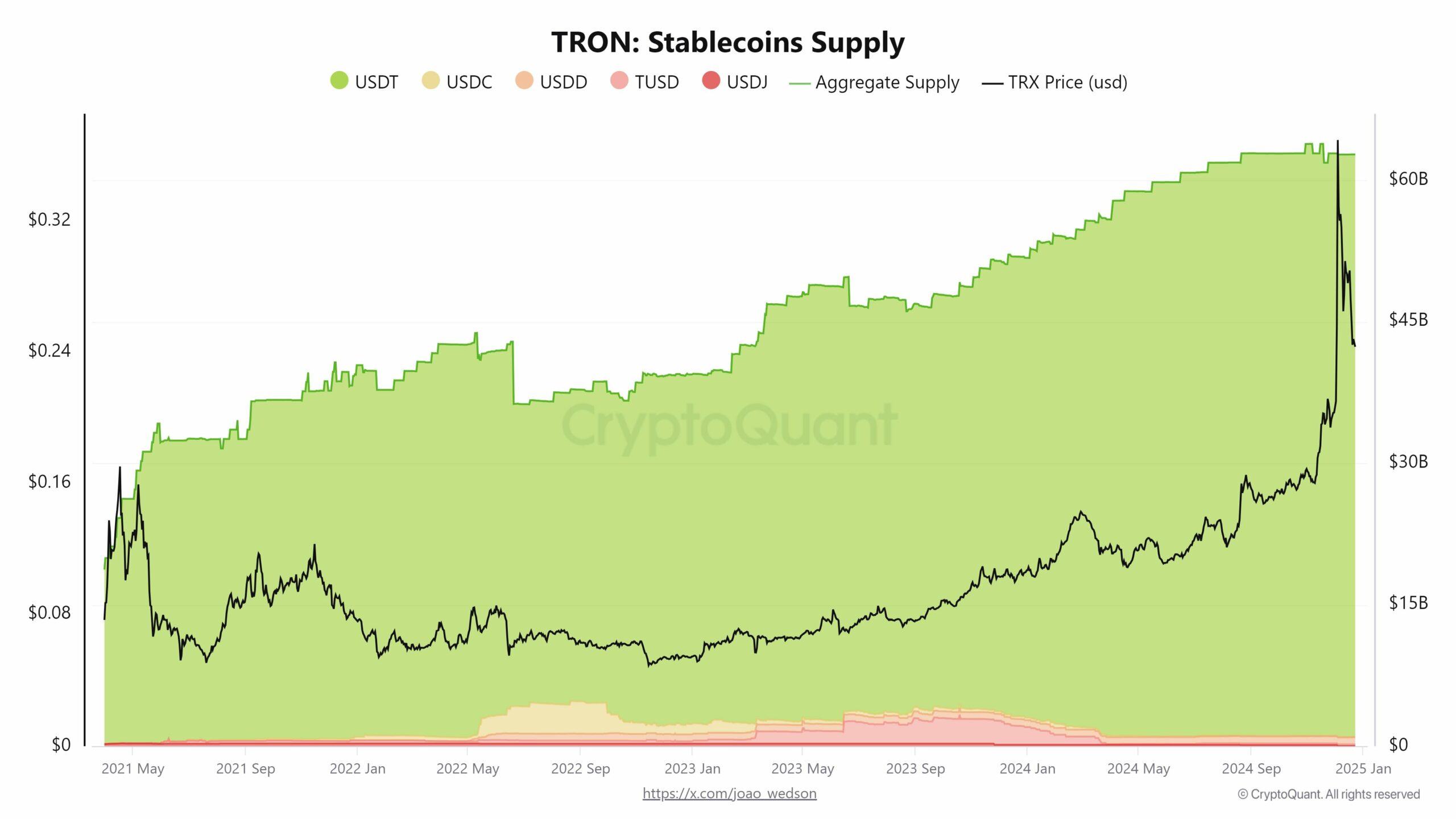

- Stablecoins on TRON network stabilized at $62 billion

- Lending on the network accounted for 55% of the TVL

As a researcher with years of immersion in the cryptosphere, I find myself consistently impressed by the dynamic growth and evolution of TRON. The recent stabilization of its stablecoin supply at $62 billion suggests a maturing ecosystem, where market forces are balancing demand and supply efficiently. This is reminiscent of a well-oiled machine, humming along without a hitch.

On the TRON platform, the amount of USDT stablecoin has reached a steady point at approximately $62 billion, suggesting that the creation of new coins (minting) has temporarily slowed down. This equilibrium in minting and supply suggests a well-balanced market, where demand and supply are evenly matched – an indicator of maturity within the ecosystem.

The stable supply level of USDT, with only slight variations, mirrored shifts in market conditions.

Leaving USDT aside, there’s been a gradual increase in volume for other stablecoins such as USDC, USDD, TUSD, and USDJ. This growth not only adds diversity but also reinforces the stability of the system. This trend suggests that the market on this network has matured, meaning major disruptions are less likely and investor confidence can be solidified.

The detailed examination of the movements in Ethereum (ETH) and TRON stablecoin transfers revealed that while Ethereum has been dominant in stablecoin transactions, its position is now being threatened by the growing influence of TRON.

As a crypto investor, I’ve noticed that Ethereum has been consistently bustling with USDT transactions, but here’s an interesting turn of events: TRON managed to grab 64% of the market share, marking a staggering 57% surge from last month! This shift is definitely worth keeping an eye on.

This transition underscores the increasing popularity of TRON within the stablecoin market, possibly due to its reduced transaction costs and quicker processing speeds through the TRC20 protocol. At the same time, it hints at a challenging competitive environment, while also suggesting its capacity to substantially transform how stablecoin transactions are carried out.

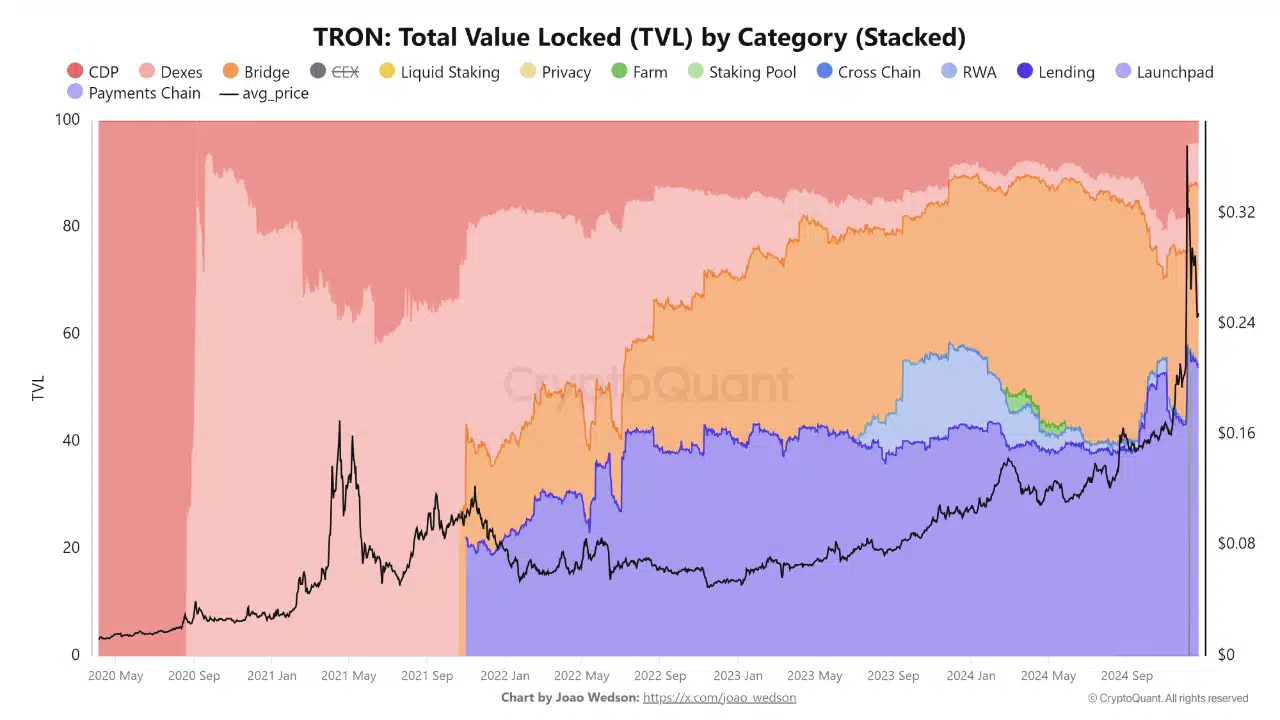

Lending on the TRON network

As a crypto investor, I’ve noticed that lending activities have played a significant role in shaping the financial landscape of the network since 2022, making up more than half of the total value locked (TVL). Leading this trend is JustLend, providing us with the chance to delve into decentralized finance (DeFi) by offering loan provision and earning opportunities without the need for intermediaries.

The rise in loans not only boosted user involvement, but it also strengthened TRON’s total liquidity and financial resilience.

Through the provision of secure loans using collateral, these platforms prioritized the safety of lenders and reduced the likelihood of defaults. JustLendDAO strengthened the decentralized finance (DeFi) ecosystem on the TRON network by providing user-friendly financial services.

This advancement significantly strengthened its position as a formidable competitor within the Decentralized Finance (DeFi) sector. This is apparent through its consistent expansion in Total Value Locked (TVL) and its involvement in various financial endeavors such as transactions, payments, and cross-chain operations.

This growth path underscores TRON’s capability to continue its significance within the fast-paced Decentralized Finance (DeFi) industry. It points towards a promising future for its ecosystem and those involved in its lending services.

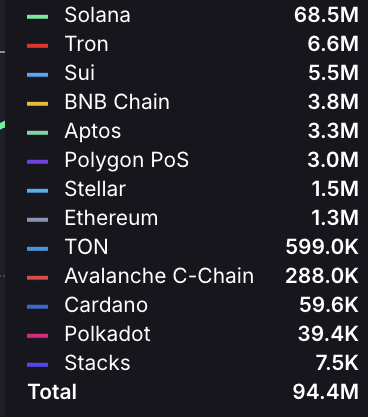

Daily network transactions

TRON ranked second, just behind Solana (SOL), in terms of daily network transactions. It handled a high volume of transactions more effectively than many other prominent chains such as Ethereum, demonstrating its capacity to manage transactions efficiently.

The transactions were found to be significantly higher in number according to TRON’s monthly transaction data. Notably, it recorded figures of approximately 182 million, 167 million, and 135 million in the past few months, outperforming others.

Together, these emphasize Tron’s dominant stance within the blockchain sector, consistently outperforming competitors in monthly transaction volumes. This performance has solidified its role as a key player in Decentralized Finance (DeFi).

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-12-25 11:06