-

Machi Big Brother’s massive BLUR transfer to Binance caused a sharp 7% price decline

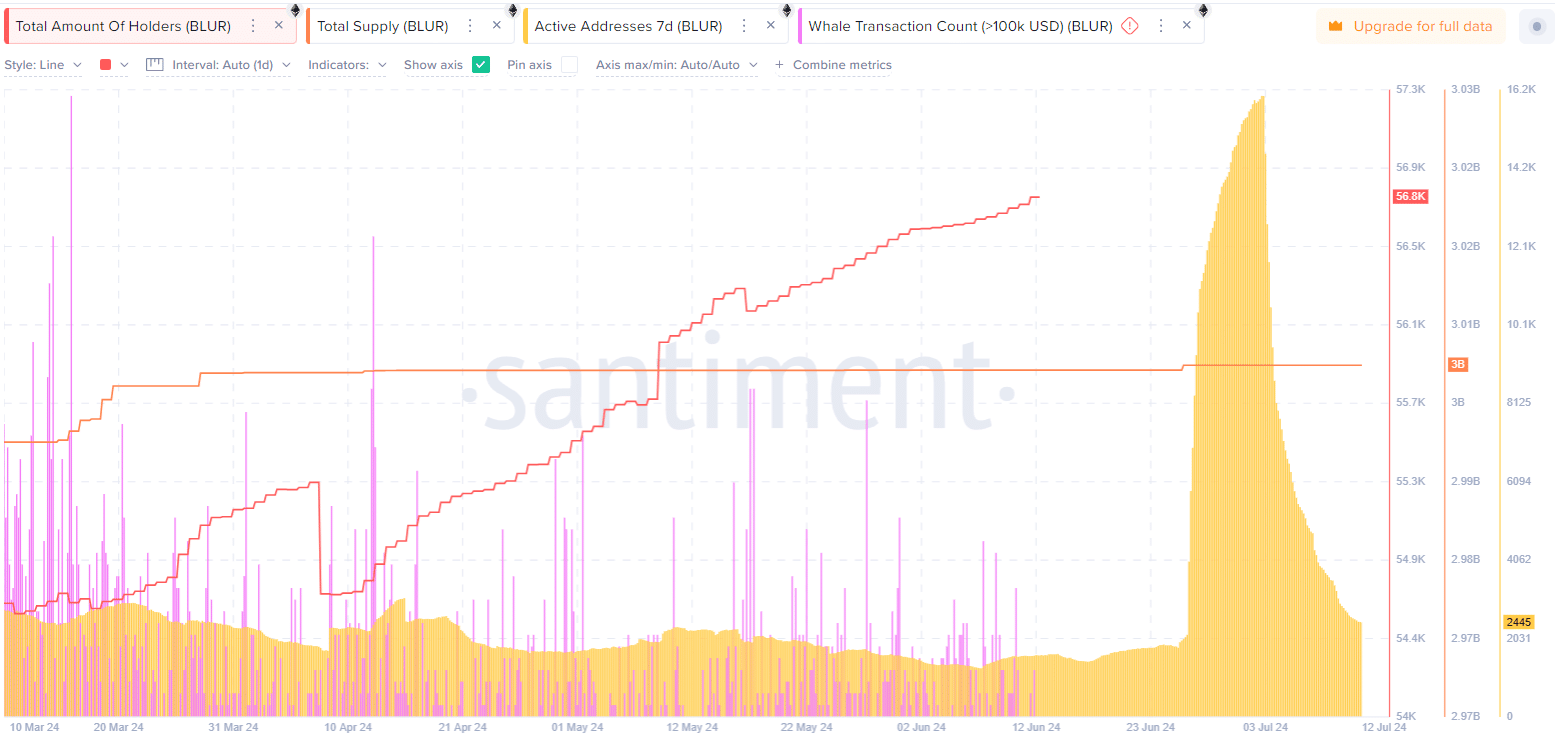

Blur’s active addresses surged and peaked at over 16,000 in late June, before dropping

As an experienced analyst, I find the recent events surrounding the BLUR token intriguing. Machi Big Brother’s massive transfer of tokens to Binance for sale triggered a sharp 7% price decline, causing worry among investors and highlighting the influence that significant traders can have on token markets.

🌪️ EUR/USD Turmoil Warning as Trump Escalates Trade Wars!

New research shows euro-dollar volatility about to spike — are you ready?

View Urgent ForecastA 7% decrease occurred in the value of BLUR tokens after the notable trader, Machi Big Brother, moved all his holdings to Binance, sparking apprehension among investors regarding a possible massive sell-off.

Major sell-off by Machi Big Brother

Machi Big Brother transferred 18.4 million tokens, valued around $3.13 million, into Binance’s holdings according to Spot On Chain. This action fueled speculation among investors about possible upcoming sales, causing the crypto’s price to decrease by 7% within the past day. The average selling price for these tokens was set at $0.170 each.

Machi Big Brother (@machibigbrother) has allegedly dumped all $BLUR at a $3.16M loss!

Over the last day, he transferred a total of $18.4 million in $BLUR (equivalent to approximately $3.13 million) into Binance. Each deposit made by him led to a subsequent price decrease for $BLUR.

Note that his other notable holdings are not doing well either!…

— Spot On Chain (@spotonchain) July 12, 2024

Machi Big Brother’s substantial trade has sparked apprehension among investors regarding the impact of major players on cryptocurrency markets. Caution prevails in the investing community as there are fears of potential market downturns.

The deal provided insight into Machi Big Brother’s additional assets, which are likewise incurring losses. He owns approximately 275 million Blast tokens, amounting to a projected loss of around $1.5 million, and roughly 8.8 million Friend tokens, representing a potential loss of about $13.8 million.

Currently, BLUR is priced at $0.162 during my writing, with a trading volume of approximately $48.7 million in the last 24 hours. Although it has experienced a decrease, BLUR has managed to increase by 9.38% over the past week. The market remains unpredictable, shaped by significant trader actions and overall investor sentiment.

Active addresses and whale transactions

Starting late June, there was a significant increase in the number of active BLUR addresses, reaching over 16,000 at its peak. Yet, this number drastically decreased to approximately 2,445 by mid-July.

Occasional surge in whale transactions occurred, most notably around mid-March and late May. Such fluctuations typically indicate brief market engagement or the occurrence of significant events prompting increased activity.

The total number of BLUR holders has steadily increased too, reaching 56,800 by mid-July.

In the end, the unwavering 3 billion token supply of BLUR, which has persisted since mid-March, defies the volatile pricing trends. This consistency underscores burgeoning user interest and adoption, sans inflating token quantities.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Masters Toronto 2025: Everything You Need to Know

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- The Lowdown on Labubu: What to Know About the Viral Toy

2024-07-13 09:11