to trend downwards, it might lead to a noticeable change towards a more pessimistic outlook.

Read More

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-10-03 02:15