- ENA’s native platform, Ethena, overtook Tether in fees generated, with its stablecoin surpassing MakerDAO’s DAI by market capitalization

- Market metrics ddi not fully support a sustained price rally for ENA

As an analyst with years of experience navigating the volatile crypto market, I have learned to appreciate the nuanced dynamics that drive asset prices. While ENA has certainly seen some impressive milestones recently – overtaking Tether in transaction fees and surpassing MakerDAO’s DAI in market capitalization for its stablecoin USDe – these developments alone do not guarantee a sustained price rally.

Even though there was a significant increase of 67.24% for ENA just last month, it has been experiencing losses over the past few weeks. To be precise, it has dropped by 11.19% on a weekly basis and also lost 3.96% of its worth within the last 24 hours.

Despite a continued optimistic outlook towards ENA, AMBCrypto’s examination suggests that market players are still hesitant. This uncertainty is particularly pronounced given the ongoing selling pressure that affects the asset.

Good news for ENA—But is it really?

Good news keeps surrounding ENA, as various advancements hint at possible price influence. Notably, the indigenous platform of ENA, Ethena, has surpassed Tether.io in transaction fees generated within the past 24 hours.

For the duration under discussion, Ethena earned a total of $24.32 million in fees, outperforming Tether’s $17.83 million. This suggests that there was greater or more significant engagement on Ethena’s platform as opposed to Tether’s.

Furthermore, it’s worth noting that the market value of Ethena’s stablecoin, USDe, has outpaced MakerDAO’s DAI. At present, USDe stands at approximately $5.81 billion, whereas DAI is currently valued at around $5.36 billion.

This suggests a larger acceptance of USDe, as its supply increases to match the rising need, coinciding with the rapid expansion of the Ethena network.

Given that ENA is central to these advancements, it’s logical to assume that it would prosper due to increased activity. Yet, AMBCrypto’s examination uncovered a contrasting pattern, as market players appear to be adopting a more reserved approach instead.

A different pattern – Traders are selling

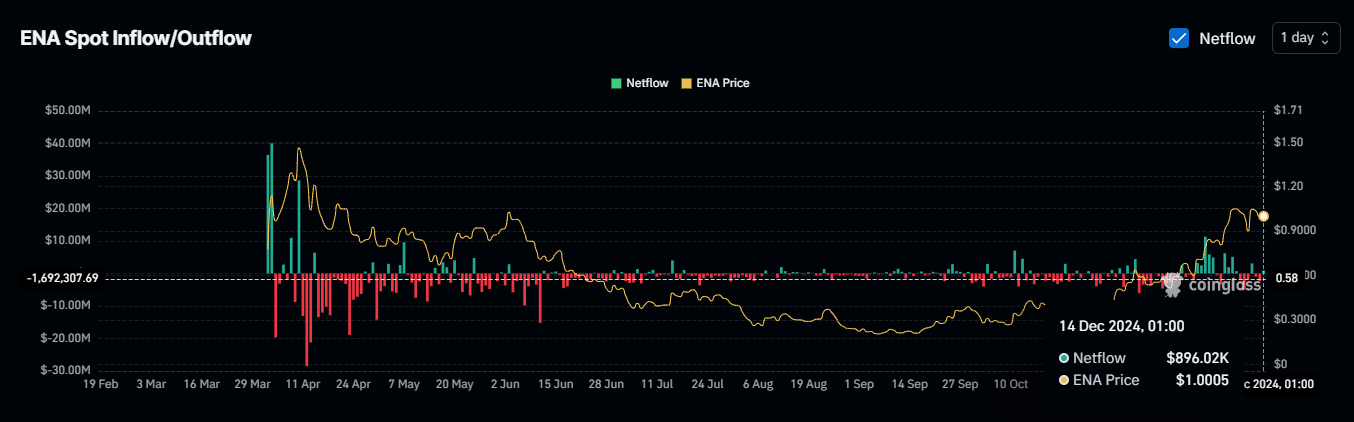

According to data analyzed by Coinglass, there seems to be a change in the market’s dynamics – traders appear to be offloading their holdings. This is evident as open interest decreases, and exchange net flows show an increase, suggesting heightened selling activity.

The decrease in open interest was 4.09%, leaving it at approximately $504.07 million as of the news release. This suggests an increase in pending sell contracts, indicating a rising pessimism or bearish trend within the market.

Furthermore, these spot traders began transferring their ENA tokens to trading platforms, indicating a desire to liquidate rather than store the tokens in personal wallets for future use.

As a crypto investor, I’ve noticed that a total of $899,020 worth of ENA tokens have been moved to exchanges, which could potentially increase the supply and lead to selling pressure. This selling pressure seems to be gradual, subtly influencing the price trend and causing a downward movement in the market.

Forceful closure for bulls

A substantial portion of prolonged buy positions on ENA have been forcibly liquidated, amounting to approximately $636,300 in asset value being withdrawn from circulation. This mass selling appears to indicate that market opinion is not favorable towards further increases in the price of ENA, as most traders are now predicting a drop rather than an increase.

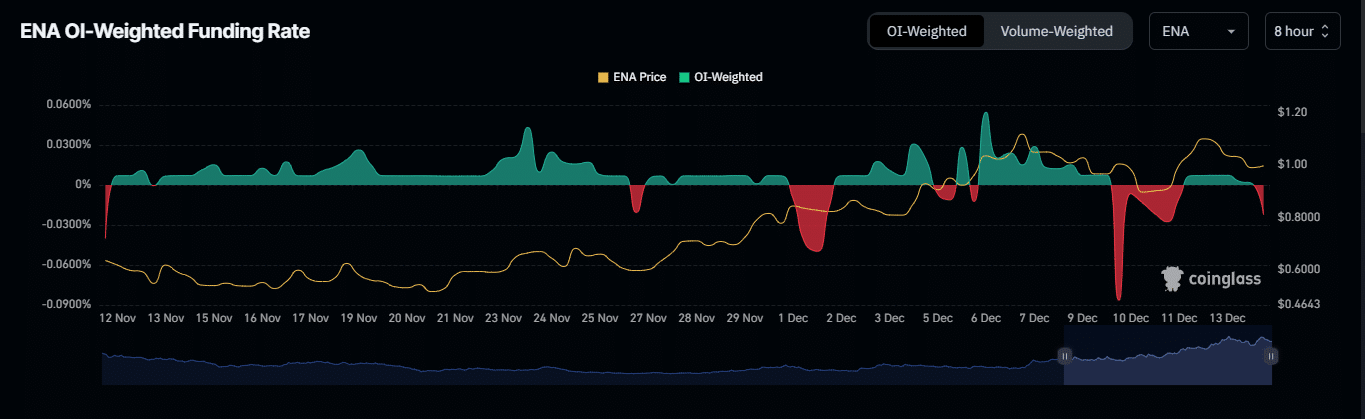

Additionally, AMBCrypto examined the Funding Rate, which is influenced by the size of open positions in perpetual futures contracts, to uncover more about market attitudes. This rate adjusts dynamically.

On the 8-hour chart, the Funding Rate, which is influenced by open interest, consistently stayed below zero (in the negative zone), indicating a downtrend with a value of approximately 0.0224%.

Despite encouraging advancements, it appears the negative trends indicated by key markers might cause Energy Neutral A (ENA) to persist in a descending trajectory.

Read More

2024-12-14 20:08