- TRON’s 20% weekly surge signals strong bullish momentum, with key resistance at $0.20 and support at $0.1653.

- On-chain data shows stable network growth and institutional interest, reinforcing the rally’s potential for further gains.

As a seasoned researcher with over two decades of experience in the crypto market, I have seen my fair share of price surges and corrections. However, TRON’s recent 20% weekly surge has certainly caught my attention.

I’ve been keeping a close eye on my TRON (TRX) investments, and over the past week, they’ve skyrocketed by an astounding 20%. At this moment, it’s reached a 2500-day high with a price of $0.1986. This sudden surge has piqued the interest of both traders and investors alike, indicating a robust bullish momentum that I find quite encouraging.

With TRON’s price trending higher, there’s curiosity about if this climb will endure. To uncover the reasons fueling this rally, let’s delve into the technical indicators, blockchain activity, and liquidation patterns for a comprehensive analysis of its underlying forces.

What’s behind TRON’s price surge?

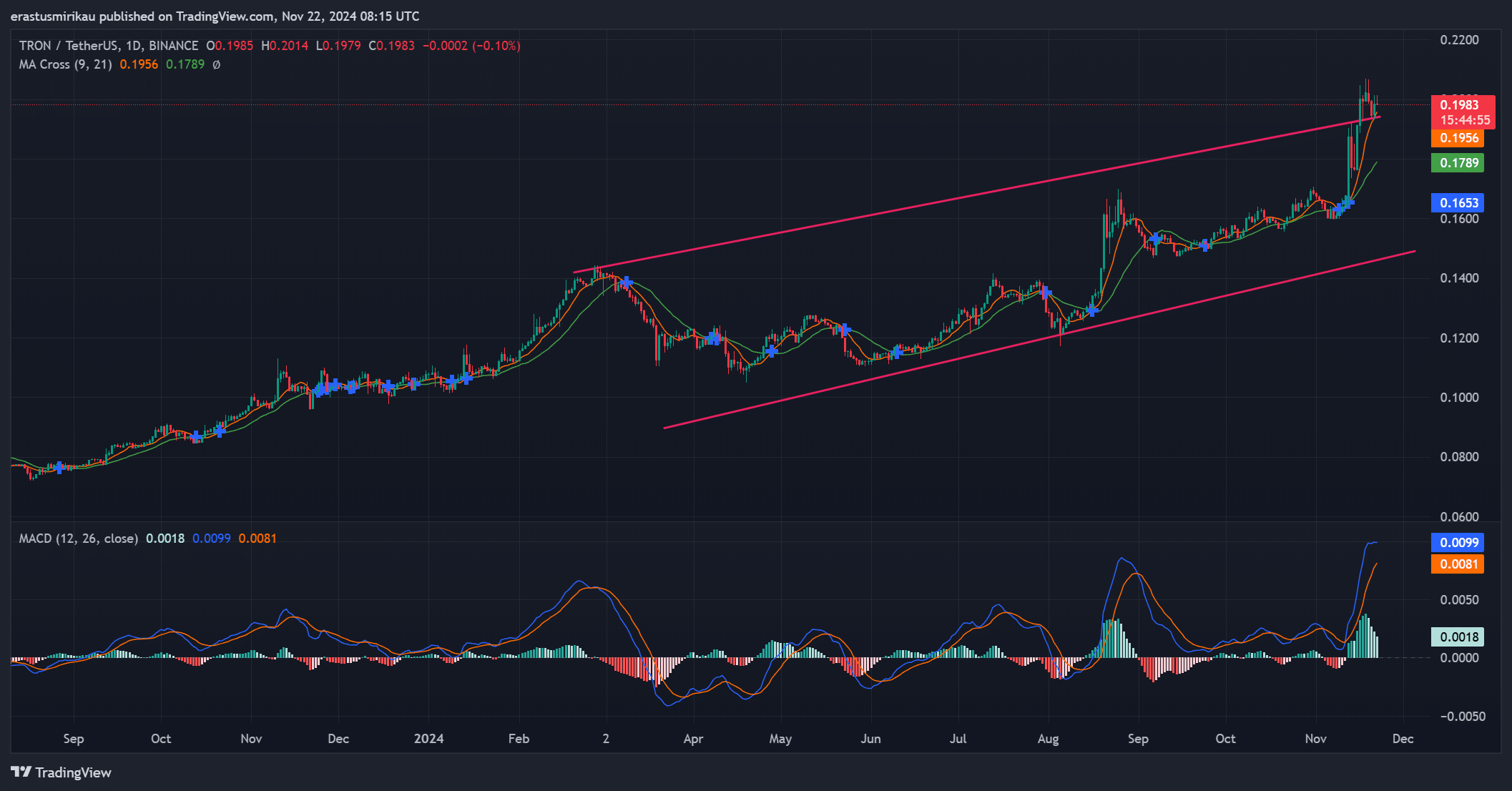

TRON appears to be steadily rising, conforming to an uptrend that’s contained within a rising channel. Lately, it breached significant resistance points and climbed up to $0.1983, suggesting a robustly optimistic perspective for bulls.

Currently, TRON is encountering resistance near the $0.20 mark. Should it manage to surpass this barrier, it might aim for the subsequent resistance at $0.22. As such, the bullish trend should persist so long as the price maintains above vital support thresholds.

Considering current support, $0.1653 continues to be a robust point. Previously, it provided firm ground during brief market corrections. Should TRON experience a dip, this level might function as a foundation for a possible rebound.

In simpler terms, the current price hurdle for TRON is at $0.20. If it manages to surpass this, the next potential barrier is at $0.22. If TRON overcomes these levels, it might continue its upward trend swiftly.

Furthermore, the 9-day Simple Moving Average (SMA) has surpassed the 21-day SMA, indicating a robust short-term trend momentum. This SMA crossover often serves as a bullish signal and may indicate that TRON’s price could potentially keep escalating.

Additionally, the MACD (Moving Average Convergence Divergence) indicator supports the upward trend as the MACD line (represented by blue) is above the signal line (symbolized by orange). In other words, this setup suggests that buying power continues to dominate, reinforcing the persistence of the market’s upward movement.

On-chain signals: Is the network supporting the rally?

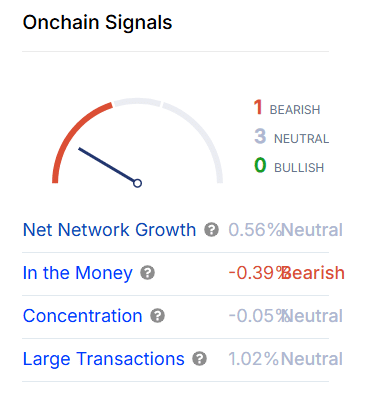

Based on blockchain analysis, the overall sentiment remains neutral. The network growth has grown slightly by 0.56%, indicating a steady level of activity. Yet, the In-The-Money ratio stands at -0.39%, hinting at some downward pressure.

In spite of the recent volatility, there’s been a 1.02% rise in large transactions, indicating robust enthusiasm from institutional investors, potentially driving more market activity.

Total liquidations: What’s the impact?

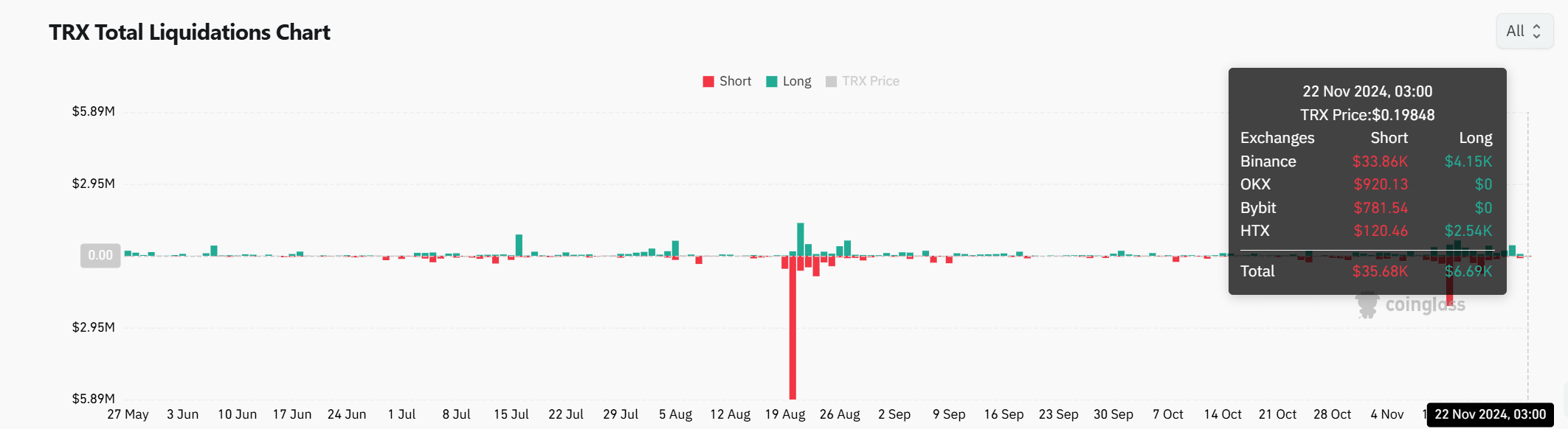

The chart demonstrates a total of $35.68 million in liquidations, primarily due to short liquidations. This implies that traders who were speculating negatively on TRON have been compelled to exit their positions, potentially boosting the positive trend.

The persistent rise might be due, at least in part, to the buying spree triggered by the need for short sellers to cover their positions.

Read TRON’s [TRX] Price Prediction 2024-25

Can TRON sustain its bullish momentum?

TRON’s remarkable 20% weekly increase is bolstered by robust technical signals, such as the Moving Average Cross and MACD. As the value nears significant resistance points at $0.20, a potential breakthrough might push the price further to $0.22.

Signals within the blockchain indicate persistent expansion of the network and rising involvement from institutional investors. This suggests that if TRON maintains its value above $0.1653, it appears primed for potential growth in the short term.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

2024-11-23 02:15