-

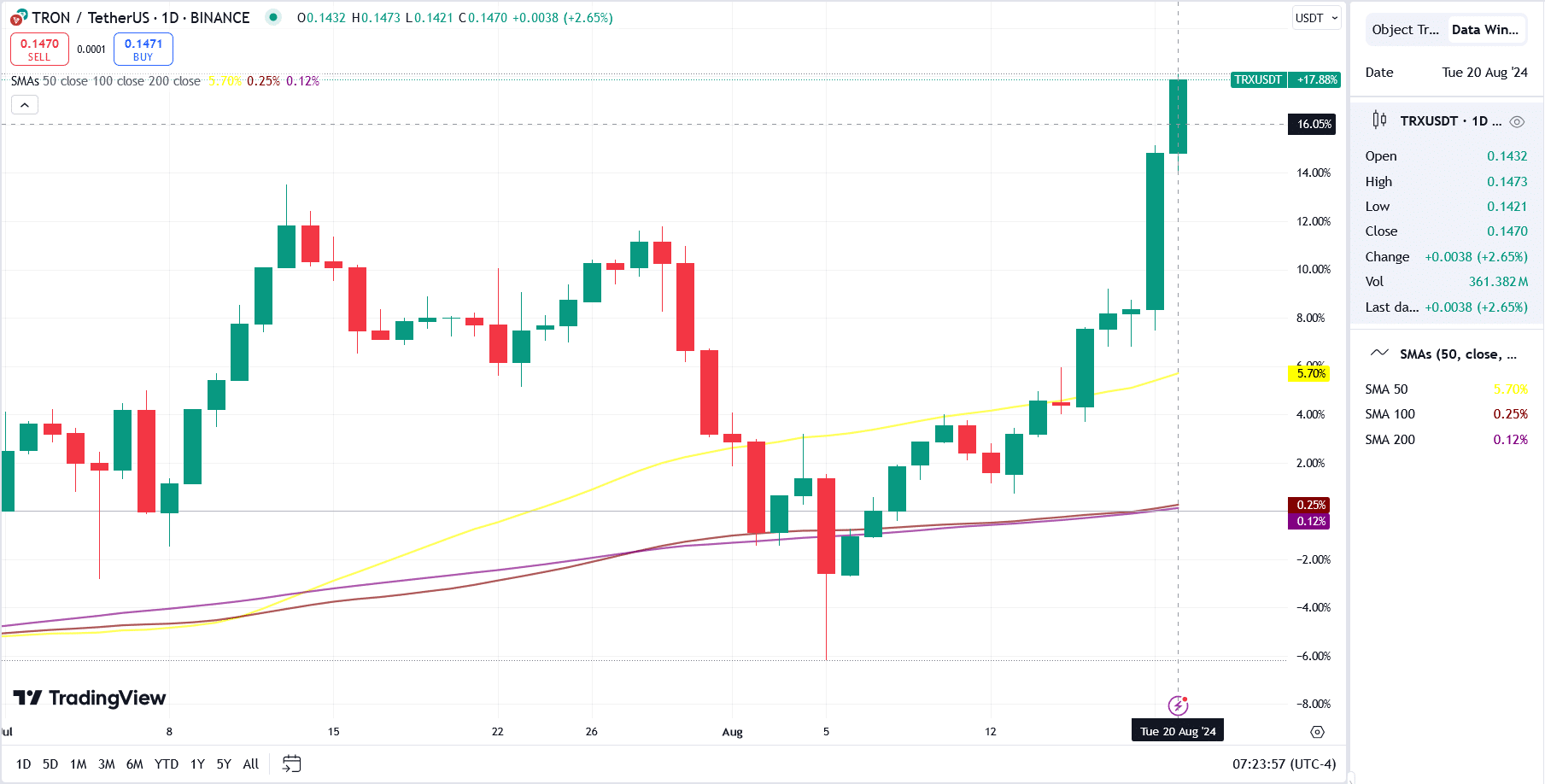

Tron’s price set an intraday high of $0.148 today, revisiting May 2021 highs.

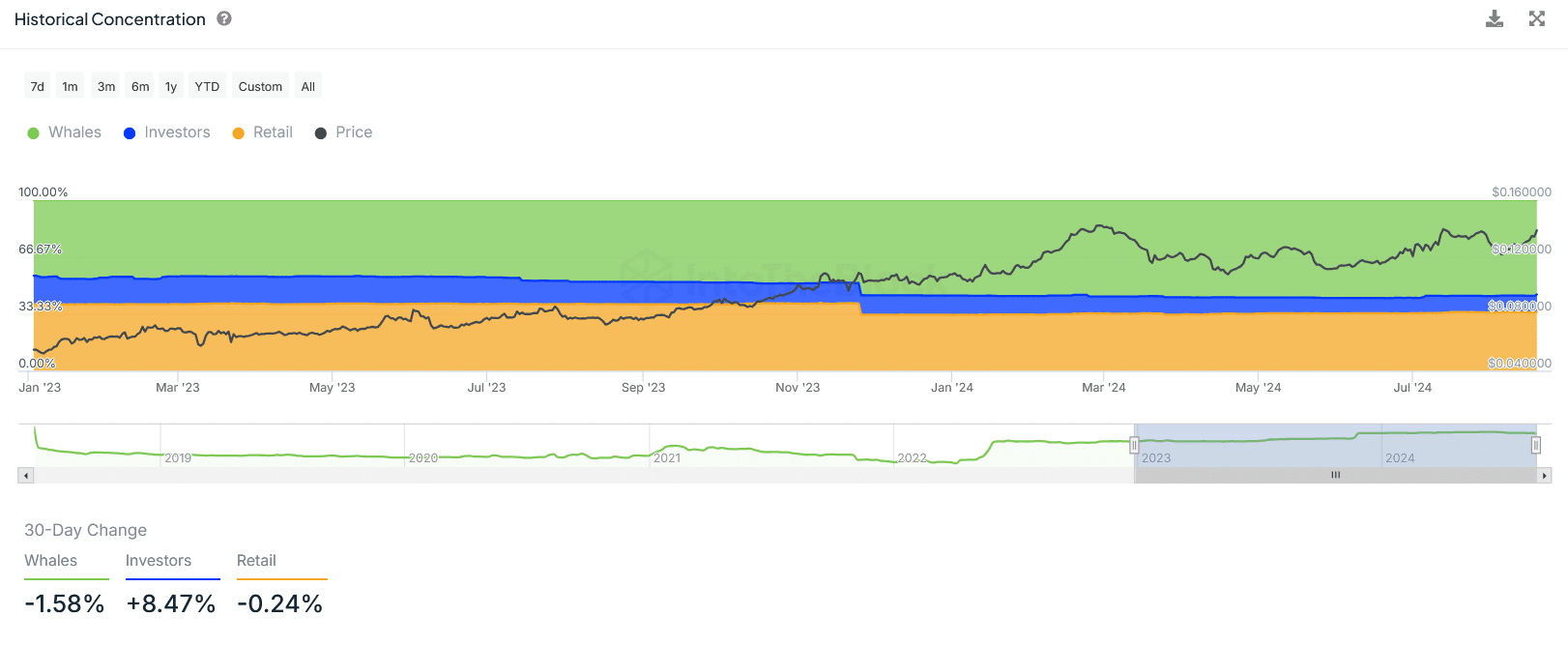

Tron has a whale concentration of 55.35%, collectively accounting for a supply of 46.86 billion TRX tokens.

As a seasoned analyst with over a decade of experience in the crypto market, I have seen bull runs and bear markets come and go. Today, I find myself closely watching Tron [TRX], a coin that has shown remarkable resilience amidst the recent market turbulence.

🛑 Market Warning: EUR/USD May Collapse on Trump Tariffs!

Top analysts urge immediate attention to shifting forecasts!

View Urgent ForecastTron (TRX) has stood out among altcoins this month, quickly rebounding from its price following the stock and cryptocurrency market downturn that occurred on August 5th.

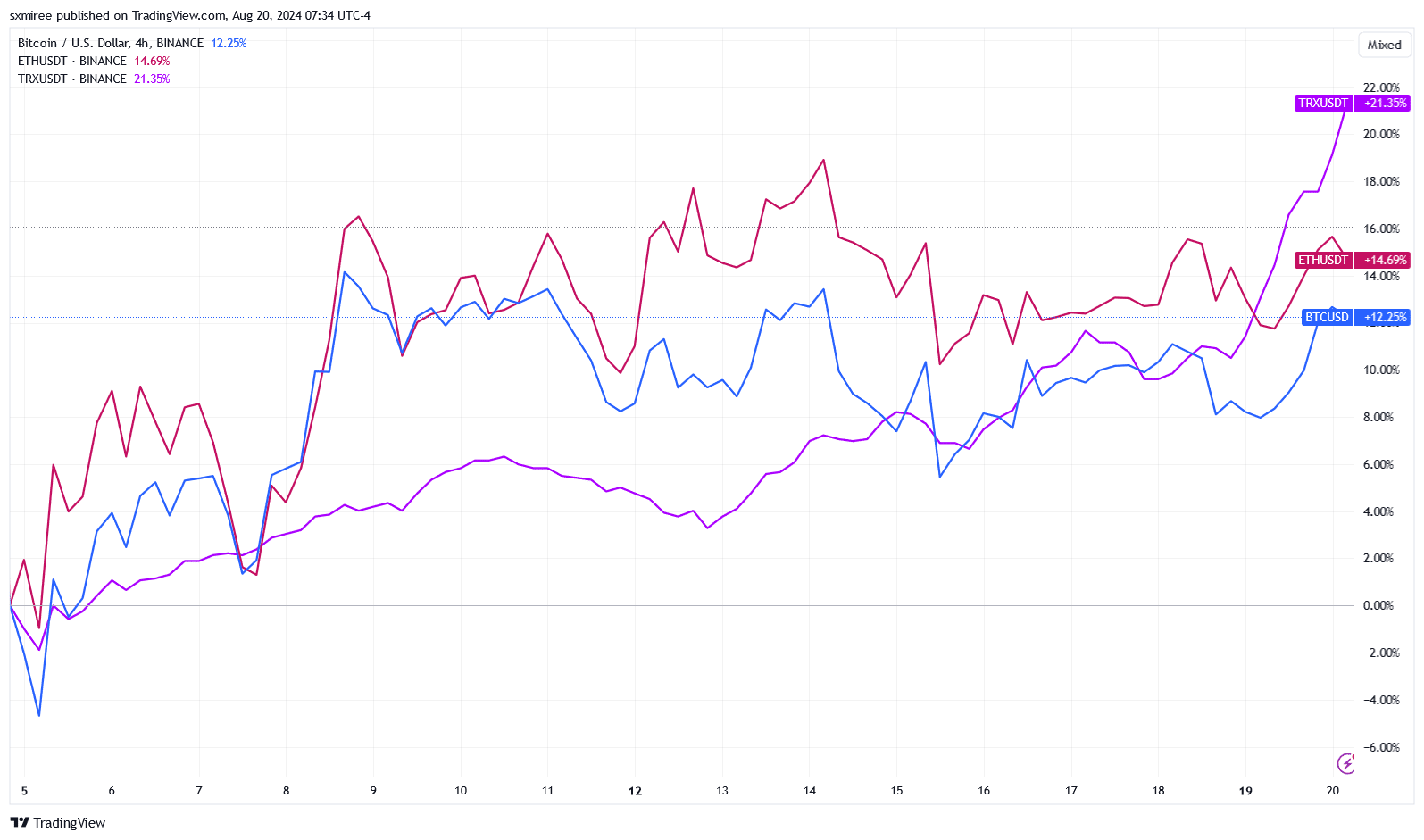

During the intense market downturn, TRX‘s value dipped beneath 11 cents, marking a significant decrease. This selling wave also resulted in Bitcoin [BTC] and Ethereum [ETH] recording their sharpest single-day declines since the start of 2021.

In the past fortnight, TRX has experienced a substantial surge, increasing by approximately 22%. Meanwhile, the other entity has seen more moderate improvements since then.

TRX’s price rose 6% on the 19th of August, overtaking Cardano [ADA] in market capital rankings.

According to CoinMarketCap’s latest data, the market capitalization of TRX surged by approximately 7.58% within the last 24 hours, reaching a value of around $12.9 billion at the time of press. Simultaneously, its trading volume experienced a significant boost of 142%, amounting to over $791 million during the same period.

Profit-taking concerns

As a seasoned crypto investor with over a decade of experience under my belt, I can confidently say that Tron’s performance this year has been nothing short of impressive. Despite TRX being 51% below its January 2018 all-time high, token holders have found themselves among the most profitable in the market. This is a testament to the resilience and potential of the Tron ecosystem, even amidst the volatile nature of the crypto market. My personal investment journey has taught me that it’s not just about the initial highs, but also about weathering the storms and capitalizing on opportunities when they present themselves. Tron’s spot market action this year is a shining example of that.

A large majority, approximately 98%, of TRX token holders currently enjoy a profit, while only a small portion hover around the break-even point, as per information from the analytics platform IntoTheBlock.

In the given situation, approximately two out of three Ethereum owners are currently earning a profit with the present prices, whereas nearly all Polygon [MATIC] investors find themselves in a position where their returns have not yet materialized (i.e., they’re experiencing unrealized losses).

An abundance of TRX addresses with profits could lead to further price increases if large amounts are sold, possibly causing a surge in supply and potential selling pressure.

According to IntoTheBlock’s analysis of Tron’s past 30 days, it appears that whales have decreased their collective holdings by about 1.58%. Meanwhile, retail investors have also seen a drop of approximately 0.24%. This pattern might indicate widespread selling activities throughout the market.

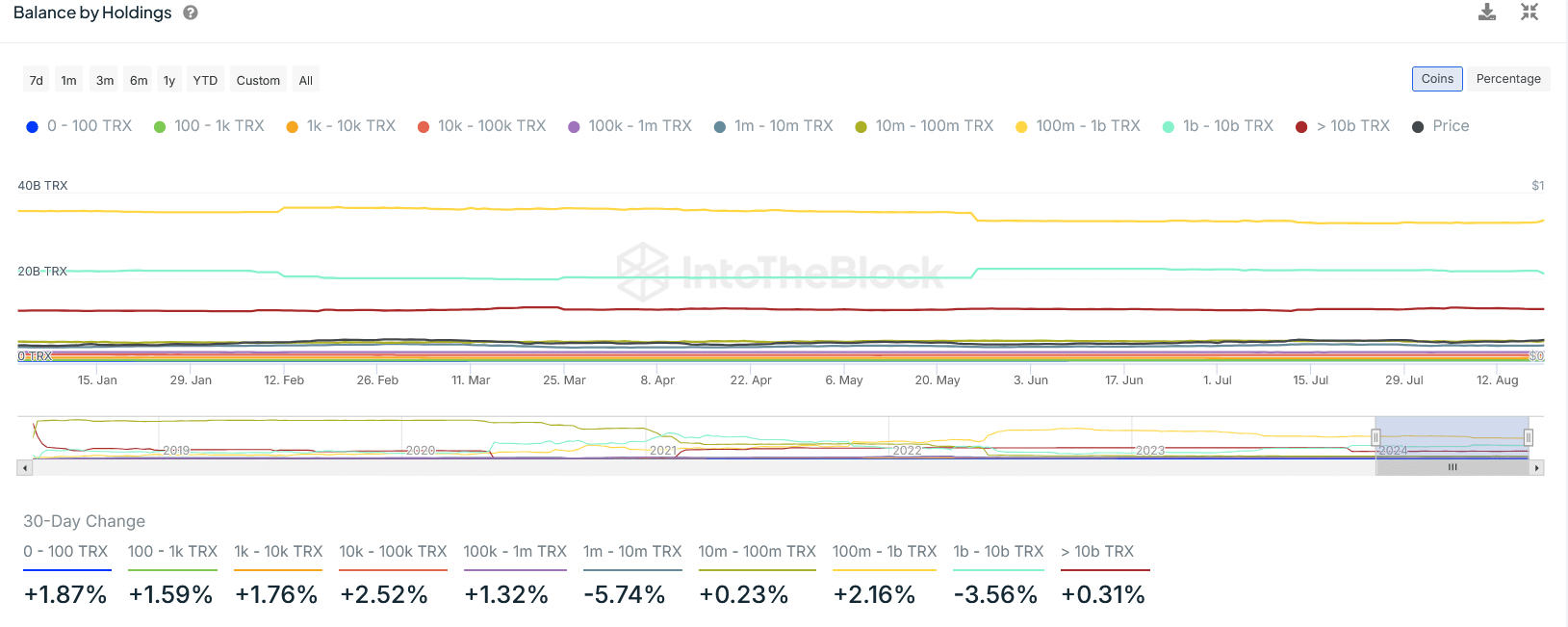

Data on TRX balance by holdings also painted a similar picture. The aggregate amount of crypto held by addresses with 1 million to 10 million TRX tokens has decreased by 5.74% in the last 30 days.

In a similar fashion, there’s been a decrease of approximately 3.56% in the number of TRX addresses holding between 1 and 10 billion TRX over this specified timeframe.

Technical analysis

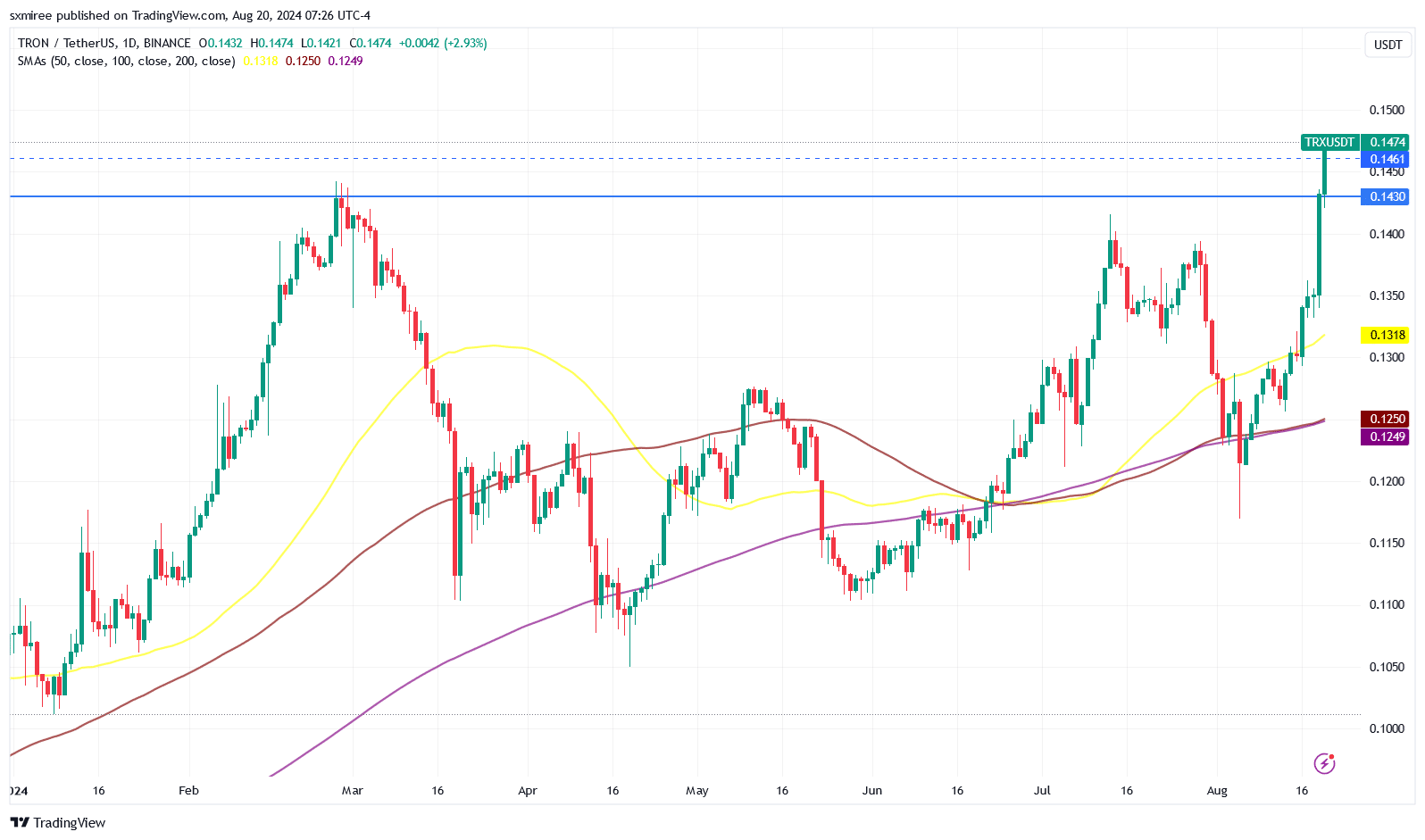

Technical indicators on the TRX price chart flashed bullish signals across multiple timeframes.

TRX’s price surpassed its 20-day, 50-day, and 100-day moving averages on the 1-hour, 4-hour, and daily charts, indicating a robust upward trend that might lead to further bullish momentum.

On August 19th, Tron (TRX) saw a 6% increase in value, surpassing $0.14. At the moment of reporting, it is continuing to grow by approximately 2.65%.

As a seasoned cryptocurrency trader with years of experience under my belt, I have observed that the market can be quite unpredictable. However, I must admit that this sustained uptrend in TRX/USDT has caught my attention. Previously, I’ve seen TRX hit the $0.143 mark several times only to be rejected, but it seems that this time around, it has managed to push through. This could be a sign of a potential breakout or a bullish momentum, but as always, caution is advised when dealing with cryptocurrencies. I’ll be keeping a close eye on TRX/USDT and will adjust my trading strategy accordingly.

Realistic or not, here’s TRX market cap in BTC;s terms

Affirming a daily close at this elevated point will fortify the confidence of optimistic investors, encouraging them to reposition it as a potential support level. On the day-to-day chart, the TRX/USDT pair is situated within a bullish ascending triangle, which benefits from an upwardly trending line.

A continuation of this trend could see TRX claim $0.152 in the near term and challenge $0.155.

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Masters Toronto 2025: Everything You Need to Know

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

2024-08-21 09:44