- On-chain metrics revealed a declining number of active addresses, with Open Interest also falling in recent days

- Technical indicators showed that NEAR’s recent decline has been losing steam

As a seasoned crypto investor with over a decade of experience navigating through market cycles, I’ve seen my fair share of bearish and bullish trends. Recently, the declining number of active addresses on NEAR and the falling Open Interest have raised some concerns for me. However, I am an optimist at heart and believe that even in the darkest days of winter, spring follows.

Over the past month, NEAR’s performance in the cryptocurrency market has been less than stellar, with a decline of 16.44%. To make matters worse, it also dropped by 6.57% within the last 24 hours, indicating that its downward trend may continue.

Although there seems to be a lot of pessimism, the market analysis suggests that the downward trend might be starting to slow down. This lull could pave the way for a substantial price increase, which could counteract the recent declines.

Lack of interest pushes NEAR lower

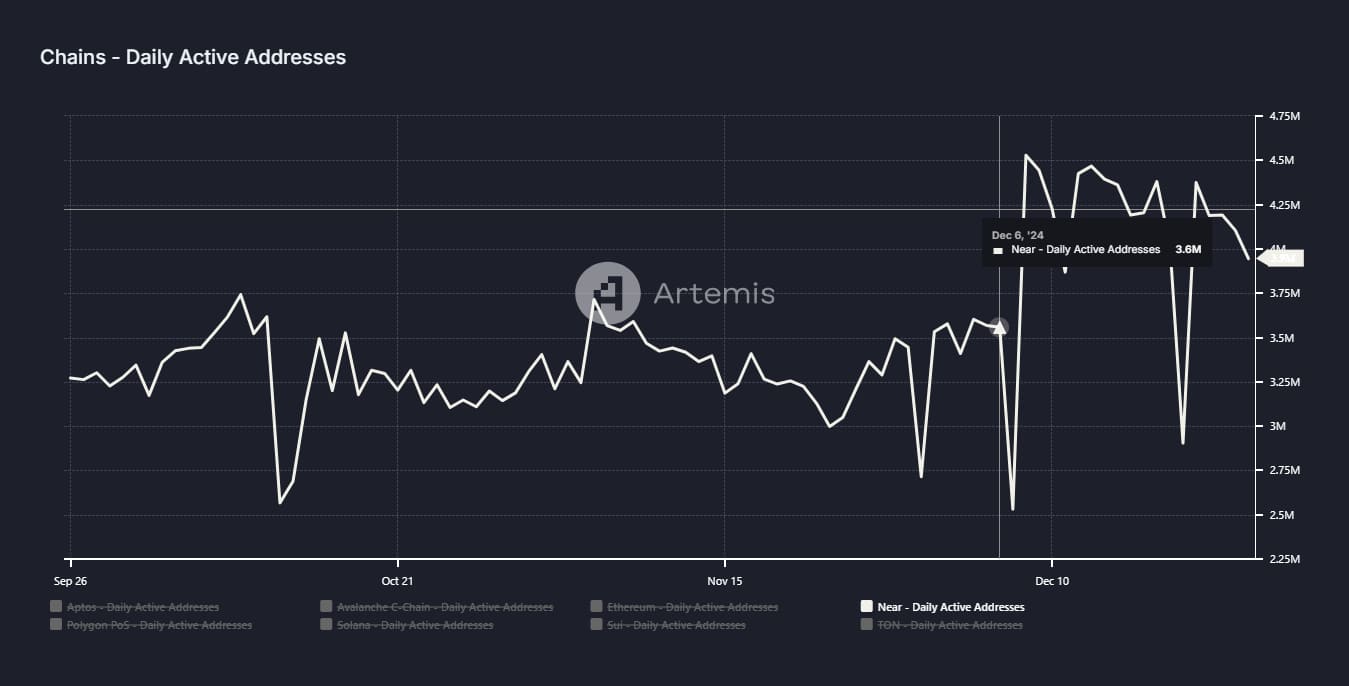

On the NEAR network, there seems to be a decrease in the number of daily active addresses, according to reports from Artemis. This could indicate waning enthusiasm among both users and investors.

As a researcher studying the dynamics of cryptocurrency networks, I find that Active Addresses (AA) play a crucial role in assessing a network’s worth and usage. The value associated with a token often correlates closely with the number of Active Addresses. When I observe a situation where both Active Addresses and the price are falling concurrently, it serves as an indicator of waning interest. This decreased interest could potentially lead to further price declines.

Over the past four days, there has been a significant decrease in the number of daily active addresses on the NEAR network, going from approximately 4.4 million down to 3.9 million. This downward trend is also reflected in the price of NEAR, currently trading at $5.11 as reported by CoinMarketCap.

According to AMBCrypto’s assessment, there was significant selling activity, predominantly among derivative traders, which put additional downward pressure on the value of NEAR.

Derivative traders show lack of confidence in NEAR

The demand to buy NEAR has noticeably decreased, especially among derivative traders who have been frequently selling it short.

As reported by Coinglass, the NEAR market’s long-to-short ratio stands at 0.8793, suggesting an increase in the use of short contracts. This action is typically taken when traders predict a decrease in price. A long-to-short ratio less than 1 implies a greater number of sellers. Lower readings indicate stronger feelings of pessimism among traders.

It appears that the selling pressure had a noticeable effect, as the Open Interest of NEAR decreased. To be specific, it declined by 6.86% within the past 24 hours, dropping down to approximately $237.39 million on the graphs.

The data on liquidations indicates a pessimistic outlook in the market. Out of the $966,310 worth of contracts that were liquidated, approximately 92.7% were from long traders who suffered losses because the price went against their forecasts. This trend implies that NEAR’s price might keep decreasing further.

However, technical indicators seemed to point towards a possible weakening of the bearish trend.

To put it simply, the Average Directional Movement Index (ADX), a tool that gauges the strength of an ongoing market trend, showed a decrease on the weekly graph. When the ADX is high, it means the trend is strong; however, a lowering ADX indicates that the momentum is starting to weaken.

Right now, the Activity-Directional Index (ADX) for NEAR stands at 17.85, indicating it’s currently moving downwards. This suggests that selling pressure might decrease shortly. If this downtrend continues, there’s a possibility that NEAR could experience an upturn and start trading at higher values.

What’s next for NEAR?

Over a weekly timeframe, Near appeared to trade within a symmetrical triangle formation – a period of consolidation during which the price fluctuates between clearly defined upper and lower boundaries, with buying pressure gradually building up. Typically, this kind of pattern tends to signal an upcoming substantial price increase.

Nevertheless, persistent selling might cause NEAR’s price to drop to the $4.625 support point, possibly even falling further towards the bottom of the symmetrical channel.

This drop could signal the last part of the current downward trend, which is likely to be followed by an upturn. The value of the asset is anticipated to return to at least $10 as seen on the graphs.

In the current situation, the continuous decline could be a warning sign of a significant price fluctuation approaching soon.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SOL PREDICTION. SOL cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

2024-12-27 13:12